The Rise and Rise of Deepak Nitrite

What's the special recipe of success for this chemical manufacturing company? Read on.

In the stock market, a stock or company becomes popular for two reasons: either they give exceptional returns to investors, or their prices crash rapidly. While the stories of Orchid Pharma and Ruchi Soya were like “House of Cards”, today’s company of choice is one that’s been the talk of the town in the chemical world for the right reasons.

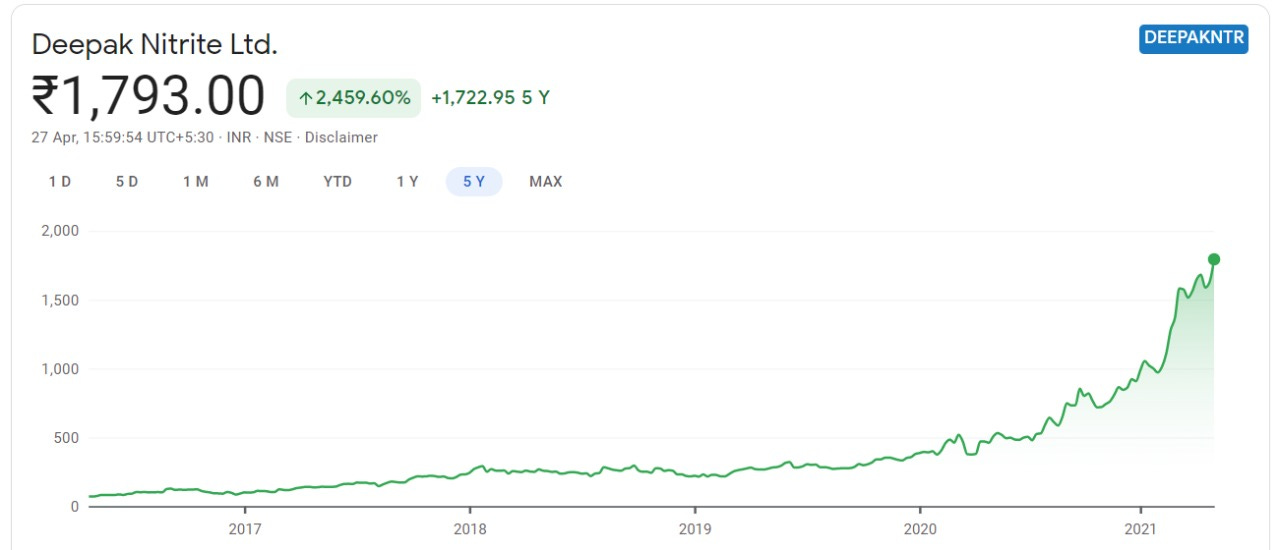

Deepak Nitrite has generated a mammoth return of 2460% in the last five years (and 271% return in the last one year itself). Rs. 10,000 invested five years ago would give you Rs. 2,44,000 today!

Every single financial year has ended with positive returns for the company. Child's play? Nope. Then how did Deepak Nitrite manage to pull this off, especially amidst a pandemic?

Read on.

Diversified Product Mix

Isn’t this what we get to hear in the stock market - diversification (or putting your eggs in multiple baskets) reduces risk? But, how exactly?

Well, let's say a bakery makes only plain white bread. But, the new-gen consumers are more health conscious, and want multigrain bread. If the bakery does not start selling multi-grain bread, it will not be able to tap into the demand, and may even risk losing considerable business.

This is what diversification does. Hedges (or protects) you against the risk of going bust.

Deepak Nitrite has been following the same strategy by diversifying into different product segments:

Basic Chemicals: Well, these really are basic chemicals, like Hydrogen Chloride. Nothing special! They are traded in high-volumes and low margins (or profits). But, you can’t not have them. You gotta have the basics for customers to trust you with their special needs, right?

Fine & Speciality Chemicals: Yes, they are special since they are customised as per the client’s requirements. They are traded in low-volumes, but fetch the company really good margins. Example - Cosmetic additives.

Performance Products: They are used to add specific characteristics to the end products. Example - Paints and Coatings.

Phenol & Acetone: They target household and personal care products and are used as disinfectants and cleaners. Example - Nail polish remover.

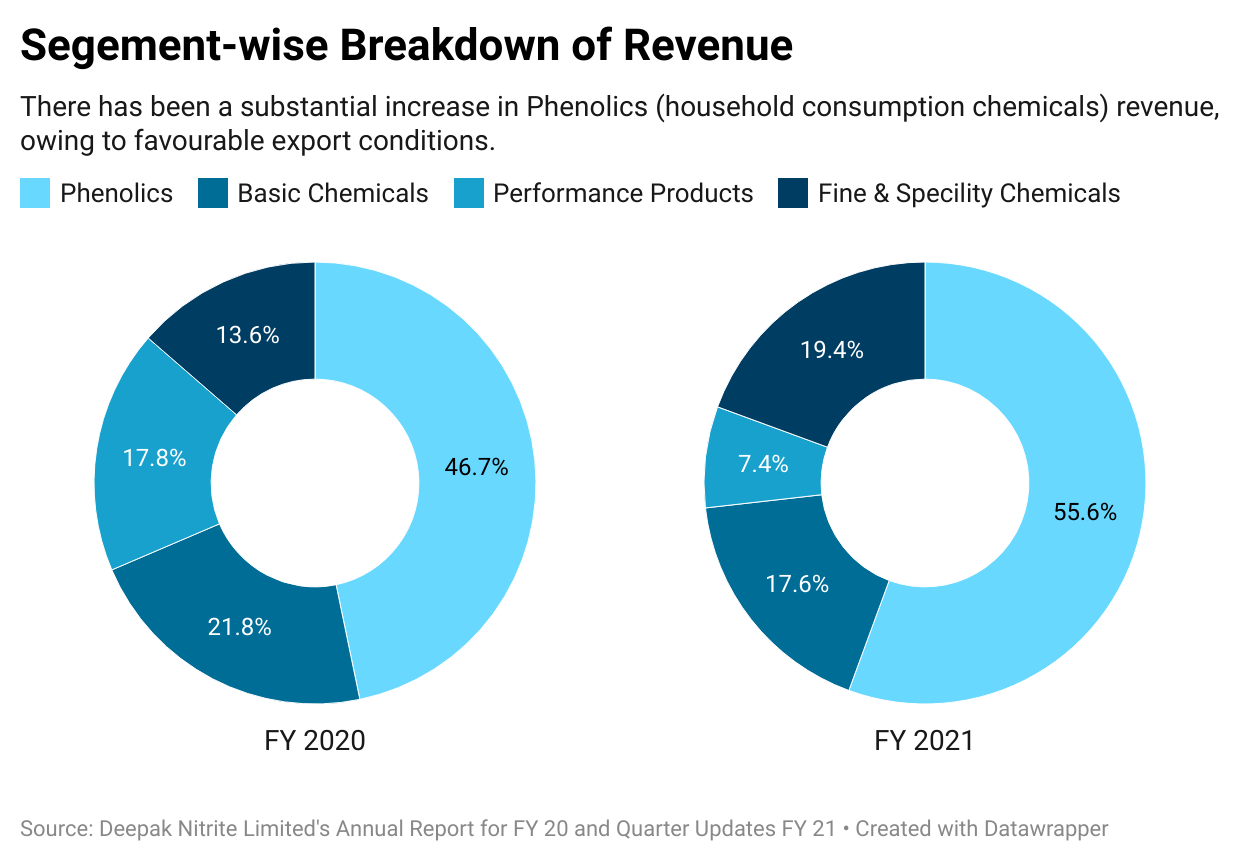

Fine & Speciality Chemicals, and Phenol & Acetone segments kept the business roaring in the Financial Year 2020-21, while the Basic Chemical and Performance segment languished in the backdrop.

So, is diversification the only secret chemical for Deepak Nitrite’s success?

Of course not!

Management plays a role too.

For any business, a lot depends on the management taking the right calls at the right time. Deepak Nitrite’s management saw an opportunity for essential products during the pandemic. And it pounced on it, without wasting any time.

Deepak Phenolics Ltd, a wholly-owned subsidiary of Deepak Nitrite commissioned its premium grade IPA (chemical used for disinfectant) plant with a volume of 30,000 MT. The plant has been operating at 110% capacity since April 2020.

As quick as the management is to jump on new opportunities, it is equally swift with pivoting strategies for optimum results.

Despite the low demand for Phenol in the domestic market during the lockdown, Deepak Phenolics didn’t waste much time to change tracks to increase its export volumes. Overall, DNL exports to more than 30 countries in the world.

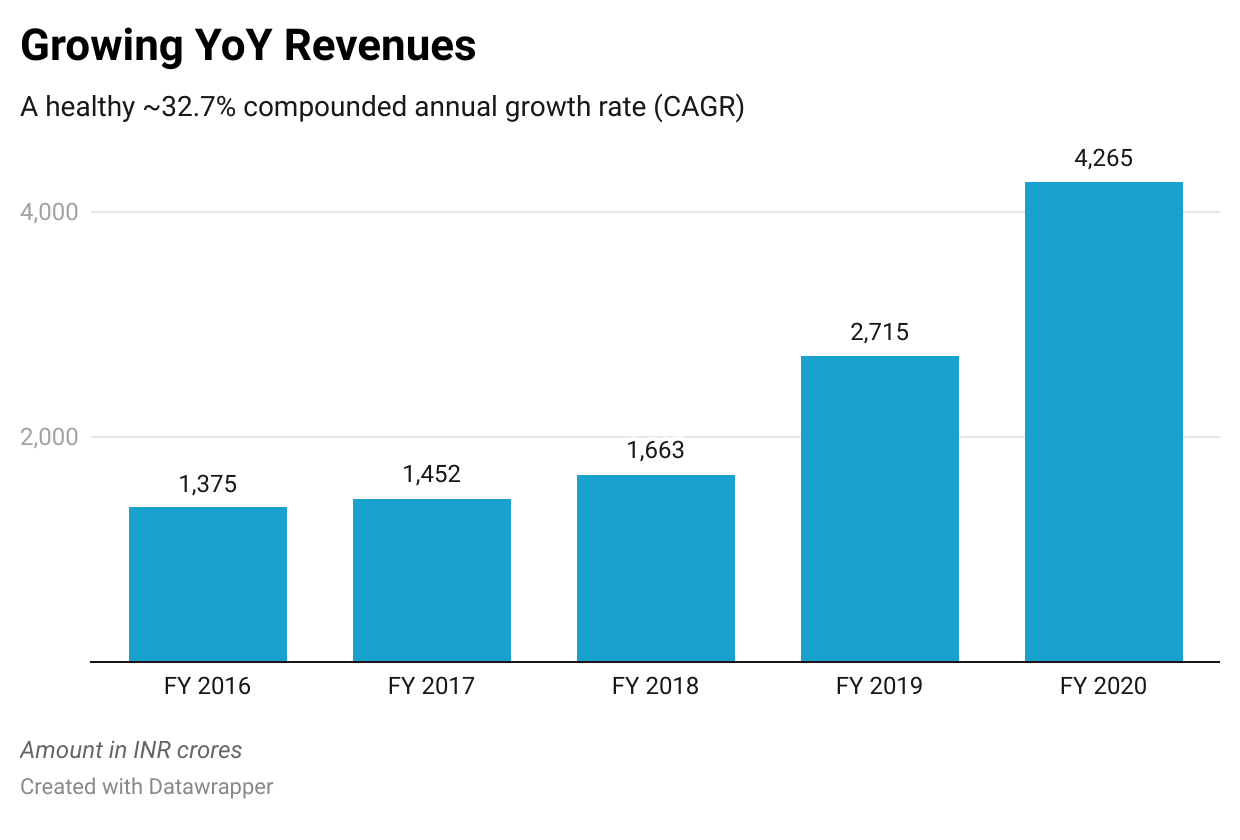

Here’s how the revenue graph looks like:

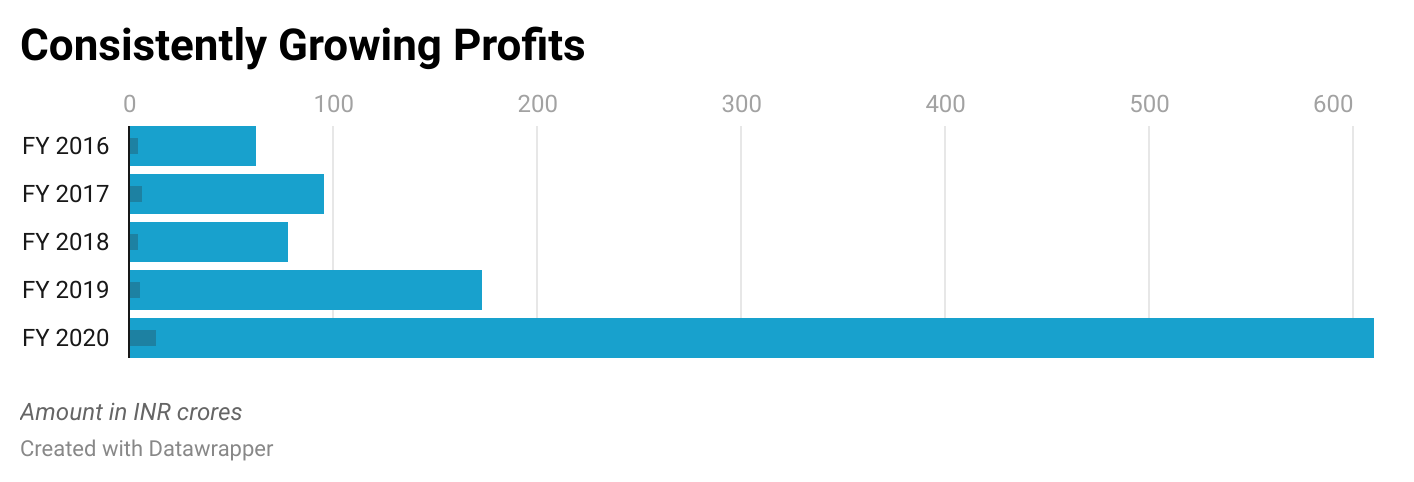

And, well. 2020 was indeed a good year:

All in all, the company is doing everything in its power to stay at the top of its game. But, let’s not forget the role of fate. Even the stars are aligning in its favour...

China’s Loss is Deepak Nitrite’s gain

China represents 35% of the global chemical industry. But, it is starting to lose its position. Nations have declared a trade war against China!

Seeing the change in the direction of wind, the company was quick to construct its production to capture the potential demand. And so, 42% of Deepak Nitirite’s revenue came from exports in FY20 against 21.8% in FY19.

Additionally, the Production Linked Incentive scheme introduced by the government to incentivise certain industries in India to export is expected to indirectly benefit Deepak Nitrite. You see, the company caters to customers in these specific industries that the government is incentivising. And when they will flourish, they are expected to take Deepak Nitrite up with the rising wave.

Deepak Nitrite’s performance and attractiveness is highly induced by the depth of its products. It has been resilient to deliver dependable returns despite the challenges encountered throughout the journey. While India is looking to tap any potential to become the world’s export leader for chemicals, will Deepak Nitrite lead the way to India’s chemical-prosperity?

Thousands of readers get our daily updates directly on WhatsApp! 👇 Join now!