The Curious Case of Ruchi Soya

While the pandemic has slowed the world down, and stock markets are all over the place, there is one company that seems to be running on steroids.

While the pandemic has slowed the world down, and stock markets are all over the place, there is one company that seems to be running on steroids. A company whose investors are having the time of their lives watching the share price soar daily.

Ruchi Soya Industries Ltd.

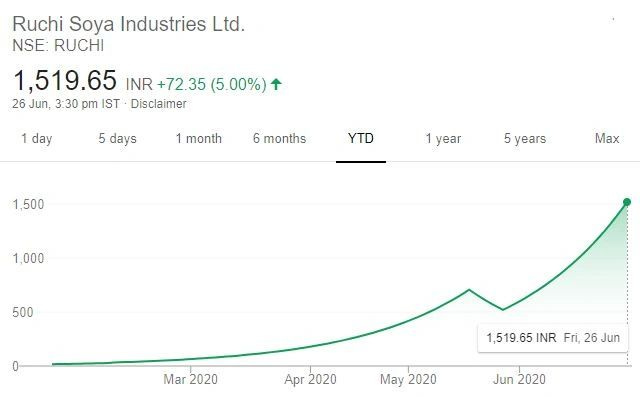

The company saw a whopping jump in its share prices, from Rs. 17 per share to Rs. 1,519 per share (~8,900% absolute returns in a span of 5 months).

What has led to this crazy rise in the prices of this stock? Why is no one selling? Is the company so great, or are we missing a piece of the puzzle?

Let's dive deeper.

When we googled the stock price chart for Ruchi Soya, this is what we found:

Isn't this super exciting? Looks like the stock was freshly listed in Jan 2020 and went up, up, and up!

Well, well. Wait a minute. We realised we got played when we saw this:

Looks like a dead company brought to life by some Sanjeevni Booti? Ayurveda ki shakti? More on that later.

First, let us understand what this company does a little better.

"Ruchi Soya Ltd., incorporated in 1986, is a leading producer of branded edible oils in India currently having the largest edible oil refining capacity of 3.3 million metric tonnes per annum across 13 facilities. Some of its leading brands include Nutrela, Mahakosh, Sunrich, Ruchi Star and Ruchi Gold." - says its website.

During 2011-2015, the company was generating revenues of ~25-27K crores per annum on an average.

Everything was going good. The company started spreading its wings. Year after year, it set up more and more factories.

Where did the money to expand come from? From the profits that the company was making? The company was making only 1% net profit after tax. So, no.

From shareholders bringing in more capital? Naaah. Around 85% of the shares were held by small retail investors like us. Again, nope.

The money came from the banks.

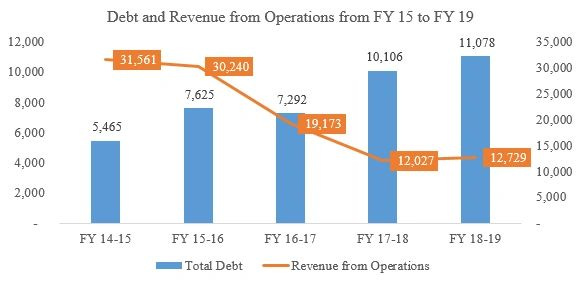

This highly ambitious company had a great plan. It took huge amounts of loans to expand its operations, and rule the edible oil market. It thought it would make enough money to be able to repay the loans later. Take a look at how its debt piled up over the years.

Borrowings doubled, while revenues halved between 2014-15 to 2018-19.

As with all great plans, this one also failed.

The company saw a turn in fortune, and it's profits started tumbling. The God of Rains had no mercy on India for 4 years straight, and the Indian oil-seed crushing industry saw domestic raw material prices soaring. The increasing demand for edible oil was being met by cheaper imports (not Chinese. Please, no protests here).

To add to this, the company wasn’t able to recover dues from its customers (~ Rs. 5,000 crores written off in the year ended March 2018). Since the company wasn’t able to generate enough cash flows to sustain itself, Ruchi Soya fell into a vicious cycle of borrowing more to pay off the existing debt.

Lenders weren’t gonna keep quiet. Plus, the RBI was pushing banks to clean their books, treat bad loans as bad. So, the bankers took Ruchi Soya to court, and insolvency proceedings began.

Let’s take a minute and understand how this works.

When borrowers fail to pay back the loaned amount to banks, the banks have a right to refer the company to a board called the National Company Law Tribunal (NCLT) and appoint a ‘resolution partner’ - someone who can make the company better again. The resolution partner acts on behalf of these downtrodden lenders and tries to revive the company. If they cannot revive the company, they look for potential buyers (if the company has worthwhile assets). It makes multiple plans and submits them to the Board of Creditors (banks). The banks, if they like the plan, approve it, and this seals the fate of the company.

For Ruchi Soya, the resolution plan involved the following:

The banks agreed to waive off around 60% of their loans

Patanjali Ayurveda offered to take over the company for INR 4,350 crores for 98.9% equity stake

Existing equity shareholders stake was reduced to 1/100th of what they held previously

This deal made the old investors mad.

Their holdings were reduced to 1/100th! So much so for investing their hard-earned money in this company.

Confused? Time to simplify.

Let’s say you purchased 1,000 shares of Ruchi Soya at Rs. 7 each when things were not so bad (total investment of Rs. 7,000).

After the announcement of the share reduction plan, you were now left with only 10 shares of Rs. 7 each. Which is basically Rs. 70.

That works out to a loss of Rs. 6,930 which is like 99% of your investment.

Got it?

Now, as per regulations, promoters (entities having a significant influence on a company) can't hold more than 75% stake in a listed company. However, Patanjali got special treatment (sort of) as it was ready to clean up the loan mess. The courts approved Patanjali to hold 98.9% stake for a period of 3 years, after which Patanjali will have to dilute (sell) its holding and bring it down to 75%. The three year period ends in December 2022.

To make all of this happen, the Ruchi Soya first had to remove itself from the stock exchanges (delisting).

Note: Delisting implies that the stock will no longer be trade-able from your laptop or mobile screens on NSE / BSE. However, you can still sell your shares to some other willing buyers through a share transfer document. (Alert: Lots of paper-work and hassle involved). Why do companies do this? So a listed company has to file a lot of documents and publish a lot of reports to regulators and investors. By delisting, they free themselves from this hassle of reporting regularly.

So basically, delisting implies more hassles for investors and fewer hassles for the company?

Yes, smarty. Absolutely on point.

The new Ruchi Soya was re-listed on 27 Jan 2020. And it has gone only one way since then. Onwards, and upwards (except for a very brief period of time, when it went down. But let’s ignore that for now).

Promoter holding in Sep'19 company was 15.53% and remaining was invested by retail investors (small investors like us). Large institutions and mutual funds stayed away from this stock (and for good reason). Smaller ones got duped.

In Jan 2020 the promoter holding went up to 98.9% (Patanjali) and the remaining is with retail investors. (Note: Larger players are still staying away).

Basically, they took the shares from the small shareholders and handed them over to Baba Ramdev’s Patanjali.

Valuation Game

The value of the company is already 10X of what Patanjali paid to acquire it. Some neat business gimmicks.

Cost of Investment - INR 4,350 crores

Value of Investment - INR 44,150 crores

In years? Nope. Just 5 months.

But, why is the price still rising? Is Ruchi Soya so good?

It is rising because of the law of demand and supply. The number of shares available for trade has drastically reduced. Since everybody sees the price only going up, there is always someone trying to buy Ruchi Soya’s shares and no one willing to sell it.

So, is Ruchi Soya really worth INR 44.5K crores? Let’s take a look at its value (to understand the difference between price and value, read this one).

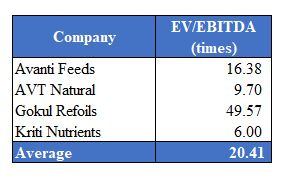

Enterprise Value (EV) to Earnings before Interest, Taxes and Depreciation (EBITDA) ratio gives a fair idea about the value of a manufacturing business. Take a look at the EV / EBITDA ratio of some of Ruchi Soya’s peers.

Historical EBITDA margin (EBITDA / Revenue) for Ruchi Soya (during the good years) was 3%. Assuming it can maintain that and achieve a revenue of INR 30,000 crores (as Patanjali claims, which is SUPER out of the world), and using industry average EV / EBITDA ratio of 20 times, we arrive at an enterprise value for Ruchi Soya:

INR 30,000 crores x 3% x 20 times = ~INR 18,000 crores

This is nowhere near to the current valuation of ~INR 45,000 crores. Even if we consider the company to be super awesome, and use an out-of-the-world EV / EBITDA ratio of 40 times, we still get only INR 36,000 crores.

To justify the current value of 44.5K crores, Ruchi Soya will have to earn an EBITDA margin of ~7.5% consistently. Can that be achieved? We couldn’t find anything from the Annual Reports to suggest so. (We may be wrong, obviously. Do your own research for more comfort).

Note: We have been super lenient with our assumptions. If we were to assume aggressively, we would get a valuation of:

INR 13,000 crores x 3% x 20 times = INR 7,800 crores

(that’s like 20% of the current valuation. Implying that the prices should fall by 80% basis this).

Ramdev Baba’s ayurvedic formula seems to have worked for Patanjali and Ruchi Soya.

The real question is - what will happen once Patanjali has to offload 14% shares (to reduce its holding to 75%)? Will it be sold off in the open market, making the stock prices crash (momentarily, because of the huge supply and not enough demand)? Or will it sell off the remaining stake to some “strategic” investor? Or will it go for a reverse merger (explained below) and get listed through the back-door?

Only time will tell.

Till then, we can just crib about not buying this at INR 17 per share. Life is tough, and then we die. Huh.

Note: A reverse merger implies that a larger company is eaten up (voluntarily) by a smaller company. Why do this? See, Ruchi Soya is listed. Patanjali is not. And it is tough to get listed. Patanjali has been trying to get listed separately, but some regulatory concerns don't allow it to do so. Hence, it is trying to get listed through the back-door. Reverse-merge with Ruchi, and life set. Sounds like a match made in heaven. Or the bourses. Whichever. Don’t really care. Guess we need to find our Ruchi somewhere else. As my friend likes to remind me thrice a day, “Ye Ruchi to haath se nikal gayi.”

Going back to cribbing. Bye.

Thousands of readers get our daily updates directly on WhatsApp! 👇 Join now!

Disclosure: All content provided in this website is for informational and educational purposes only and is not meant to represent trade or investment recommendations.