The Curious Case of Orchid Pharma

Orchid Pharma has given a crazy 12,066% return in the last few months. Another Ruchi Soya in the making? Or is it different this time? Read on.

Stock markets is a funny game. Something bizarre happens every once in a while. Sometimes it gives the best lesson in economics. Sometimes, on human psychology.

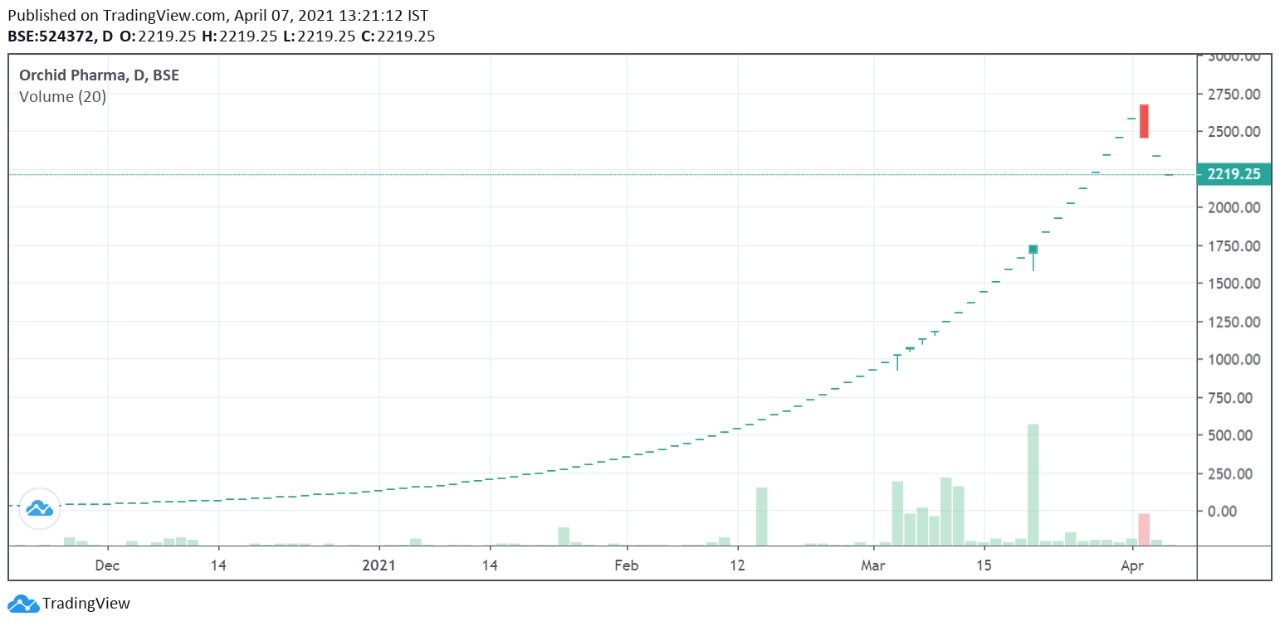

Something out worldly is happening with the stock prices of Orchid Pharma. The shares of this unsuspecting and innocent company got listed on 3rd November 2020 at Rs. 18. But, just within 5 months, the stock prices have soared to Rs. 2,220 (currently, as we write), a 12,066% return on investment!

This return will put Bitcoin to shame, which only gave a 218% return in the same period.

Urghh! Firse train miss kar di?

Before you slip into the bubble of regret, let's understand what's going on and if the train was even worth catching?

The journey of Orchid Pharma began in 1992 as an export-oriented pharmaceutical company. All was going well until 2016. But then, the business took a downturn. The company’s offerings of Active Pharmaceutical Ingredients (API) was facing tough competition from Chinese companies' cheap APIs.

Orchid Pharma could not keep up with its margins and its revenue declined.

For the year ended March 2017, the company’s revenue was Rs. 782 crores and the loss was Rs. 488 crores! As a result, they could not repay the heavy debts that they had (Rs. 3,526 crores) and the company had to go for restructuring and insolvency proceedings. These proceedings are a final attempt to make the business viable again or to salvage whatever is left of the company and distribute it among the creditors and investors in the fairest manner.

If you keep the troubles aside, Orchid Pharma was a company of substance. It had government-approved pharma manufacturing facilities, which could be a good asset if acquired by other pharmaceutical companies. And so, after a lot of drama and action, the company was finally taken over by Dhanuka Laboratories. They got 98% of the shareholding and the retail investors who invested in Orchid Pharma back in 2017 were allotted 1 share for every 221 shares they were holding before the company went under the hammer in 2020.

Now imagine if you earn Rs. 221 and you are told that Rs. 220 will be taken away from you, just by the stroke of a pen - won’t you be furious?

Well, under normal circumstances, entities having a significant influence on a company can't hold more than 75% stake in a listed company, but Dhanuka Laboratories got special treatment for its heroics. So, you will have to draw comfort from the fact that if Dhanuka Laboratories would not have saved the day, there would be no Orchid Pharma shares at all. Although, with a condition that it will have to reduce its stakes to 75% within 36 months.

And, this is where the real story begins.

The retail investors hold only 0.5% of the shares (2,06,480 shares) that are traded on the stock exchange. And they might be unwilling to book losses, so they kept holding onto their shares, creating a situation of scarcity. And scarcity leads to a price surge.

One thing leads to another. Seeing the price rise made others excited about the prospects of the company and increased the demand for the shares. High demand and scarce supply make any commodity more desirable, leading to a further surge in price. Everyone wants to buy and no one wants to sell!

Stock prices could shoot the roof one day or crash to the ground. Well, SEBI also thought so. To stop this from happening, they set a rule - if there are a lot of people willing to buy in comparison to almost negligible people wanting to sell, the price increase is capped at 5% (varies for different companies).

When this happens, market pundits call it - ‘circuit lag gaya.’

But that ball of price once set in motion only goes one way - up.

If not on one day, across several days. And Orchid Pharma was one such company that hit the upper circuit on more than 100 consecutive days. You can see the massive price rise in the chart below (the bubble has however started deflating as the prices have been falling over the past few days).

Even if you wanted to buy the shares (when they were rising), chances are you wouldn’t have gotten them at all.

The massive price rise and people rushing in to buy might not be very surprising. What’s surprising is how we fall in the same trap again and again. It’s like an episode of ‘Dark’ where you keep repeating the same thing over and over. This incident is a repeat telecast of Ruchi Soya’s 8,800% rally. That’s an interesting story in itself (click here to read).

And who ends up losing in this game?

Us. The retail investors.

For this very reason, SEBI has revised its norms. These “back-from-the death” companies will now need to have 5% public shareholding at the time of listing itself. No more super small shareholding gimmicks.

Hopefully.

Until next time… read on.

Don’t check your inbox regularly? Thousands of readers get our daily updates directly on WhatsApp! 👇