Why is Infosys Buying Its Own Shares?

Great news for those who invested in Infosys. And a lesson in finance for those who did not.

Infosys has announced share buybacks of Rs. 9,200 crores and dividends of Rs. 6,400 crores for its shareholders!

This is huge!

But wait, what is a share buyback?

When a company earns profits, it can do these three things:

Keep the money, and invest it in more projects (growth)

Give the money directly to its shareholders as dividends

Buy some of its own shares from shareholders in a "buy-back"

Money goes in the hands of the shareholders who sell their shares to the company (not all choose to). The company then deletes the shares it buys from its books.

So, why is Infosys doing this?

Because it is sitting on a huge pile of cash. Rs. 24,714 crores of it.

The company generates enough cash every year to grow on its own and hence, does not need soooo much.

So, the best way out is to give money back to its shareholders, who can then choose to invest the money wherever they wish to.

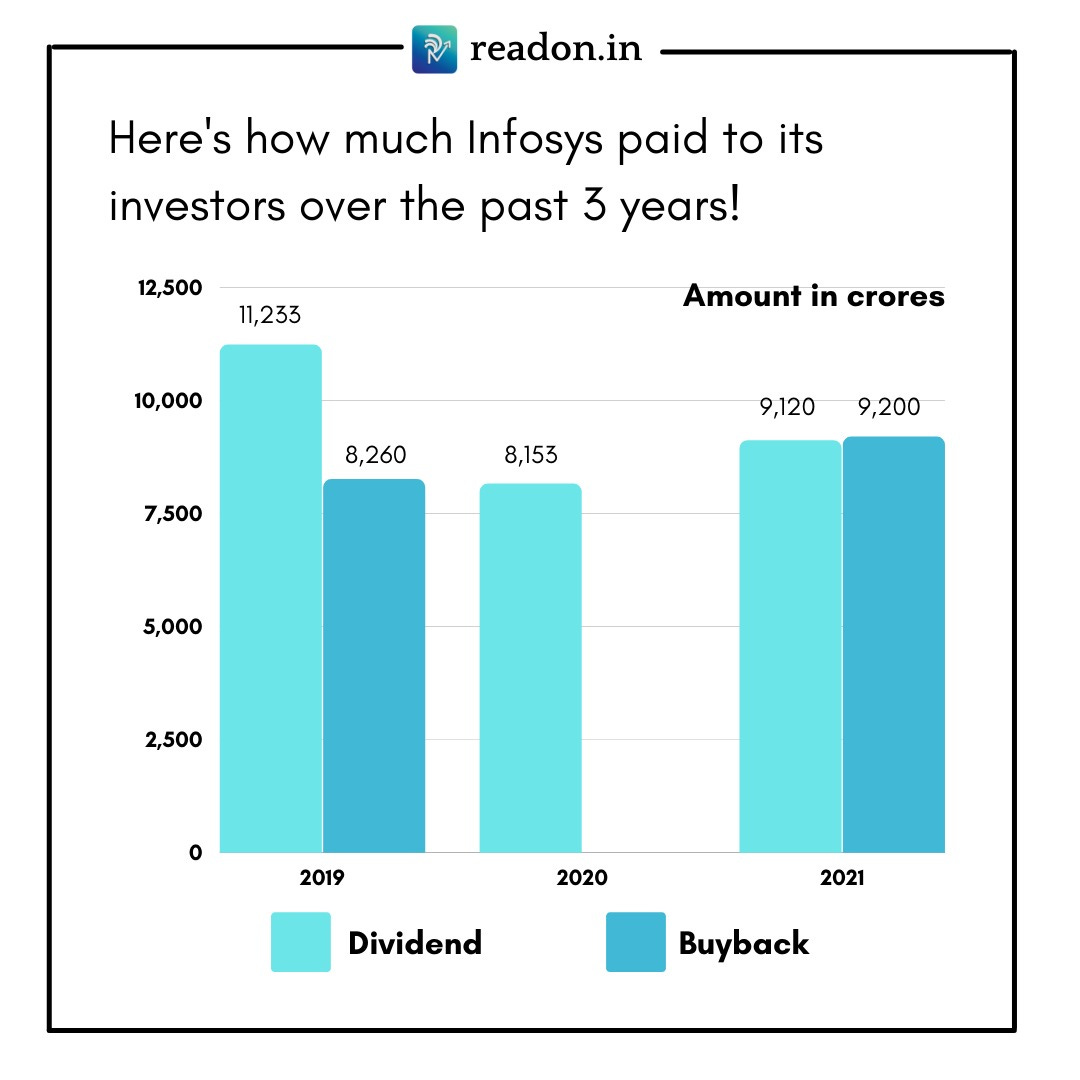

And Infosys has a history of paying out huge sums to shareholders.

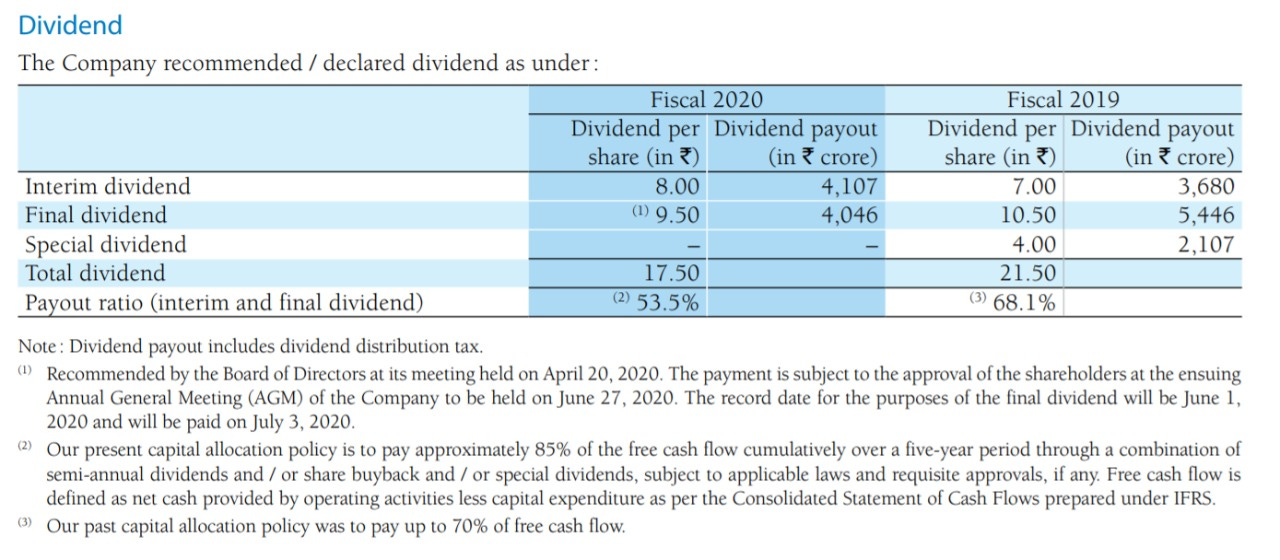

Till 2019, it used to give back 70% of its cash earnings to shareholders.

Now, the company has decided to give back 85% of it! How do we know? Here, mentioned in these tiny notes to accounts. Take a look:

But why do companies go for buybacks? Why not just simply distribute dividends and be done with it?

Buyback reduces the number of shares of the company in the market. Now, the earnings of the company will be divided among a lesser number of shares. This increases the earning per share.

Buybacks also show the confidence of the management in the business and is a way to boost its stock prices.

Buybacks have been used to reward shareholders by almost all IT companies - Wipro, TCS - you name them. The industry is ultra-cash rich, hence this is possible.

Know any other super famous company in the world, run by a super successful investor, that loves buying back its stock?

Any guesses? (use the comment section to make a guess).

Here’s something I was reading yesternight and would want you to take a look at. It’s Jeff Bezos’ last annual letter to its shareholders - he’s stepping down as CEO, and will take the position of Executive Chairman. The piece is inspiring and bold. Here.

Have a great day ahead 😊 - Shantanu Jain

Don’t wanna miss out on any post? Get our daily updates on WhatsApp. Just two clicks, and done!

Berkshire Hathaway loves buyback the most 😅 As per Warren Buffett it's a sign of good management who resist institutional imparative and in case they don't have great opportunity to invest excess cash, they decides to return to its shareholders by way of dividend or share buy back.

But its a open buyback . you never know at what price they buy. It could be lesser than announced price