When Shareholders Start Getting Loud

Don't underestimate the power of a... minority shareholder!

At ReadOn, we don’t just report the markets. We help you understand what truly drives them, so your next decision isn’t just informed, it’s intelligent.

₹7 lakh crore.

That’s how much investors lost in ten listed Adani Group companies after a report from US-based short seller Hinderberg Research alleged the group of “brazen stock manipulation and accounting fraud scheme over the course of decades”. Hindenburg Research was a prominent forensic financial research firm specialised in activist short-selling. The firm investigated companies for fraud, mismanagement, and accounting irregularities, releasing public reports while taking short positions to profit from stock price declines.

But this was a foreign firm investigating an Indian one for potential gains. Indian shareholders, for decades, have been exceptionally well-behaved. They showed up to AGMs. They voted as promoters wanted. They rarely questioned management. But somewhere between the Satyam scandal, the Kingfisher collapse, and a wave of corporate governance failures, something shifted. Shareholders stopped treating their equity stakes as passive bets and started treating them as tools for change.

However, August 2017 marked a significant milestone for the average Indian investor. Shareholders at HDFC Life’s annual general meeting did something unusual. They voted against the board. Not with a handful of dissenting voices, but with 22.64% of shareholders opposing the reappointment of one of India’s most respected corporate figures, Deepak Parekh, as a director.

The resolution still passed. Parekh kept his seat. But that 22.64% was a signal that India’s traditionally silent shareholders were finally learning to speak up.

How has shareholder activism grown in India and abroad? Let’s find out.

What is Shareholder Activism?

At its core, shareholder activism is simple. It’s when investors use their ownership stake (often a relatively small one) to pressure companies into action. They don’t need 51% of shares to make noise. A 5-10% stake is often enough to force uncomfortable conversations.

The goal can be financial, like unlocking value through spin-offs, buybacks, or dividend payouts. Or it can be operational like demanding better governance, questioning executive pay, or blocking questionable related-party transactions. Sometimes, it’s about forcing board changes. Other times, it’s simply about making management uncomfortable enough to course-correct.

Unlike hostile takeovers, which are expensive and rare, activism is scrappy. It leverages proxy battles, media campaigns, and shareholder resolutions to create pressure without needing control. The activist’s weapon isn’t money. It’s influence.

But how has India’s shareholder activism been?

When Indian Shareholders Finally Showed Up

India’s tryst with shareholder activism has been slow-burning. According to a 2017 report by InGovern Research Services, 45 out of 100 companies in the Nifty 100 index saw at least one resolution at their AGM opposed by 20% or more shareholders. That’s not enough to block decisions, but enough to make boards sweat.

Take Raymond Ltd. in 2017. The company proposed selling an apartment owned by it to its promoters, reportedly at a price significantly below market value. Since promoters can’t vote on related-party transactions, the resolution depended entirely on minority shareholders. They rejected it with 70.6% voting against it. This was a governance red flag too obvious to ignore, and the minority shareholders tore it down.

Then there’s Suzlon Energy in July 2018. The board wanted to raise ₹2,900 crore through equity and debentures. Shareholders killed the proposal. It received only 65.12% approval, and fell short of the 75% threshold needed for a special resolution.

The most dramatic case came in 2022 with Invesco versus Zee Entertainment. Invesco, holding a significant stake in Zee, requisitioned an extraordinary general meeting to reconstitute the board. Zee’s promoters resisted. The matter went to the Bombay High Court, which delivered a landmark judgment affirming Invesco’s right to call the meeting. Though Invesco eventually withdrew its request, the legal precedent was set. Shareholders could, in theory, force board overhauls.

Around the same time, at Dish TV’s EGM in June 2022, shareholders rejected the reappointment of the managing director, with nearly 79% voting against it. These weren’t fringe cases. These were high-profile battles involving well-known promoters.

But the situation remained the same. Most of these interventions succeeded only when governance breaches were extremely bad and undeniable. But this won’t be enough. Shareholders, even in the minority, are the owners of the business. They need to get their hands dirty and take charge. We took a page or two out of the global playbook in this matter.

When Activism Gets Nasty Globally

To understand where India might be headed, it helps to look at where activism thrives. In the US, activist investors aren’t limited to just complaining. Their stakes are their weapons.

Take Carl Icahn, an American businessman and investor. In 2013, when Michael Dell proposed taking Dell private through a leveraged buyout, Icahn bought a large position and launched a public campaign against the deal, arguing it undervalued the company. He didn’t win outright, but he forced Dell to increase the offer.

Then there’s the legendary Herbalife battle between Icahn and Bill Ackman. In 2012, Ackman’s Pershing Square took a $1 billion short position on Herbalife, calling it a pyramid scheme. Icahn took the opposite bet, buying a major stake and defending the company. A multi-year, public war followed, complete with televised insults on CNBC. Icahn won. Herbalife’s stock climbed, and Ackman eventually exited his position at a loss.

In 2013, Icahn also targeted Apple, tweeting that the company was “extremely undervalued” and pushing for a $150 billion buyback program. Apple didn’t go that far, but it did increase its buyback, marking a partial victory driven largely by Icahn’s noise.

Activists don’t need board seats or majority stakes. What they have is credibility, capital, and the willingness to make things uncomfortable. That playbook remains largely foreign to India’s corporate culture.

Is Shareholder Activism There Yet in India?

The short (and unpleasant) answer: Not quite. The long answer: It’s complicated.

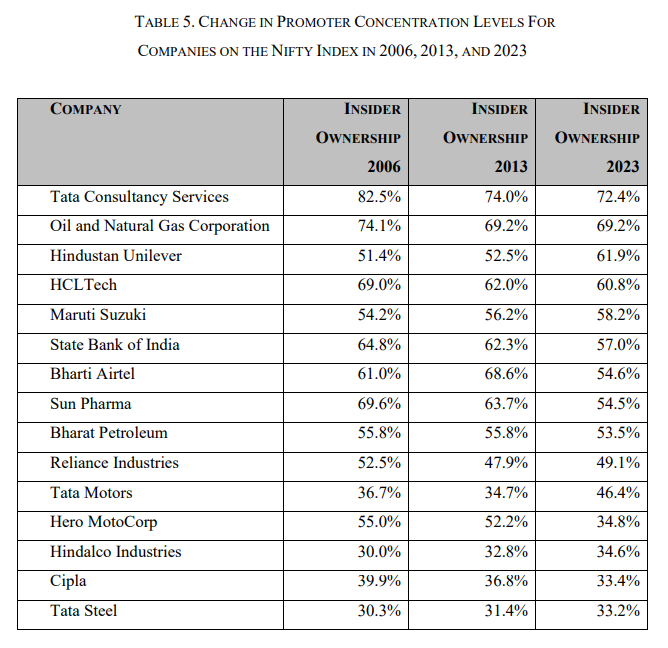

India’s corporate structure is fundamentally different from the US or the UK. Over half of the Nifty 50 companies still have promoters holding majority stakes.

Even where promoters don’t have 51%, effective control often rests with them due to concentrated ownership and voter apathy among smaller shareholders. In such a setup, activism can only go so far.

As Professor George Geis noted in his 2024 analysis, “even at the end of 2023, half of the firms in the Nifty Index continue to have shareholder patterns where insiders own an outright majority of shares.” That dominance makes board overhauls or strategy reversals extraordinarily difficult.

But there are positive signs. The Companies Act, 2013 gave minority shareholders stronger legal tools. SEBI’s regulations on related-party transactions and disclosure norms raised governance standards. Proxy advisory firms, though not as influential as in the US, are starting to matter. Institutional investors, particularly foreign funds, are becoming more vocal.

And courts are paying attention. The Invesco-Zee judgment was a watershed moment, affirming shareholders’ rights to requisition meetings and challenge boards. That kind of judicial backing emboldens future activism.

The challenge? Activism in India still succeeds mainly when governance violations are blatant. Subtler issues like strategic missteps, capital allocation errors, or underperformance don’t yet trigger the same shareholder backlash that they do in the West.

Informal activism through quiet negotiations between institutional investors and promoters remains underdeveloped. Most activism is formal and public, often adversarial. That limits its effectiveness.

The Road Ahead

So, where does this leave India? Somewhere between promise and frustration.

The infrastructure is improving. Legal protections exist. Institutional ownership is rising. Courts are more supportive. Proxy firms are gaining traction. But at a structural level, promoter dominance and concentrated ownership patterns continue to dampen the impact of activism.

India’s shareholder movement is real, and it’s growing. But it’s not yet a force that can consistently reshape corporate strategy or dislodge entrenched management. For that to happen, ownership structures need to disperse further, and minority shareholders, both institutional and retail, need to coordinate better.

Until then, activism in India will remain what it is today. Loud enough to make promoters uncomfortable, but rarely loud enough to force their hand.

Development in shareholder activism should happen in India’s investing future. Hopefully not in a future that’s too far.

Until then, ReadOn!

In other news, have you been checking out the crosswords below these articles? Try them out for yourselves, and see how quickly you can solve them!

ReadOn Insights Crossword 09-02-26

For: Copper’s Bacteria Gold Rush

Hints:

Across:

3: A low-energy metallurgical process that uses microbes to dissolve metals instead of relying on high-temperature smelting.

5: A critical industrial metal whose global benchmark price touched $13,000 per tonne in 2026, driven by electrification and supply constraints.

6: A digital technology increasingly used to optimise copper recovery, predict microbial performance, and manage variability in waste-pile composition.

7: A technology unit focused on microbial metal recovery, whose leadership has highlighted advances in copper-eating bacteria.

8: Micro-organisms deployed to extract metals from low-grade ores and legacy mining waste that were earlier considered uneconomic.

Down:

1: Tinto A major miner producing copper at scale using micro-organism-based recovery techniques.

2: A miner applying heap-leaching techniques on massive legacy waste dumps in the United States.

4: An executive who explained how bacteria adapt and evolve over decades to improve metal recovery.

8: The mining giant is testing bacterial copper extraction at its Olympic Dam operations.

9: The world’s largest copper-producing nation, supplying nearly one-quarter of global output.

To solve this puzzle, click here!

06.02.2026 (Answer Key)

Across:

3: Textiles

5: Automotive

7: CBAM

8: Wines

10: Gems

Down:

1: Narendra Modi

2: Leyen

4: Fta

6: EU

9

Services