Copper's Bacteria Gold Rush

The global industry has found an infectious new extraction technique!

At ReadOn, we don’t just report the markets. We help you understand what truly drives them, so your next decision isn’t just informed, it’s intelligent.

Copper has hit $13,000 per tonne. Mining giants are scrambling. But there’s a twist. They’re not racing to discover new deposits. They’re digging through their own garbage dumps.

BHP, Rio Tinto, Freeport-McMoRan, and Vale are deploying an unlikely workforce: bacteria. These microscopic miners are feasting on decades-old waste piles, extracting copper that was once considered unrecoverable. It’s not science fiction. Rio Tinto announced last month it produced industrial-scale copper quantities using “micro-organisms”. These are bugs that have been adapted over 30 years to eat copper-bearing minerals.

The industry’s “holy grail”, as one mining executive called it, is suddenly within reach. But why now? And what does this mean for the copper supercycle everyone’s betting on?

The Copper Crunch Is Real

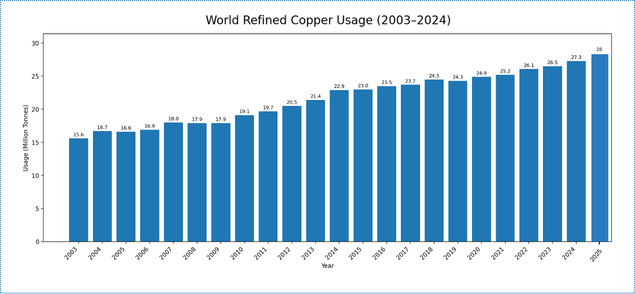

Let’s start with the numbers. Global copper demand grew 2.7% annually over the past two decades and hit 28 million tonnes in 2025. By 2050, we’ll need 50 million tonnes per year.

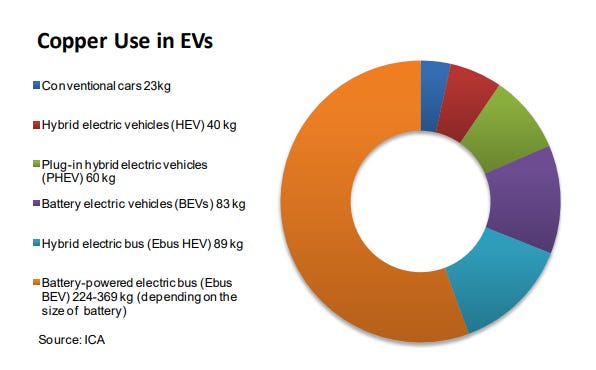

The culprit? Everything we’re building for the future runs on copper. Electric vehicles use 3-4 times more copper than internal combustion engine (ICE) cars. Data centres alone consume 500,000 tonnes of copper annually, equivalent to India’s entire annual refined copper production.

Renewable energy systems use 5 to 12 times more copper than traditional fossil fuel plants. Translation: our clean energy transition is impossible without dramatically more copper.

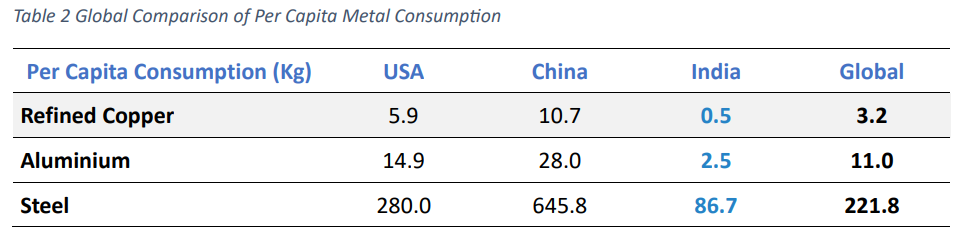

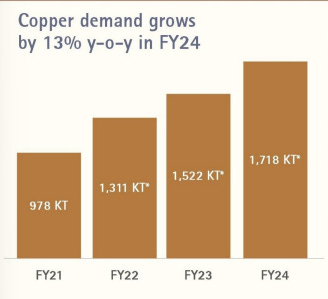

In India, per capita copper consumption is just 0.5 kg, far below the 3.2 kg global average. But we’re catching up fast. Demand grew 20% annually over the past three years, reaching 1.7 million tonnes in FY24. By 2030, we’ll need 3-3.3 million tonnes. By 2047? 10 million tonnes!

The market knows this. Copper prices have tripled since July 2020, jumping from ₹450 per kg to ₹1,318. Investors aren’t calling it the “new oil” for nothing.

The Supply Side Nightmare

But copper’s supply isn’t keeping pace. Mine production grew just 2.43% annually, which is slower than the 2.7% demand growth. Analysts predict a 30% supply deficit by 2035.

The problem? Easy copper is gone. Average ore grades at major mines crashed from 1-2% to 0.5% or lower. Since the 1990s, ore grades declined 40%. Companies now extract, process, and transport significantly more rock for the same copper. Every kilogram requires 84 litres of water and expensive energy.

Over 50% of copper mines are 20+ years old. High-quality deposits are exhausted. New mines take 10-15 years from discovery to production, requiring billions in capital. Environmental assessments alone consume 3-5 years, followed by permitting battles and construction delays.

Geographic concentration compounds the problem. Chile produces 23% of global copper (13.6% of its GDP), Peru adds 12%. China controls 45% of refining capacity and seven of the world’s eight largest refineries are in China.

Recycling Alone Won’t Save Us

Copper is 100% recyclable without quality loss. Unlike silver, where recycled material degrades, recycled copper performs identically to freshly mined copper. Currently, 32% of copper supply (about 8.5 million tonnes annually) comes from recycling.

But there’s a catch. Copper is predominantly used in equipment, construction, and infrastructure with 20-40 year lifespans. You can only recycle copper after these products reach end-of-life. The recycling cycle is too slow to match today’s surging demand.

Even if we recycled every available scrap, we’d still face a massive shortfall. The International Energy Agency’s projections make this clear. Expected supply by 2030 is 21.8 million tonnes under the base case, while copper required for stated policy scenarios hits 28.3 million tonnes. Recycling helps, but it’s not the solution.

Enter the Bacteria

This is where yesterday’s waste becomes today’s opportunity.

The economics of copper mining have flipped. Material that was unprofitable to process 20 years ago, sitting in waste piles with 0.2-0.3% copper content, now contains similar concentrations to ore currently being mined. At $13,000 per tonne, even low recovery rates generate substantial profits.

Industry estimates suggest waste pile recovery could add 500,000 to 1 million tonnes of annual copper production. That’s equal to 5-10% of current world supply. The material already sits on company-owned land near existing infrastructure. Nearly pure profit.

Bio-leaching is the breakthrough. Here’s how it works. Naturally occurring bacteria, adapted over decades, are grown in bioreactors and added to piles of crushed ore. These microorganisms consume copper-bearing minerals and release copper ions into acidic solution. The copper dissolves and gets collected through conventional recovery techniques.

The magic? This happens at ambient temperature without energy-intensive smelting. Bio-leaching operates at roughly one-tenth the energy cost of traditional smelting while processing material that’s too low-grade or metallurgically complex for old methods.

“It’s fascinating what these little bugs or bacteria can do,” Harald Muller, Nuton’s chief technology officer, told the Financial Times. “They’re naturally occurring but have been adapted to our conditions over the last 30 years.”

BHP is researching bio-leaching for its Olympic Dam operation in Australia. Freeport-McMoRan is deploying large-scale heap leaching on billion-tonne waste dumps in Arizona. Kathleen Quirk, Freeport’s chief executive, said the new leaching technology could provide two-thirds of growth in the company’s US copper production by 2030.

“Now we have technology that allows us to find where the copper is in these stockpiles,” she explained. “The effect on production of deploying the process at the US site was ‘the equivalent of a big new mine.’”

Beyond Bacteria: AI and Advanced Metallurgy

Mining companies aren’t stopping at bugs. They’re combining multiple technologies to squeeze maximum value from waste.

Artificial intelligence and sensor networks continuously optimize copper extraction. Modern sensors monitor recovery in real-time while AI algorithms adjust processing parameters like acid concentration, flow rates, temperature, etc. to maximize yields. These technologies improve recovery from low-grade material by 20-30% compared to traditional methods.

Rio Tinto’s Kennecott operation in Utah uses AI-optimized heap leaching. Computer systems adjust operations continuously based on sensor feedback. Since waste piles contain highly variable material, AI identifies and exploits copper-rich pockets to maximize overall economics.

Advanced metallurgical techniques recover copper that 1970s-1990s technology left behind. Mining tailings from that era often contain 0.1-0.3% copper because historical technology couldn’t economically extract it. Modern chemicals lead to better extraction. Sensor-based sorting identifies copper-rich particles before processing. Hydrometallurgical techniques extract copper from ultra-fine tailings too small for mechanical processing.

The timeline advantage is crucial. Waste reprocessing can begin producing copper within 2-3 years of investment decision, requiring 30-50% less capital than developing equivalent production from new mines. Roads, power lines, water systems, and basic processing infrastructure already exist. They just need adaptation, not construction from scratch.

The M&A Feeding Frenzy

Copper demand skyrocketing has taken the prices with it, triggering a consolidation fever. Rio Tinto and Glencore resumed talks this month about creating the world’s largest mining company. Anglo American and Teck Resources agreed on a $60 billion combination last year.

In India, major players are expanding aggressively. Adani Group’s Mundra refinery has 500,000 tonnes capacity, planning to double by 2029. Hindalco is investing ₹2,000 crores in copper and e-waste recycling. Vedanta set up a 125,000-tonne plant in Saudi Arabia. JSW plans a 500,000 tonne refinery in Odisha.

India needs to add 1 million tonnes of refining capacity every five years to meet projected 2047 demand of 10 million tonnes. We currently import over 50% of copper demand and 90% of concentrate requirements.

What This Means for the Copper Cycle

The transformation of mining waste from liability to asset reflects fundamental shifts in copper economics.

The supply response is faster than expected. Waste recovery produces copper within 2-3 years versus 10-15 years for new mines, helping moderate price spikes.

The supply curve has shifted. Material uneconomical at $5,000 per tonne becomes profitable at $13,000. As technology improves, even lower-grade material becomes viable. The effective resource base is expanding without discovering new deposits.

Environmental benefits drive support. Companies get paid to remediate historical hazards while extracting copper. This improves ESG ratings and social license to operate.

But challenges remain. Recovery rates from waste hit 40-70% versus 85-95% from fresh ore. Bacteria work slowly. Months to years versus hours for mechanical processing. Projects stay profitable only if prices remain elevated.

The Bottom Line

Traditional mining worked when easy copper was abundant. You find high-grade deposits, extract ore, process once, discard waste. That era ended.

The future requires extracting maximum value from all available copper sources. Mining innovation through biotechnology and artificial intelligence enables economic extraction at grades that would have bankrupted companies two decades ago.

For India, the implications are clear. With low per capita consumption and infrastructure ambitions driving demand high, we’re both a massive market and a critical supply chain participant.

The copper shortage everyone fears might just be solved by the trash we’ve been sitting on all along.

In other news, have you been checking out the crosswords below these articles? Try them out for yourselves, and see how quickly you can solve them!

Until next time, ReadOn!

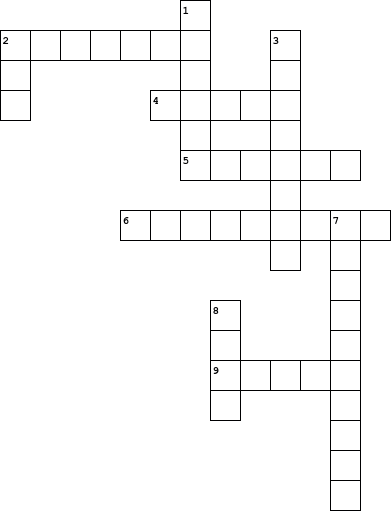

ReadOn Insights Crossword 04-02-2026

Hints:

Across:

2: The state income stream that shrinks over time as the working-age population declines and dependency ratios rise.

4: A mature ageing economy facing extreme pension obligations and high public debt, often cited as a cautionary example.

5: A demographic category applied to states where more than 15% of the population is elderly, triggering structural fiscal pressures.

6: A southern state nearing the ageing threshold, with rapidly rising pension liabilities.

9: A youthful state prioritising education and development spending over pensions.

Down:

1: The state with over 15% of its population aged 60+, making it India’s oldest state demographically.

2: The institution whose State Finances report analysed the fiscal impact of ageing across Indian states.

3: A social spending item that consumes nearly 30% of expenditure in ageing states, crowding out capital spending.

7: The population structure that shapes long-term state finances, influencing revenue capacity, spending priorities, and debt sustainability.

8: The fiscal burden that tends to be highest in ageing states when measured as a share of Gross State Domestic Product (GSDP).

To solve this puzzle, click here!

03.02.2026 (Answer Key)

Across:

1: HZL

4: Debari

6: Sindesar

8: Coal

9: Udaipur

Down:

1: Hedging

2: Tailing

3: Rajasthan

5: Byproduct

7: Silver

Solid breakdown. What caught my attenton was how bio-leaching flips the entire waste narrative. I've been tracking the copper shortage for a minute, and the 2-3 year timeline versus 10-15 for new mines is huge for supply chain planning. The AI optimization part is underrated tho, adjusting processing in realtime based on variability in waste piles makes this scaleable.