The Global Chocolate Roller Coaster

And no, this isn't some sweet Willy Wonka ride!

At ReadOn, we don’t just report the markets. We help you understand what truly drives them, so your next decision isn’t just informed, it’s intelligent.

Speaking of Willy Wonka, its writer Roald Dahl was inspired to write the story from Prestat, a 124-year-old upmarket chocolatier in London. Unfortunately, Dahl’s muse shut its main store in February 2026. The reason? High cocoa prices pushed it to make this decision.

And Prestat isn’t alone. Across the ocean, British favourite Cadbury is slashing pack sizes again. In Switzerland, even premium brands are struggling. Some legacy chocolate makers aren’t just slowing down. They’re shutting down altogether. Others are reformulating their products with less cocoa and more palm oil, so much so that brands like Club and Penguins can no longer legally be called “chocolate” anymore.

This is despite chocolate prices falling for the last few months. Even in the first 12 days of January 2026, cocoa dropped to $5,443 per tonne, down 10.3% from the start of the year.

So what’s going on with the chocolate industry? Let’s find out.

The Shortage That Changed Everything

The trouble started brewing in 2023, but nobody saw how bad it would get.

See, most of the world’s cocoa (~60%) comes from just two countries. Côte d’Ivoire and Ghana in West Africa. These aren’t industrial farming operations with fancy technology. We’re talking about small farms with aging cocoa trees, planted back in the early 2000s, that have been slowly producing less and less.

Then climate change kicked in hard. Erratic rainfall. Scorching heat. Long droughts. And to make things worse, diseases like the Cocoa Swollen Shoot Virus and black pod disease spread through plantations, devastating harvests.

Ghana’s harvest, which used to exceed 1 million tonnes, declined to under 500,000 tonnes in the 2023-24 season. Côte d’Ivoire’s production dropped from over 2 million tonnes to around 1.6 million tonnes.

The result? The International Cocoa Organization predicted a supply deficit of over 370,000 metric tonnes for the 2023-24 season. That’s roughly 6.8 billion 70-gram chocolate bars missing from global supply. And remember this is a commodity where it takes 3-5 years for new cocoa trees to start producing. There’s no quick fix.

Oh, and here’s another sad thought. According to climate scientists, if things don’t change, cocoa-growing regions in West Africa could become completely unsuitable for production by 2050. Some industry experts warn the world may run out of chocolate altogether by mid-century.

Before that happens, there are more problems on the near horizon.

Economics 101

When supply crashes, prices spike.

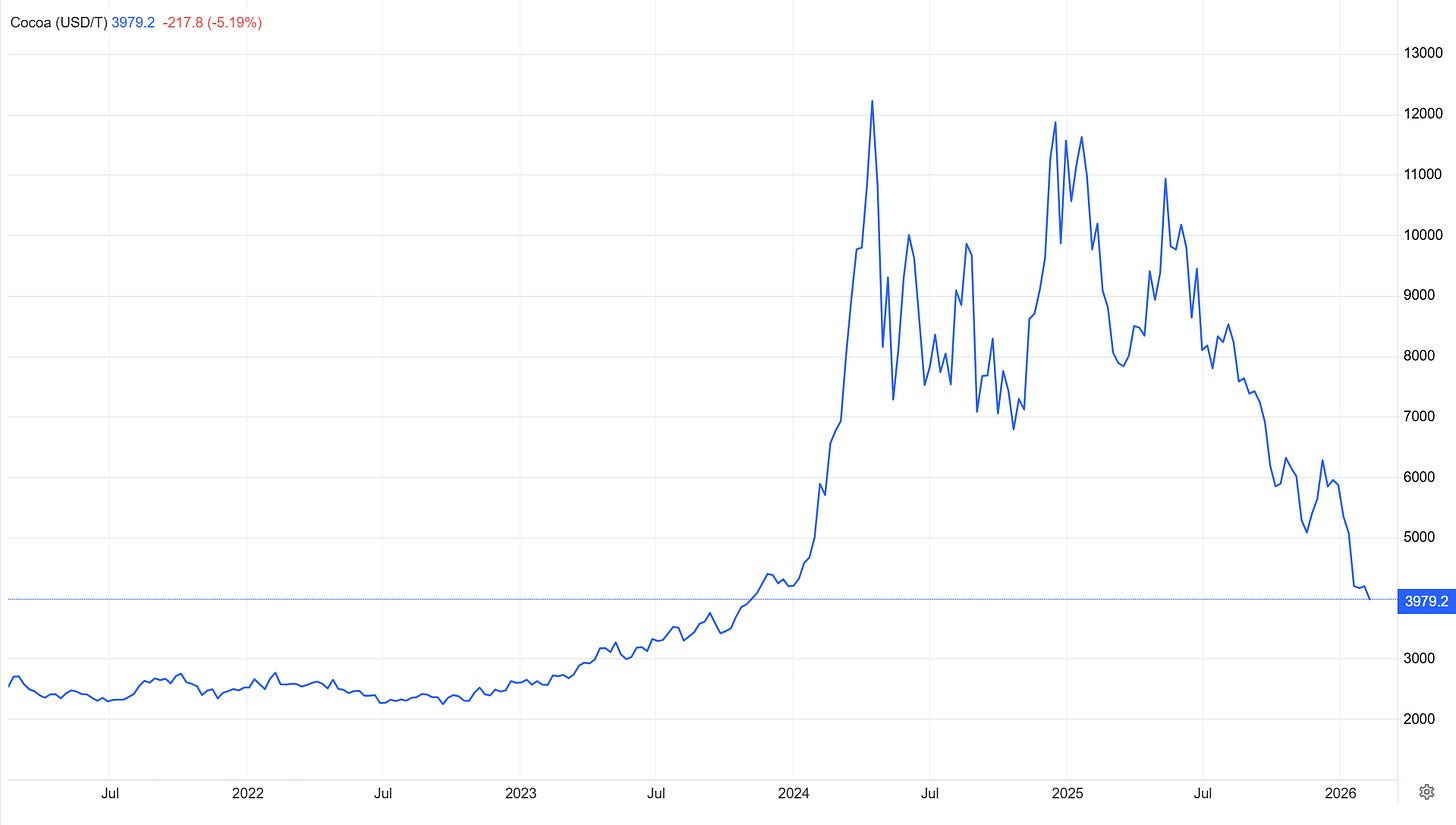

And spike they did. By December 2023, cocoa prices hit $4,200 per tonne. Not bad, but wait. By February 2024: $6,000. March: $9,000. By mid-April, prices were at almost $12,000. Another peak came in late 2024 and early 2025 when prices crossed $11,000 per tonne. That’s nearly three times the historical average.

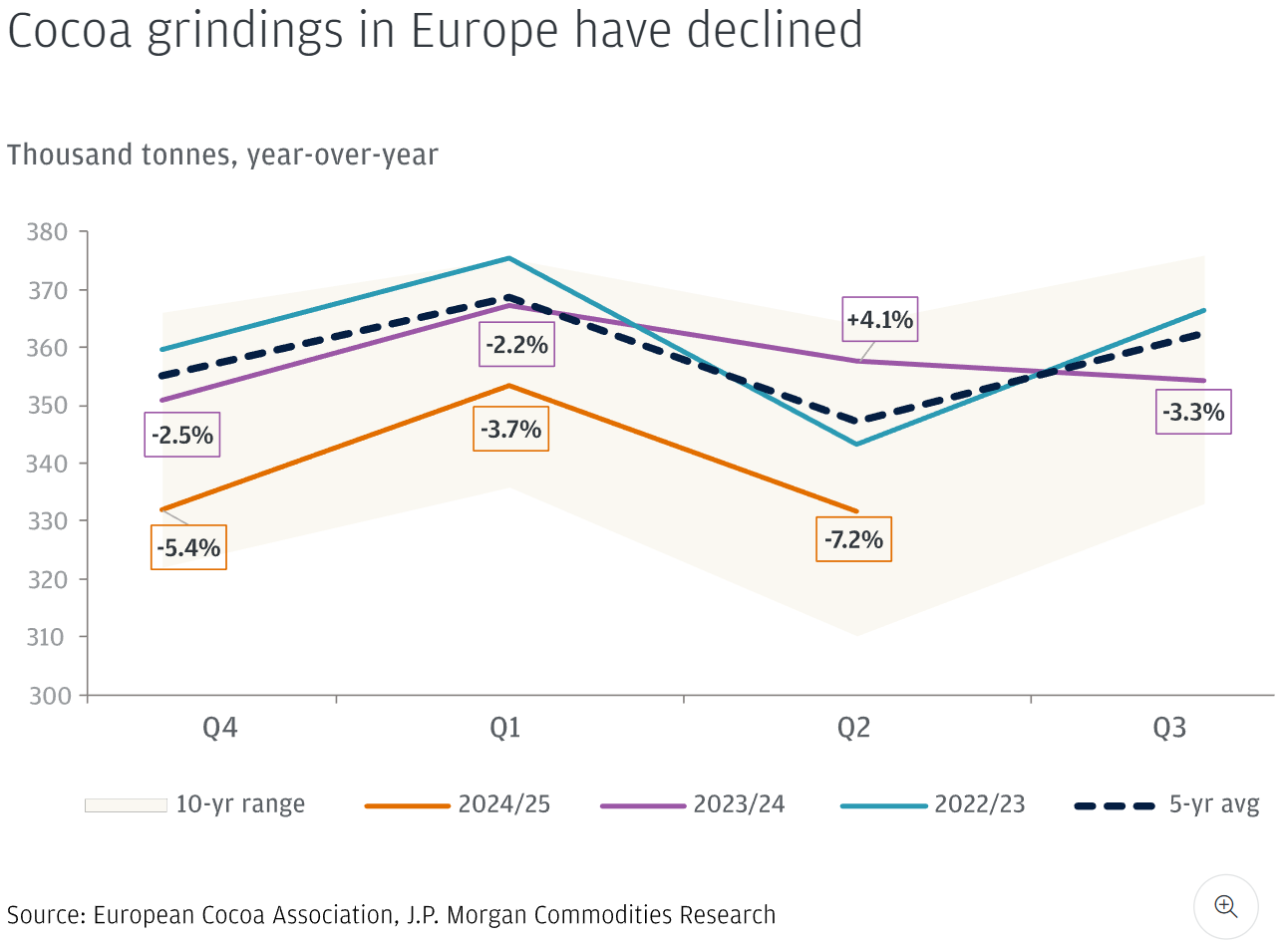

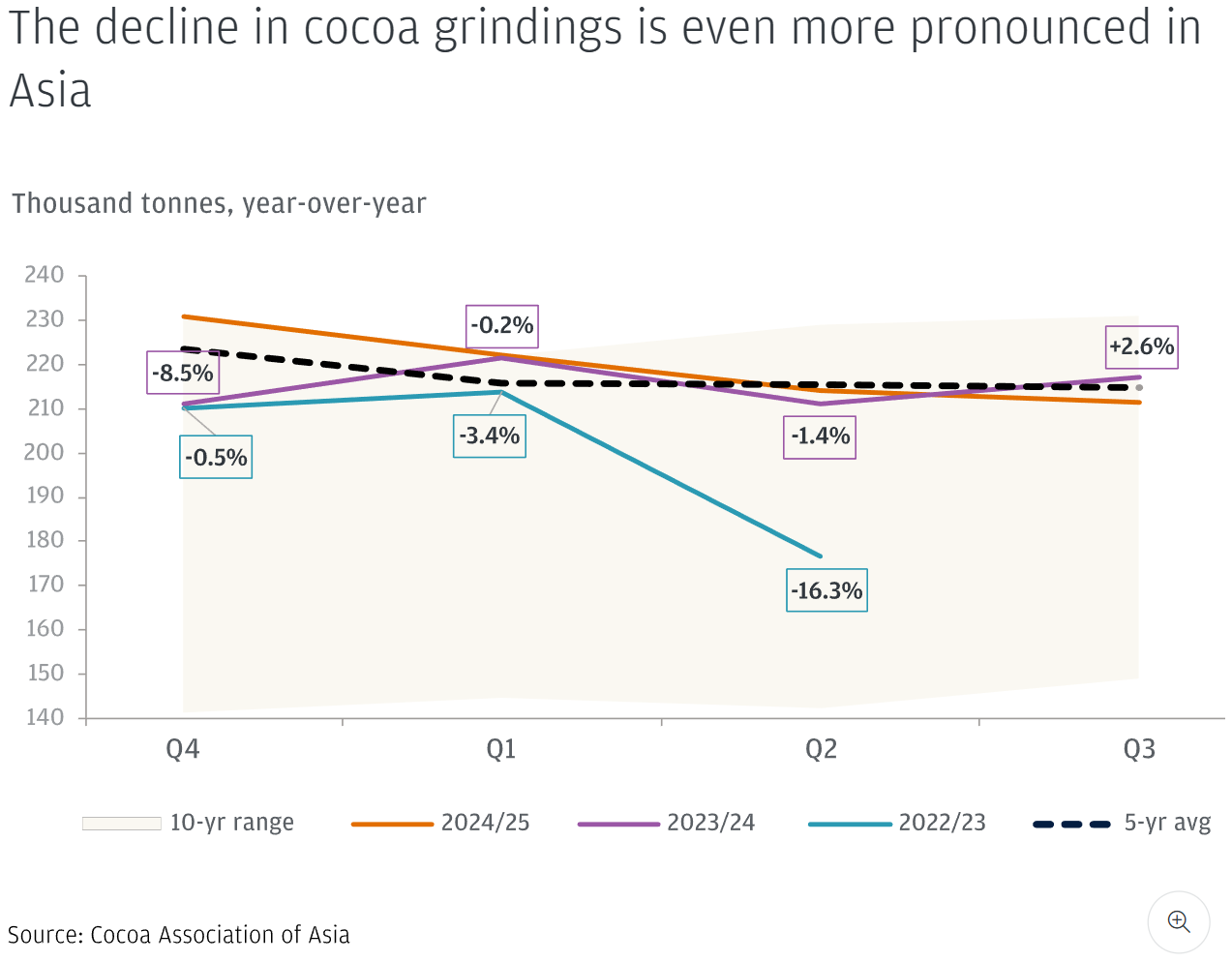

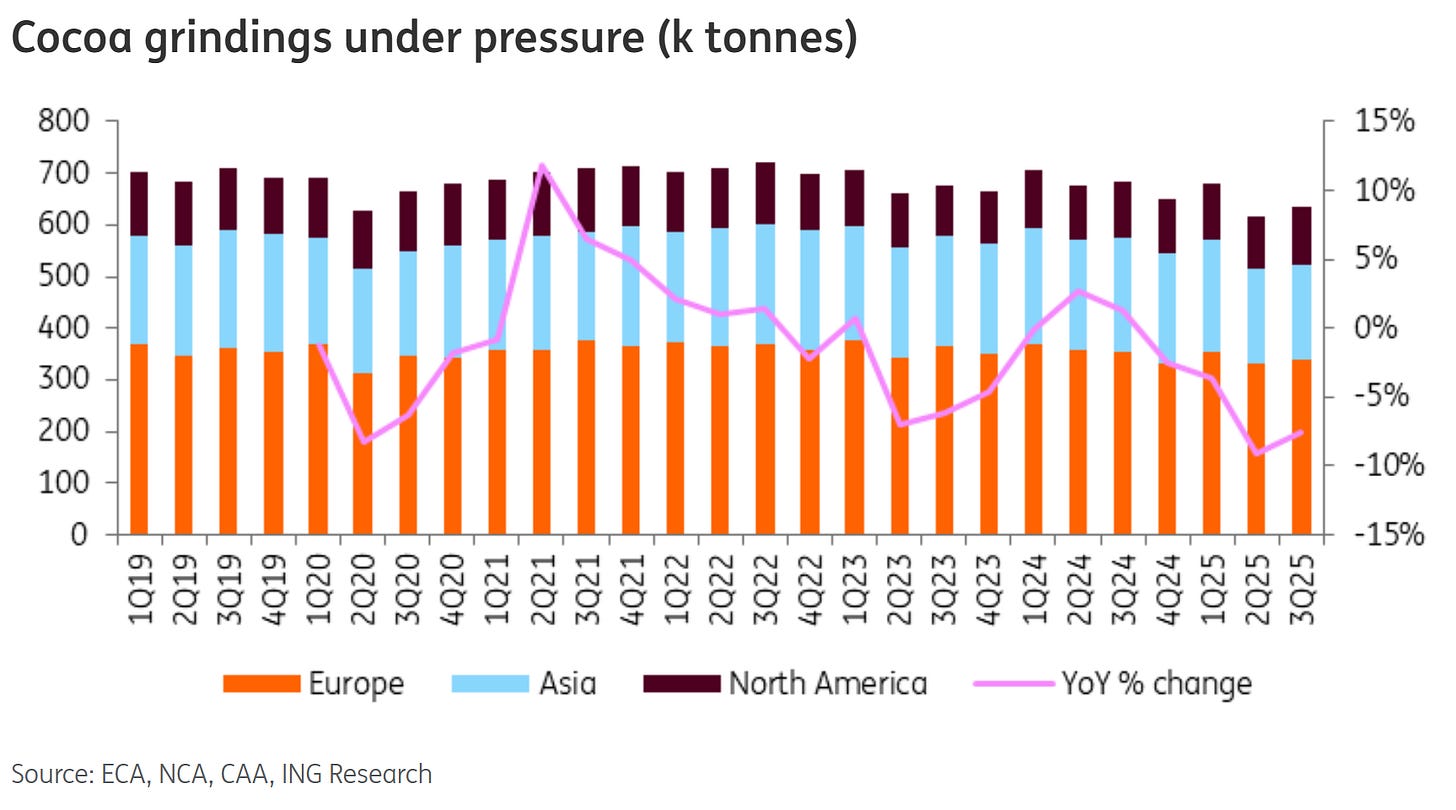

Chocolate manufacturers panicked and demand destruction kicked in. People simply stopped buying chocolate at those prices. Cocoa grindings, which are a key measure of demand, declined by ~7.2% year-over-year in Europe, 16% in Asia, and 2.8% in North America during Q2 2025.

Consumers switched to cheaper alternatives. Gummy bears replaced chocolate bars at Halloween 2025. Candy switched hands on valentines instead of chocolate. A survey by the National Confectioners Association found 45% of respondents had cut down on chocolate spending, switching brands or buying smaller sizes.

Manufacturers weren’t sitting idle either. They reduced cocoa content in products, introduced smaller pack sizes (hello, shrinkflation), and reformulated recipes. Some even launched cocoa-free “chocolate” alternatives using grape seeds and sunflower seeds instead.

The Current Situation

Fast forward to late 2025 and early 2026. Cocoa prices have been falling. You’d think good news finally arrived. After all, in the first 12 days of 2026, cocoa dropped to $5,443 per tonne, down 10.3% from the start of the year. By late January, prices were hovering around $4,200 per tonne.

Relief, right? Not exactly.

The price fall isn’t because supply magically recovered. It’s because demand collapsed. Combined grindings in Europe, North America and Asia are down 6.7% over the first three quarters of 2025. Chocolate makers are simply buying less cocoa because consumers are buying less chocolate.

There’s also a surplus building up. StoneX projects a global surplus of 287,000 tonnes for the 2025-26 crop year and 267,000 tonnes for 2026-27. But there’s a catch. Unsold cocoa is piling up at ports. Ghana has about 50,000 metric tonnes of unsold cocoa sitting at its ports. Ivory Coast launched an emergency operation to buy back thousands of tonnes of unsold beans. This is to help stabilise the supply of cocoa in the markets, and its prices by extension. This in turn, will help local farmers earn a fair price for their crops.

Why? Buyers are resisting because even at lower prices, chocolate still isn’t selling like before. Global chocolate sales volumes fell by 4.5%, and the sector is officially in decline according to Nielsen data.

J.P. Morgan doesn’t expect prices to return to pre-crisis levels anytime soon. They’re holding their medium-term price forecast at $6,000 per tonne. That’s double what it was a few years ago.

India Wasn’t Spared Either

Even India, often seen as a growth market that saves struggling global brands, couldn’t escape the chocolate crisis.

Mars, Mondelez, Perfetti Van Melle, and Hershey posted their weakest India performance since the pandemic in FY25. Mondelez and Perfetti each saw a 2% decline in India sales. Hershey’s growth was flat. Mars managed just 2% revenue growth internationally.

This is a market where chocolates and candies typically do well during slowdowns as affordable little treats. What went wrong?

Simple. Cocoa prices touched $12,000 per tonne in April 2024. Up from around $2,500 for many years. This forced chocolate makers to hike prices. Indian consumers, already price-sensitive, immediately traded down or switched categories.

Global brands tried to be clever. Instead of sharply hiking prices, they cut grammages. Your favorite Dairy Milk got lighter. But consumers noticed. And they weren’t happy.

Enter local players with a killer strategy. Hundreds of regional manufacturers flooded markets with hard-boiled candies, offering retailers higher trade margins and aggressive discounts.

The winners? Brands you’ve probably never heard of. Prayagh Consumer, maker of Cintu candies, crossed ₹900 crore in revenue with double-digit growth in FY25. DS Foods, which sells Pulse candy, expanded sales to about ₹750 crore.

Think about it. When chocolate became expensive, Indians didn’t just downgrade to smaller packs. They switched to tangy, spicy candies that reminded them of childhood, like kaccha aam, imli, jeera. Flavors that western chocolate giants can’t replicate.

India’s chocolate and confectionery market is worth about ₹25,000 crore, split almost equally between chocolates and sugar confectionery. Per-capita chocolate consumption remains low at around 200 grams a year, compared with over 10 kg in the UK. That’s supposed to mean long-term growth potential.

But in reality, if global brands can’t compete on price and local players keep innovating on flavors and distribution, that growth might not flow where chocolate makers expect it to.

What This Means Going Forward

The chocolate industry is fundamentally changing. The era of abundant chocolate is over. Even if supply recovers, demand patterns have shifted permanently. Consumers now see chocolate as a rare luxury.

Instances like this show us that a supply glut due to technological shortfalls can be somewhat recovered from. Burn the midnight oil for a few months, force innovation a little harder, and some innovation pokes its head out eventually. But in situations like this, you cannot expedite nature’s clock. You have to sit and watch the paint dry.

For now, manufacturers are diversifying away from West Africa, and investing in cocoa production in Ecuador, Brazil, and Indonesia. They’re developing cocoa alternatives and reducing cocoa content in products. Some are even growing cocoa in controlled environments to avoid climate risks.

But the bigger question remains. Will chocolate exist in three decades? Climate scientists say West African production could collapse by 2050 unless serious interventions happen now.

So the next time you reach for a chocolate bar, remember, it might be rarer, and pricier than you think.

Until the chocolate industry sweetens again, ReadOn!

In other news, have you been checking out the crosswords below these articles? Try them out for yourselves, and see how quickly you can solve them!

ReadOn Insights Crossword 11-02-26

For: India’s Ad Industry

Hints:

Across:

5: The advertising medium holding 59% of India’s total ad spend in 2025, overtaking all traditional formats.

6: The media partner that co-published India’s digital advertising report.

7: The fastest-growing digital advertising format on e-commerce and e-retail platforms, driven by performance marketing.

9: The digital ad format with the biggest share of online ad spend, driven by creator-led discovery and short video.

10: The public digital infrastructure is shrinking the gap between advertising exposure and transaction.

Down:

1: The sector contributes the largest share of digital advertising spends, led by brands in packaged goods and personal care.

2: A commerce network enabling closed-loop ad attribution by linking ads directly to transactions.

3: The largest traditional advertising medium by 2025, despite digital dominance.

4: An automated ad-buying method accounting for about 42% of digital ad spends, reflecting data-driven media buying.

8: The advertising agency group behind the Digital Advertising Report 2026.

To solve this puzzle, click here!

10.02.2026 (Answer Key)

Across:

2: NIID

6: Sitaraman

7: AVGC

9: Lothal

10: Duque

Down:

1: UNCTAD

3: Buitrago

4: ShareChat

5: Orange

8: Jaipur