India's Ad Industry

We interrupt your regularly scheduled scrolling for some advertisement... statistics!

At ReadOn, we don’t just report the markets. We help you understand what truly drives them, so your next decision isn’t just informed, it’s intelligent.

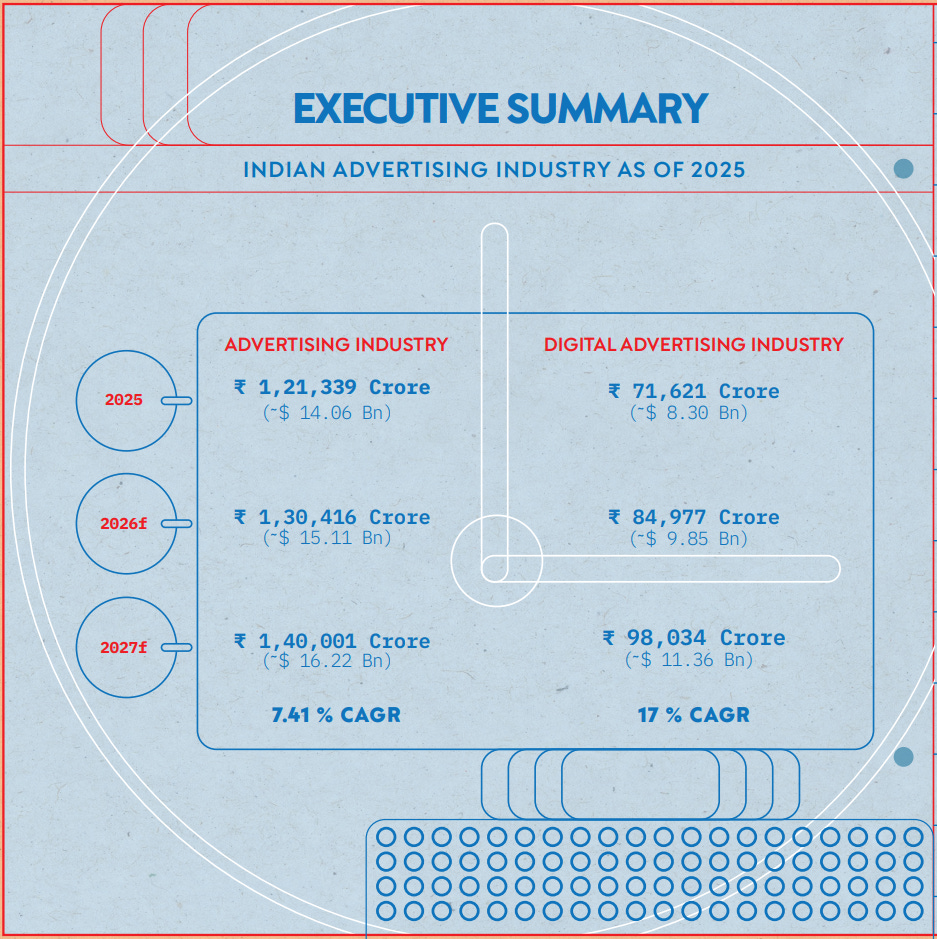

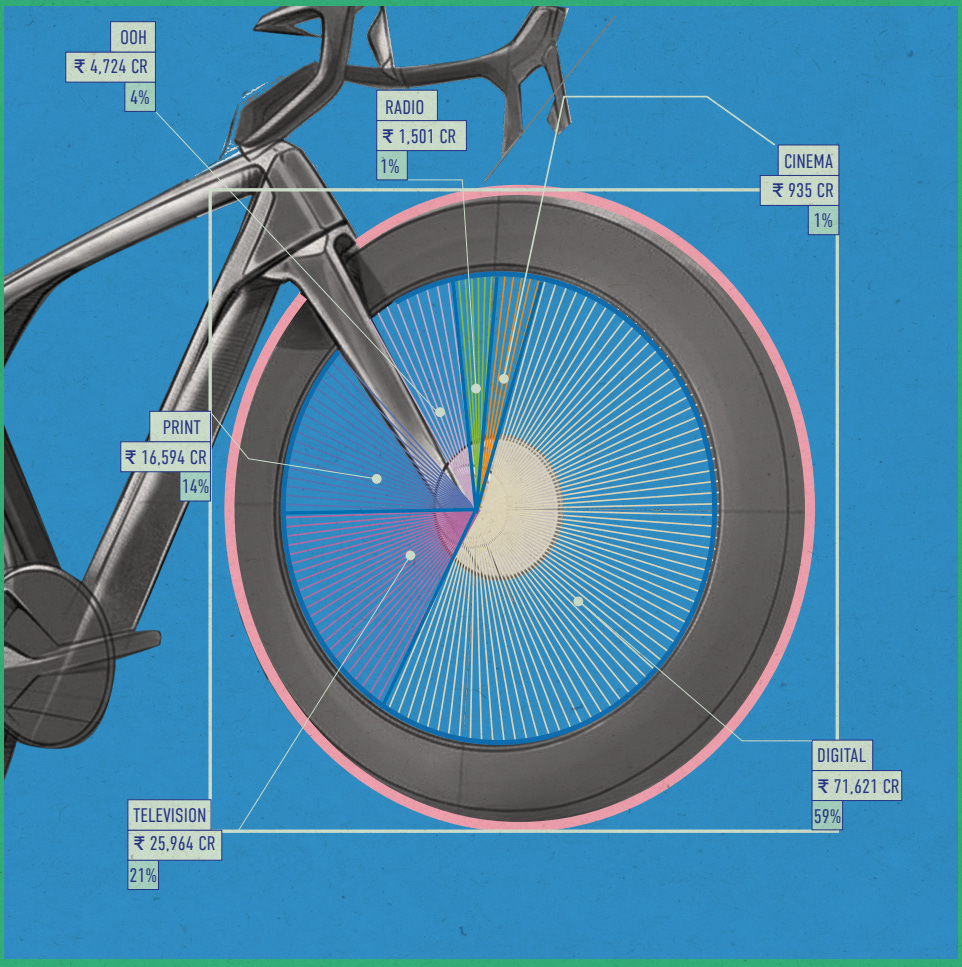

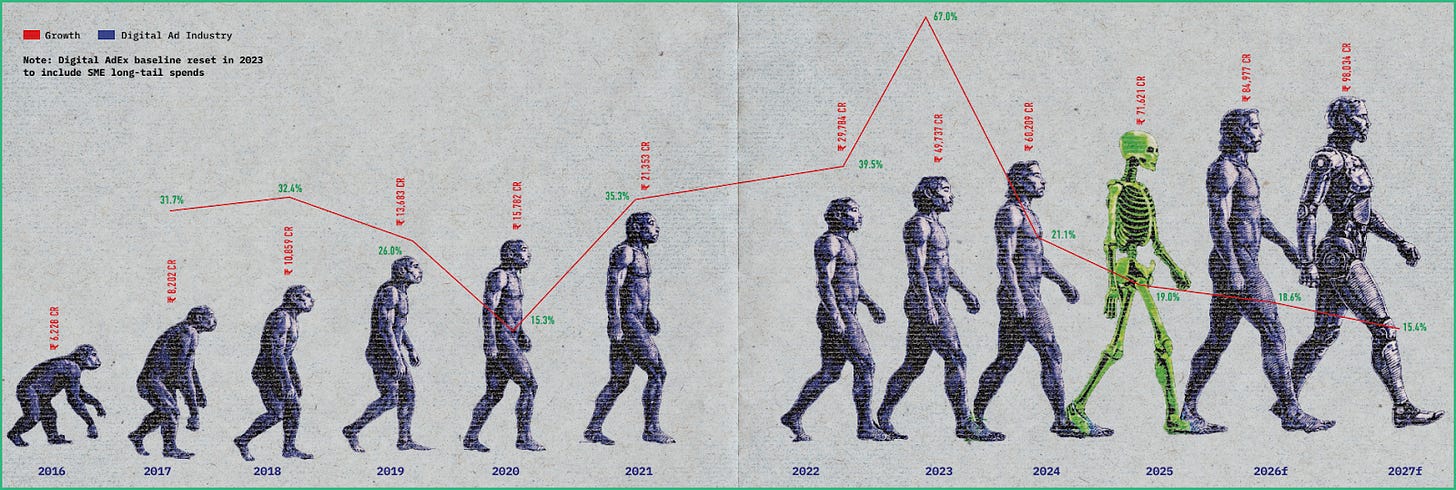

In 2016, Indian advertisers spent just 12% of their budgets on digital media. Nearly 90% of ad money still flowed into television, print, radio, and outdoor hoardings. By the end of 2025, that ratio had flipped. Digital is now worth ₹71,621 crore, and it commands 59% of all advertising spends. It’s also on track to touch ₹98,034 crore by 2027, the share growing to 70%.

That shift isn’t just about screens replacing paper or prime-time slots losing relevance. Advertising in India has stopped being about buying space. It’s now about buying moments, of intent, emotion, trust, and action.

The Dentsu–Exchange4Media Digital Advertising Report 2026 captures this transition at a critical juncture. The Indian advertising industry closed 2025 at ₹1.21 lakh crore, growing at 8.3%, despite macro uncertainty. By 2027, it is expected to reach ₹1.40 lakh crore, growing at a steady 7.4% CAGR. Digital media alone is growing far faster at 17% CAGR, making it the undeniable growth engine of the entire ecosystem.

But there’s a more interesting question behind this raw growth. What kind of advertising industry is India actually building?

Let’s find out.

Where Is the Advertising Industry Now?

At first glance, the structure of Indian advertising still looks familiar. Television, at ₹25,964 crore, remains the single largest traditional medium, especially for sports, entertainment, and regional programming. Print, at ₹16,594 crore, continues to command trust in government communication, education, and retail-heavy categories.

Yet structurally, the centre of gravity has shifted.

In 2016, the media mix stood at 12:88 in favour of traditional media. By 2025, that ratio has swung to 59:41, and by 2027, digital is projected to command 70% of all ad spends. This is systemic.

The reasons are layered:

Mobile-first consumption has made digital the default interface for discovery.

Digital Public Infrastructure (UPI, ONDC) has compressed the distance between awareness and transaction.

AI-led optimisation has made outcome-based planning more precise.

And perhaps most importantly, advertisers now demand proof, not just presence.

Digital media offers granular attribution, real-time optimisation, and commerce linkage. That’s something traditional channels struggle to do. As a result, advertising strategies are increasingly built backwards from conversion to consideration to awareness, rather than the other way around.

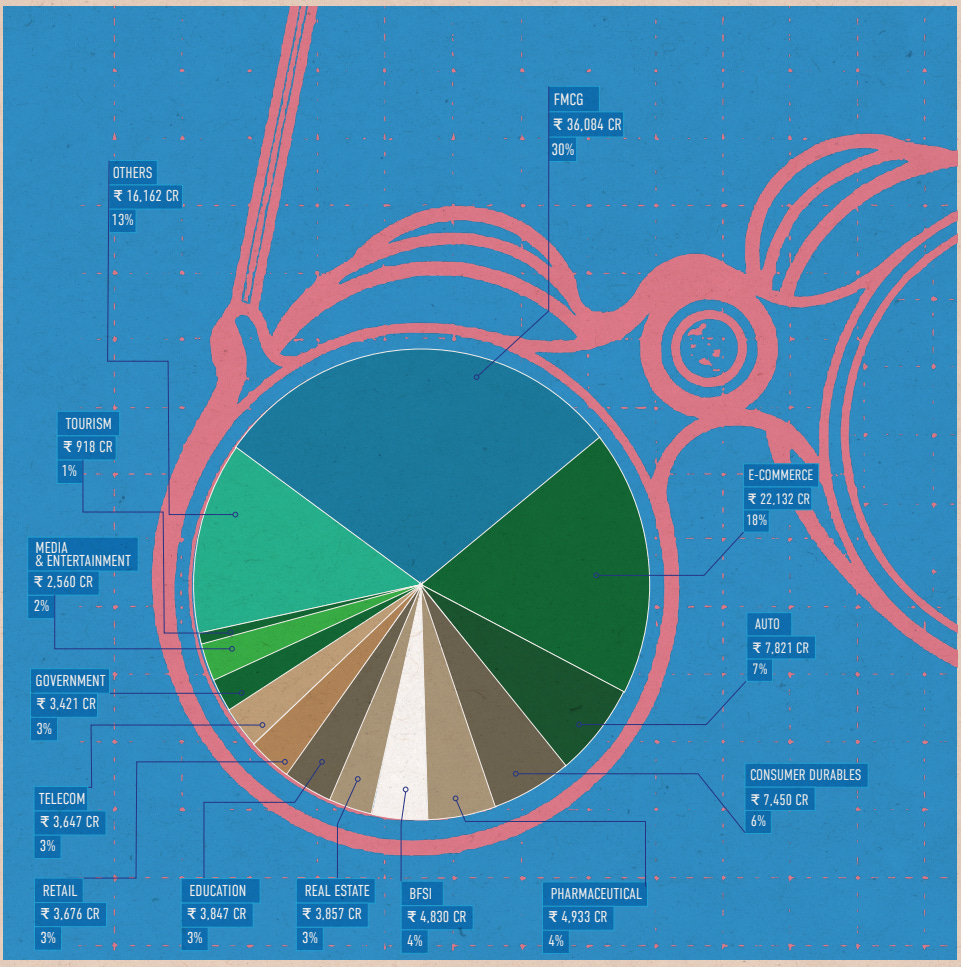

This shift is visible across sectors. FMCG (30%) and e-commerce (18%) lead total ad spends, followed by automotive, consumer durables, BFSI, and telecom. But when you isolate digital spends alone, the skew becomes sharper. FMCG accounts for 32% of digital advertising, while e-commerce contributes 22%, reflecting their need for always-on engagement and performance-led outcomes.

India’s ad industry today is stable, growing, and digitally dominated. But it’s also increasingly fragmented.

How Digital Advertising Actually Grew This Big

Digital’s rise was explosive.

In 2016, India’s digital advertising market was just ₹6,228 crore. By 2025, it had grown more than 11x to ₹71,621 crore, registering 19% growth in 2025 alone. By 2027, it is projected to touch ₹98,034 crore.

What powered this acceleration?

First, formats evolved.

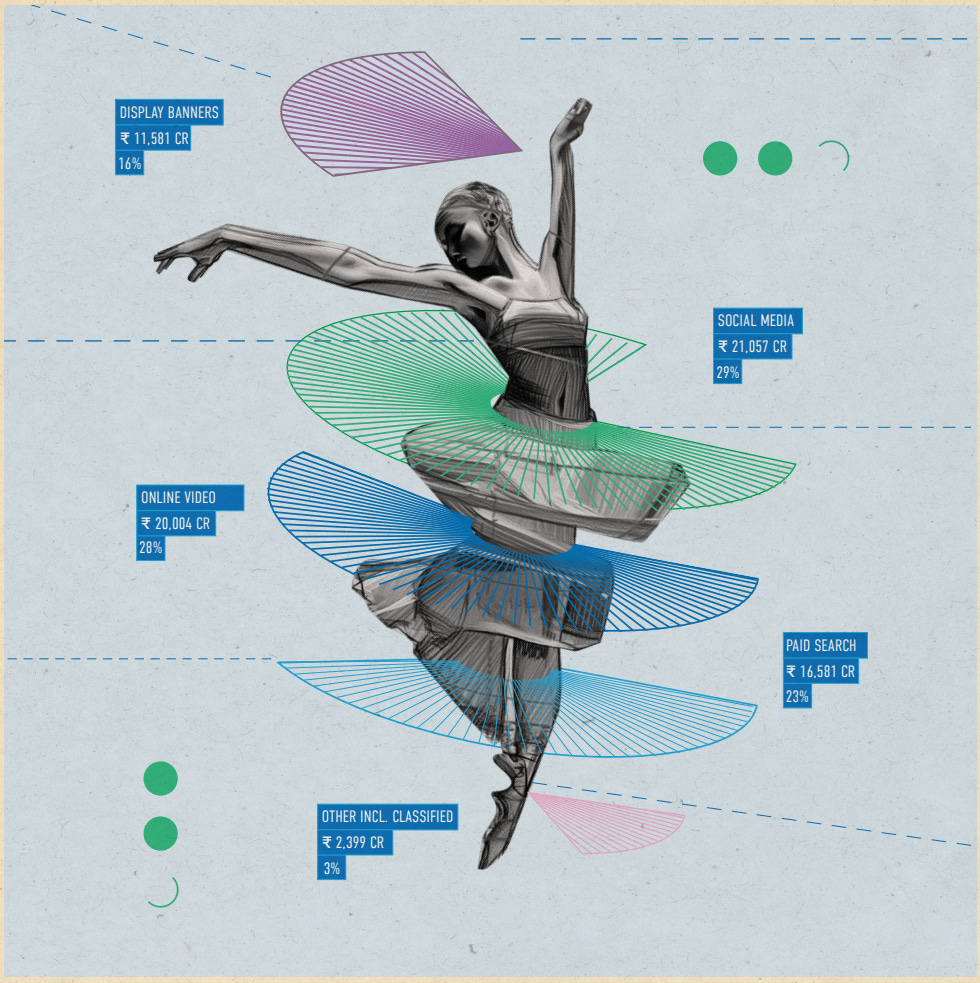

Digital advertising in India is no longer dominated by static banners or keyword-driven search alone. In 2025:

Social media leads with 29% share (₹21,057 crore).

Online video follows closely at 28% (₹20,004 crore).

Paid search accounts for 23% (₹16,581 crore).

Display banners make up the remaining 16%.

This format mix reflects how Indians consume content today. Short-form video, creator-led storytelling, and always-on social feeds are the primary sources. Online video, in particular, is projected to grow at over 22%, and is expected to overtake social media by 2027, signalling a convergence of entertainment, influence, and commerce.

Second, digital became commerce-native.

The most striking data point in the report sits inside retail media.

By the end of 2025, advertising spends on e-retail platforms reached ₹17,601 crore, growing a staggering 55.9% year-on-year, and accounting for 24.6% of all digital ad spends. Retail platforms have grown from being just transaction endpoints. They’ve become full-funnel ecosystems where discovery, storytelling, purchase, and measurement coexist within the same environment.

This closed-loop advantage, powered by first-party shopping and streaming signals, has eliminated one of advertising’s oldest problems of connecting spend to outcomes.

Third, automation scaled trust.

Programmatic buying (automated, data-driven purchasing of digital advertising space) now accounts for 42% of digital media spends (₹30,081 crore) and is expected to reach 43% by 2027. AI-led optimisation, outcome-based buying models, and privacy-aligned first-party data have made programmatic the default buying layer rather than an experimental one.

Digital didn’t just grow because audiences moved online. It grew because it rewired how advertising decisions are made.

Where Is Digital Advertising Headed Now?

If the last decade was about migration, the next phase is about integration.

Three shifts define where digital advertising is heading.

From performance silos to full-funnel systems

For years, Indian digital advertising over-performed on performance marketing with search, retargeting, and bottom-funnel conversions. But that model is now showing signs of fatigue. Rising acquisition costs and diminishing returns have forced brands to rethink.

The report signals a decisive shift toward full-funnel advertising, where awareness, consideration, and conversion are planned and measured together. Retail media is central to this transition. By 2026, retail media is expected to account for 15% of total ad spends, evolving into a core pillar of brand-building rather than just a sales lever.

From impressions to attention

Traditional metrics like impressions, clicks, reach, etc. are losing relevance. The report argues that attention, measured through time spent, interaction quality, and emotional engagement, is becoming the new currency.

This matters because India’s media environment is increasingly cluttered. The brands that win won’t be those that shout louder, but those that earn deeper, sustained engagement across fewer, more meaningful moments.

From channels to ecosystems

Digital advertising is no longer confined to screens. Audio platforms, connected TVs, digital Out-Of-Home (OOH), and conversational interfaces are expanding the surface area of media. Audio, for instance, is emerging as a high-attention, under-allocated channel that’s deeply embedded in daily routines like commuting, workouts, and downtime.

So planning around isolated channels no longer reflects how Indians live or consume.

What Could Digital Advertising Evolve Into?

Beyond near-term growth, the report outlines a longer-term blueprint for Indian media. One that moves advertising from interruption to participation.

Retail media becomes storytelling infrastructure

Retail Media 2.0 will move decisively up the funnel. Streaming content, shoppable video, live commerce, and creator partnerships will turn commerce platforms into narrative environments. Brands will need to move beyond discounts and price-led messaging to build distinct worlds inside retail ecosystems.

Culture becomes the medium

India’s next wave of growth will come from regional creators, women-led voices, and micro-communities. These creators won’t just influence consumption; they’ll build scalable IP that travels globally while staying locally rooted.

For advertisers, cultural relevance won’t be more than just a creative add-on. It will be a strategic requirement.

Advertising becomes part of value exchange

Subscription fatigue is pushing consumers toward bundled, ad-supported ecosystems. In this world, advertising must justify its presence by being useful, contextual, and respectful of attention. Brands will increasingly fund access rather than interrupt it.

Brands become media companies

As ad-free environments grow, brands will invest in owned media like podcasts, video series, newsletters, and communities. Advertising will shift from campaigns to long-running franchises, blurring the line between brand and publisher.

The Takeaway

India’s digital advertising story is often told as a scale narrative. More users, more screens, more spending. The Dentsu–E4M report tells a different story.

The real transition underway is from reach to relevance, from clicks to culture, and from media buying to media participation. Digital advertising in India is no longer about chasing attention at scale. It’s about earning it. Moment by moment, context by context.

For advertisers, agencies, and platforms alike, the question isn’t whether digital will dominate. That battle is already over. The real question is whether the industry can build an ecosystem where advertising feels less like noise, and more like value.

And that will define the next decade.

In other news, have you been checking out the crosswords below these articles? Try them out for yourselves, and see how quickly you can solve them!

Until advertising changes again, ReadOn!

ReadOn Insights Crossword 05-02-2026

Hints:

Across:

1: The German sports brand was founded after the historic split between the Dassler brothers.

3: The Dassler brother who founded Puma after parting ways with his sibling.

6: The French luxury group that spun off Puma in 2018.

7: The rival brand was founded by Adolf Dassler.

9: The sprinter who signed Puma’s first lifetime sponsorship deal with a track athlete.

Down:

1: The football legend whose boots helped Puma pull off its famous 1970 World Cup marketing coup.

2: The Pinault family holding company that later sold its stake in Puma.

4: The Bavarian town where the Dassler family feud split the local community for decades.

5: The brand that Anta successfully transformed into a major revenue engine in China.

8: The Chinese sportswear giant that became Puma’s largest shareholder in 2026.

04.02.2026 (Answer Key)

Across:

2: Revenue

4: Japan

5: Ageing

6: TamilNadu

9: Bihar

Down:

1: Kerala

2: RBI

3: Pensions

7: Demography

8: Debt