🔍Pre-Budget Round Up: Understanding the Economic Survey

Before the budget hogs all the limelight and headlines, let's take a look at what the country has achieved so far in terms of the economy.

Before we begin with the Economic Survey, let us invite you to decode the Union Budget LIVE with us today at 11 AM!

We’re sure everyone is excited about today’s Budget Session. After all, the policies that are formulated today will determine the economic future of the country tomorrow. The seeds sowed today will grow tomorrow.

Before we take a look at the next year’s forecast, let’s take a quick look at the Economic Survey. What’s that?

The Economic Survey of India is the yearly check-up of the nation's financial pulse. It's like a visit to the doctor for the Indian economy. It provides a diagnosis of where the country stands, what ails it and what could be done to keep the economy fit and running.

📜 The Theme of the Report

The theme of this year’s Economic Survey is “Amrit Kaal”.

This year’s survey has a super optimistic tone: this is India’s decade.

We’re set to become the third-largest economy by 2030! Let’s see how.

Over the last eight years, we have invested in building our infrastructure for growth. UPI recorded a peak of transactions worth Rs. 12 lakh crores in 2022, and is now going international!

The banking, non-banking and corporate sectors have also recovered from the pandemic. They all have healthy balance sheets and are set to grow.

Other positives:

Private consumption is high

Our debt is high but comparatively lower than other countries

The government’s super-high capital expenditure (which has increased by 63.4% in the first 8 months) has helped us grow despite roadblocks like high-interest rates

Urban unemployment has declined

MSMEs are getting more credit from banks

Now that we’ve set the tone, let’s dive deeper.

📈 GDP Growth

One of the most important insights from the Economic Survey is the GDP growth for the upcoming year. It has projected that the GDP for FY24 will be 6-6.8% in real terms.

This is lower than the 8%-8.5% GDP projection made for the current financial year.

Possible reasons for this slowdown are that the global economy might slow down due to central banks raising interest rates (to control inflation). However, our Chief Economic Advisor has said that the US is set to narrowly avoid a recession (super good for us).

This global slowdown can be good for us because it will lower commodity prices, which will lower our manufacturing and importing costs.

📖 Sector-wise Report Card

Agriculture: The agriculture sector saw a slight decline in growth from 3.3% in 2020-21 to 3% in 2021-22. However, the government has been working hard to help this space grow.

This is being done through several policies, focus on Farmer Producer Organisations, removal of middlemen, etc.

Some key numbers:

Private investment in agriculture has risen by 9.3%

MSP of all crops set at 1.5x of production costs

Foodgrain production increased from 310.7 mn tonnes to 315.7 mn tonnes

Industrial sector: The industrial sector rose 3.7% in the first half of FY23, which is higher than the average growth of 2.8% achieved in the first half of the years of the last decade. The manufacturing sector is also expanding.

Services sector: The services sector is expected to grow at 9.1% in FY23 as compared to 8.4% in FY22. With the right focus and investment, India can soon become a service hub for the world.

Sub-sector-wise growth in the services industry:

The IT-BPM Industry saw a YoY growth of 15.5% during FY22 compared to 2.1% growth in FY21.

The E-commerce industry is set to grow at 18% as the world is going digital.

Digital financial services and tourism and hospitality are also going to witness growth.

📉 Fiscal Deficit

India’s fiscal deficit has fallen from 9.2% of the GDP in FY21 to 6.7% in FY22. It is set to further decline to 6.4% in FY23.

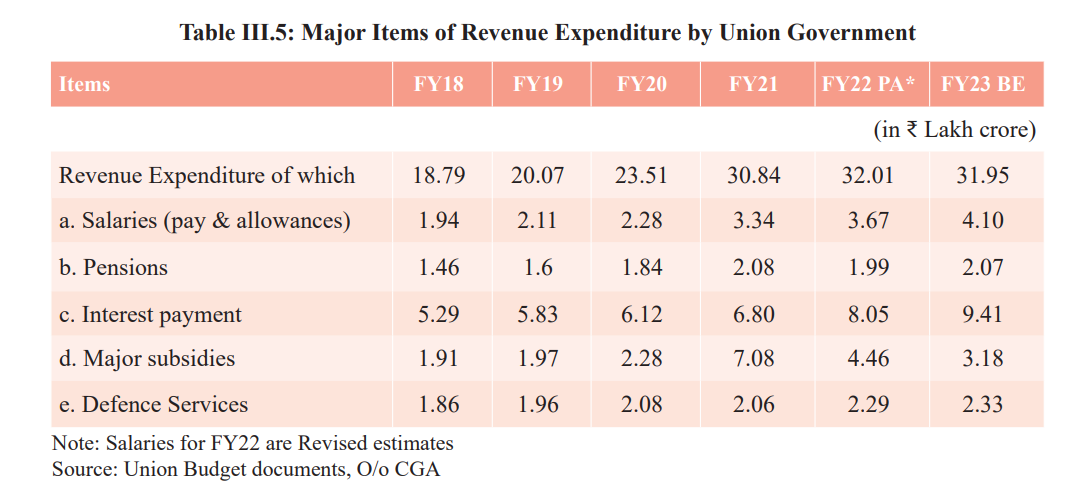

Revenue expenditure, however, has grown.

This is mainly due to an increase in interest rate payments. These payments rose as the dollar’s price rose against the rupee.

However, the government’s tax revenue has also increased and indirect tax revenue is set to keep rising.

🚢 Imports and Exports

The export of goods and services in the first nine months of the financial year (April – December) is up 16% compared to the same period in 2021-22.

One area where we have shown significant improvement is electronics exports: Our electronics exports have risen from $4.4 bn in FY19 to $11.6 bn in FY22!

However, imports are still pretty high.

With self-reliance being a major theme, we can expect the Budget to announce more Product-Linked Incentive Schemes to reduce imports.

Inflation Worries

Last year, we finally brought down inflation to acceptable levels. But this year, it is again set to reach 6.8% (above RBI’s accepted limit of 6%). So, we can expect more interest hikes. But how will this impact our consumption?

The survey also talked about various government policies and how they have helped India become the third-largest economy (in terms of purchasing power parity). The focus on capex has also helped infrastructure development grow by 80%!

However, to fulfill our dream of becoming a self-reliant economy, we have outlined a few goals:

Harness Nari Shakti

Focus on the Energy Sector

Boost the MSME sector

Focus on Education and Skilling

Dismantle Licence, Inspection, and Compliance (to promote ease of business)

We guess we’ll be seeing a lot of policies focused on these goals in today’s budget. What are your predictions?

P.S. There’s a lot more to the Economic Survey. We’ve tried to glean the main points from the 414-page document in the time we had. We’ll try to cover some more interesting aspects from the document soon. Till then, you can read the Economic Survey here.

Let us know if you found this informative. You can reply to this email with your responses or ping us directly on WhatsApp!

Apni kursi ki peti bandh lo, mausam bigadane wala hai.