The Dance of Deficit

This year, don't just watch the budget; understand what is going on. In this one, we simplify fiscal deficit and explain how it impacts our daily lives. ReadOn.

Every year, during this pre-Budget period, every newspaper, news channel, and self-proclaimed financial expert talks about fiscal deficit. And we just sit and scratch our heads.

No more.

This year, we will simplify the “fiscal deficit” for you.

ReadOn.

Let's say you have Rs.10 as your pocket money. Do you think it's possible to buy a candy worth Rs.15 with it? Let's assume that the shop owner gives you a loan of Rs. 5 and lets you buy the candy. But, will he give you a loan every time you go to him? As a matter of fact, do you think anyone (individual or company) can pull off that stunt?

Well, there is someone who often spends more than it earns. And it does this every month. Again, and again.

Yes. We are talking about the government.

The government has the power to spend as much as it wants without worrying about the money that it earns.

But, is it okay for the government to spend more than it earns on a regular basis?

It's okay only till a point where things don't go out of control. But there's more to this game than what meets the eye.

Financial People jargonize this over spending situation of the government as 'Fiscal Deficit'. It reflects the loans of the government in a Financial Year.

Now, to understand fiscal deficit and its implications for the common man, let's first understand who gives the government its pocket money and what’s its candy.

The major source of revenue for the government is taxes. It's hard to imagine a financial transaction which does not involve taxes. You earn and you pay taxes, you spend and you pay taxes (such is life, sigh!). And all these taxes go and sit inside the pockets of the government. Other than the taxes, the government also earns interest and dividend from the various investments it makes. At times, it also makes disinvestments, to finance its expenses (just like the women of the house sell their jewelry to save the day in Indian serials).

Now to run the country, the government has to bear expenses like employee salaries, pensions, etc on a regular basis. Alongside, it has to invest money to create productive assets like roads, airports, etc.

When these expenses overtake the revenues, we face the situation of fiscal deficit. But, why can’t the government control its expenses?

Think again.

Do you ask a startup this question? Why can’t they control their expenses? Why do they run into huge losses? Hell, these days startups are established even without a revenue model! We don’t ask them this question. Rather we say, the startups are growing at a break-neck pace, we can worry about profits later. They have VCs to save the day (Spoiler Alert: The government also has a special someone).

Now, apply the same logic to the economy. A high fiscal deficit can be good for the economy if the money spent goes into the creation of productive assets like highways, roads, ports and airports that boost economic growth and result in job creation. An increase in the fiscal deficit, in theory, can boost a sluggish economy by giving more money to people, who can then buy and invest more. It gets the ball rolling. With a better infrastructure, the economy can bloom. We can worry about profits later.

But getting into a fiscal deficit situation is like courting the angels and the demons together. If you are not wise, you can fall into a demon trap, and the way out is seldom a desirable one.

Let us explain.

All deficits need to be financed. This is initially done through the sale of government securities, such as Treasury bonds (T-bonds).

Individuals, businesses, and other governments purchase Treasury bonds and lend money to the government with the promise of future payment. And this one action opens a whole can of worms. Whether those worms nurture the soil or decompose the nation depends on how the government handles them.

The clear, initial impact of government borrowing is that it reduces the pool of available funds for private companies. An individual who has Rs.5,000 and lends it all to the government cannot use that same Rs.5,000 to purchase the stocks or bonds of a private company. Thus, all deficits have the effect of reducing the potential capital stock in the economy.

Now, what happens when the demand for loans is too high and the supply is mostly the same? The cost of taking a loan (the interest rate) rises. And as the loans start piling up, the government can pay only the interest on the loans and have to take more loans to pay off the earlier ones. A debt trap laid by the demon himself. Where will economic growth come from, when all the funds are going towards paying off purana paap (old sins)?

Demon-1, Angel-0.

And obviously, the interest rate rise hits the ordinary citizens directly. Loans for business, education, etc. get expensive. But that’s not all. Wait for the second blow.

To combat the rising expenses, the government unleashes its favorite weapon: taxes.

Even after all this circus, the situation can still get out of control. Thankfully, the dark knight (the government's special someone) comes to the rescue.

Well, who is the dark knight and what is its secret weapon?

The RBI: which can reduce the rate of interest by increasing the supply of money.

Hold on. Don’t be so mesmerised by the Knight in Shining Armor, for it has a knife hidden behind its smiling face. Printing money can send the economy into a tailspin. If it was so easy, every country would simply print money and become rich. But what happens when you print money without increasing the capacity and output? More and more money chases a lesser number of goods and services. This leads to inflation. Ask Zimbabwe how dire this could be? Poor guys, faced an inflation of 231,000,000% in a single year in 2008. Absolutely crazy.

See, how tricky the game can be?

What to look out for in this year’s Budget!

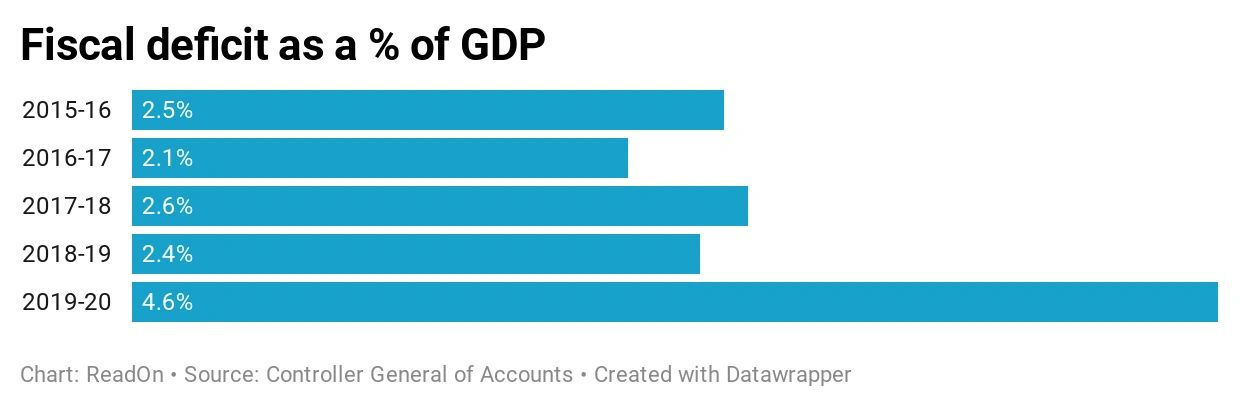

The government gives out a budgeted fiscal deficit as a percentage of GDP. But how will you know if it is less or more?

Check out what the previous fiscal deficit trends in India has been like:

As you can see, there has been an increase in fiscal deficit in recent times. The pandemic has only worsened the situation. With super low economic activity, there was almost no revenue for the government. Four months into the year and the fiscal deficit target was breached in July 2020 itself. As per early estimates, the fiscal deficit for the entire year could be as high as 8% of GDP!

Now you know what to expect from the 2020-21 budget and what it might lead to, don’t you?

The late Arun Jaitley said in his first speech as the finance minister: “We cannot leave behind a legacy of debt for our future generations. We cannot go on spending today which would be financed by taxation at a future date."

The father sins, the child pays.

We hope that the current situation tides up quickly. Godspeed.

Until then, ReadOn.

Thousands of readers get our daily updates directly on WhatsApp! 👇 Join now!

Researched by Keshav Sureka.