🧐 Hindenburg's New Target After Adani: Block Inc

Hindenburg Research has struck again. Its latest target is Jack Dorsey’s fintech firm Block Inc. Wondering why? ReadOn!

Hindenburg Research is in the news again.

After targeting the Adani Group, the activist short seller is now after Twitter co-founder Jack Dorsey’s Block Inc (previously called Square).

In less than 24 hours since Hindenburg launched its report on Block, Jack Dorsey lost $526 million!

Block’s shares have also fallen by 14.82% (as of 1 pm on March 24, 2023).

But what exactly has Block done to get Hindenburg’s attention?

Well, we’ll try to summarise their 2-year research in just a few minutes for all you busy bees.

Come, let's dive deep!

🔍 What is Block Inc, Anyway?

Block or Square is a US-based fintech firm that enables payments for individuals and companies.

It has its own debit card and an app called Cash App, which allows people to transfer money to each other even if they don’t have a bank account.

Jack Dorsey claims they do this using a magical technology.

So, what are Hindenburg’s problems with Block? It claims that Block is:

Enabling criminals transactions

Enabling fraud

Hiding its real user count

Hiding its losses

Preying on merchants through interchange fees

Involved in insider trading

Now, let’s look at these charges one by one.

🦹 Enabling Criminal Transactions

Block’s purpose was to make banking available to everyone, even to those without bank accounts.

So, its signing up process was super easy: Just add your phone number or email ID and you have an account.

No KYC, no standing in front of the camera with your PAN in your hand.

Now, this was gold for people who wanted to use the app for illegal means.

After all, the app couldn’t flag people with criminal backgrounds.

Even if criminals’ accounts were blocked, they could just create another account with a new email ID.

So, everything from drug peddling to sex trafficking started happening on Cash App.

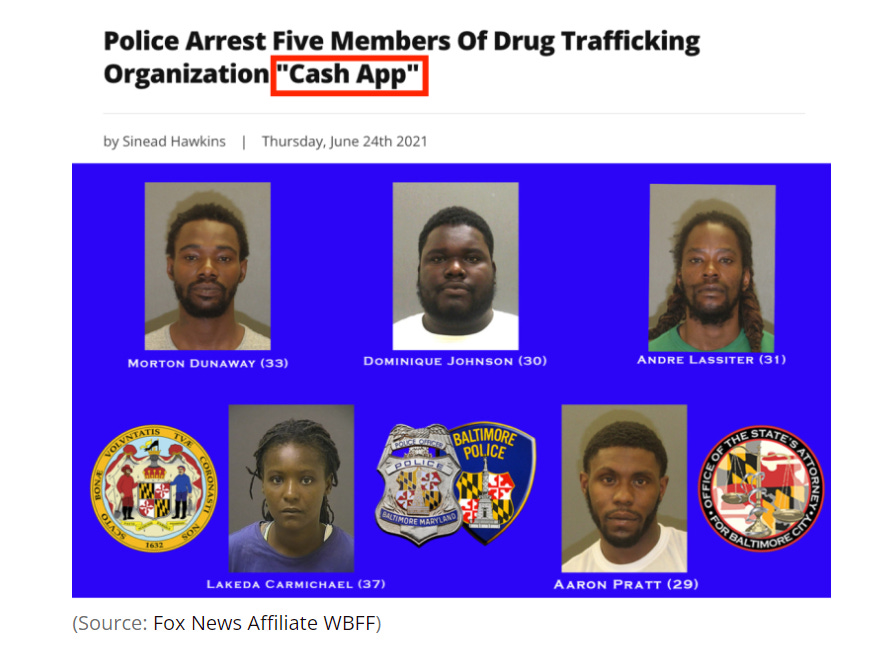

A drug gang even named themselves CashApp!

And the app has several other features, that is enabling more scams and frauds. How?

🕵️♀️ Enabling Fraud

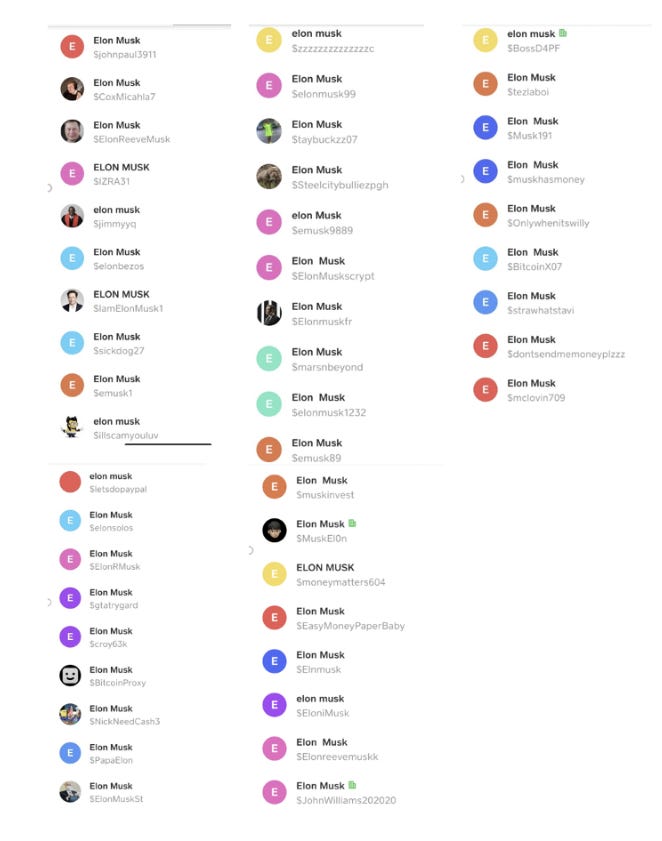

On CashApp, you can be anyone…

From Elon Musk to Donald Trump to Kim Kardashian.

Since they’re not verifying any details, you can pretend to be whoever you like.

And after you “become” Donald Trump or Elon Musk, you can ask people for funds and donations.

Some gullible people will agree and voila, you just got free cash!

That’s how Cash App is enabling fraud.

And this got worse during Covid.

The US government wanted to give people unemployment cheques and stimulus cheques to help them through tough times.

Many people used Cash App to create fake identities and collect cheques multiple times.

All because Cash App wouldn’t verify their identities!

Well, people commit fraud on a lot of apps. And more users (even if they’re unethical) means more business.

So, what really is bugging Hindenburg?

🤨 Block’s Own Frauds

Block claims it has 80 million yearly active users and 51 million monthly active users.

Hindenburg claims this number is highly inflated.

Many Block employees have claimed that most users have multiple accounts.

While some use different accounts for different purposes like spending, saving, investing, others are creating multiple accounts to not attract attention.

But if the number is actually inflated, where is Cash App’s money coming from?

*Drumroll* Another fraud alert!

On one hand, Cash App claims that its mission is to help the unbanked and underserved.

And on the other, it is charging insane amounts of interchange fees from small merchants!

Interchange fee, also known as "swipe fee," is the fee that is charged to a merchant by card networks every time a customer uses a debit card to make a purchase.

In America, if you have assets worth $10 billion, there’s a cap on the interchange fee you can charge. And Block has assets worth $31 billion.

Block is bypassing this by having a smaller bank issue its debit cards.

Since the bank doesn't have $10 billion in assets, technically, Block can charge whatever interchange fees it wants!

Now, despite doing all of this, Block is apparently not profitable.

According to Hindenburg, it is using non-GAAP accounting to convert losses worth $540.7 million into a $613 million profit.

Huh?

You see, GAAP stands for Generally Accepted Accounting Principles. This is the accepted accounting practice in the US.

But Block isn't using these principles. It is not taking into account several costs by using non-GAAP accounting principles.

And this isn't the only ghapla or fraud in its accounting.

Block is apparently also hiding its peer-to-peer lending losses in its sales and marketing costs to project a peachy image to investors.

And these efforts have worked.

Block's stock rose 639% in the 18 months of Covid!

And its management apparently took advantage of this. How?

By selling their stake.

Insiders sold Block shares worth $1 billion from March 2020 to December 2021.

Looks like a full-blown fintech scam which is only benefitting criminals and the inner team.

Now, we don't know how much truth lies in the report. But we do have a few key takeaways:

We should be thankful to the RBI for its strict KYC laws.

The Block report highlights that we too need to take a closer look at some of our homegrown startups to ensure they're not defrauding investors.

Startups need to get over their “growth at any cost” mindset. We've seen how that has only led to disaster after disaster, be it GoMechanic or Theranos.

If a startup as huge as Block has so many skeletons hiding in its closet despite so much scrutiny, we can't even imagine what some of the smaller startups might be doing.

But now the question is, should we believe Hindenburg completely?

After all, it has an ulterior motive for badmouthing Block. Are things as bad as they seem? And should short sellers like Hindenburg exist? Let us know in the comments!

Share this with your friends via WhatsApp and help them grow! See you tomorrow :)

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

short sellers should exist