📉 GoMechanic: A Growth Story Gone Wrong!

From raising over $70 million to firing 70% workforce - EY uncovers yet another (potential) fraud!

In its growth frenzy, GoMechanic has dug its own grave.

Today’s story is the story of running too fast and tripping over.

It is the story of chasing growth at any cost.

It is the story of everything that’s wrong with the startup ecosystem.

Let's dive deeper into how GoMechanic's growth chase led to an alleged fraud and how it all unravelled.

🔧Context First: What is GoMechanic?

GoMechanic's problem statement:

The car service sector is super unorganised

Servicing cars is expensive

GoMechanic's solution:

A platform to connect customers and garages and workshops

Affordable garage and cleaning services (almost 40% cheaper)

Process transparency from the garage’s end to create trust

In 3 years time (2016-19), the company had (apparently):

The company was in a happy state.

Its growth attracted large investments from marquee investors like Sequoia, Chiratae Ventures, Tiger Global and Orios Venture Partners.

Last year, it was set to raise $35 million from SoftBank.

But after investing in startups like WeWork and losing $21.7 billion in the June quarter of FY2022, SoftBank was cautious.

So, it appointed EY to conduct GoMechanic's financial due diligence.

And what EY found was shocking!

🔍 EY's Discovery

According to a Bloomberg report, here's what EY discovered:

60 out of 1,000 workshops were posting inflated revenues

These workshops were allegedly diverting funds to other sources

There were fictitious garages and some of these were being favoured more than others

We at ReadOn dived deeper to understand what more could have put off investors and this is what we found:

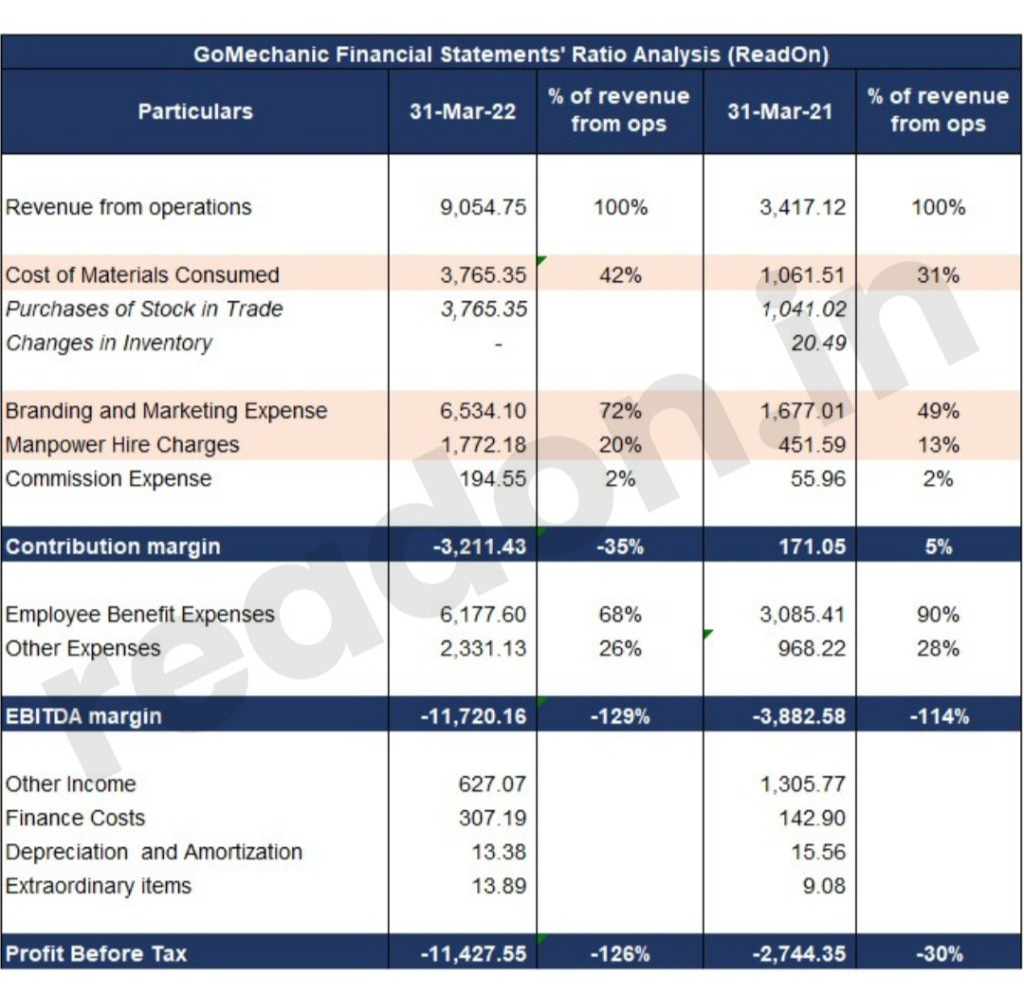

💡ReadOn Insight 1: In FY21, every rupee spent on marketing generated Rs. 2.03 in revenue.

In FY22, every rupee spent on marketing generated Rs. 1.39 in revenue.

Efficiency in marketing spends down by 65% in a year!

💡ReadOn Insight 2: Manpower charges increased from 13% of revenue to 20% of the revenue! Why? This would surely have been a red flag during the due diligence! Moreover, direct manpower hires became more inefficient? Difficult to digest. Maybe because of competition, they had to:

a) pay more for limited skilled labour

b) provide the same services at a lower price (which also put pressure on margins)

Maybe this is what spooked SoftBank and Khazanah as well.

The company is now facing a funding crunch.

Result? 70% of the workforce laid off.

What's worse, existing investors are fuming!

So far, they have invested $62 million in the company. They now want EY to conduct another detailed forensic audit that will highlight more financial irregularities and show exactly what was happening within GoMechanic!

Until then, the founders have been put on leave of absence.

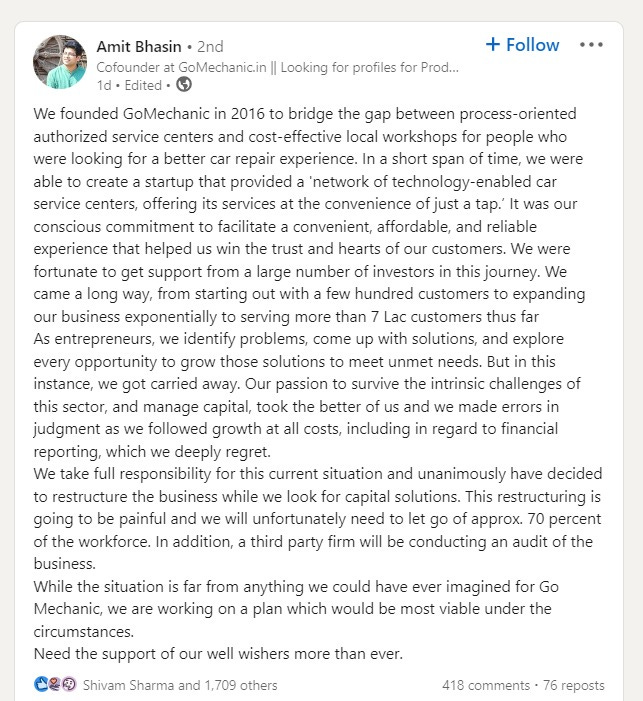

The founders have, however, tried to justify financial irregularities in the books in a viral LinkedIn post:

Wondering how fake garages and inflated revenues could lead to growth? We'll explain.

🕵🏻♀️ Fake it Till You Make it: A Myth

Startups are no longer just about solving a problem or creating a business.

Entrepreneurship is the new cool. Unicorns are cooler.

More and more startups want the unicorn tag and they want it fast.

A shortcut to get there?

Fake revenue, fake users, fake it all!

How does this work?

Create fake invoices to show increased sales. Or…

Create shell companies for circular transactions.

The more your revenue, the more your valuation!

GoMechanic's FY22 revenue was $11.3mn (Rs. 90.5 crores) and its valuation was $300mn (Rs. 2,400 crores).

With the next round of funding, GoMechanic would get a valuation of $850 mn: super close to its 'unicorn' dream tag!

Another myth founders fall for: more funding will eventually lead to profitability.

But faking it will not always make it.

Most founders who've taken the unethical shortcut to success have been discovered in some way or the other.

It may take time to see through the sketchy financials (KPMG, GoMechanic’s statutory auditor, probably failed to identify the inflated revenues), but they cannot stay hidden forever.

The sad part is that the company could have been successful if it didn't blindly chase high growth. If it tried to optimise for profitability instead of valuation, it could've had both!

This whole situation brings to the surface a major question: why were major VCs like Sequoia and Tiger Global not able to catch this flaw?

😰 The Lack of Due Diligence

This is not the first time Sequoia has seen financial irregularities in one of its portfolio startups. BharatPe, Trell, and Zilingo, all have been guilty of similar issues.

What's going wrong?

Well, in a report, Sequoia itself said that it sometimes invests in startups at a very early stage when due diligence is almost impossible. After all, there is hardly any business at that stage.

Well, VCs could conduct due diligence at regular intervals once the business starts growing.

According to another venture capitalist valuation is now mostly decided by the founder's strength and their story.

This poses a problem: there are many founders who could be great storytellers and be super convincing.

Betting on the founder and trusting them blindly without regular checks could be disastrous.

And history is proof. So many of the founders that have been celebrated or have been called 'the next Warren Buffett' have had a disastrous future!

Our major insights from this whole fiasco:

Due diligence needs to be done frequently and more time needs to be spent on it. EY spent a lot of time focusing on GoMechanic because this was a new space for the firm. This is what helped it uncover the fraud.

We need more smart auditors to conduct this due diligence properly. Founders need to take setting robust financial processes seriously. A penny saved is a penny earned.

Betting solely on the founders could be dangerous. At scale, processes run companies, much more than any grand vision. Marry great processes and grand visions, and you may have a future giant in your hands!

GoMechanic's story will serve as a cautionary tale for founders out there chasing high-pace growth.

There's a silver lining to this (of course, we are always looking for positive angles!).

VCs are once again getting serious about due diligence.

This could help uncover startup frauds before they reach the IPO stage and thereby (hopefully) protect retail investors.

But will this cautiousness last only till there is a fear of recession?

Who knows. The VC circus goes on.

Until next time, ReadOn :)

Let us know if you found this informative. You can reply to this email with your responses or ping us directly on WhatsApp!