🧠 What's Nykaa's Strategy to Avoid A Crash?

Nykaa is issuing bonus shares the same day as the lock-in period for IPO investors ends. Here's why.

If you're a founder of a listed company and you do not want to let investors dump your shares in a frenzy, Nykaa has a playbook for you.

Issue Bonus Shares

Time the Issue Just Right

How do you do this? ReadOn!

🧐 Nykaa's Bonus Issue Explained

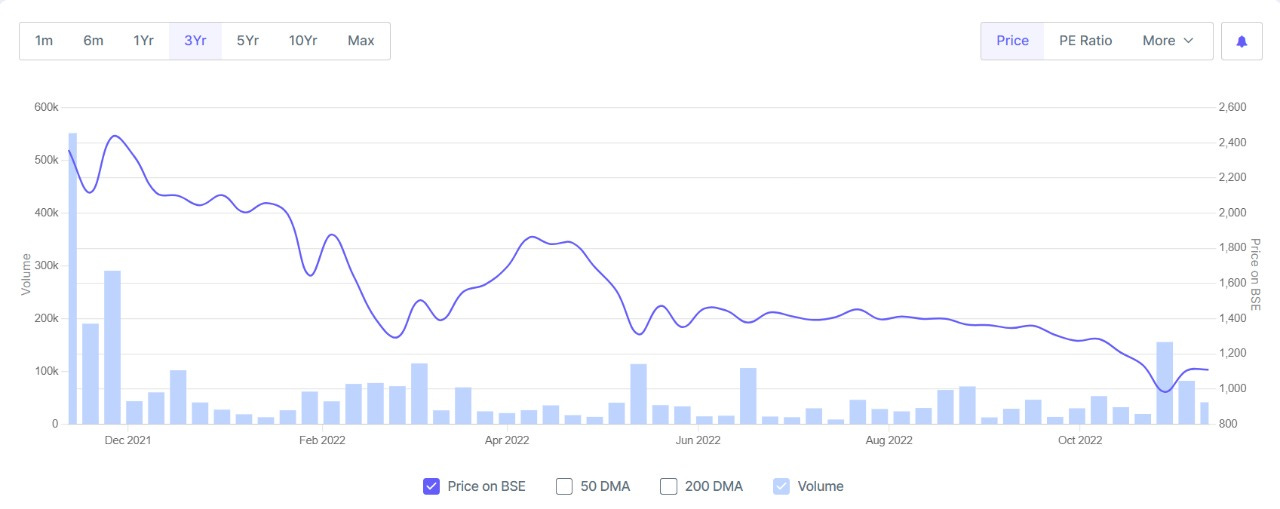

Nykaa's shares have been in a freefall for the last month.

That's because the lock-in period for its IPO (here's an article that explains what a lock-in period is) is expiring. So, from November 10 onwards, pre-IPO investors can start dumping their shares back into the market.

And people are worried that they are going to be dumping their shares in large numbers.

Approximately, 31.9 crore shares, representing 67% of the company's total equity will be free for trading now.

Something similar happened to Zomato earlier this year (you can read more about this here), so people's fears are justified.

Now, Nykaa obviously does not want this to happen.

So, it is decreasing its share price itself. Huh?

Yes, Nykaa is issuing bonus shares*.

Each Nykaa shareholder will get 5 bonus shares for each share they own. This means, the number of Nykaa shares in the market will increase but their price will go down.

This new price is obviously more affordable. So, many retail investors will be willing to buy them.

Now comes the interesting part. The bonus issue, which was earlier taking place on November 3, is now happening on November 11, the day after the lock-in period expires.

This is super important for two main reasons:

Like we said, a lot of pre-IPO investors want to dump their shares. But they need buyers too, right? So, if Nykaa makes shares cheaper, more retail investors will be able to buy them and pre-IPO investors will get comfortable exits.

This may just give an incentive to pre-IPO investors to stick around. Because if they sell their shares now, they will have to pay short term capital gains tax on them. That's because the bonus shares have just been issued, if they are sold before a year has passed, a 15% tax has to be paid on them. But if investors wait a year, they will have to pay a 10% tax (after an exemption of Rs. 1 lakh).

So, Nykaa has hit two birds with one stone. Ensured proper exit for those who want to leave but also making sure that not too many shares are dumped at once.

But why is Nykaa afraid that investors will dump its shares?

Well, the company hasn't been doing all that well.

🔍 A Look into Nykaa's Finances

While Nykaa's main platform is doing well, its other verticals are dragging down its performance.

For instance, Nykaa Fashion. The platform's monthly average unique users have reached a high of 16 million users but have remained the same for 5 quarters now.

Its net sales have also grown by just 1.1%.

Meanwhile NykaaMan, its B2B vertical SuperStore and other verticals are all seeing losses.

Only, the Beauty and Personal Care segment, Nykaa's main platform showed considerable growth. Profit grew 344% YoY, while gross merchandise value (total order value) grew 45% YoY.

However, quarter on quarter growth of gross merchandise value was just 9%.

Plus, Nykaa's monthly average unique users also seem to be stagnating now.

This could be because a lot of competitors have now emerged in this space. So, Nykaa could be facing a tough time ahead.

And with its profit margin only 1.09%, it needs to increase its order value to increase profits.

Moreover, Nykaa's valuation and its price-to-earnings ratio seem super high right now. Which is probably why pre-IPO investors may want an exit now.

But will Nykaa's strategy ensure that its share price doesn't fall too much?

⚡In a line: Nykaa may have found the perfect playbook to stop pre-IPO investors from exiting.

💡Quick question: Have you invested in Nykaa?

Noob's Corner

*What are Bonus Shares?

Let's assume Company A has a total of 1,000 shares priced at Rs. 100 each. You own 10 shares of this company. Now, the company announces that for each share you own you will get five extra shares.

So, the company now has 6,000 shares and you own 60 of them.

But because extra shares were issued, the price of each share will be divided by 6.

So, you still have shares worth Rs. 1,000 but each share is now priced Rs. 16.6.

Share this with your friends via WhatsApp or Twitter and help us grow! See you tomorrow :)

You can also listen to our stories. Catch it on Spotify, Apple Podcast, Amazon Music, Google Podcasts, Gaana or Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇