🤔 Zomato's Fortune Turning Soon?

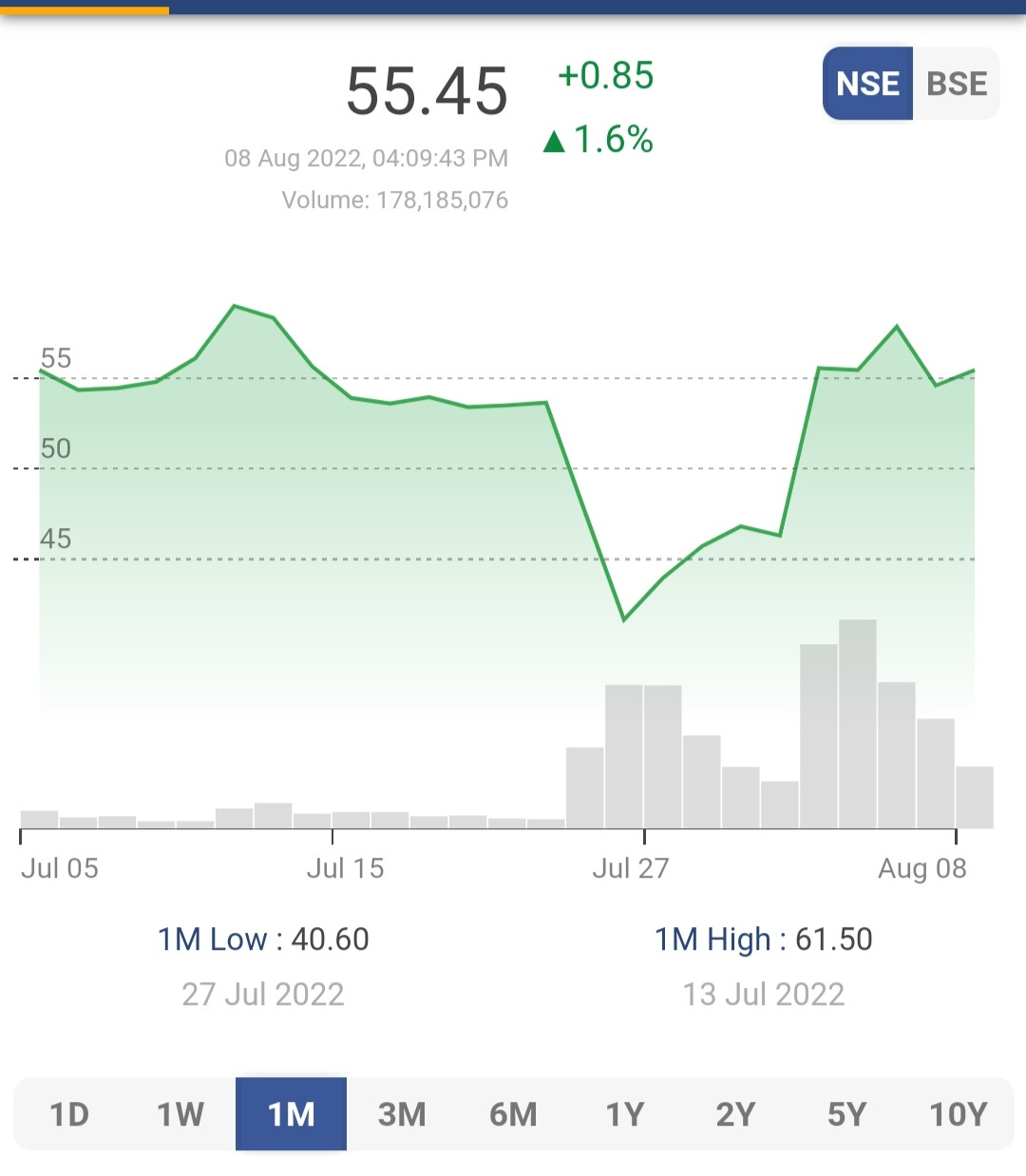

Zomato has been disappointing investors lately thanks to multiple sell-offs by pre-IPO investors. But the company's fortune may soon be changing.

Lately, Zomato has not just been giving investors sugar highs: it has been taking them on a whole roller-coaster ride.

One day we hear news that Zomato has massively reduced losses and the other day we hear of major sell-offs.

Investors be like:

And all of this started on July 23rd.

🤔 What's Cooking At Zomato?

What was on July 23rd you ask?

Well, just the end of the lock-in period for Zomato’s pre-IPO shareholders. Huh?

You see, Zomato doesn't have any promoters.

So, as a rule, pre-IPO investors had to hold on to their stake for a year.

This is done to protect the interests of retail investors (basically regular folks) like you and I.

Right after an IPO, a company's stakes are usually high because there is a lot of fanfare about it going public (this obviously depends on the company).

So, promoters or pre-IPO investors can usually make a quick buck by selling their stake at the time (demand is high, so price of the stock is high and they get better returns).

But these sell-offs bring down the stock's price, which is totally unfair to the regular folks who have put in their hard-earned money in the IPO.

So, these pre-IPO folks have to wait a year, when prices will be determined by market conditions and not just hype, to sell their stake.

Now, call it co-incidence or just fate: this date came eerily close to Zomato announcing its results.

And its results were just as yummylicious as its food: the company managed to cut its losses by half!

But ReadOn, it still made losses! Yes, it still made losses!

Startups like Zomato are expected to make at least some losses in the first few years of their functioning.

So, investors saw this as a great new update and the stock price rose.

And this was sone pe suhaaga for institutional investors who were waiting to cash out.

Institutional investors like Uber acquired shares when they were worth around Rs. 22.47 (according to LiveMint's analysis)

Fun Fact: Uber never bought Zomato's shares. The company got a 9.99% stake in the company, when it sold Uber Eats to it.

So, even though Zomato was trading at around Rs. 55, much below its IPO price of Rs. 76, cashing out meant at least a 2x profit for the company.

And this is cash Uber could use right now to kickstart the business after Covid.

Earlier this year, the company had assumed a $707 million loss from its investment in Zomato, so when it saw an opportunity to make money, it jumped in.

Uber wasn't the only investor who cashed in on this opportunity. Moore Strategic Ventures also sold part of its stake, but sadly that was at a loss of Rs. 4 crores. The company basically decided to cut its losses amid a huge sell-off pressure on the stock, but turned out to be on the losing end. Sometimes patience pays.

Another major seller? Tiger Global.

The VC fund also sold 2.34% or half its stake in Zomato when the company's shares were priced at around Rs. 50.

It has acquired the stake at two different prices: Rs. 44.81 and Rs. 58.20. Which means it also kind of saw a profit. And this was a win the fund badly needed.

Tiger Global has been having a bad year, witnessing losses worth over $17 billion after the tech startups it had bet on saw massive sell-offs.

Here's what Zomato's shareholding pattern looked before the sell-off and what it looks like after it:

But while these institutional investors have breathed a heavy sigh of relief after off-loading a stock that has plunged from its early highs, retail investors are still struggling under its burden.

Will the common folk only be able to offload this stock by booking a loss?

Well, no, because things are looking up for Zomato.

🍰 Should We Order Sweets?

Zomato has made a move into quick grocery delivery, a sector that is set to grow in the future, with its acquisition of Blinkit.

And while people are still skeptical about this merger, it shows a lot of promise and helps Zomato compete on an equal footing with its main rival Swiggy (jiske paas Insta'Ma'rt hai).

With this acquisition, it has realised that just like a loaded Rajasthani thali, it has a lot on its plate.

So, it is moving to a multi-CEO model.

Each of its current offerings: Zomato, Blinkit, Hyperpure (which provides ingredients to restaurants) and Feeding India (an organisation aiming to end hunger), will be headed by a different person. They will all come under one brand: Eternal.

This will bring a lot of efficiency to the organisation and could help it further cut down on losses.

And studies have found that more than one CEO may actually be better.

60% of companies that had more than one CEO performed better.

So, these institutional investors could have missed out on bigger payouts later.

In fact, Jefferies believes that Zomato shares will go to Rs. 100, while Citi is more optimistic estimating they will hit Rs. 118.

Now, we will have to wait and watch who got the better end of the deal, retail investors or institutional investors.

⚡ In a line: Zomato seems to be in trouble, with investors selling shares but good things may be in store for the company as it shifts to a multi-CEO model.

💡 Quick question: Are you bearish or bullish on Zomato?

Share this with your friends via WhatsApp or Twitter and help them declutter news from noise! See you tomorrow :)

You can also listen to our stories. Catch it on Spotify, Apple Podcast, Amazon Music, Google Podcasts, Gaana or Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇