😯 Death Knell for Indian Fintechs?

Fintech companies have had a great run in India so far. But the RBI just forced them to slow down.

This piece is a long one because to prune it further would have been an injustice. Sit tight and ReadOn :)

After the Green and the White Revolution, India is currently undergoing a banking revolution.

The entry of NeoBanks, NBFCs, and an endless number of fintech firms have completely changed the face of India's banking and payments system.

And thanks to the ease of business they provide, these entities have thrived.

India is currently the third-largest fintech ecosystem in the world, with a market size of $31 billion.

But after a set of recent RBI announcements, the fintech party could be over.

🏦 A Blow to NeoBanks

NeoBanks are banks that don't have any physical presence. They exist only in the digital realm, putting an end to long queues, lunchtime and other problems we face at traditional banks (you can read more about NeoBanks here and here).

Sounds great, right?

Which is why NeoBanks are set to have a 17.11 million strong customer base by 2026.

But there's one problem.

They don't have banking licences.

So, they can't operate on their own but need to hold the hands of the traditional older banks to function right now.

And while this is good for traditional banks, as they can go digital easily, NeoBanks are not happy as they have to share revenue.

They were hoping this situation would change, as RBI was considering fully digital banks but it has scrapped this plan right now because this could be too risky.

This could be a death knell for NeoBanks, at least growth-wise.

You see, NeoBanks were already facing a lot of challenges.

Though these banks provide a unique use case that appeals to a lot of Indians: hassle-free banking and easy loans for MSMEs, they are currently facing tough competition from major fintech companies that are also into the digital lending game.

More and more fintechs are now trying to tap the MSME sector which is facing a major lack of credit or loans (worth around Rs. 20-25 lakh crores).

Moreover, these NeoBanks mainly rely on subscription fees from banks using their tech and interchange fees to earn revenue. And that is a problem.

Interchange fees is the amount of money earned from merchants anytime a person uses the NeoBanks' credit or debit cards.

But with UPI gaining popularity, this revenue source has practically died down.

🤔 Why is the RBI Not Giving NeoBanks A Licence?

One reason could be that these banks genuinely could pose a risk to customers and the economy.

Many small NeoBanks cater to customers that banks usually don't cater to: the ones with dodgy or no credit history.

And unlike banks, it will be difficult for them to build up enough of a protective cushion to handle the kind of bad debts these customers could bring with them.

So, these NeoBanks could drown under the weight of these bad debts, the ripples of which will impact their entire customer base and in turn the economy.

Plus, there are added risks like hacks, data storage issues and much more, which makes regulation very difficult.

And the RBI has much bigger things, like possible stagflation, to deal with right now.

So, it is putting NeoBank licences on the backburner.

But RBI is not putting an end to all regulations.

In fact, it has come up with a new rule that may ruin the boom that some buy now, pay later (BNPL) services are enjoying.

💳 The BNPL Problem

The BNPL industry is growing at a 36% rate right now and saw funding growth of 9x in 2021.

It is set to touch a market cap of $100 billion by 2023, all thanks to the ease it provides to customers by allowing them to borrow money for the short term.

But looking at its fast growth, the RBI has decided to take some steps to regulate it.

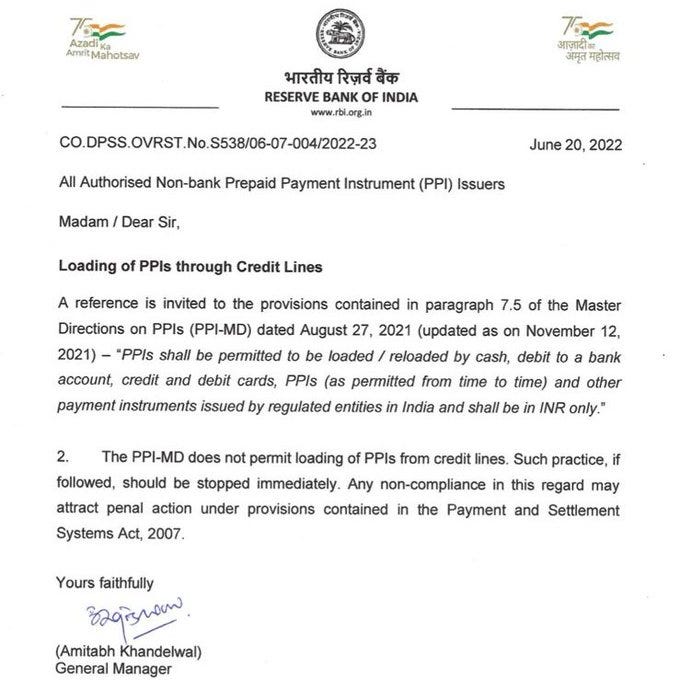

First step: Non-bank prepaid payment instruments (PPI) cannot be loaded with credit lines.

Huh?

Prepaid payment instruments are like a piggy bank in which you can load money and use it as and when you like.

These instruments can be in the form of digital wallets, vouchers or cards.

Now, what many fintech, especially these BNPL service providers did was, offer credit on these instruments.

So, instead of recharging your digital wallet or card, they allowed you to take a short-term credit or loan from them.

You could use this loan to buy now and pay it off later.

But many of these companies like Slice, Uni, PostPe did not have the licence to offer these PPIs.

So, they tied up with banks which have PPI licences.

These banks just offer the cards though, the loans are offered by NBFCs that these BNPL providers partner with.

In this way, the banks providing cards have no liabilities. If a customer defaults, it is not their problem.

Now, this backend process may seem complicated but, voila, customers now have a credit card that is much much easier to get than one offered by banks.

This model became so popular that some of these companies managed to sell around 2 million such cards in a month as compared to the 1.3-1.5mn cards banks managed to sell in the first two months of this year.

So, why is the RBI putting an end to this?

Well, this was never really allowed. PPIs were technically meant to be recharged using bank accounts, debit or credit cards.

These transactions can be easily monitored by the RBI.

Whereas monitoring loans that go through these BNPL services via an NBFC is difficult to monitor.

Also, using this method these BNPL players had almost been acting like banks, which is dangerous because like we said, they don't have a strong enough money pile to back them up if they're hit with too many bad debts.

Here’s what Ashneer Grover thinks about the issue:

However, not all BNPL players will be in trouble.

Hopefully, the ones like Jupiter, which has partnered with IDFC First Bank (regulated by the RBI) for the credit line as well, will probably not be impacted.

But companies are still seeking more clarity on this.

RBI's move could completely shut down businesses of some companies like Slice, forcing the unicorn to make a quick pivot or tie-up with banks.

We'll have to wait and watch to get more clarity on this front.

⚡In a line: The RBI is introducing new regulations to regulate NeoBanks and Buy Now Pay Later service providers, making functioning difficult for these fintechs.

💡Quick question: Do you think these fintechs will be able to survive these rules?

Share this with your friends via WhatsApp or Twitter and help them declutter news from noise! See you tomorrow :)

You can also listen to our stories. Catch it on Spotify, Apple Podcast, Amazon Music, Google Podcasts, Gaana or Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇