Buy Now, Pay Later: Good or Bad?

Payment tools are getting smoother by the day. What lies behind the veil?

The world has come a long way from ‘Pay Now, Buy Later’ to ‘Buy Now, Pay Later’ (BNPL). Yes, you can literally buy a whole array of things, without having to cough up money on the spot.

This model is cheap, convenient, and accessible to all. So much so that it is set to become the fastest growing online payment method from a 3% share in 2020 to a 9% share in 2024!

But, good things often come with a hidden cost. And, the cost isn’t always monetary.

What lies behind the veil of BNPL? Let’s see!

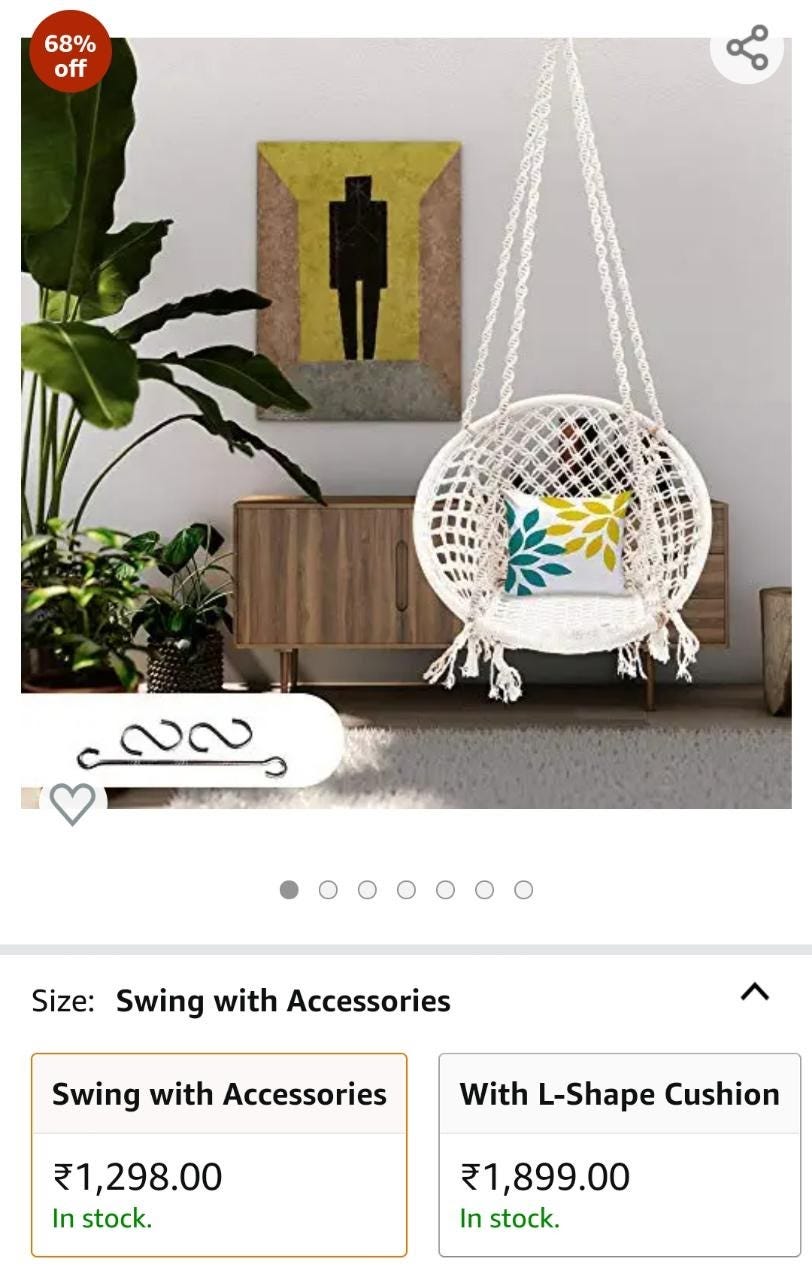

Say you want to buy this cool swing from Amazon. You can’t just not buy it, duh!

But, you are running short on cash. You can’t really afford to splurge any money and will have to say goodbye to the swing with an aching heart.

Now, Amazon cannot lose a potential customer in you. So they introduce a BNPL facility which can be set up within 60 seconds. Now you can keep ordering as much as you would like and simply pay later!

Duh! Isn’t it like a credit card? You buy now and then pay later. Just that here you don’t have a card. What difference does this make?

For starters, only 30 million people in India use credit cards. The approval rate for credit cards is very low. On the other hand, BNPL just requires a few minutes to set up. So people who have no exposure to the credit landscape and even those who make small purchases can easily avail these services.

Aah! So, easy availability of loans is BNPL’s popularity mantra?

It gets even better.

Credit cards are malicious creatures and they are designed in a way to trick innocent and uninformed consumers to pay only the “minimum amount” and not the full amount.

And then, tadaa!

They will charge you interest as high as 36% per annum. They also have several hidden charges. But, BNPLs don’t work like that. The usage fee tends to be pretty low (Amazon has 0 usage charges. Flipkart charges a flat fee of Rs. 10 for payments above Rs. 1,000). Even the interest amount is almost negligible. Simpl charges a flat late fee of Rs. 250 in case of delay in repayments.

Consumer is really the king in the BNPL service no? But, is it not disadvantageous for the fintech companies? How are they even gonna earn like this?

Doesn’t the credit and default risk increase? What if the customer vanishes without making payments? And how will the ultimate seller of the products agree to such an arrangement?

Trust us. The ultimate seller is the least bothered. These fin-tech and e-commerce companies pay them the money upfront. Instead they themselves assume the risk of non-repayment. Selfless, right? But how are they gonna survive like this?

Not so selfless if you dig a little deeper. We all know what easy money does to humans. When you don’t have to pay now you give in to the temptation to buy things that you wouldn't even think of buying if you were to shell out the money outright.

Targeting this behaviour of yours helps them generate money and build their revenue model. They persuade the merchants to give them a cut in exchange for increasing their sales. And well, by including more and more people who have had no exposure in the credit ecosystem before, they expand the size of the pie even more!

Owing to the beauty of this arrangement, the gross merchandise value of BNPL (value of transactions done using BNPL) is expected to rise at a 24.2 percent CAGR to $52.83 billion by 2028 from the current value of $6.99 billion in 2020!

BNPL can both be a friend and an enemy to you. This tool definitely makes your life easier and you can plan your finances better.

But, beware readers!

It can also drag you in the hole of temptations and can rob you of the money that you would have otherwise saved. It’s a battle between your financial goals and irrational exuberances.

You must take charge.

Liked it? Let us know! Join us on WhatsApp, and share your feedback! 👇

write article on oil Bond!!!!