Zerodha Founders to take home Rs.100 crore each?

India Inc's 'Begaani Shadi mai Abdullah Deewana' moment.

The race to become a unicorn is on. Startups are rushing to raise millions of dollars, but the dream to turn profitable is placed well into the future. The current reality paints a very different picture. High valuation doesn’t mean profits.

Then there’s one startup: Completely bootstrapped, operated on the founders’ savings and company’s profits, profitable ever since its inception!

Yes, we are talking about Zerodha.

A discount stockbroking fintech startup that offers trading services in various securities, Zerodha was founded in 2010 by Nithin Kamath alongside his spouse, Seema Patil, and his brother Nikhil Kamath. It is the only bootstrapped Indian startup to gain the unicorn feat.

But, what was so special about Zerodha? How did it manage to pull off such a stunt?

It shook the brokerage industry on its arrival by offering a flat fee of Rs. 20 per trade. In those days, investing in the stock market didn’t come cheap. Traditional brokers charged a fee as a percentage of the total trade. And this fee sometimes went as high as 0.55% of the trading amount. Zerodha planned to play in volumes and make trading a win-win game.

The startup came in the limelight in 2018 when it became the largest stockbroker in India, with 8.47 lakh active clients, surpassing the traditional brokerage companies like ICICI Securities and HDFC Securities. It continued to expand its client base and by 2020, it was valued at $1 billion.

That’s some big feat considering it did not raise a single penny from outsiders. Acquiring a customer base against the might of ICICI and HDFC, how did it even survive in the first place?

Reasonable trading fee could not be the only reason, right?

Zerodha brought the new age technology to the age-old table of stock-broking. It rolled out a very clean, simple to use interface, that even a noob could understand.

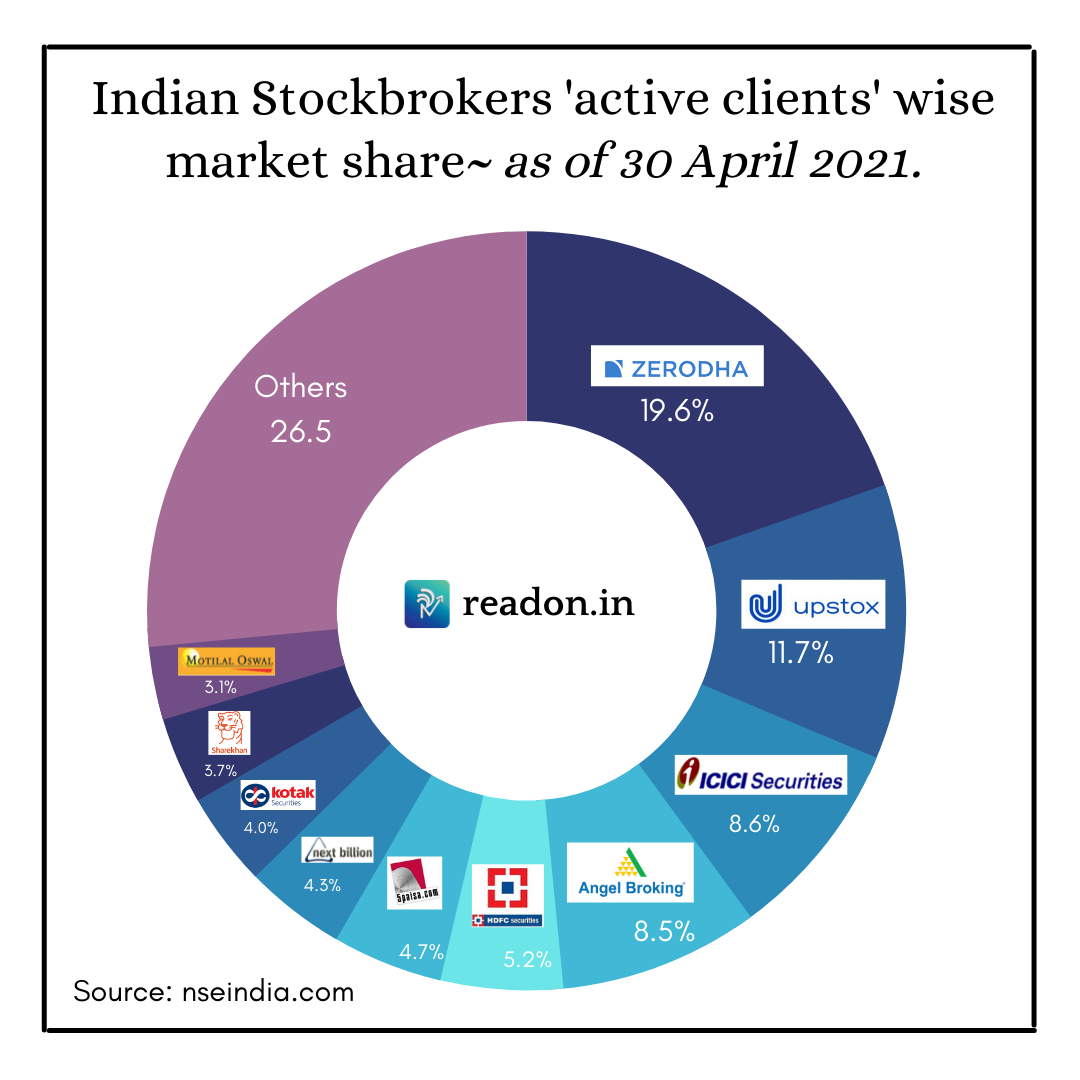

Good UI/UX and reasonable stock-broking fees together changed the Indian way of trading stocks. And, Zerodha became the apple of the public's eye. So much so that it recorded profits of Rs 1,000 crores in FY 2020-21 (as claimed by Zerodha’s founder Nithin Kamath). And its market share grew to:

Result? The founders decided that it was the right time for each to take home a paycheck of upto Rs. 100 crore. This, obviously raised some eyebrows and caused some more eyerolls. After all, people couldn't believe that the founders of a startup are drawing more salary than top executives of prominent companies in India!

The news became a game of Chinese Whispers.

Some people missed the point that Rs.100 crores was the upper cap and not the actual figure that the founders were drawing. They rushed in with their opinions (on Twitter ofcourse) and the event snowballed. So much so that Nithin Kamath had to come out with a clarification.

The gist of what he said was: even though they were a private company and did not owe any explanation, yet he will give one. Businesses are risky and they need to diversify. What they are withdrawing is being ploughed in other initiatives for good cause. The route he has used will also provide tax revenue to the government to invest in the economy.

The arguments that he laid out, gave us a lot to think about.

> As a private company do they owe an explanation to the public at large?

There is a saying in Hindi, ‘Begaani shaadi mai Abdullah Deewana’. It’s their business, it’s their profits, why should anyone else be poking noses, right? Well, one could also argue, when a business is so big, that it affects the lives of many people, it becomes a public company in essence, even if it is private by nature.

> His clarification is a lesson on diversification.

That a company will never fail is not written in stone. If something untoward were to happen, the founders should also have a strong foundation to bounce back on their feet. And for that, they need to diversify. There is no pride in going down with the ship when you can be smart and build a boat to remain afloat. (Tweet this)

> If great minds were to use the extra money to try out other businesses, wouldn’t it be good for the society as a whole? Maybe Zerodha doesn’t need that much money in the future. Shouldn’t we start trusting the founders to think the best for the company they made? (Tweet this)

> This case opens a whole can of worms (Read: India’s tax structure).

What are the routes that founders can resort to if they were to withdraw money from their company? They could sell shares, announce dividends or pay salaries to themselves.

Now, the tax system is so designed that the most profitable option is selling the shares. Next comes taking salaries. But announcing dividends is the least profitable of all. It leads to double taxation (first tax is paid on profits earned by the company and then the founder has to again pay taxes on dividends, which is basically a transfer of profits from the company to shareholders).

By making the transfer of shares the most profitable option, maybe the government is discouraging the withdrawal of capital from businesses to encourage growth. The business should be running. Who runs it, doesn’t matter maybe?

But to think of it, aren’t the founders the people who really dreamt of solving the problem in the first place? If they are nudged to sell their shares, is it good for the ecosystem? Won’t it be counter-productive if they chase high-valuations, something that just looks good on papers? Will the rainbow winged pony come to life, if the founders don’t take ownership to run the business until it attains profitability?

Here’s what Shantanu (our Founder) had to say about the entire fiasco,

“There’s a need to differentiate between an investor and an entrepreneur. An entrepreneur obsesses about the problem, finding people to work with to figure out relevant solutions to the problem, and creating an enterprise around it. On the other hand, an investor obsesses about return on and return of capital. When looking at Startup Founders, this distinction should always be made. Thus, you will find founders of startups that have raised money to be drawing salaries. Sometimes, hefty sums. When founders themselves are investors, they are in a unique position to draw out the money as salaries.” (Tweet this)

In Zerodha’s case, investors and entrepreneurs are one and the same. They have to balance the act of increasing returns and solving problems.

We don’t know whether it was good of Nithin Kamath to have issued this clarification - and we are no one to comment on that.

What we do know is we got to learn a hell lot about salaries, dividends and taxes through this.

Another case study for us to ponder upon, debate and discuss about, that will help us broaden the horizons of our understanding about the world of business and finance.

Brought to you, with love, by team ReadOn.

(this was an overnight effort, and Shantanu wanted to be quoted as this is his opinion, and not a fact - we want to clearly demarcate between the two).

If you like our efforts, do share this with your friends, alumni, and colleagues :)

Wanna interact with the creators of these insightful pieces? Join our WhatsApp Channel! (it’s free).

Great article! :)

Brilliant article, absolutely spot on!