What's giving stability to the Indian Rupee?

The currencies are surprisingly stable off late. Why aren't the tables turning? And what will happen once they do?

Stability is a golden word. It helps you plan better, anticipate better, and execute better.

The Indian Rupee has also been providing us this stable comfort. For quite some time now, it’s been hovering around INR 74/USD.

But, quite a lot is going behind the scenes to maintain this stability. Two opposite forces are tugging at both ends, making sure that the value of the dollar stays where it is. What are these forces?

The Big, Fat Indian Financial Market

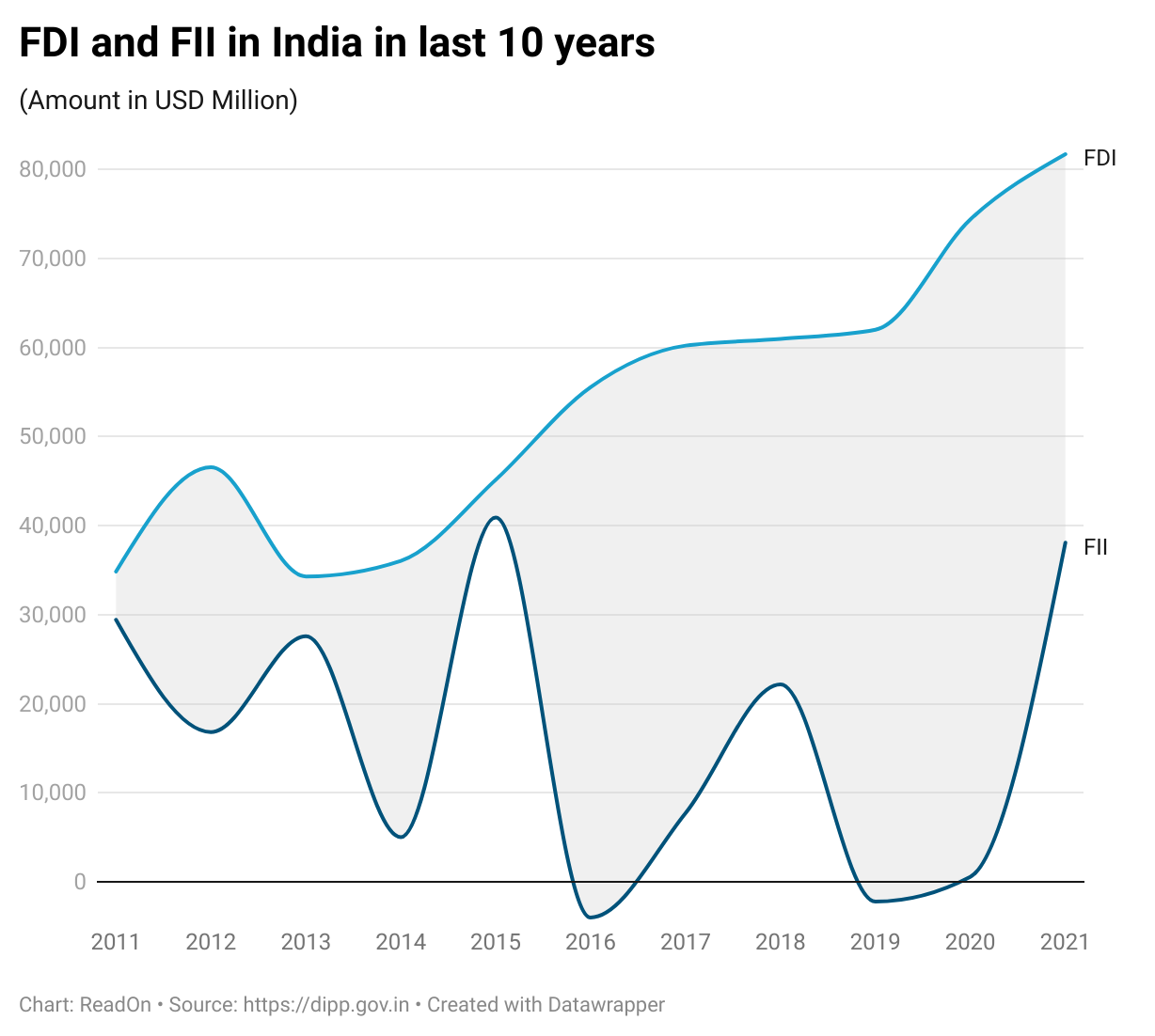

In 2020-21, Foreign Direct Investment in India was at an all time high at $81.72 billion, 10% higher than the year before. This is the amount that the multi-nationals have pumped in their Indian subsidiaries (child companies that are owned by Foreign Parents). And, out of this ~73% went into Indian equities.

At the same time, Foreign Institutional Investment (FII), that flows through the stock market was at $38.1 billion, 68 times higher as compared to 2019-20. This was the highest ever investment in the Indian markets since 2014-15. Look at this crazy graph!

The interest in Indian markets seems to have caught up and is not showing any signs of slowing down. In the latest IPO of Zomato, FIIs themselves oversubscribed the quota reserved for all Institutional Buyers (big companies whose business is investing) by 35.57 times!

With more interesting IPOs lined up, we can only imagine the funds that will enter the market in the coming days.

Why such frenzy, you ask?

A Government report suggests that ease of doing business and policy reforms have led to a boost in investments.

Now, here’s something interesting...

Out of total FDI received during the year, 64% went to the Reliance Group (we are not saying anything, but you can connect the dots, right?)

Well, there are several other factors too.

To deal with the Covid crisis, banks across the globe have been injecting record liquidity (more cash in the economy). The Indian markets are also getting a reasonable chunk of the global bonanza. Also, the government’s increased focus towards privatisation and India’s lucrative digital economy has attracted foreign investors into the country.

Hey, weren’t you talking about currencies? And here you are, going on and on about foreign investments.

It’s all connected. As the supply of USD increases, it becomes cheaper. Which means INR gets expensive.

So, that's…good?

Umm, Rupee becoming too expensive is also a problem because other nations may not be able to “afford” it. Confused?

Say a pen costs Rs.100. If the exchange rate were INR 75/USD, the cost of the pen would be USD 1.33. On the other hand, if the exchange rate were INR 70/USD (which means Indian Rupee becomes expensive), then the cost of the pen would be USD 1.428.

You see? For the same pen, a foreigner will have to pay more Dollars if the Rupee becomes expensive. So, they might not place their orders in India. This in turn, will hamper India’s exports.

To prevent this from happening: *drumroll*

Enter: Opposing forces

A collection of forces is tugging at the opposite end.

The RBI is buying USD to reduce the supply of the currency. Once the supply of the currency will reduce, its price will automatically go up to be able to meet the demand (Economics 101).

The US Federal Reserve has given hints of rate hikes. This means once the interest rate increases in the US, it will become a more lucrative investment option and money will flow out from the Indian markets. In anticipation of this move, combined with the uncertainty of Covid, some people withdraw their funds in advance. This again reduces USD in the Indian market.

The result of all of this drama? A stable rupee.

But what do you think, how long will this stability last? perfectly balanced, as they should be?

Got some feedback or suggestion? Join us on WhatsApp list and keep ‘em coming!

PS: Humans operate the channel, and we reply to all messages :)

I really love articles related to currency. Thanks Readon Team