🤔 What Metro’s Exit Means for India’s Wholesale Space

One of India’s oldest wholesalers is now planning on exiting the country despite making profits. Here’s why.

Accepting defeat is one of the most difficult things to do. ‘One last try’ is what we keep consoling ourselves with.

However heroic this ‘never give up’ attitude might be, sometimes it is better to cut your losses in time.

But how can we know which route is to be taken and when?

We’ll try to answer this question by analysing Metro Cash and Carry’s possible exit from India.

📝 Context First

Metro Cash and Carry is a German wholesaler that entered India 19 years ago. It operates around 30 stores in India and is one of the biggest players in the wholesale space in the country.

This means that instead of directly selling to non-business customers, it sells goods to large accounts such as grocery stores, hotels and restaurants, corporates and SMEs.

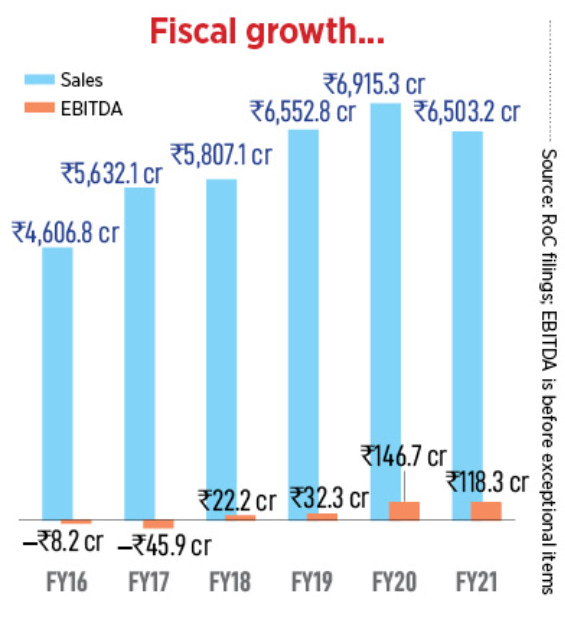

Not just that, as per a Metro spokesperson it is the only profitable B2B player in India. And it has managed to achieve this status only in the last four years.

But then why is it considering leaving India, which is one of its biggest markets?

The answer: It wants to remain profitable.

Confused?

Let’s look at the Indian B2B scenario to understand Metro’s seemingly confounding decision.

🛍 India’s FMCG Wholesale Space

Have you ever wondered how the products that you use every day reach you?

The answer is distributors. The distributors collect products in bulk from FMCG (fast-moving consumer goods) companies and then supply them to different grocery stores in their areas.

Sounds simple? It isn't.

Not only do these distributors have to manage the entire logistics of the deliveries, they also have to deal with the rules and regulations surrounding such deliveries and take back any defective or expired products back to the brands again.

Plus, they also often have to give out these goods on credit because small kirana stores can only repay them once the goods have been sold. This is a huge risk.

For all these services they end up getting only a 3.5%-5% margin on the products.

So far, the distributors had been okay with this and life was going on.

But then new players entered the market.

At first when it was just a few companies like Metro, the distributors did not mind.

The real problem began when more and more players started realising what a gold mine this business was.

Inflation ho ya recession, people will continue buying groceries. Just the FMCG market in India is set to grow to $220 billion by 2025 from $110 billion in 2020.

So, soon a lot of foreign players like Walmart and Thailand-based LOTS Wholesale entered this space.

They weren’t interested in the B2C aspect, which involved dealing with small portion sizes and customers.

They wanted to play big, so they all entered the B2B space.

That’s when Indian companies realised why should foreigners have all the fun?

Indian companies like Udaan and JioMart also jumped into this space.

Now, with 12.8 million small stores and the growing hotel restaurant business as the customer base, you would think that these players could all co-exist together, right?

Nah, businesses are never satisfied with just a small piece of the pie.

So, all of these companies are now burning insane amounts of cash to give perks like discounted products, free deliveries and extra credit to win more and more customers.

Metro also tried its hands in this game.

🎮 Metro’s Gameplay

It decided to help kiranas go digital to help them better manage their inventory and become more productive.

It even offered over 100 retailers in Bengaluru software and hardware worth Rs. 32,000 for free.

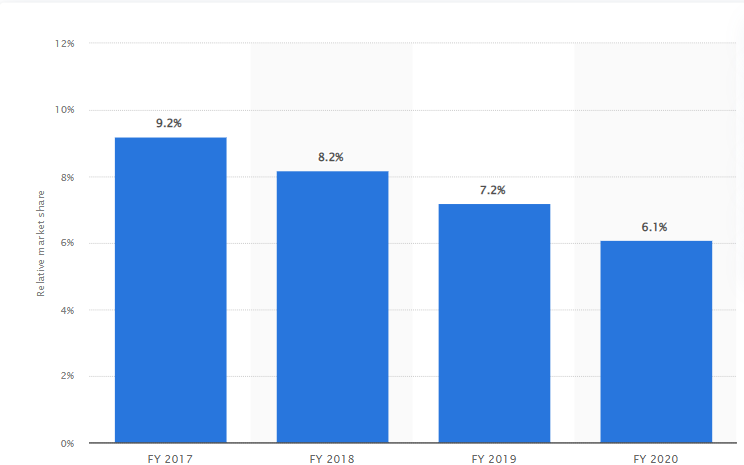

All of these efforts managed to make the company profitable, but it is constantly losing market share.

And it feels it is not up to the task of competing with giants like Reliance, which have the cash and the capability of erasing age-old brands from the market (remember how many telecom brands existed before Jio came in).

So, instead of burning a lot of cash and then potentially going out of business later, it is getting out first.

If it cannot be profitable, it doesn’t want to continue.

And it is not like this decision was taken in haste. The company decided to take this step after a detailed strategy report by Bain & Company.

So, Metro's exit makes sense. It is trying to leave after exhausting every other avenue.

It is considering a possible sale of its business for $1.5-$1.75 billion.

And there are many takers including Amazon, Reliance and the Tata Group: all companies that have a lot of cash to burn.

This sale could set the stage for yet another fight between Amazon and Reliance group, like the one for Future Group.

No matter how bloody this war gets, we will be there to tell you who ultimately emerges victorious.

⚡ In a line: India’s wholesale space is going to witness a major change as several big players are now going to be fighting over one profitable business.

💡 Quick question: Which company do you think will win this race?

Share this with your friends via WhatsApp or Twitter and help them declutter news from noise! See you tomorrow :)

You can also listen to our stories. Catch it on Spotify, Apple Podcast, Amazon Music, Google Podcasts, Gaana or Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇