Tulip Mania: Story of the First Bubble

Bitcoin hit an all-time high of $23K this week. While its fun to see it soar, some folks feel that this is a new "bubble" taking shape. Today, we present the story of the world's first-ever bubble.

Any time is a good time to study the financial mishaps of our ancestors.

History has time and again, witnessed various financial crises. Bubbles remain the most intriguing of them.

"See the soap bubble that travels in the air,

It shoots for the sky,

Is hollow inside,

Floats around for a few seconds

And then, bursts with a prick."

- (by Pratibha Jain)

We love new things. A new product, a new concept: anything that’s new tickles our curiosity. New things have a charm of their own. And if that new thing is scarce? OMG! We need to have it!

Our financial history is full of instances, where something new captured our collective imagination and blinded us to its pitfalls.

Mass greed of financial institutions was responsible for the 2008 housing bubble. Growth chasing internet companies caused the dot-com bubble.

But, the story that we discuss today dates back to 1636, the year of The Mother of all Bubbles.

It was not gold or diamonds or real estate that caused the bubble.

It was a special flower.

In the 16th century, the Turkish brought tulips to Europe.

Citizens of The Netherlands were mesmerised by this.

It was also the Dutch Golden Age. Their trade, art and science flourished and they had the highest per capita income in the world.

As the economy prospered, the aspirations of the people also grew. With those aspirations, grew the desire to possess rare commodities.

Tulips were rare and the rich began drooling over them (Yup. Just because they were “rare”). Soon, Tulips became a luxury product. Their possession became a status symbol.

As demand soared, prices skyrocketed. Everybody wanted to hold a tulip.

A mania was taking shape.

But, why would anyone in their right mind pay such high prices for a flower? It has no use and a shelf life of only 10 days!

Well, because everyone else was paying. Another basic human trait - follow the herd.

And, if you know you can sell something for a higher price, it's reason enough to buy, right? If you can make someone a greater fool and make some bucks out of it, then why not?

Such was the mania that people started buying tulip buds. The anticipation of a good bloom and high returns jacked up the dopamine circuits and captured the imagination of people.

Charles Mackay, a Scottish journalist claimed that “a basket of goods that included 12 sheep, 4 oxen, 8 swine, 2-4 tuns of beer and butter, 1,000 pounds of cheese, a bed, suit of clothes and one silver drinking cup could be exchanged for one bud of tulip.”

That's right. One bud of tulip.

Many people started to sell their assets and savings to be a part of the race. Semper Augustus, believed to be the most valuable and expensive tulip, could be exchanged for a fashionable mansion!

For context - Semper Augustus was priced at 10,000 Florence (the then currency of Dutch). The average Dutch worker survived with family, for 12 months, at 300 Florence.

Bubble, Bursted

The demand was so high that a regulated market for trading tulips was established.

But, illusions have a peculiarity of waning away with time. They can captivate people for only so long.

When the bubonic plague hit a few European cities, the traders could no longer find buyers to buy their highly inflated products (buds). Also, with soaring demand, the supply started catching up and the rare commodity was not rare anymore.

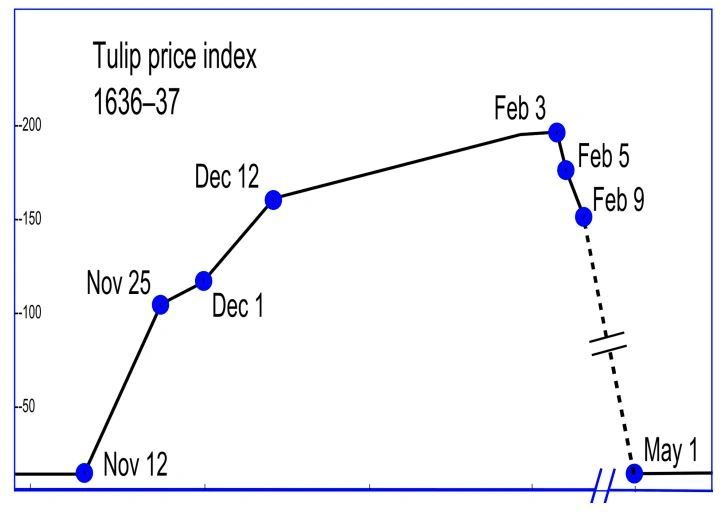

With more production and reduced demand, prices plummeted dramatically, bursting arguably the first speculative bubble of the world. Look at this very interesting image. It depicts the rise and fall of the tulip prices; the rise and fall of the collective illusion nurtured by the people.

Well, the flowers were flowers again. And the mania was gone.

Whoosh!

But, did this really happen?

The Tulip Fever officially breathed its last in 1637. Bankruptcies were filed, market sentiments nose-dived and a shock wave drowned the economy.

Now. What if we say that this bubble of illusion could be an illusion in itself?

As it turns out, all claims of a devastated economy, figures/facts and importantly, the whole bubble itself has been challenged and questioned by a historian - Anne Goldgar.

Anne argues that the Tulip phenomenon was limited to wealthy people, claiming that neither did the public lose money nor was there any economic impact experienced by the Dutch economy.

The Tulip Mania is a fascinating historical incident, a mixture of facts, figures and sensationalism. It remains a poster-child for bubbles, regardless of whether it had a consequential impact or not.

Are we seeing another such bubble?

This incident shows that when mania drives an asset's price to unrealistic heights, the fall is harder.

But, isn't it easier to call out stupidity when you have the benefit of hindsight? When you live through a bubble, it is often countered with terms like ‘opportunism’, ‘next big thing’, ‘riding the wave’ and whatnot. The illusion blurs reality.

Many from the world of finance believe that we are yet again living through a bubble.

“This is worse than the tulip mania. At least then you had a tulip, now you get nothing!” - says President of the Central Bank of the Netherlands. His indication is towards a particular phenomenon taking shape in the world of bits.

Bitcoins.

Are they 21st Century’s Tulips?

Thousands of readers get daily updates on WhatsApp! 👇 Join now!

By Divya and Yavantika.