The Yes-No Markets

Yes, this is a real thing. No, we are not joking!

At ReadOn, we don’t just report the markets. We help you understand what truly drives them, so your next decision isn’t just informed, it’s intelligent.

One man’s gain is another man’s loss, they say. But what happens when people start seeking economic benefits from people betting on random theological events?

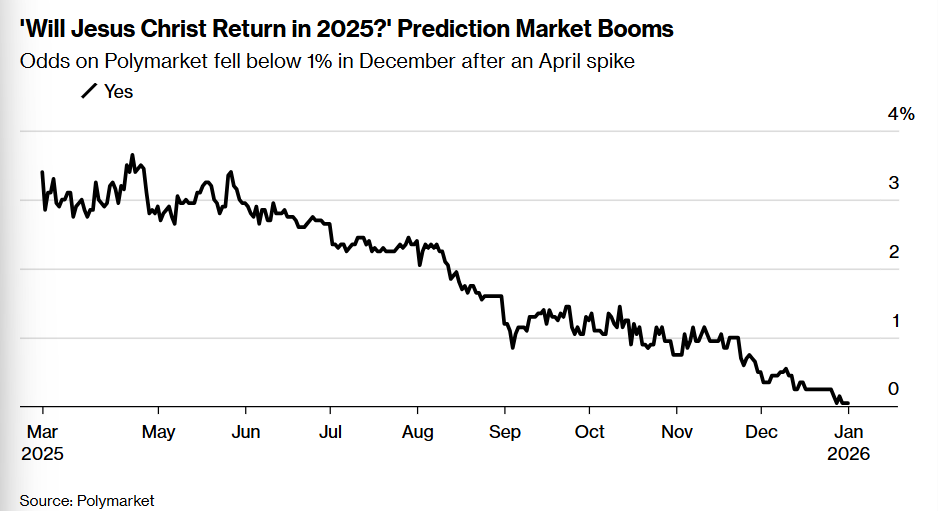

On December 25, 2025, a small group of traders on Polymarket collected their winnings on one of the platform’s more unusual contracts: “Will Jesus Christ return to Earth by the end of 2025?”

An amount of $3.3 million was bet on the subject!

Christ did not return in 2025. And for those who held the position, made an annualised return of 5.5%. Whereas the US Treasury bonds yielded around 4.5% annually. The Christ bet turned out more risk-free in this case.

There are millions of such bets on these platforms and they aren’t hypotheticals. These generate actual returns in markets that allow you to bet on anything with a verifiable outcome. Be it elections, hurricanes, product launches, sports outcomes, and yes, divine interventions.

And that raises the question, Silicon Valley and Wall Street are now betting billions to answer one question. Are prediction markets legitimate information aggregators that work better than alternatives (polls, experts)? Or is it just gambling?

Let’s find out!

When Chaos Pays $85 Million

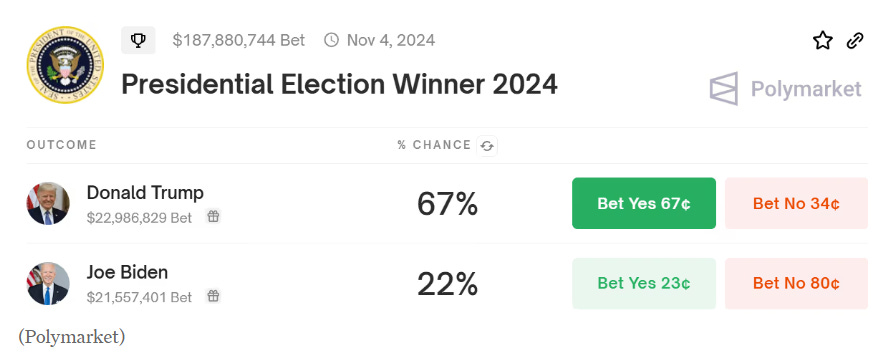

These Yes-no platforms aren’t small anymore. Polymarket, the five-year-old blockchain-based platform processed over $3.6 billion in trades on the 2024 US presidential election alone. When conventional polls on November 5, 2024 called the race “too close to call,” Polymarket showed Donald Trump with 95% odds hours before major networks confirmed his victory.

A single French trader, using the pseudonym “Théo,” walked away with ~$83 million in profit. He hadn’t conducted polls. Hadn’t knocked on doors. He’d simply believed that polls systematically underestimated Republican turnout, and bet $28 million on that belief weeks before election day.

But what was more remarkable was what happened a year later. In October 2025, Intercontinental Exchange, the company that owns the New York Stock Exchange, announced it would invest $2 billion in Polymarket.

Not for entertainment. Not as a gamble. But because ICE believes prediction markets process a fundamentally different, and increasingly valuable, type of information than traditional financial markets.

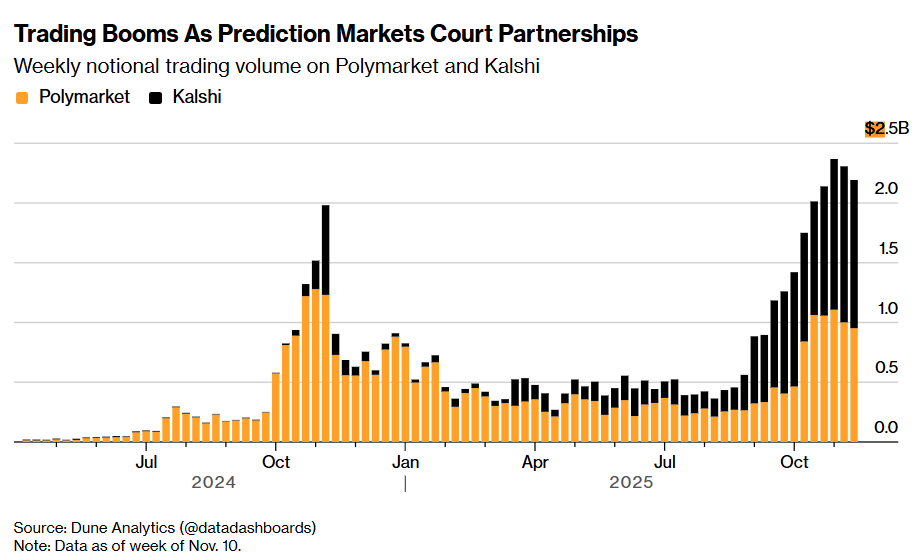

The numbers tell the story. Polymarket and Kalshi, the two dominant platforms, now handle over $2 billion in trading volume during some week.

Their combined valuation hit $22 billion in December 2025. Traditional finance giants like the CME Group, Cboe Global Markets, Robinhood are piling in. Even Trump Media announced plans to launch prediction markets on Truth Social.

These platforms aggregate distributed knowledge better than polls, better than experts, better than any single forecasting method. When you have skin in the game, or real money at risk, you reveal what you truly believe about the future. The “wisdom of crowds” meets financial incentives, creating what proponents call “truth machines.”

But strip away the grand claims, and a different picture emerges. Billions of dollars are flowing into yes-or-no bets on whether Taylor Swift will mention her fiancé on her next album, whether a meteor will strike Earth before 2030, whether sex toys will land on basketball courts, and whether the Denver Nuggets will win the NBA Finals.

So which is it? Information infrastructure or elaborate casinos?

How are financial markets and prediction markets different?

To understand the promise of prediction markets, you need to understand what makes them fundamentally different from the markets that have governed capitalism for four centuries.

When you buy Apple stock at $230, you’re betting on uncertain future cash flows that never definitively resolve. The debate about whether Apple is “correctly priced” continues perpetually. Is it overvalued? Undervalued? Millions of variables like supply chain disruptions, consumer trends, competitive dynamics, compress into a single number representing subjective beliefs about value.

The question Apple’s stock price answers is, “What should this be worth?”

Prediction markets ask a different question.

When you buy a contract on “Will Apple launch a car by 2027?” for 40 cents, you’re betting on a verifiable event. If Apple launches the car, your contract pays $1. If not, it expires worthless. On January 1, 2028, there’s no debate. The event either happened or it didn’t.

The question a prediction market answers is, “What will happen?”

Capital markets price subjective value. Prediction markets price objective reality.

Both rely on Friedrich Hayek’s 1945 insight about spontaneous order. Prices aggregate dispersed information without central planning. When tin becomes scarce, the price rises. No central planner needs to coordinate; manufacturers automatically conserve tin, consumers substitute alternatives, the market self-corrects.

But Hayek was writing about commodities. The question is whether the same mechanism works for events, whether a single number (a price) can really aggregate vast distributed knowledge about complex future outcomes.

The early evidence? Mixed.

Prediction markets nailed the 2024 election when polls showed a tie. But they badly missed Brexit in 2016 and underestimated Trump’s chances that same year. Historical studies show they perform roughly on par with traditional polls, not dramatically better.

But speed’s where things get interesting.

When Biden delivered his disastrous debate performance on June 27, 2024, Polymarket showed his withdrawal odds within hours. Traditional polls took five days to show movement. Expert consensus took two weeks to shift.

This speed advantage explains why ICE paid billions for Polymarket data. Portfolio managers don’t just want to know what assets are worth. They want to know what will happen to those assets, in real time. A pharmaceutical company’s stock price tells you one thing. A prediction market showing 34% probability of FDA drug approval tells you something operationally actionable for hiring, investment, supply chain, and hedging decisions.

When Markets Fail at Truth

The promise of prediction markets as information-aggregating machines collides with reality almost daily. The problems aren’t theoretical. They’re happening in real time, with real money, and raising questions about whether these platforms aggregate truth or just amplify the loudest voices with the deepest pockets.

The Insider Problem: In late December 2025, a new Polymarket account bet ~$33,000 that Maduro would be captured. Days later, he was in US custody. Trader profit: $436,000. The problem? The market climbed hours before Trump announced the operation. Representative Torres introduced legislation barring federal officials from trading on material non-public information.

The Whale Problem: Théo’s eleven accounts wagered $28 million on Trump between October 18-24, 2024. Estimates are his capital moved odds from 55% to 67% in one week, not from new information, but from one actor’s money distorting collective intelligence.

Research found Polymarket had the lowest accuracy rate of 67%, versus 78% for Kalshi, and 93% for PredictIt. So there might be a possibility that unlimited stakes attract risk-seeking speculators rather than informed traders.

The Timing Problem: In mid-January 2025, a trader bet $40,000 that the US would strike Iran before midnight January 14. The strike never happened. Total loss. The twist? The broader market priced 54-55% odds of a strike before June 30. Directionally correct, timing wrong, lose 100%. Prediction markets force precise deadlines. Miss by a day, lose everything.

The Resolution Problem: A $237 million market on “Will Zelensky wear a suit?” ruled “No” despite photographic evidence, citing lack of “credible reporting consensus.” Factually correct traders lost their money. And who decides credibility? An opaque oracle mechanism that can override observable reality.

The Manipulation Problem: Markets tracking whether sex toys would be thrown onto basketball courts actively encouraged fans to do it. When you can bet on an event and make it happen, manipulation is trivial. NCAA President Charlie Baker called the oversight gap “catastrophic.” Financial regulators worry about “assassination markets”, contracts that could theoretically reward violence by tying payouts to deaths or attacks. The CFTC asked Kalshi to remove contracts on the UnitedHealthcare CEO’s assassin. Kalshi complied. Polymarket, outside US jurisdiction, kept them live.

The Global Experiment

The regulatory response varies wildly. Switzerland, France, Belgium, Poland, and Singapore banned prediction markets as gambling. The US treats them as derivatives under minimal CFTC oversight. The UK operates in a gray zone.

India made its choice in August 2025 with a blanket ban. The Promotion and Regulation of Online Gaming Act criminalized all “online money games”, prediction markets included. The penalties include 3 years imprisonment, ₹1 crore fines. As a result, Probo shut down. SportsBaazi terminated operations. Polymarket blocked Indian users.

The paradox? India’s $100 billion illegal IPL cricket betting market alone generates billions through underground bookies who remain untouched. The law bans legitimate platforms while leaving opaque cartels intact. Estimated impact: 200,000 jobs at risk!

As of January 2026, the Act remains unenforced, facing Supreme Court challenges. The industry operates in legal limbo.

The world is running an uncoordinated experiment on whether these markets aggregate truth or amplify chaos.

The Final Thought

So are prediction markets truth machines or gambling platforms?

Honestly? They’re both, and neither. And it depends.

ICE’s $2 billion bet says these markets process genuinely valuable information distinct from traditional asset prices. The 67% accuracy rate and $400,000 insider-trading windfall suggest the “wisdom of crowds” often looks more like the “manipulation of whales.”

The real question isn’t whether prediction markets are perfect. They’re not. Polls aren’t either. Expert forecasts routinely fail. Traditional financial markets crash spectacularly despite supposedly aggregating all available information.

The question is whether prediction markets aggregate information better than alternatives and whether that marginal improvement justifies the gambling addiction, insider trading, and market manipulation they enable.

For developed economies with functioning polls and expert forecasters, the value proposition is exciting.

What’s clear is that the experiment is running whether regulators like it or not. Prediction markets now sit in a familiar place in modern finance. They are pitched as civic infrastructure, built on speculative energy, expanding faster than rules can contain them.

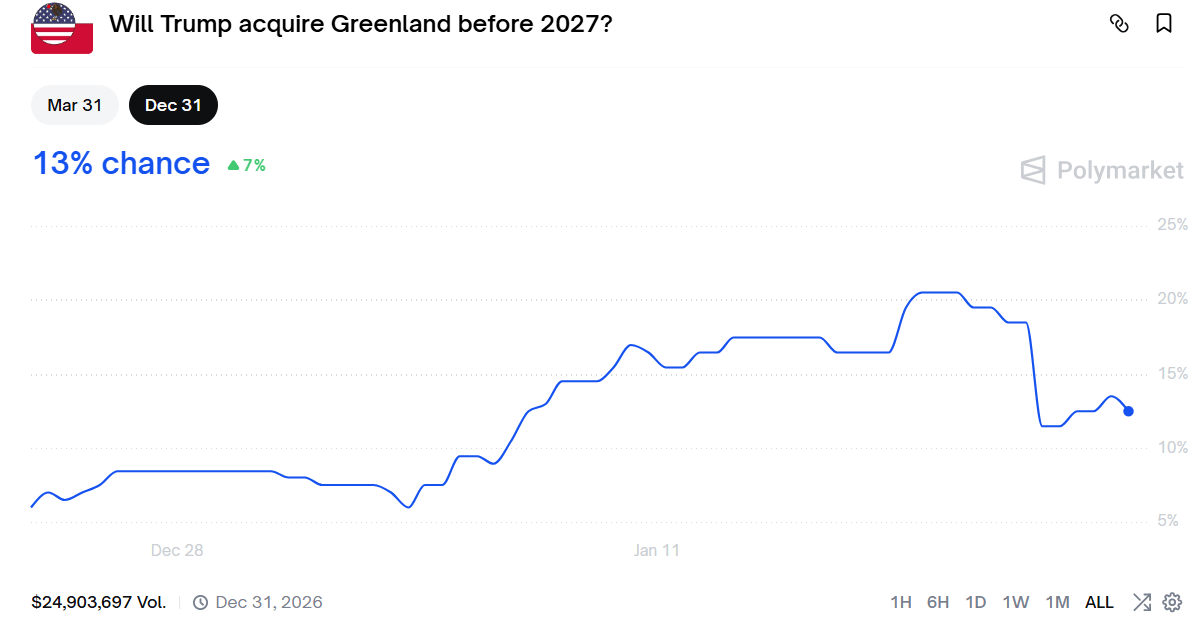

The final irony? Right now on Polymarket, traders are betting $14 million on whether Trump will acquire Greenland before 2027. The current odds stand at 13%.

Whether those odds reflect collective intelligence or collective delusion, that’s the question Wall Street just bet $22 billion to answer.

In other news, have you been checking out the crosswords below these articles? Try them out for yourselves, and see how quickly you can solve them!

Until next time, ReadOn!

ReadOn Insights Crossword 28-01-2026

Hints:

Across:

4: State where about 8 GW of wind and solar projects are stuck due to transmission delays

5: Government-led group formed to resolve wind sector bottlenecks

6: Suzlon Energy, an Indian company among the largest domestic manufacturers of wind turbines.

7: Process of upgrading old low-capacity turbines to modern multi-megawatt machines

10: Infrastructure missing that is forcing nearly 50 GW of renewable power to lie idle

Down:

1: Endangered bird whose protection delayed transmission lines in Rajasthan

2: State utilities delaying power purchase agreements due to financial stress

3: Process of forcing wind generators to shut down despite available wind

8: Renewable energy source with over 50 GW installed capacity in India

9: Ministry that publishes India’s official wind resource potential maps

To solve this puzzle, click here!

27.01.2026 (Answer Key)

Across:

4: China

6: Meesho

7: Trust

8: India

9: Glow Road

Down:

1: We Chat

2: Pinduoduo

3: Livestreaming

5: COD

10: WhatsApp