The Rise and Fall of Bombay Stock Exchange

Bombay Stock Exchange - a building that has witnessed many economic crises. A building that has seen the rise of small businesses, and the fall of many empires.

In the city of dreams, closer to the Arabian Sea, a building, with a big bull statue, as if touching the sky, stands tall. A building that has witnessed many economic crises. A building that has seen the rise of small businesses, and the fall of many empires. A building that has created wealth, fortune and future for many. And destroyed for some.

The building we talk about today is the Bombay Stock Exchange.

BSE is Asia’s oldest stock exchange (established in 1875) and is the 10th largest stock exchange in the world today, boasting a current (11 Dec 2020) market capitalization of Rs.171.40 trillion (1 trillion = 1L crores).

(Stock exchange is a place where one buys and sells shares of companies. A marketplace for stocks).

While musing about this beautiful great building, we got curious about how it makes money.

Besides being a facilitator of buying and selling stocks, it is also a company (with revenues and costs, profits and losses) and is even listed on stock exchanges.

Yes, a stock exchange can be listed on another stock exchange. It is just a company, at the end of the day.

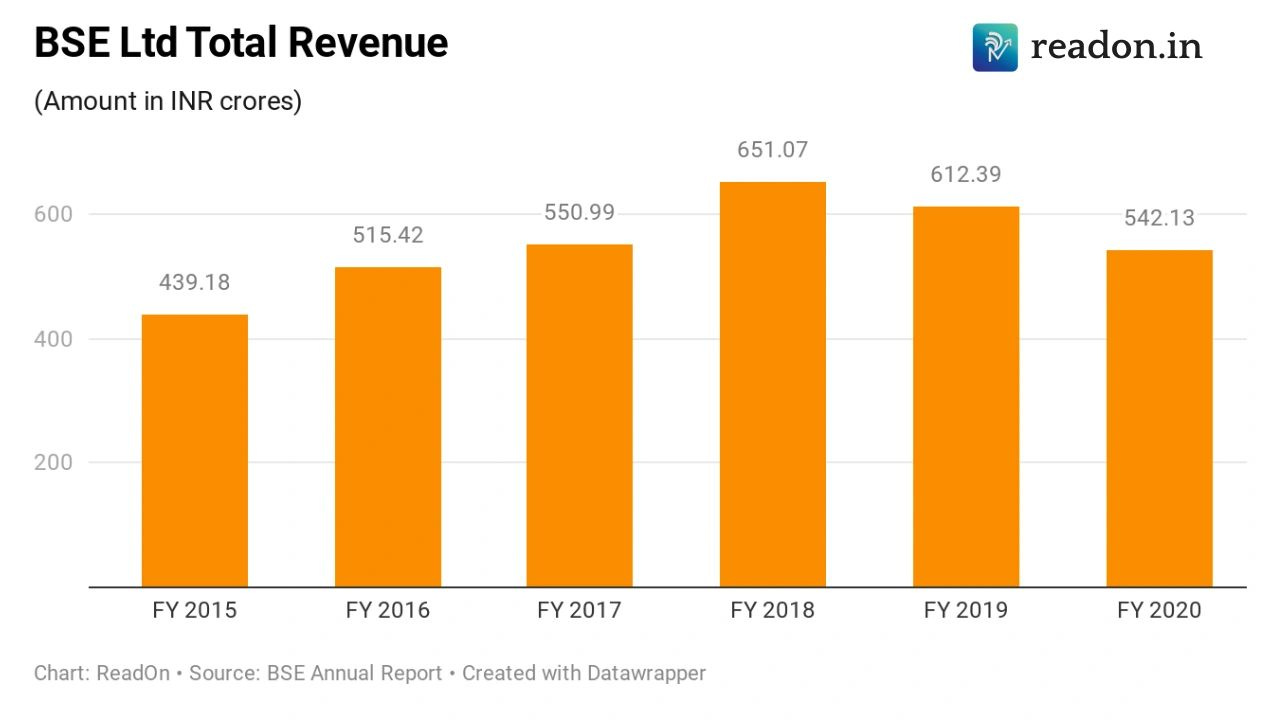

For context, let's see how much revenue BSE Ltd. makes and what are the various ways in which it makes money.

But what is BSE (or, for that matter, any stock exchange) really?

It is a match-making institution. It provides a platform for companies to raise money publicly. And for investors, it provides a platform to find prospective companies to place their bets on.

And so, many would think that stock exchanges make money by charging transaction and brokerage fees from the investors and listing fees from the corporates. Basically, anyone and everyone who is going to use the platform to make money in any manner.

Well, you are right in thinking so.

Out of revenue of INR 542.13 crore registered by BSE for the year ended March 2020, 56% came from the obvious route of listing fees and transactional charges.

But, what about the balance 44%?

Well, BSE is not one to leave out any opportunity to milk a cow!

It generates some revenue by charging for its book building software (branded as iBBS). Sounds fancy! But what is "book building" anyway?

When a company raises money from the public, it has to quote a price at which it will issue its securities. But how does it know the sweet spot where it can raise more money without reducing the demand? Through a process called book building.

Well, the company still has a broad idea of the price (called the price band) and invites bidding on the same. It provides a period (typically of 3 days) for the public to ‘bid’ for its shares. A book building software allows users to place bids electronically on a real-time basis. It also provides real-time visual graphics of price vs quantity during the bidding period. When the bid is finally closed, the sweet spot for issue is determined based on the demand generated.

Nice move, BSE!

If you want to increase the value of your offerings, you surely have a lot to learn from BSE. All you have to do is monetize everything that you think will have value for someone. And that is exactly what BSE does.

If you think of it, over time, BSE would have gathered a lot of data about the companies' share prices. And so BSE found an opportunity to make money by selling real-time or historical data of shares to brokerage firms.

Have a look at the graph below for a complete picture of how BSE makes money.

BSE also has many subsidiaries (significant stakes held) and associate companies (small stakes held) that have multiple revenue sources. These companies provide certifications, conduct investment programs and engage in educational activities.

One of its very popular associate companies is the CDSL (Central Depository Services (India) Limited).

It functions as a facilitator to holding and transferring securities in electronic form. CDSL is also a listed company. And, profitable. In fact, it’s popularity increased so much that its market cap surpassed that of BSE in November 2019.

With all the opportunities that BSE has grabbed, they made some vital misses as well.

Misses they couldn’t really afford.

Misses that gave NSE an edge in the duopoly between the two.

In the words of Mr. Ashish Kumar Chauhan, the CEO and MD of BSE Ltd,

“The BSE was late to the derivatives game. Typically, one is likely to trade equities at the same exchange where one trades derivatives. So, a gap was created. The BSE had basically zero market share in derivatives, currencies, commodities… pretty much everything except a few equities and some initial public offerings (IPOs). The technology wasn’t considered very good. People had written the BSE off. Why did the NSE become so big? Not on the back of the past but on the back of the new [offerings]. Derivatives played a big role in it.”

Funnily enough, Mr. Ashish Kumar Chauhan is the founding member of NSE (a.k.a the father of modern financial derivatives). And the man himself was responsible for making NSE bigger than BSE.

The creator of one, the destroyer of another? You decide.

Until next time…

ReadOn

By Yavantika and Divya.

Thousands of readers get daily updates on WhatsApp! 👇 Join now!