The Iran Crisis: Decoded

When President Ebrahim Rasai was 18 years old, the Iranian crisis had disrupted the world's economy. With his death, will history repeat itself?

Breaking News: Iran’s President Ebrahim Raisi died in a helicopter crash.

This can mean only one thing: More uncertainty in the Middle East.

Just about a month ago, the Iran-Israel conflict got everyone biting their nails.

Now, Raisi's death opens the door for fresh speculations.

Speculations about who will fill the president’s shoes and what it will mean for the Middle East.

And this opens up the possibility for endless escalations and ultimately, maybe a full-blown war.

“But why should we care? It’s happening somewhere else, no? Will it impact our day-to-day lives in any way?”

Short answer - it does impact us.

Here’s why.

Reason #1: Over 20% of global crude oil supply comes through the Middle East. The world’s most important oil transit choke point, Strait of Hormuz, is in the region and Iran has its hands on it.

Reason #2: We need crude oil for almost everything. From the cost of your daily bread to the cost of running your car, from your daily medicine to complex chemical products - everything is affected when crude oil prices go up.

Especially in India.

Because we import more than 85% of our crude oil needs, spending precious $$ that we don’t really have much of.

And as market pandits are fond of saying, “this time, it’s different.”

But is it?

In today's piece, we try to answer exactly this.

Whether “this time, it’s different.”

To keep life simpler, we will look at this in 4 parts. First, we will draw on historical parallels, and how the world has dealt with “oil shocks.” Then we will dive deeper into the Indian context.

Each day of the week, we will serve you one part.

So let’s begin with looking at the history of big crude oil jumps in the past, and how it has impacted the World order.

Part 1: How the world reacted to big crude oil price jumps in the past

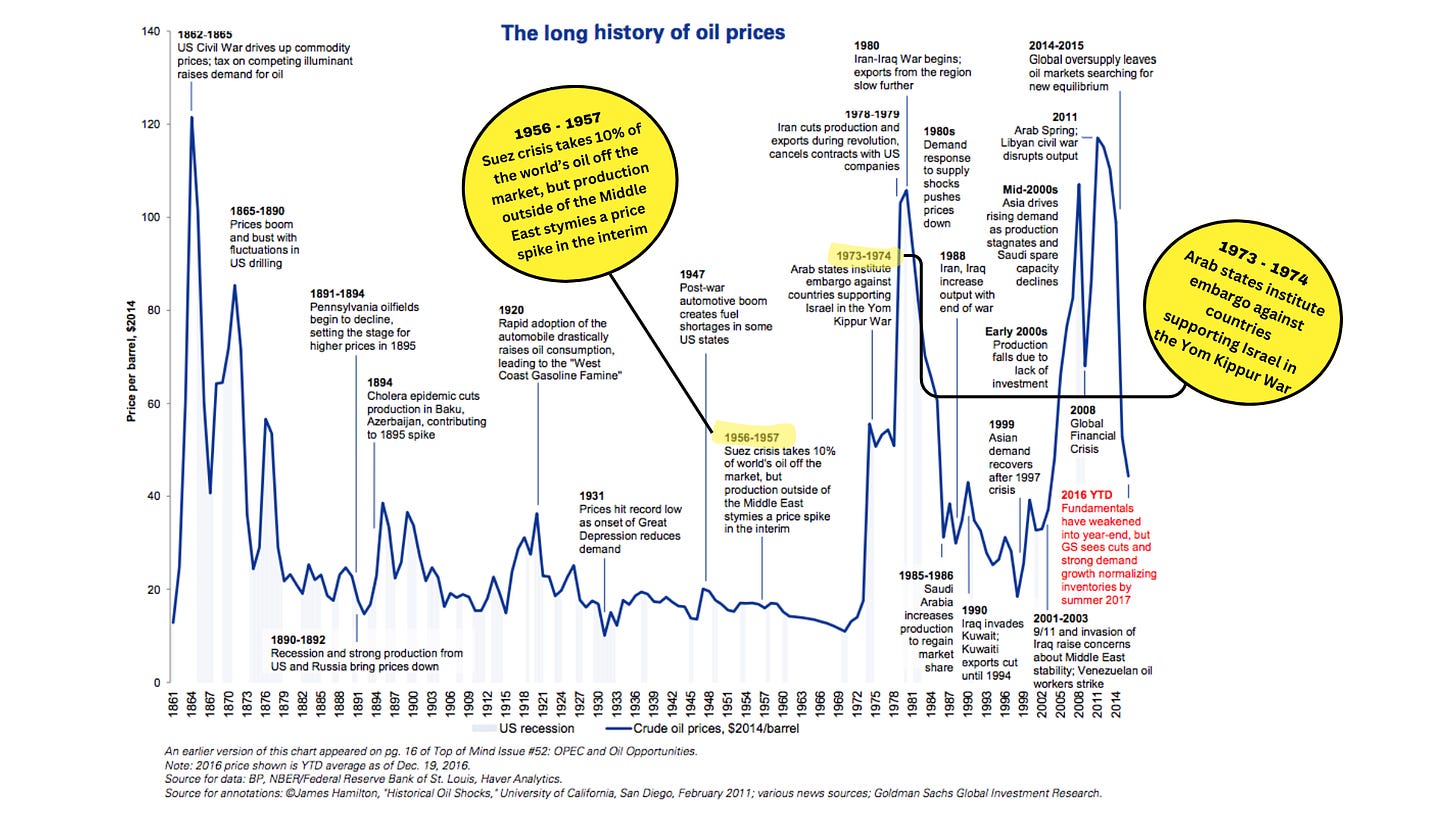

Look carefully at the chart below. This chart is telling us the story of a commodity almost as precious as gold today. But with much more utility than the shiny-old metal.

Wars have been fought over this energy resource.

For the longest time in history, crude oil was just a commodity. And like any other commodity, supply and demand were the only forces that determined its price.

Until some countries started using it as geopolitical leverage.

And this was possible because of the growing reliance on crude oil as a major energy resource. Between 1960 and 1972, the world’s crude oil consumption more than doubled.

“But why crude oil? Why the switch? Was it better than alternatives available back then?”

Yes. It was. Waaaay better.

You see, crude oil offers a better calorific value (amount of heat released during combustion) than coal and is easier to transport than natural gas (over oceans, as oil has higher density and lower volume than gas).

Plus, crude oil's distillation gave us many by-products like LPG (used in kitchen), naptha for plastic, synthetic textile, drugs, cosmetics, ATF for aviation, petrol, diesel for cars, heavy fuel for ship, bitumen for road construction and roofing.

Basically we anchored our lives around this one product.

By 1973, the United States was fulfilling more than 33% of its crude oil demand by imports.

Yes, the country, which is NOW the world’s largest crude oil producer, was THEN the world’s largest crude oil importer.

Every nation on Earth wanted this liquid gold.

The simple forces of supply and demand started getting layered with power and greed.

Crude oil became the weapon to exert global supremacy.

And that’s when the human race faced the first oil-shock.

World's first oil shock

The world’s first oil shock was thanks to a war - called the “Six-Day War” - in 1967.

Israel was at war with Arab nations (Eqypt, Jordan, Syria). And USA extended support.

Israel won.

Some context - Israel, a predominantly Jewish country, has been the sore of the eye for many Arab and Middle East countries. So much so, that they don’t even acknowledge its existence. Even Iran, since 1979, has taken this stance.

This left the other nations sour.

They sought revenge.

But there was a twist.

Daniel Yergin, Vice Chairman S&P Global, has explained the context (and the twist) of the world's first oil shock really well in his keynote address at Columbia (Center on Global Energy Policy).

Read on:

“During the Six-Day War in 1967, Arab oil exporters had sought to mobilize the “oil weapon”—that is, level an embargo against western countries to pressure them to cease support for Israel. But the weapon misfired. At that time, the oil market was in surplus, and the United States had spare capacity—additional oil production capacity that was not in use, but that could be mobilized against an embargo.

The 1967 Six-Day War had changed the balance in the Middle East. Israel had taken control of the Sinai Peninsula, the West Bank, the Golan Heights, and East Jerusalem. Egyptian president Gamal Abdel Nasser was the great advocate of pan-Arabism, and his voice denouncing the existence of Israel resounded on transistor radios across the Middle East. Nasser died in 1970, leaving his successor, Anwar Sadat, in his shadow.

But Sadat was determined to reverse the outcome of the 1967 war. He concluded that the only way to do that, to compel negotiations with Israel, was with a new war. Syria was with him. By August 1973, he had persuaded Saudi Arabia’s King Faisal to consider integrating the oil weapon into an overall war plan. The king, who remembered its failure in 1967 and the consequent costs in terms of lost revenues, now recognized that the dramatic shift in the world market would provide the fire power necessary to wield the oil weapon. The essential fact was that, between 1967 and 1973, Saudi Arabia, and not the United States, had become the swing producer in a market that was very tight.”

10 days after the 1973 war began, OPEC increased crude oil prices by 70% and production was reduced by 5% a month.

The big shocker: an embargo was imposed on the US by the Arab oil-producing nations. Yes the country which is so fond of sanctioning others, was itself a victim of sanctions.

The embargo was lifted in 1974, but prices were not going to fall anytime soon.

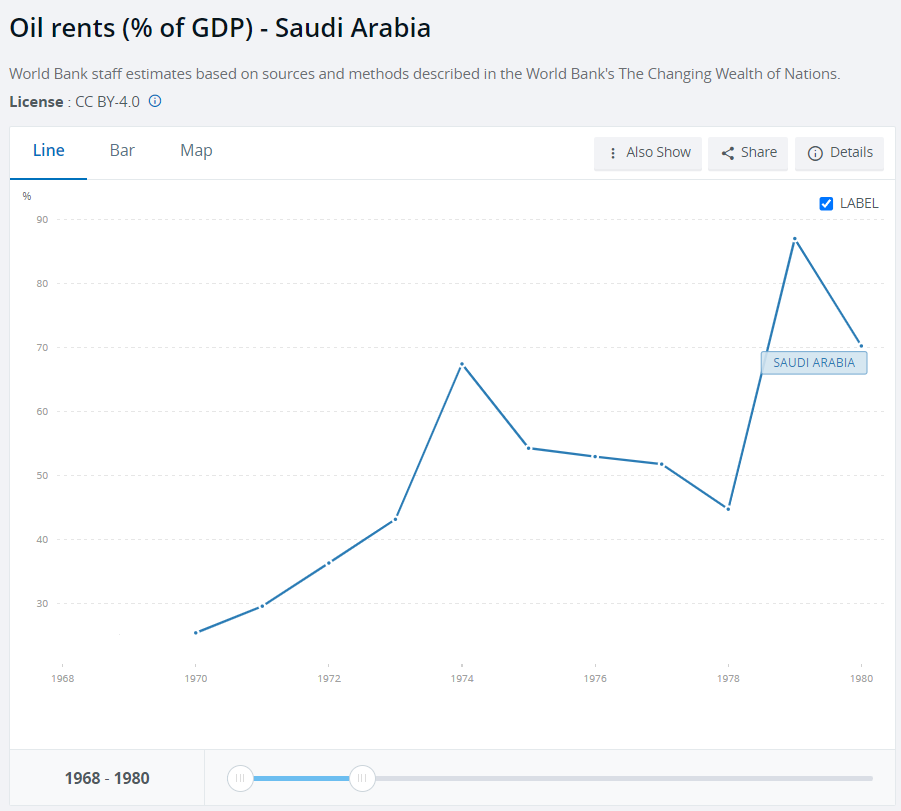

Crude oil revenues for Saudi Arabia jumped fortyfold between 1965 and 1975, from US$655 million to $26.7 billion.

Saudi Arabia prospered. The contribution of oil as a percentage to GDP increased drastically. Look at the graphs below: notice how the graph peaked during the “Oil Shock” year.

Crude oil producing nations had now tasted power.

They had found a new place in the World order.

And they were not going to cede this space anytime soon.

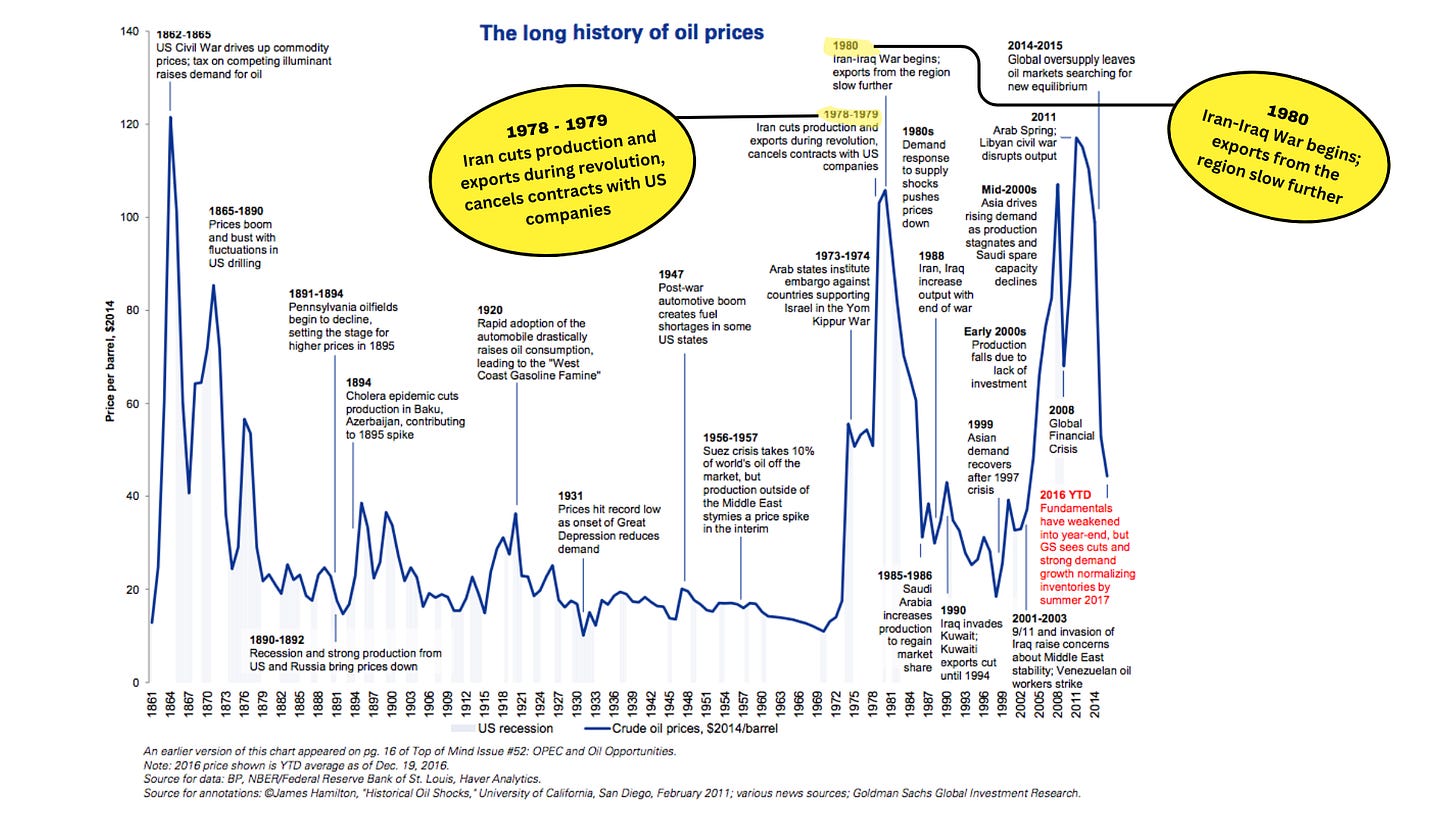

World’s second oil shock

The year was 1977. Trouble started brewing again. This time in Iran.

You see, as crude oil trade increased, it created a lot of wealth for the oil-selling countries.

Look at how Iran’s GDP and per capita GDP soared between 1960 and 1976.

While the above charts paint a picture of prosperity, this was also a period marked by civil unrest.

“Wait a second, GDP is growing, the country is prospering - then why is there civil unrest?”

Good question.

You see, the growth was not inclusive. The “crude oil rush” only made a few rich in Iran, while most Iranians were struggling to find jobs and earn a livelihood.

We found a research paper published by International Journal of Middle East Studies explaining in detail how income inequality contributed to mass mobilisation of Iranians in the 1979 revolution.

The unrest reached the oil fields of Iran.

And supply of crude oil went down by 7% of world’s oil production at that time.

But more than supply, it was panic that played a bigger role.

The oil consuming nations around the world feared that the Iranian revolution (which had taken a religious turn by then) could spread to other Middle East nations and spark a full blown crisis.

They started stocking up. So much so, that it doubled the actual shortage by 1979.

So that was the second oil shock for the World.

And this shock pushed the world into a recession.

Here’s an excerpt from the World Bank report on Global recessions, elaborating the events surrounding the global recession of 1982:

What this tells us is that even if there’s an economic sanction on Iran today, and India is not really dependent on Iran for its oil needs - any unrest in this region which ultimately involves other Middle East countries can disrupt oil supply, and thereby lead to a shortage.

The economic recession of 1982 brought forth a realisation.

Realisation that the world economy was at the mercy of oil producing nations.

What did the World do to counter this? Stay tuned for the next part :) If you have not subscribed yet, I highly recommend that you do. And if you think a friend of yours will enjoy reading this, do share it with them.

Until next time, ReadOn.

Editor's Note

We have been working on figuring out how to make higher value content. Even if it doesn’t come daily. Our first new initiative, ReadOn Insights, where we break down interesting, growing sectors you care about, has been consumed 800K+ times.

This is our latest attempt at bringing your not just good quality data backed research, but also quality analysis.

For this, we have our star writer, Yavantika Malani, a Chartered Accountant who is obsessed with satiating her curiosity, and cries herself to sleep if she has to write anything below 3000 words.

And we hope more passionate folks join us - who care about what they write, how they write, and for whom they write.

The revolution is on :)

This time, in long form.

See you in the next one!

Jai hind 🇮🇳

Editor,

Shantanu Jain

The writing is concise and simple kudos to yavantika for a detailed research!! Loved that❤️❤️

Amazing content, love it