The Harshad Mehta Scam: Explained

The world of business and finance is full of scams and scandals. This one will blow your mind!

Harshad Mehta, a name as famous in the Indian stock markets as Amitabh Bachchan is in Bollywood, is best known for the biggest stock market scam of ~Rs. 5,000 crores in 1992.

In today’s terms, it comes to Rs. 24,000 crores.

Wow.

Let that sink in.

Backdrop

Harshad Shantilal Mehta, a Gujju Bhai, spent his early childhood in Bombay (Mumbai).

In the 1980s, he took up a job as a salesperson. During this time, he started falling in love with the stock markets. He quit his job and went on to work for various brokerage companies.

In 1984, Harshad Mehta became a broker of Bombay Stock Exchange (BSE) and started his company, ‘Grow More Research and Asset Management’.

With a lot of successive quick wins, he soon became what could be called India’s first stock market celebrity.

People adored him and started trusting him with their money. He was always a smooth-talker (guess the credit goes to his stint as a salesman?).

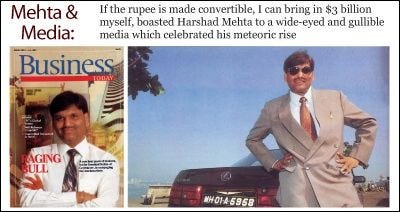

With being on the cover page of Business Today magazine, owning a sea-facing penthouse with a mini golf course in Bombay and driving two dozen luxury cars, he needed nothing more.

Such was his popularity, that people started recognizing him as the ‘Big Bull’ (a bull in the markets is someone who always believes that the markets will go up).

But, how did he do it? How did he dupe so many, for so long?

Well, if someone really looks closely, one can always find a loophole, a shortcut.

Harshad Mehta took advantage of the loopholes in the banking system and created artificial demand for some stocks.

Wait, what?

Let's understand this slowly.

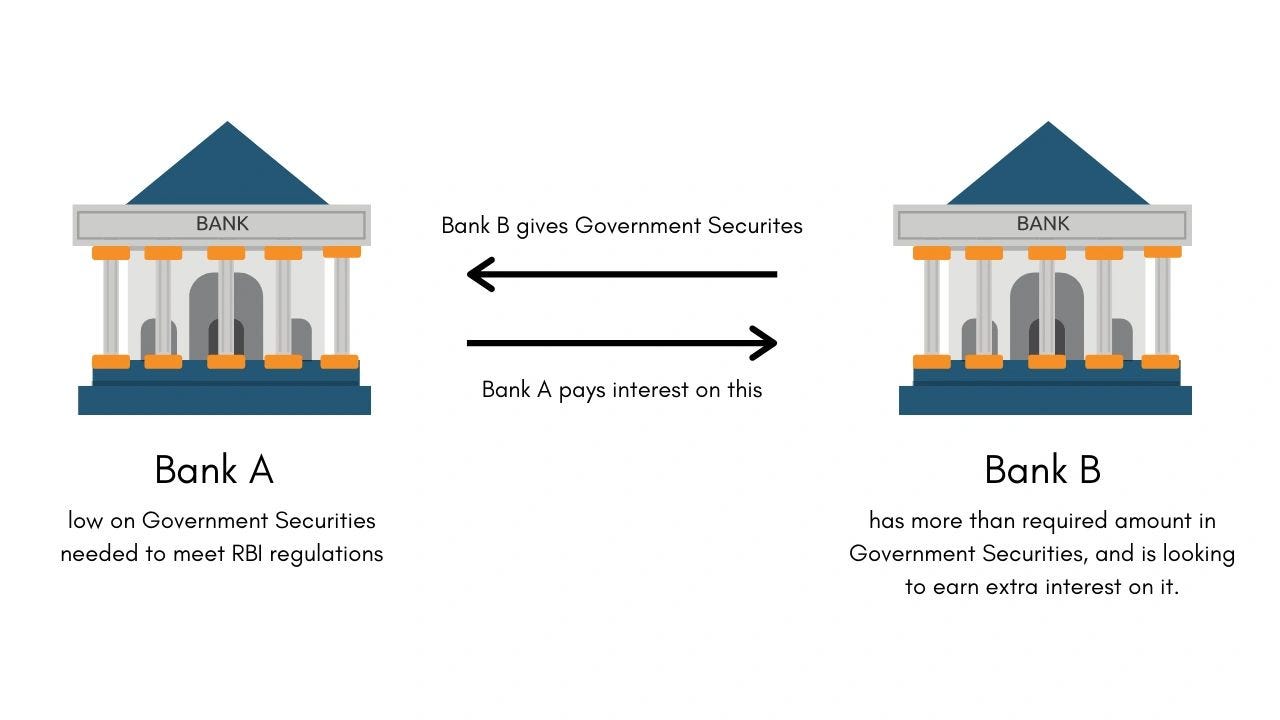

Banks have to invest a certain percentage of their assets in Government Bonds (jargonists call this liquid assets).

When this number falls below a certain threshold, banks indulge in inter-banks transactions (borrowing from, and lending to one another).

In this, a bank having (more than required) assets invested in Government bonds lends it to the bank in need (to maintain the minimum level of the threshold).

Now, in those days, banks made use of something called the Ready Forward Deal (RFD) for this purpose.

An RFD is a secured, short term 15-day-loan from one bank to another with government securities as collateral. The borrowing bank (the one with the shortfall) sells the securities to the lending bank (the one having more money) and buys them back at the end of maturity, at a slightly higher price.

This way, the lending bank earns a small amount of interest, at really low risk.

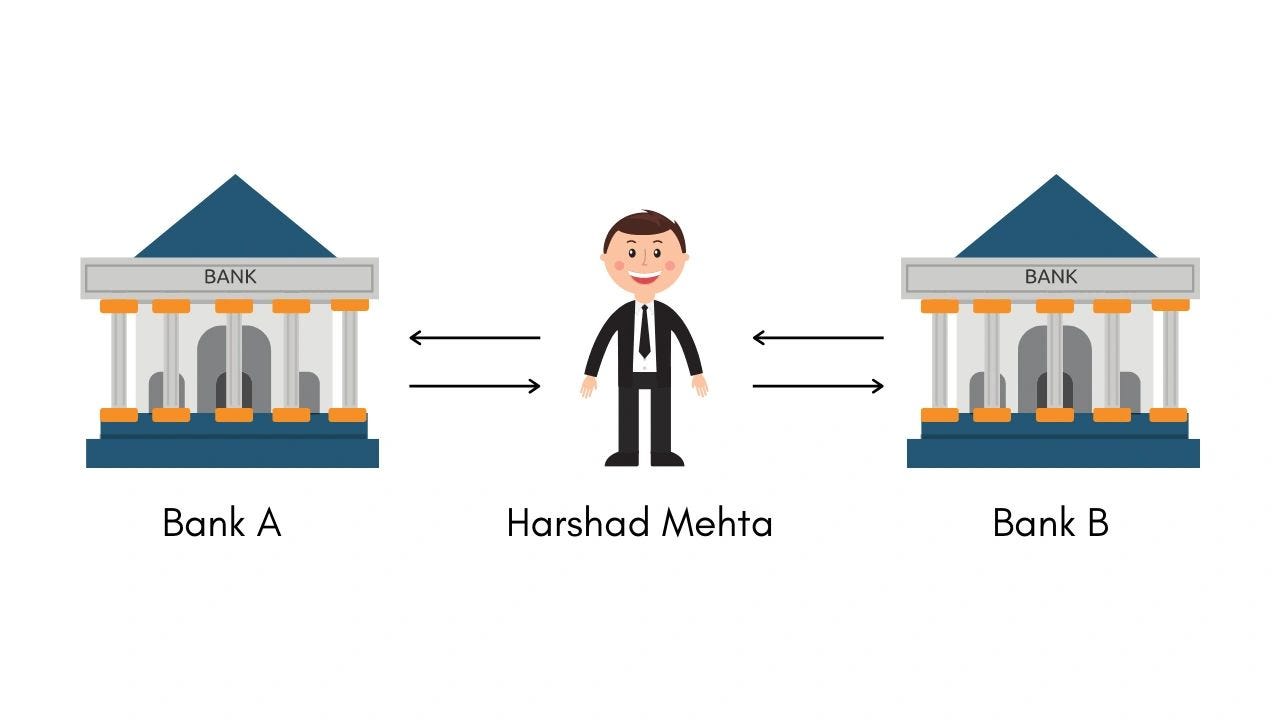

Harshad Mehta acted as a broker (mediator) between the banks. He helped the buyer bank meet the seller bank. He was the match-maker of match-makers.

No big deal, right?

Well, not exactly.

Let’s suppose there are two banks ‘A’ and ‘B’. Bank-A needs to buy the Government Securities and Bank-B wants to sell them.

According to RBI regulations, the cheque issued by the buyer bank has to be made directly to the seller bank.

But Harshad Mehta made the banks issue cheques in his own name. In this process, the buyer bank and the seller bank may not even know whom they have traded with, both being known only to the broker.

It was a blind transaction. A deadly gamble.

But why would a bank indulge in this?

Because they wanted to hide the fact that they have made an RFD (it was not considered to be a good sign for the bank to be taking money from other banks).

This is where Harshad Mehta came in handy.

And, this is where he found his opportunity.

He took money from Bank A and the government securities from Bank B. He then told both the parties that he needed to find a buyer and a seller. This way, he could keep the money with himself for some time.

Similar transactions were happening with multiple banks simultaneously and Harshad Mehta kept on rotating the money in the system.

He made sure that he always had a huge sum of money in his hand.

Now, with this “borrowed” money, he started investing aggressively in the stock market.

Watching him invest heavily in a stock, other copy-cat, lazy investors joined the party. This created artificial demand for some stocks, and their prices skyrocketed.

When the stock price was high enough, Harshad Mehta sold out, and booked his profits.

He then gave the banks their money back, and the deal was done.

Banks never came to know about this and he got richer and richer.

Hungry for more, and confident about his schemes, Mehta took this fraud to another level.

Banks, while indulging in the RFD, do not actually transfer the Government Securities to the other bank. Why?

Because it is a short-term loan and transferring securities would eat up a lot of time and anyway the transaction is going to reverse in a few days.

Instead, the buying bank, in our case Bank-A would issue a Bank Receipt (BR) in favour of Bank-B stating that the Government Securities are sold and the money is transferred. The selling bank, Bank-B will physically hold the securities but in the name of Bank-A.

Harshad Mehta now, with the help of a few small banks namely Bank of Korad and the Metropolitan Co-operative Bank, started making fake Bank Receipts (BR).

Now, the banks who needed to buy the Government Securities were delivered fake Bank Receipts (zero value), and Mehta took all the money in his own account.

He heavily invested into the stock market and drove up the stock price of ACC from Rs.200 to Rs.9,000 (a return of 4,400%).

He also created artificial demand for the stocks of Apollo Tyres, Hindalco and BPL to name a few. In this span of one-year (April’91 – April’92) SENSEX rose from 1194 points to 4467 points (a return of 274%). It felt like the golden era of Indian stock markets had arrived.

Only that, people did not realise darkness was just lurking around the corners.

Banks believed that they received the securities and were unaware of the scam undergoing (like, really?).

Mehta was safe as long as the stock market was rising and was moving according to his will.

Looking at these returns many small investors started investing in the stock market (like they have started investing now).

This went on until 23rd April 1992, when journalist Sucheta Dalal, exposed the scam in an article in the Times of India.

At that time, Harshad Mehta owed Rs.500 crores to the State Bank of India (SBI). This led to exposing that there were various banks who held fake Bank Receipts and Harshad Mehta owed them more than Rs.4,000 crores.

When the scam was revealed, SENSEX went down by almost 50%.

Wealth halved. Families, destroyed.

Banks started demanding their money back. The money Harshad had put into the markets. The money Harshad did not have.

Harshad Mehta was charged with 72 criminal offences and 600+ civil lawsuits were filed against him.

It was difficult to trace back all the money. Some part of the money was used to pay bribes, and a part was also remitted out of India and converted into dollars.

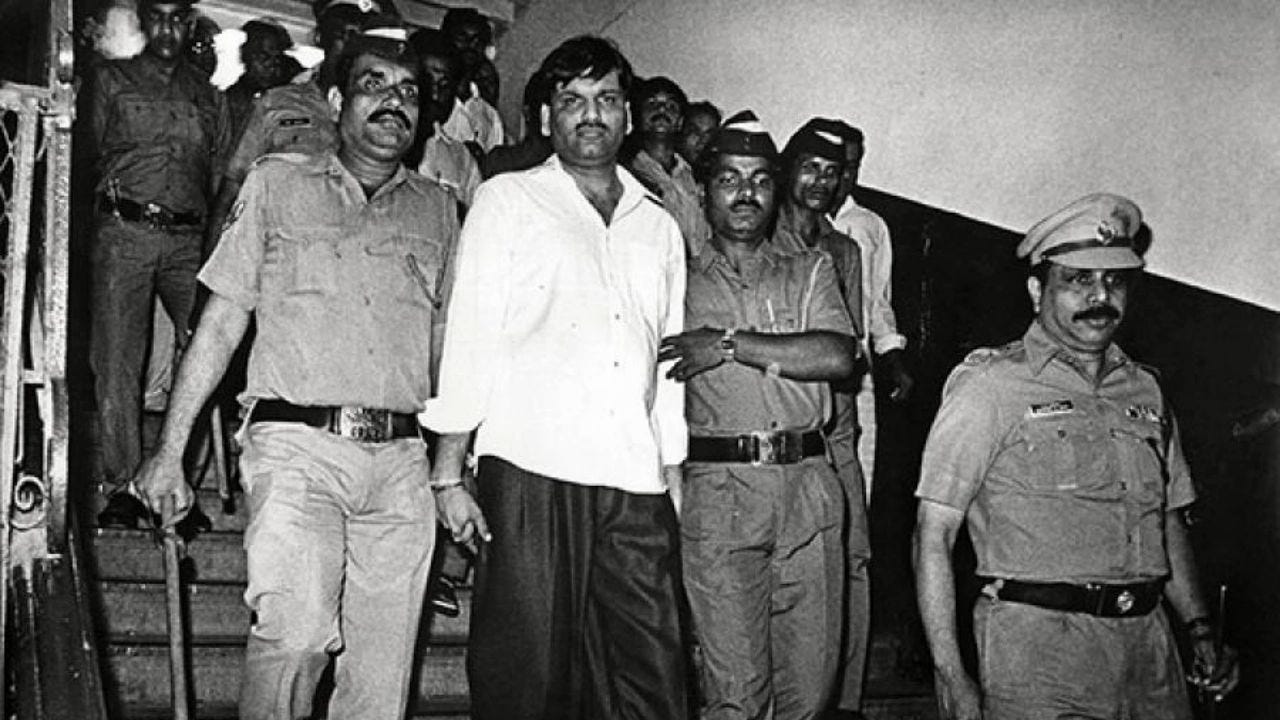

CBI arrested Mehta on 9th November 1992.

In September 1999, Bombay High Court convicted him and sentenced him to 5 years of imprisonment to Thane jail. Yes, only 5 years.

Many cases are still pending against him. Trials are still undergoing in various courts in the country. But he is no longer bothered by them.

Harshad Mehta, 47, died of a heart attack on 31 December 2001.

May his soul rest in peace.

Interesting, right? Share it with your friends on WhatsApp, and start a conversation.

Stay safe, take care.

ReadOn.

By: Yash Gandhi and Shantanu Jain

Thousands of readers get daily updates on WhatsApp! 👇 Join now!

Oh, almost forgot! A movie on his life is coming out on October 9, 2020! Here's the trailer.