The FinCEN Files: Leaked

The drama, the scandals, and the reveals - that’s what we love about the world of finance. It never gets boring! This one, what you are about to read, is no joking matter.

There has been a leak of top-secret documents from the US which reveal trillions of dollars of tainted money being moved by large banks ($1TN = INR 75 lakh crores).

“Secret U.S. government documents reveal that JPMorgan Chase, HSBC and other big banks have defied money laundering crackdowns by moving staggering sums of illicit cash for shadowy characters and criminal networks that have spread chaos and undermined democracy around the world.” – ICIJ

It reveals that in various cases, the banks kept moving illicit money even after being warned by US authorities.

The documents were first leaked to BuzzFeed News, which then passed it on to ICIJ. A former U.S. Treasury Department official, Natalie Mayflower Sours Edwards, pleaded guilty in January to conspiring to unlawfully disclose FinCEN documents to BuzzFeed News.

How do they do it?

Banks operating in the US are required to file a Suspicious Activities Report (SAR) periodically. This report is compiled by the fraud and risk detection wing of the banks (internal functions, questionable independence), and submitted to the authorities.

Now, in an ideal scenario, after identifying these suspicious accounts, the banks should stop moving money from or to these accounts. However, currently, they are not obliged or required to do so by any law.

This loophole keeps the banks safe even when moving money of alleged fraudsters.

Why do they do it?

Because it earns money - it is profitable. Adds to the bottom-line of the banks. If not convicted, the banks earn a lot of money as “fees” to move these funds. Moreover, if one bank denies, the other banks are happy to oblige. Just leads to loss of customers for the “good” bank. So, no incentive to do or be good. Keep movin’, keep earnin’.

To cite an example, the leaked files reveal that JP Morgan moved ~$1.2BN between 2013 and 2016 for Jho Low, the mastermind in the $4.5BN 1MDB Scandal, who is still on the run (we covered this one in detail here).

Side note: Goldman Sachs, another famous Investment Bank, was also fined millions of dollars on account of its senior leadership members taking bribes from Malaysian officials to raise money for 1MDB funds.

The report is full of citations where banks have moved money for Ponzi schemers (read this one to understand how Ponzi Schemes work) and even for a shell company allegedly owned by the “Boss of the Bosses” of the Russia Mafia, Mogilevich.

The Indian Context

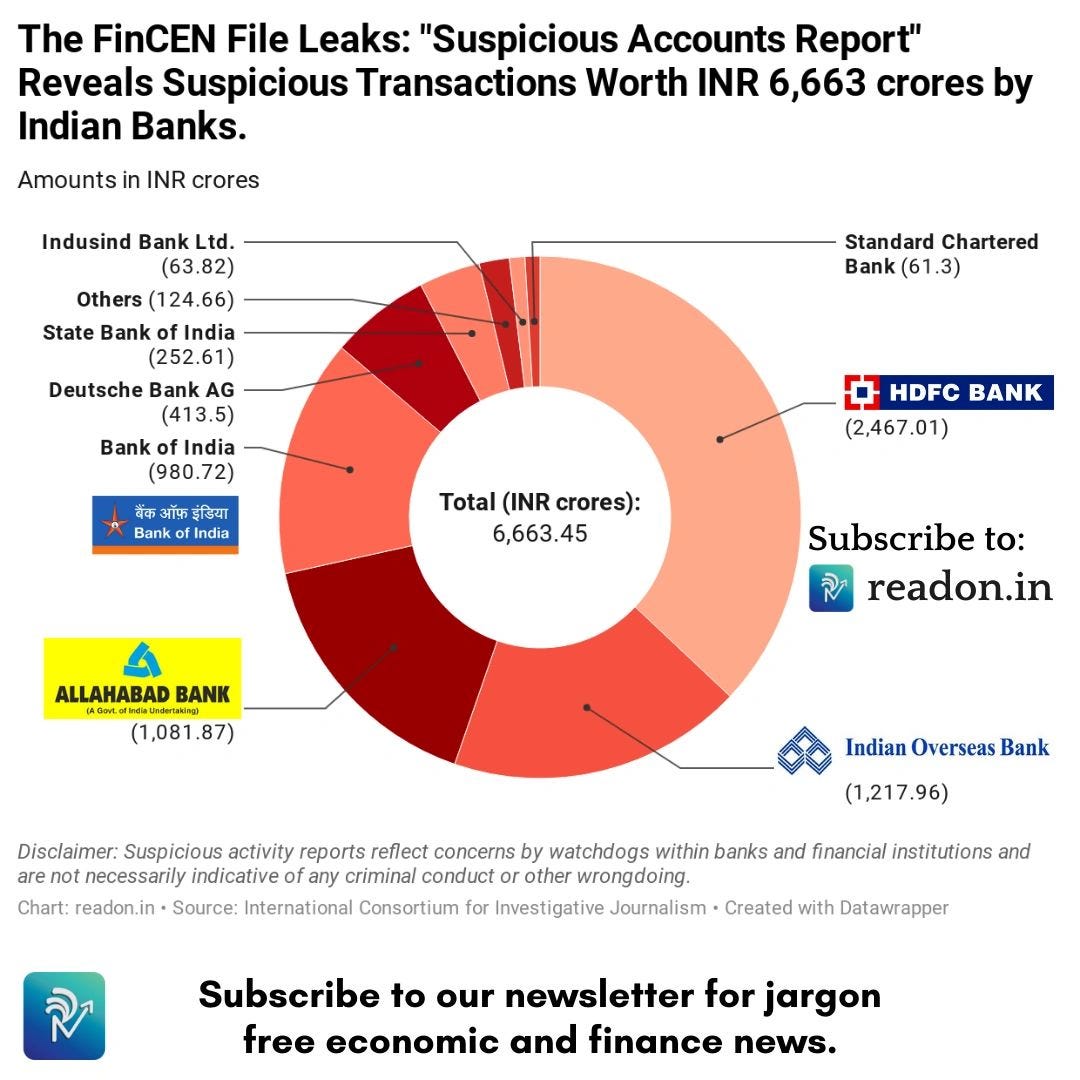

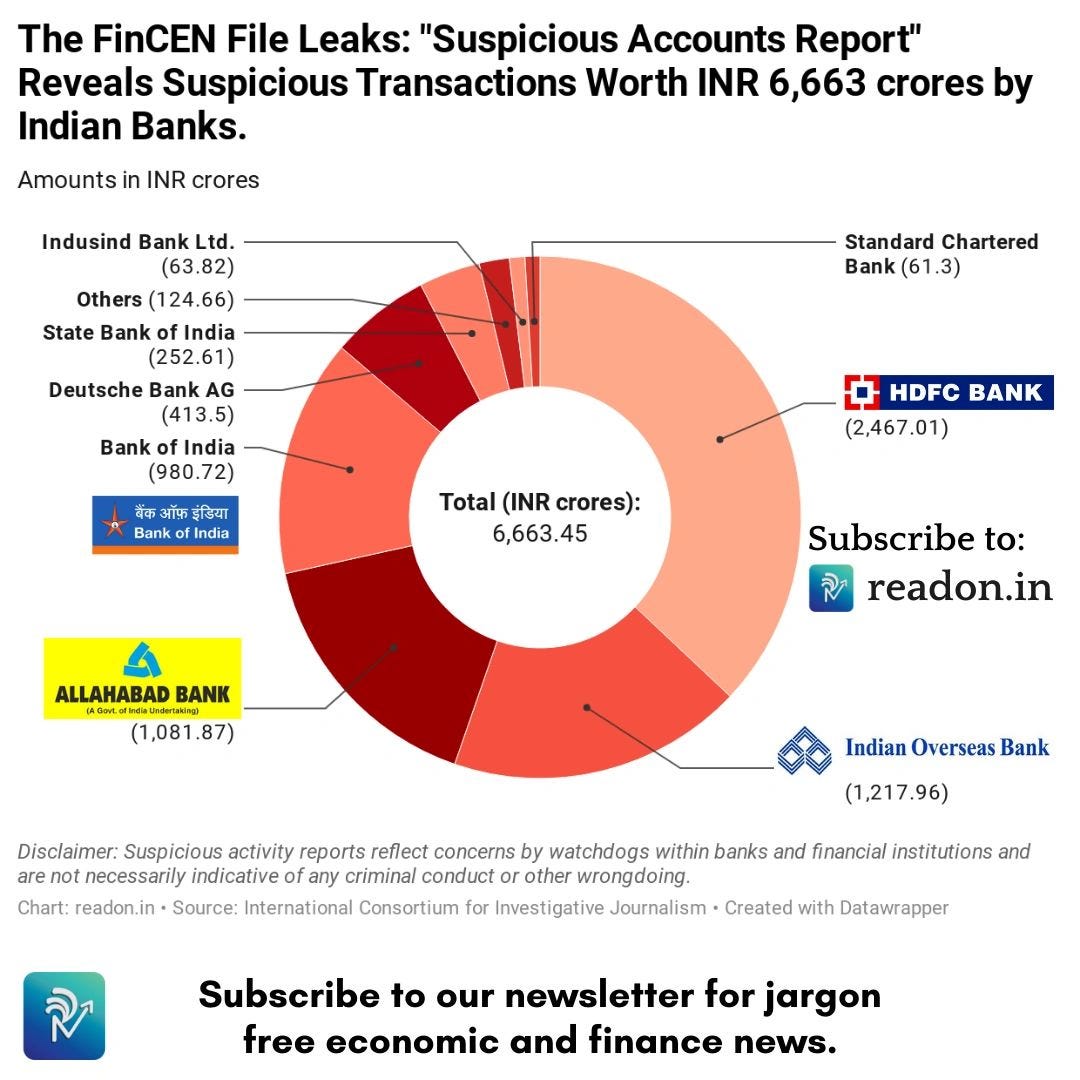

While none of the articles mentions any Indian banks, we dove deeper into the data and found suspicious transactions amounting to INR 6,663 crores.

Here’s the bank-wise break up:

Note: Here’s the link for detailed data for the inquisitive ones.

Although there’s much to be revealed and proved, what’s clear is the twisted financial structure we have built our economies around.

Could new-blood, tech-led financial companies show us the path to a more responsible, responsive and robust banking system? Or will the old-ones keep ruling the tainted streets?

Only time will tell. For now, let us hope that our banks can explain INR 6,663 crores worth of suspicious activity (good luck!).

Thousands of readers get our daily updates directly on WhatsApp! 👇 Join now!