📉 The Fall of the Silicon Valley Bank

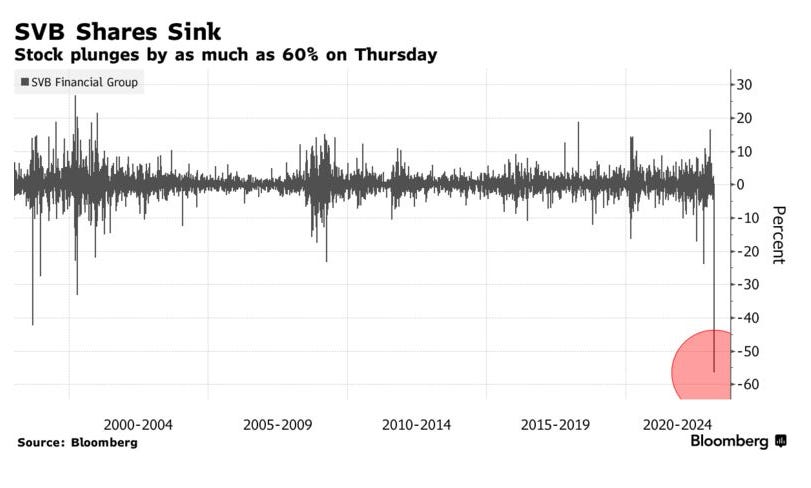

The Silicon Valley Bank saw shares plunge 60% in just one day. Could this trigger a domino effect of the fall of US startups?

$80 billion.

On 9th March 2023, major US Banks lost more than $80 billion in market value.

All because of one US bank: Silicon Valley Bank.

The bank’s shares sank 60%, wiping out $9.6 billion from its market value!

All because of one wrong signal and lots and lots of panic.

But what is Silicon Valley Bank, and what exactly did it do wrong? Let’s find out!

Sit tight and ReadOn!

🤓 Context First

Silicon Valley Bank is the USA’s 16th largest bank.

Its major clients: venture capital firms, private equity firms and over half of all US VC-backed startups!

Yes, the bank was true to its name and the reason for the success of a lot of companies in Silicon Valley.

So, what happened that caused this 40-year-old bank’s stocks to plunge?

SVB recently sold government securities worth $21 bn at a loss of $1.8 bn. This is more than its income in 2022!

But why did SVB have to sell these securities at a loss?

🤷♀️ The Two Major Problems

2021 saw high liquidity in the ecosystem.

Everyone at the time had a lot of cash. So the bank really did not have a lot of contenders for loans. What did it do with the money?

It decided to invest in securities.

Now, the interest rate at the time was near zero.

The interest rate now is 4.57%!

This impacted the securities’ yields.

SVB’s portfolio was yielding an average 1.79% return, far below the current 10-year Treasury yield of around 3.9%!

So, SVB decided to cut losses, get back some money and invest it in bonds giving higher yields.

With startup fundraising slowing down, it could do with some more cash. Makes sense, no?

Now, two things went wrong with this plan…

SVB wanted cash to bridge the loss. So, it planned to sell stocks worth $2.25 bn!

This came just hours after Silvergate Capital shut down its bank. Silvergate Bank was a crypto-focused bank. And with cryptos not doing well (understatement of the year) and the FTX drama (you can read about it here), the bank had to shut down.

Now, SVB had nothing to do with it.

Its only mistake? It didn’t realise that people would connect it to the Silvergate Bank fiasco.

After all, it just wanted to strengthen its balance sheet.

But it unintentionally sent the signal that banks are in trouble.

This signal was enough to trigger the panic selling of bank stocks.

In fact, the situation is so bad that startups are now withdrawing their deposits from the bank.

Even VCs like Peter Thiel are warning founders to get their money back from the bank.

If this continues, Silicon Valley Bank could soon go bankrupt and not have enough money left to return to depositors.

This could mean trouble for startups.

They could soon have very little money left with them.

This could be the final nail in the coffin at a time when recession scares have taken over the world.

This could trigger a domino effect: massive layoffs, stalled operations, and complete shutdown.

Now, SVB claims it has enough liquidity. All it wants is that investors stop panicking and clients stop withdrawing money.

But will investors listen to SVB?

And should they listen to it?

Well, may be not. Trading of SVB stocks has already been stopped and rumours are flying that it is planning to sell itself as plans to raise capital have failed.

What does the future hold for the bank and all its clients?

Only time will tell…

Share this with your friends via WhatsApp and help them grow! See you tomorrow :)

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

Wow, such an exposé I must say.