Rewriting the Story of Indian Commerce: The Ambani Way

While the pandemic has hit everyone hard, Mr. Ambani is leaving on stone unturned to catch on the Digital India wave. How? Read on.

The corona-virus pandemic has hit everyone hard, suddenly bringing things to a standstill. While most of the businesses are struggling to make ends meet, some businesses are marching forward, relentless in their pursuit of world dominance.

That is the dream of our very own, not so young entrepreneur, Mr. Mukesh Ambani who is leaving no stone unturned to catch the Digital India wave.

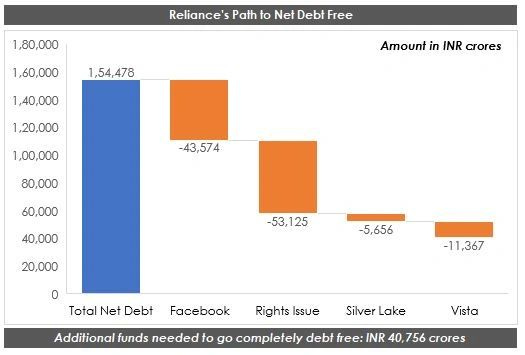

In pursuit of this dream, Reliance recently struck three major deals with: Facebook, Silver Lake and Vista Equity Partners. All three have agreed to invest a total of INR 60,597 crores in Jio Platforms Limited (JPL), a subsidiary of Reliance Industries Limited (RIL).

Now, why would our Gujju Motabhai sell stake in the crown-jewel of Indian telecom industry?

Let’s take a look.

Socializing with Facebook

Facebook agreed to pour in INR 43,574 crores (sic) in Jio platforms for a stake of 9.99%.

Reliance has appeared out of nowhere as a knight in shining armour for the technologically challenged, middle class, self-employed business-folks of our country.

Ambitious Ambani is looking to disrupt the e-commerce landscape, like it did with the telecom sector.

Currently, India has 56 crores internet users, second only to China. However, only about one-third of the total population could access the Internet as of April-June 2019, depicting that majority of the Indian internet market is untapped.

And, guess which app that Facebook owns has 40 crores users in India? That’s right, WhatsApp! Jio plans to disrupt the retail industry and digitise the small and medium business (SMB) supply chain – read, Kirana Stores, by taking advantage of the easy-to-use-and-free communication application, while Facebook gets to monetise WhatsApp.

Amazon and Flipkart, beware!

JioMart: Desh Ki Nayi Dukaan

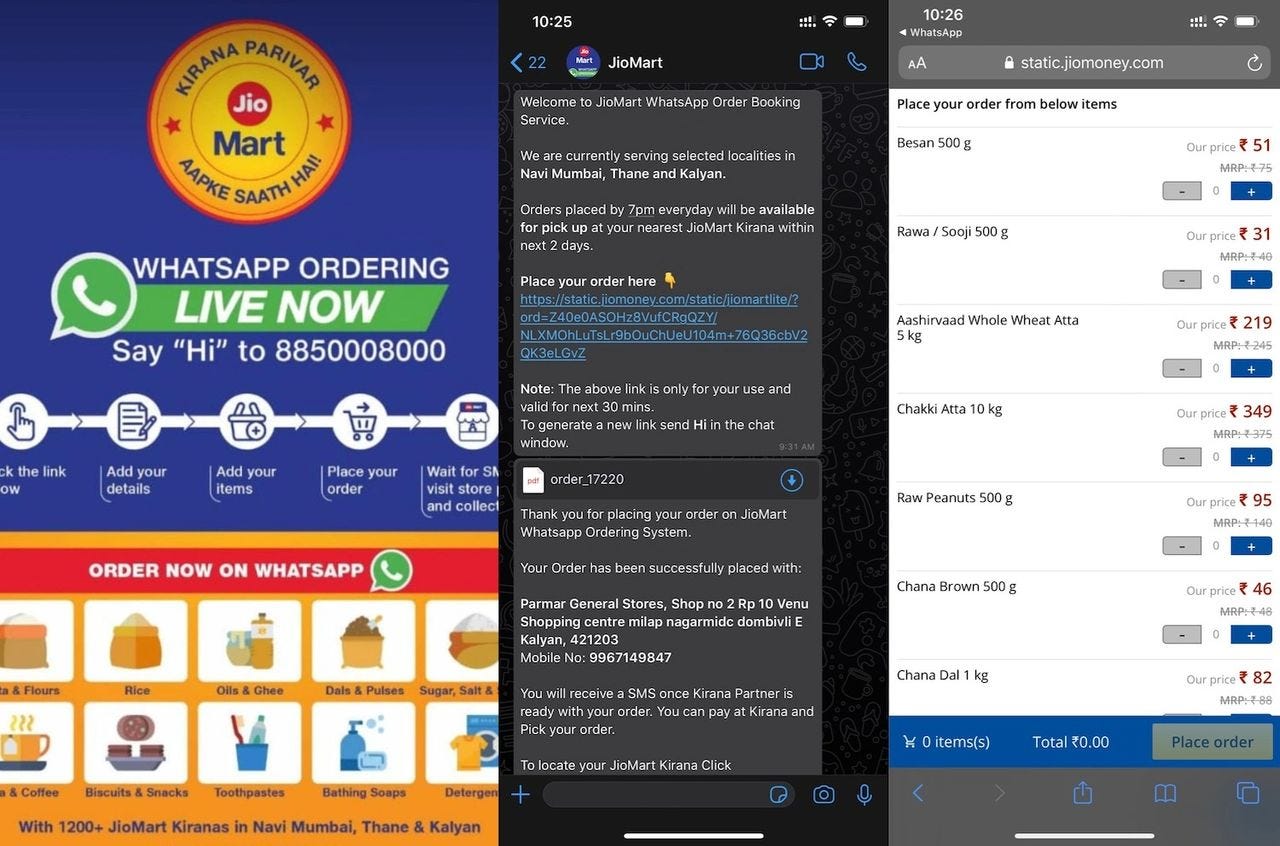

JioMart, Jio's e-commerce venture, is tying up with Kirana stores across the country to help them increase their user reach and enhance their digital capabilities.

Jio customers who are also WhatsApp users can now order various food items through JioMart’s WhatsApp number. The services will be provided through the local Kirana stores. So, this is how it works: JioMart has a dedicated WhatsApp number, where customers can place orders through the link given to them.

Once the customer finishes choosing the items, JioMart will send the bill and the address and location of a nearby Kirana store, on Google Maps. Customers will be notified through an SMS after the order is processed by the Kirana store. They can either collect the order from the store or opt for an online delivery.

Some other features of JioMart are express delivery, no minimum order value and easy return policy.

The “Silver” Lining

A U.S. based private equity (PE) firm, Silver Lake, has agreed to invest INR 5,656 crores in Jio Platforms for a 1.15% stake in the company.

The PE firm holds investments in other tech companies like - Expedia, Twitter and Airbnb. Silver Lake has the expertise in identifying and investing in technology-enabled companies that have game-changing strategy.

Silvere Lake gets the following in return:

Jio’s capability to bring innovative technological capabilities at low cost to millions of Indian consumers.

Exposure to the untapped treasure that the Indian digital space is.

The PE firm will bring in technological expertise which will allow Reliance, and India, to move one step closer towards our Digital India dreams.

Vista: That’s a Hat-Trick!

Howazzat! As we were about to publish this, another U.S. based PE firm signed up to invest INR 11,367 crores in Jio for a stake of 2.32%. This makes it the third largest investor in Jio after Reliance and Facebook.

And guess what? There’s a possible Gujarati connection here: Brian N. Sheth (co-founder at Vista Equity) is from the promise land of India, Gujarat. He was listed in the Forbes 2018 World Billionaires list with an estimated net worth of $2 billion. Go figure.

Vista Equity Partners invests in firms that are technology-enabled and have innovative software solutions across the world.

Reducing the Net Debt

Mukesh Ambani proclaimed that he plans to make RIL zero net debt by 2021.

RIL also confirmed that it is expecting investments from other global investors on the scale of Facebook-Jio investment.

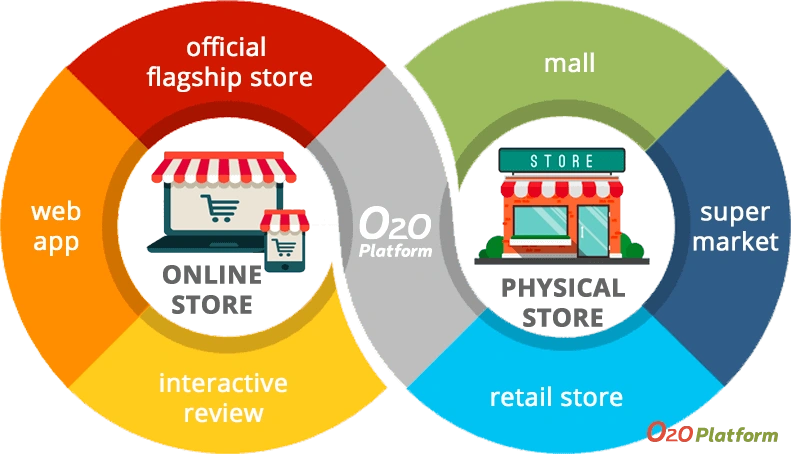

Strengthening Offline-to-Online (O2O) presence

Apart from taking care of the Kirana stores digital needs like inventory management, point of sales (PoS) better customer relations etc, Reliance can also help these Kirana stores source materials at a low price, with its vast network of retail stores.

With India’s 90% retail industry being unorganised, Reliance will have an advantage as it is increasingly onboarding Kirana Stores. These Kirana stores might be more than happy to tie up for the following reasons:

RIL’s expertise in supply chain management, technology and network.

The stores will become more competitive vis-à-vis e-commerce and grocery giants like Flipkart, BigBasket, Grofers, etc.

Delivery logistics, for customers, gets taken care of, and their reach increases organically.

The foreign investors can now take advantage of the multi-billion-dollar “new commerce” industry in India (experts say it is a $700 billion industry). They also foresee new commerce to be one of the biggest growth drivers for Reliance. Jio has relentlessly bought stake in a lot of Indian start-ups (some newsletters titled him as “Son” of India - SoftBank connect) to enable this.

The Indian government has recently increased restrictions for foreign e-commerce companies operating in the country, putting them at a disadvantage. Thus, it makes perfect sense for the notorious social media giant to leverage Mr. Ambani’s political connections in the country (especially after it was heavily criticized and fined for its Data Privacy issues globally).

Doesn’t hurt to be in the good books of Ambanis in India, does it?

Window of Opportunity in Crisis

As with all crises in history, this pandemic will bring with it new consumer preferences and habits. One such change could be in terms of consumers preferring home deliveries and avoiding crowded shopping marts.

JioMart, with the force of India’s middle-class behind it, is well positioned to compete alongside Amazon Pantry, Uber, Swiggy and Zomato, among others, in the race to capture grocery market-share in India. The jury’s still out on who will win, but we are all rooting for our favourite: Mr. Ambani.

May these companies survive his wrath! Amen.

Noob's Corner

What is net-debt zero?

Debt is a source of fund for a company. When a company needs money to expand (amongst other things), it takes funds from banks and other big lenders, and starts buying assets. This amount loaned to the company bears an interest. Some part of the original loan, along with interest, has to be paid every month (EMI).

Net Debt = Total Debt - (Cash + assets that can quickly be converted into cash)

Thus, Net Debt = 0 means,Total Debt = Cash + Cash equivalents.

It does not mean the company will repay all the loans. Just means they will have enough cash for any emergency needs (like expanding crazily - Blitzscaling).

What is a subsidiary?

A subsidiary is like a child of the original company. Reliance started Jio as a separate company. In this case, Reliance is a “holding” or “parent” company, and Jio is its “subsidiary.”

What is a PE firm?

PE firms provide financial assistance to any private firm, i.e. not listed on stock market, looking for investments. Now, the PE firms can invest their own money or source money from others to put into companies they believe will grow.

What is new commerce?

New commerce is Reliance Retail’s offline-to-online (O2O) initiative, which connects “producers, traders, small merchants, brands and consumers through technology.”

What is a rights issue?

When companies need money, they offer existing shares holders to buy the shares of the company at a discount. That is, the existing shareholders can buy the shares at less than the market trading price for a certain period.

Video Summary

Don’t wanna miss out on any post? Get our daily updates on WhatsApp. Subscribe. Now 👇