😯 RBI Stopping the Rich From Taking Money Out of India?

India’s rich and powerful are following a new trend: setting up family offices outside India. But the RBI wants to stop them. Here’s what’s going on.

India is a land of stark contrasts. From dry deserts to humid coasts, from the poorest of the poor to the richie-rich, we have it all.

While one section of society does odd jobs to earn the daily bread, the other finds ways to spend its massive pile of money.

India is home to 187 billionaires.

But have you ever wondered how these billionaires invest their fortunes?

Looks like some magical power they have, no?

Well, it’s more like a magical institution they have for all their money management: a family office.

Today, let’s unravel this magical institution. We will talk about:

What are family offices?

Why are some Indians setting up family offices abroad?

And most importantly, why the RBI may be against some foreign offices set up by Indians in other countries.

ReadOn!

🤔 What are Family Offices?

Family offices are like the financial wizards behind the curtains, working tirelessly to make sure that a family's money doesn't disappear like a packet of chips at a party.

So, are they like wealth management firms?

Not really.

They don’t just manage a family’s investments or wealth. They also help with succession planning, help them manage their assets, taxes, and philanthropic pursuits, all while keeping a keen eye on the ever-changing economic landscape.

If the family's wealth is a sprawling garden, the family office is the team of expert gardeners that make sure the garden is watered, fertilised, and pruned to perfection. Everything remains green and doesn’t go red.

Now, to set up a family office you need to have a net worth of at least Rs. 250 crores.

The cost of running a family office goes up to Rs. 2-3 crores annually. In some cases, it can even go up to Rs. 12 crores.

So, having at least $100 million (~800 crores) worth of assets under management (AUM) can justify the high costs.

🧐 Different Kinds of Family Offices

There are two kinds of family offices:

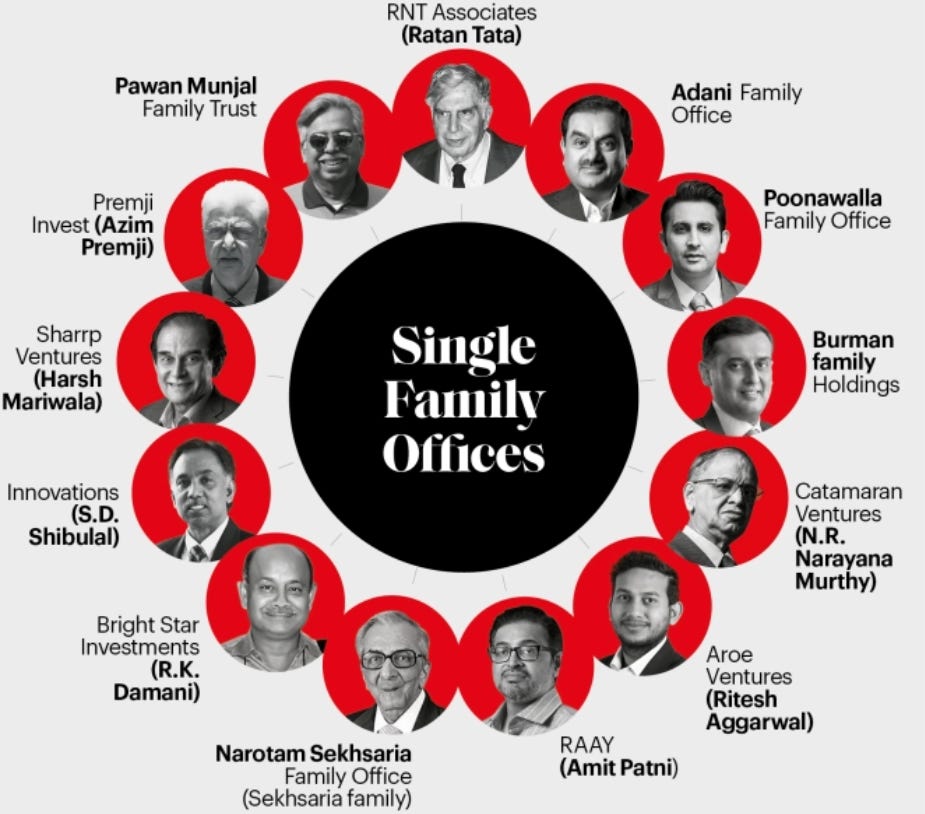

Single Family Office

Multi Family Office

A single-family office runs on the terms and whims of one single (but extended) family.

Single-family offices are mostly born in born in large families where succession planning could be difficult. Instead of leaving the family haggling over an estate, a family office works on increasing the size of the asset and making sure that it is divided according to the wishes of the family head.

And a multi-family office, as the name suggests, manages the wealth and investments of multiple ultra-rich families. Since one family office is catering to the needs of multiple clients, the overall costs are reduced.

📈The Rise of Family Offices

Family offices are traditionally not an Indian concept.

In India, businesses usually plough most of their profits back into the business to allow it to grow.

But lately, family offices have been growing because of 3 main reasons:

The rise in wealth in India: The Indian economy is booming and it is booming super fast. Every year we are creating more high net-worth individuals, ultra high net-worth individuals and billionaires. In 2020, we had 102 billionaires, and in 2023, we have 187 billionaires. With more people getting rich, the need for family offices is rising.

The rise in startups: As more and more startups emerge, the rich have more and more investment avenues available to them. And family offices help them manage these investments better. According to a 2021 report by EY, over 83% of family offices have an allocation to private markets which is over 10% of their overall asset distribution. This number has been steadily increasing over the past five years for 50% of the respondents and has doubled for 40% of the participants.

The need for succession planning: Many Indian businesses are now focusing on something that their predecessors didn’t: planning what to leave behind to their kids and how. Family offices also help with that.

Currently, there are about 300 family offices in India with average assets under management of $100 million. While this is nothing compared to the 6,000-7000 family offices in the US, family offices in India are swiftly rising.

Another emerging trend: more and more Indian billionaires are now setting up family offices outside India.

Why?

🔍 Why are Indians Setting Up Family Offices Outside India?

The rich love foreign locations, whether it is for vacationing, shopping or investing.

So, why should family offices be any different?

Last year, RBI’s new rules allowed non-financial entities in India to make overseas direct investments in financial entities abroad, if they have been profitable for 3 years.

This meant family offices in India could set up funds abroad.

So, Ambani, Adani and many other billionaires started setting up or planning to set up family offices abroad. Especially in Dubai and Singapore.

Why? For two main reasons:

They want exposure in global assets to diversify their portfolios. Many a time, the right talent to do this isn’t available in India.

They want to reduce taxes. Singapore has a corporate tax rate of 17% and Dubai will have a corporate tax rate of 9% from June 2023. India has a corporate tax rate of 25% for companies with a turnover of upto Rs. 400 crores and 30% for companies with a turnover of more than Rs. 400 crores.

Now, now. Apparently, the change in overseas investment laws was not meant to facilitate family offices.

So, the RBI has reportedly asked banks to stop facilitating such structures as they are apparently not permitted.

This is still an informal order or rather an advisory. People are still waiting for a formal announcement.

But what’s the problem?

You see, through these foreign offices, a lot of Indian money is going out of the country.

The worst part? Not a lot of it is being invested in business purposes immediately.

A lot of it is invested in liquid funds while family offices wait for the right opportunity to come their way.

If this money was invested in India, it would help the Indian government, Indian banks, Indian companies and the Indian economy.

And these foreign offices don’t make short-term investments. It's not like they are investing money, making quick gains and bringing back the money into the country.

Once this money is out, it is out for at least 10-20 years!

Yep, India’s loss.

Now, you may think: Why doesn’t India just lower taxes?

This would keep the money in India.

Well, that’s easier said than done.

Corporation tax accounts for 15% of our government’s total income. If we reduced this, we would struggle to make ends meet.

So, RBI’s statement seems fair.

Now, will the RBI get super strict and shut down family offices outside India altogether or will it leave things as they are?

Only time will tell.

But what do you think: Should family offices be allowed to be set up outside India? Or should India’s money stay in India?

Share this with your friends via WhatsApp and help them grow! See you tomorrow :)

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

Seems new concept to me, thanks for the insight!

Never heard of this concept earlier. Thank you ReadOn for introducing this concept to me and to many others out there.