Parle Agro decides to milk the market

The milk market is boiling with a new competitor in town. "Genius" move, Parle?

Carbonated drinks are cool. Slice, Maza, and Frooti have their separate cult. But, flavoured milk is altogether a different emotion in India (plays ‘Amul Doodh Peeta hai India’).

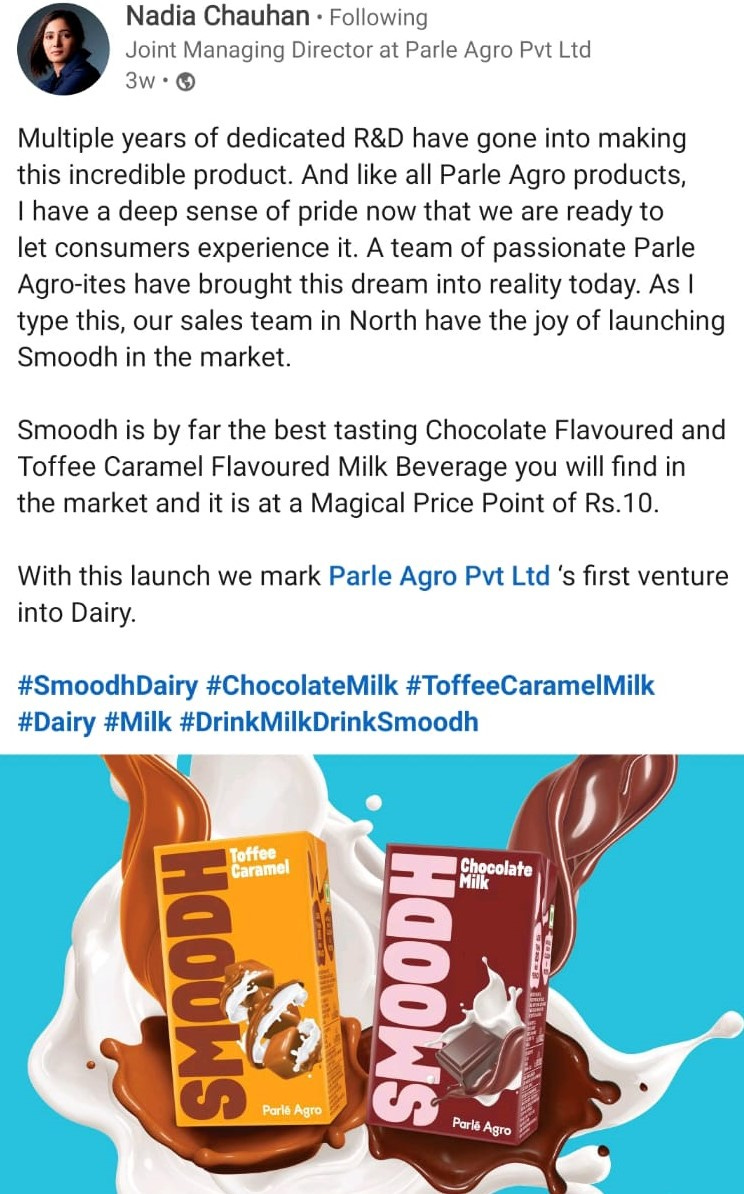

Tapping into this emotion, Parle Agro, the maker of our beloved Frooti, is launching its own dairy category called Smoodh. The company’s joint MD and CMO, Nadia Chauhan, took to social media to announce the launch:

Parle Agro has invested Rs. 100 crores to set up 2 plants for Smoodh, and is planning to add two more by the end of the year. What’s fuelling Parle’s strong conviction in an entirely new category?

Currently, only 23% of regular milk drinkers consume flavoured milk. This means 77% of those who consume milk don’t engage with this category. Maybe the existing players have no idea why, and Parle aims to find just that.

The market is currently estimated at Rs. 800 crores and Parle Agro expects to grow that to Rs. 5,000 crores in 4 years. By 2016, 43% of dairy drinks were flavoured milk, and this number is set to rise to 71% by 2028. But, how is Parle going to achieve this?

With its price point and flavours.

Parle is offering the product at Rs. 10 per 85ml pack. And, its competitors are offering milkshakes at Rs. 20-35 for 180-200ml packs. But it’s almost the same quantity per ml, no? How does it create a difference?

The same way small sachets of shampoos and detergents have disrupted the market. Spending on a Rs. 20 bottle at one go might feel like a big deal. But a Rs. 10 might not feel very burdensome. This way Parle can tap into the milk-consuming price-sensitive market, which its competitors could not convert.

Additionally, Parle has come up with 2 chocolate-based flavours. Hitting the bull’s eye, these flavours are the most popular in the Indian market.

Looks like Parle is all set for success, no?

Well, it had tried entering the segment in the past. But it failed and had to retreat. In 2001, Parle launched N-Joi fruit milk. But, sourcing and evaluating the quality of milk wasn’t an easy job. And so, it had to shut shop within 4 years.

Having tasted defeat once, this time Parle is leaving no stone unturned to capture the market. Do you think this will be a game-changer for Parle Agro, just like Frooti was? Or will the competitors also lower the price and we can soon expect a milk war?

Got some feedback or suggestion? Join us on WhatsApp list and keep ‘em coming!

PS: Humans operate the channel, and we reply to all messages :)