🤨 No More Big Four in China?

China levied a fine of $30.8 million on Deloitte! And this could be its start to banning Big Four completely! Why? ReadOn.

That’s how much China’s Ministry of Finance has fined Deloitte’s Beijing office.

This is 25 times more than the combined fines that China imposed on accounting firms last year!

So, today we’re going to discuss:

What did Deloitte do to earn such a huge fine?

Why are the Big Four firms in China in trouble?

😯 Deloitte’s Accounting Failures

Deloitte is in trouble because it failed to perform its auditing duties well.

According to China’s Ministry of Finance, Deloitte failed to discover the real situation of the underlying assets in its audit and ignored certain compliances for approval for China’s Huarong Asset Management Co Ltd.

It wasn’t very diligent as an auditor.

Now, what’s the fuss about Huarong? And how much did it lose because of Deloitte’s mistakes?

Let’s dive deeper.

📝 Huarong’s Complex History

Huarong started as a bad bank (you can read all about bad banks here) in the 1990s.

When China wanted to open its economy in the 1990s, it needed its banks to look more attractive so that they could get foreign investment. So, it needed organisations that would suck up their poisonous debt and make banks look squeaky clean.

So, four bad banks were born to take on this debt and restructure and recover it.

Huarong became the biggest of these bad banks.

But it wasn’t satisfied with this role.

It wanted to be more, much more.

So, it soon entered securities trading, insurance, trusts and other investments.

With every step towards a new sector, it moved another step away from its core purpose.

In 2019, it was discovered that Huarong's leadership was involved in corruption and bribery.

Its ex-chairman Lai Xiaomin was even sentenced to death in 2021 for accepting bribes worth $277 million from 2008-2018.

Yes, in China if you’re super corrupt, you die.

This corruption scandal led to more problems ahead for Huarong.

Due to the complexities that arose, Huarong’s auditors were late to submit their financial reports for 2020 in 2021. This caused widespread panic about its financial health.

Result? Massive sell-off in Huarong’s bonds and shares, causing an actual problem in the bad bank’s financial health.

So much so that it ultimately had to be rescued by the Chinese authorities with an infusion of $6.6 billion.

How did Deloitte become part of this mess?

Well, Deloitte was partly to blame for this mess.

You see, it was Huarong’s auditor from 2014-2019.

Reportedly, Deloitte did not issue proper audit opinions on the identified abnormal transactions of Huarong. It also did not obtain sufficient and appropriate evidence when it provided auditing services.

Now, after countless interviews and investigations, it has finally been punished.

This severe punishment shows that China is getting stricter with Big Four firms. Why exactly?

🔍 China’s Problem with the Big Four

Last month, China announced that Chinese firms should start cutting ties with the Big Four firms: EY, KPMG, PwC and Deloitte.

Why?

Because of two reasons:

Data security: These international auditors have connections with the US and could leak sensitive information about how Chinese companies are operating to US authorities.

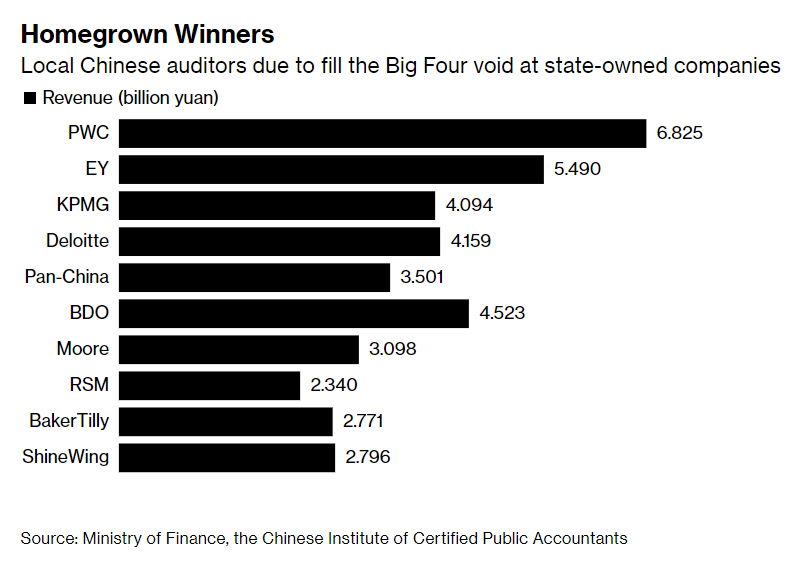

Job security: With Big Four auditors gone, Chinese auditing firms could now get more revenue.

This shift has been happening since last year. Since September 2022, 60 Hong Kong-based firms have changed auditors.

While this may be good for China’s economy, it could cost Big Four companies $3 billion in revenue each year!

But will this shift really add value?

You see, smaller firms have very little experience in handling major clients. So, the exit of the Big Four could mean more audit irregularities rather than efficiencies.

And maybe, China realises this. It has not made it mandatory for companies to let go of Big Four auditors.

However, if it does, who will suffer more: China or the Big Four?

And should India also consider taking a step like this? Let us know in the comments!

Share this with your friends via WhatsApp and help them grow! See you tomorrow :)

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

The big 4 have created most of the problems. Being auditors they turn a blind eye to so many things. It’s high time they are put in their place. Hope india takes this step too !!!