Nifty and Its Variants

Today, we talk about what an index is, and what different indices one may track (other than Nifty or Sensex) that suit their investment mindset and needs. Read on :)

“Nifty crashes 300 points; blood-bath on Dalal Street”.

“Sensex down 700 points; the economy in turmoil.”

“Markets are down, will the Indian economy collapse?”

If you or anyone close to you invests or trades, you must have come across terms like SENSEX and NIFTY.

So let us understand these terms better, and see whether they are the only ones to talk about.

Stock Exchange allows investors to buy and sell shares of a company in a regulated and legitimate space. It makes sure that the buyer pays, and the seller delivers the shares. In India, the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) are the most popular stock exchanges.

These stock exchanges also publish an index to serve as a guide of overall market movements to investors.

How does an index work?

Let us assume that 3 stocks affect the economy - A, B, and C.

Finance enthusiasts want to track the cumulative effect of these companies or sectors on the economy, and hence, create an index.

Assume that each company has equal weight in the index (33%).

Now, say all the companies were trading at Rs. 100 when the index was created.

So, the value of the index will be Rs.100 x 33% (A) + Rs. 100 x 33% (B) + Rs. 100 x 33% (C) = Rs. 100.

Say, after a year, the revised prices are:

A - Rs. 150 (50% up)

B - Rs. 50 (50% down)

C - Rs. 120 (20% up)

Isn’t it difficult to assess the cumulative impact on the economy by looking at individual companies? Let’s see if the index helps.

Value of index = Rs. 150 x 33% + Rs. 50 x 33% + Rs. 120 x 33% = 106.67

Comparing Rs. 106.67 to Rs. 100 index value is easier. It tells us that the stock prices of major companies in the economy grew by 6.67%.

This is essentially what Nifty or Sensex is - a weighted average stock price of top companies in India that helps assess how the overall economy is doing (using these top companies as a proxy of the economy).

BSE calculates and reports SENSEX, which constitutes of the top-30 companies trading on its Stock Exchange.

NSE calculates and reports NIFTY50, which constitutes the top 50 companies trading on NSE.

Note: Almost all companies trade on both platforms. Think of them as Flipkart and Amazon of stocks. Will be easier to understand their functionality.

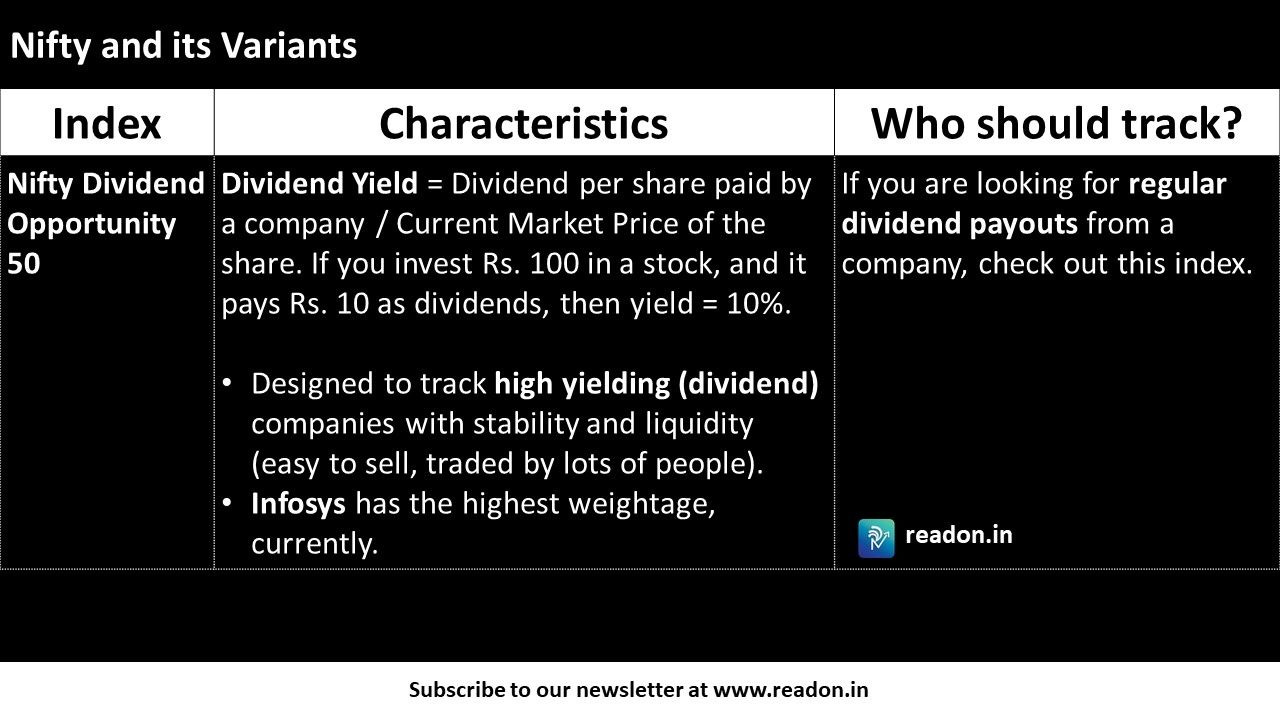

But, what if we want to look at certain other types of companies, instead of the top 30 or 50? What if we want to look at companies that pay high dividends? Or maybe companies that can easily be sold (high liquidity)?

Well, we hear you (or they do).

NSE and BSE do report other customised and categorised indices.

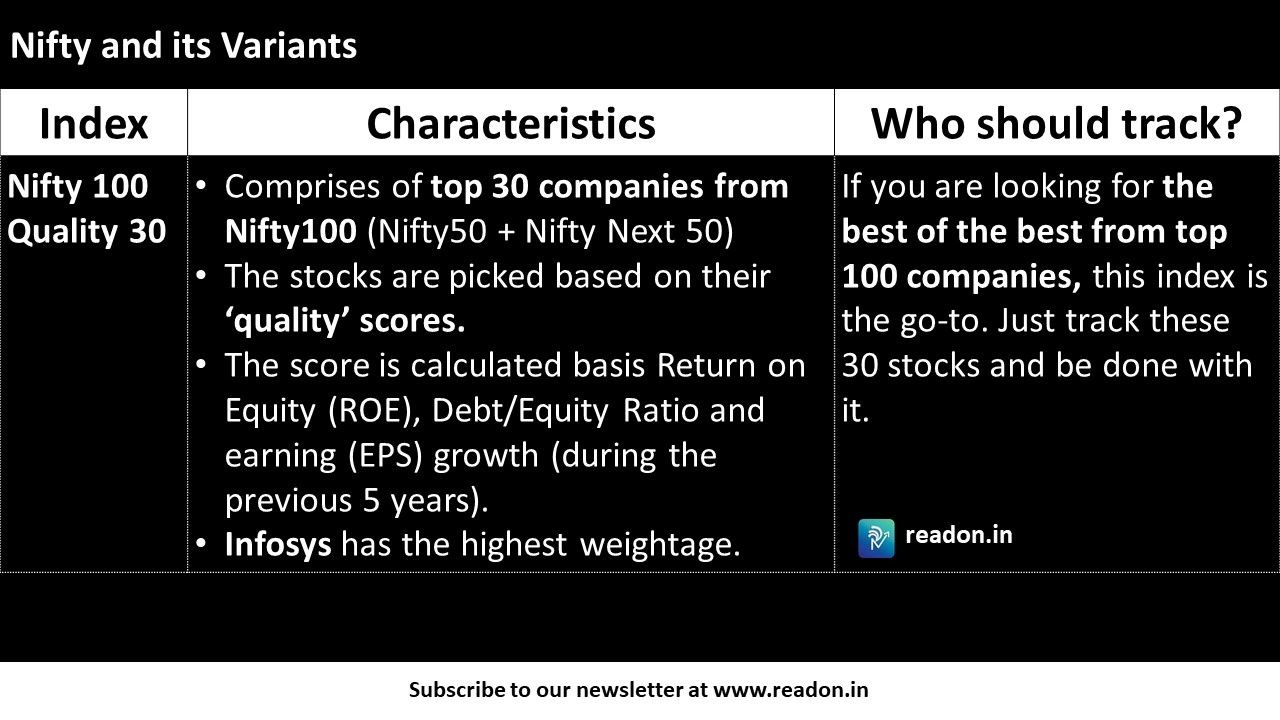

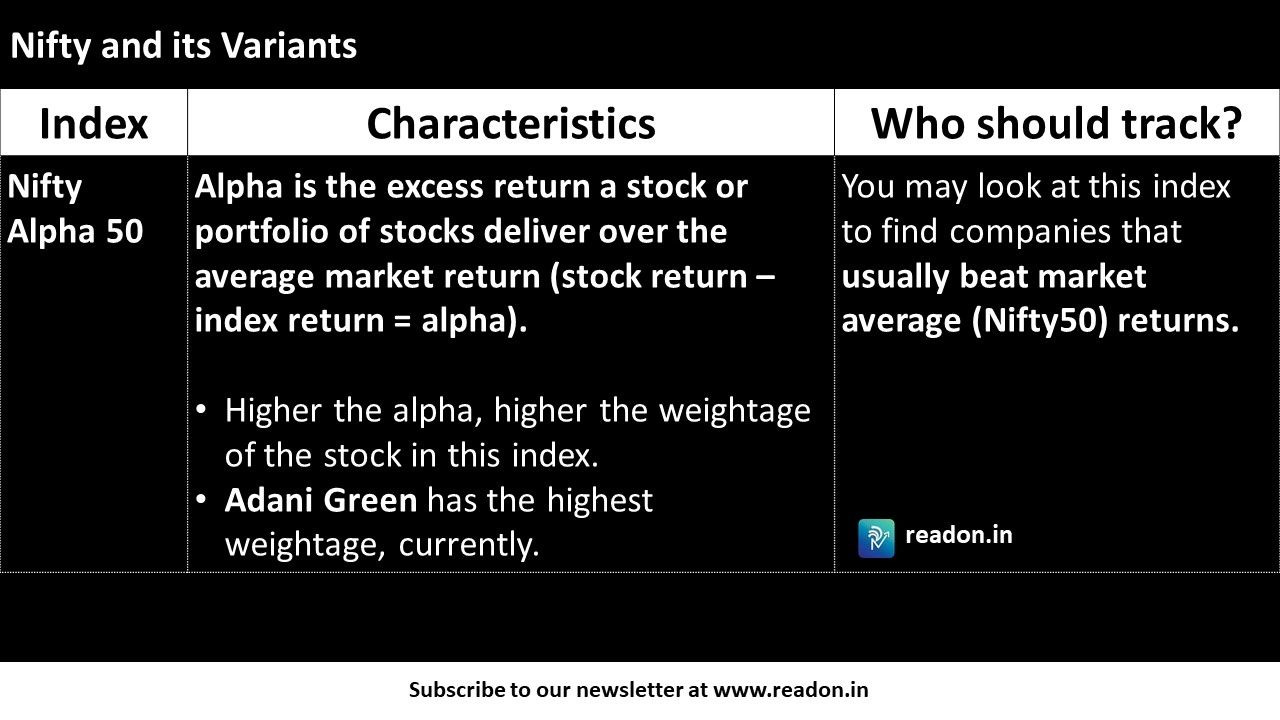

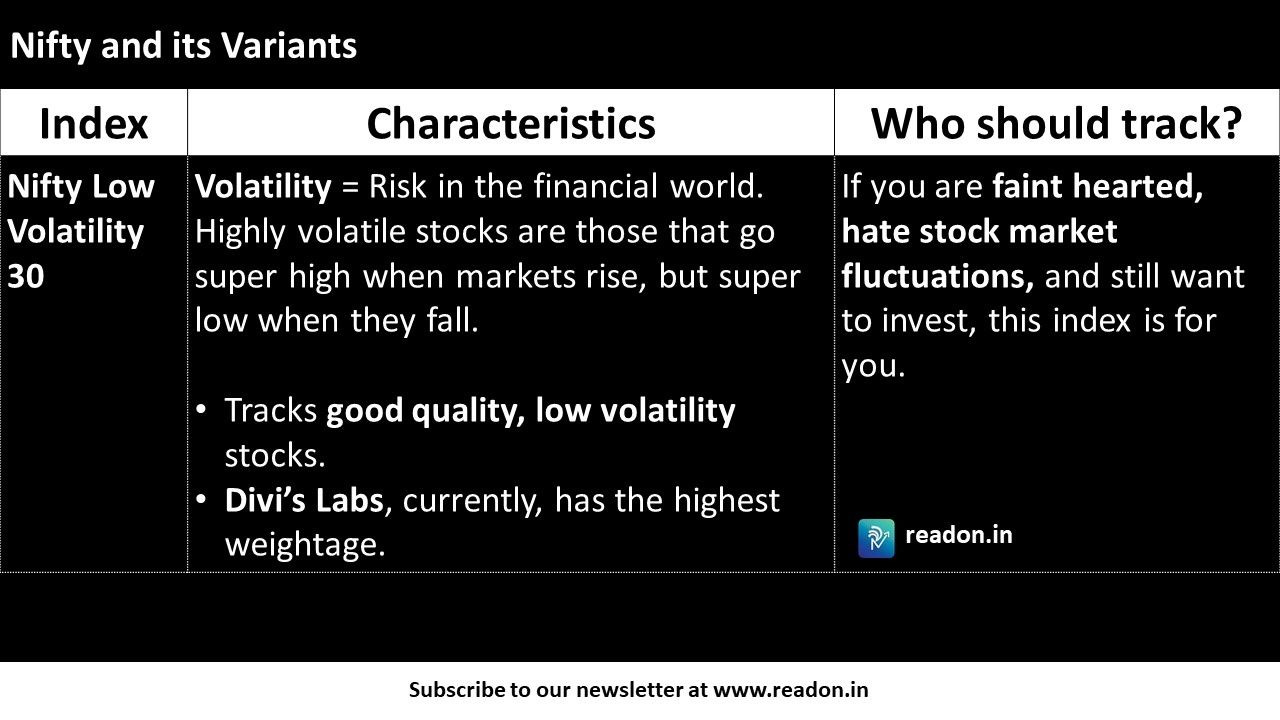

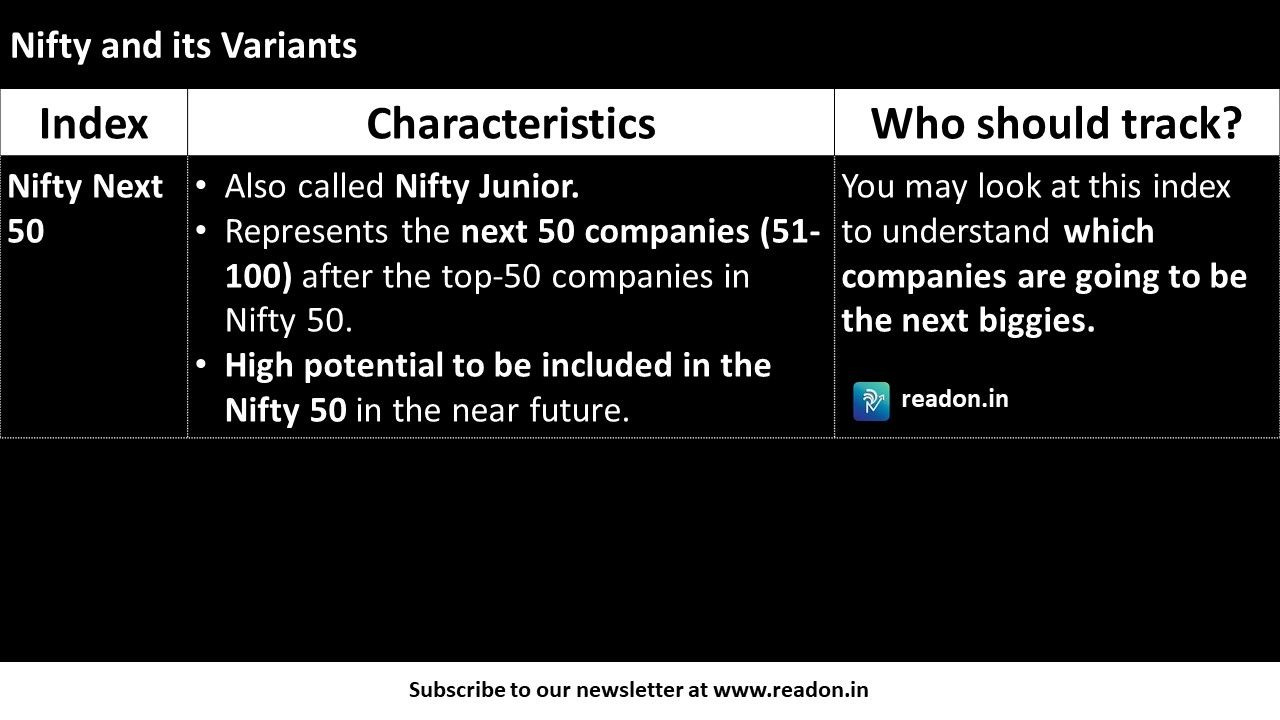

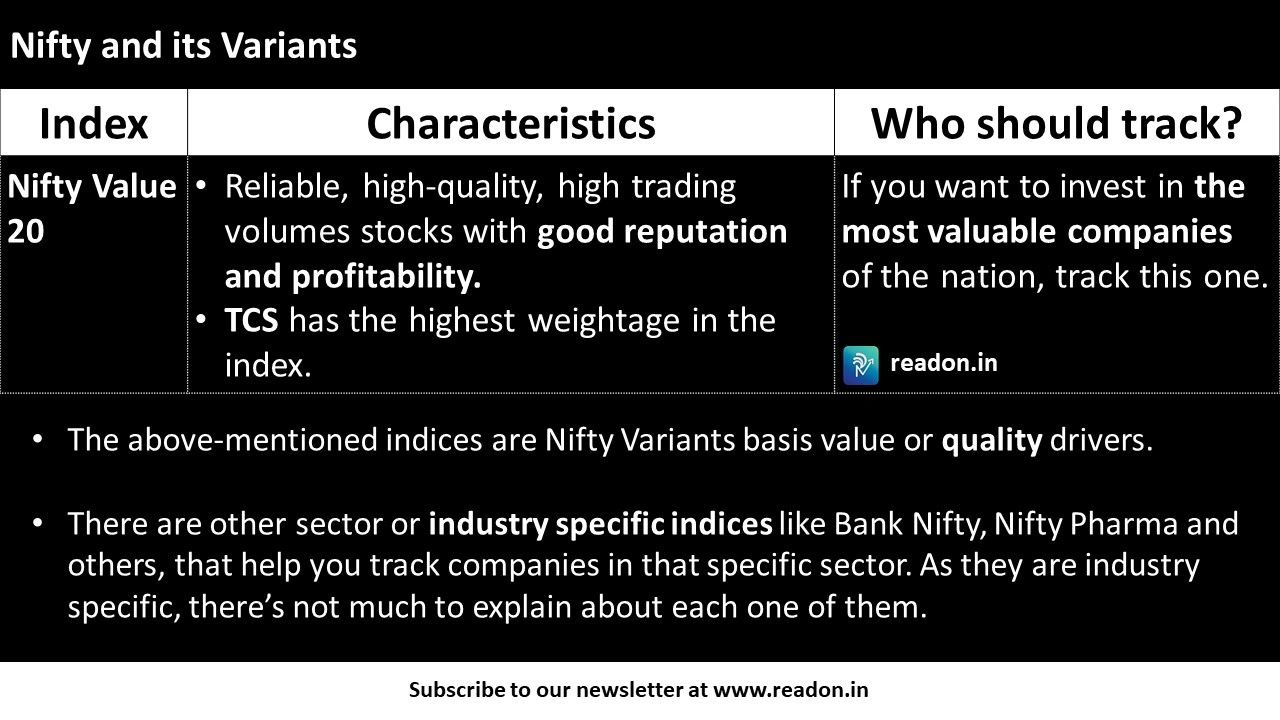

Here’s a list of some of the important ones that Nifty reports, along with our inputs on which one would suit what kind of an investor:

The above mentioned indices are Nifty Variants basis value or quality drivers.

There are other sector or industry specific indices like Bank Nifty, Nifty Pharma and others, that help you track companies in that specific sector. As they are industry specific, there’s not much to explain about each one of them.

Disclaimers and Gyaan:

The information shared in this document is only for the purpose of educating investors and should not be considered as investment advice.

Investing is a risky game, especially if you don’t know what you are doing.

Don’t take anyone’s word when it comes to investing, unless they are SEBI registered / authorised financial advisors.

Do your own research (and please go beyond the first page of Google Search).

Chalo, done.

Free advice: Track only some of these indices, not all. Else, you may risk going crazy. Like us.

Thousands of readers get our daily updates directly on WhatsApp! 👇 Join now!

Co-authored by Yash Gandhi, who is a rising LinkedIn star, and a capital markets freak!