📉 India's GDP Growth Down to 4.4%: Why?

Wondering what’s put the brakes on India’s growth? ReadOn!

2023 started off as a year of hope and progress. After years of Covid's darkness, came 2023: a ray of light and growth.

With the Budget declaring this as the start of the 'Amrit Kaal', 2023 was a bed of roses for India's growth.

Ouch, a thorn!

Yes, there's a teeny tiny thorn pricking our vision: Q3 2022-23’s GDP growth has only been 4.4%.

This is a much slower pace of growth from 13.2% in Q1 and 6.3 % in Q2.

Why is our growth slowing down?

And can we do something to stop this?

Let’s take a look…

🧐 What’s Happening?

“Don’t Panic!”

That’s the government's stance on the issue.

It is blaming the base effect for this apparent slow down in growth.

Eh, what effect?

You see, Covid tanked our GDP growth as we were all locked up.

When the world finally opened up, it was no less than being freed from a prison. We travelled, ate and we shopped like crazy!

Result? A CRAZY hike in growth!

Now, after this crazy hike, the normal growth rate seems bleh.

Still confused?

Let's say a company's revenue was Rs. 10 lakhs in 2020 and Rs. 20 lakhs in 2021. In 2022, the company's revenue grew to Rs. 30 lakhs.

Growth rate of revenue from 2020 to 2021: 100%

Growth rate of revenue from 2021 to 2022: 50%

Looks like the company's growth rate has slowed down?

Well, this comparison ignores the fact that the base of the data (2020’s revenue) was much lower than the next year. This resulted in a higher percentage growth rate from 2020 to 2021.

The same thing is happening with India.

What's more, our growth estimates for previous years were recently revised.

So, the government is saying that it's not fair to compare revised data (from the previous quarters) with unrevised data from the current quarter.

It’s like comparing apples to oranges.

So, can we assume everything’s great?

NOPE!

🤔 What’s Really Hurting the Economy?

While the government’s argument makes some sense, we cannot say everything is peachy.

Growth has slowed down mainly due to:

Decline in demand

Weakening manufacturing sector

Slow down in government spending

Let’s look at each of these factors individually:

Government data has shown that growth in private consumption, which forms 55-60% of the GDP, has slowed down from 8.8% in Q2 to 2.1% in Q3! This could be due to several reasons like the high inflation rate, the high-interest rates which have made borrowing expensive, or a break from the post-Covid revenge spending.

Whatever the reasons, this is definitely impacting a lot of companies. Many companies from FMCG to apparel companies have seen profits decline or even entered losses. Examples include Dabur, Page Industries (exclusive licensee of Jockey), Tata Steel, RIL, and more.

Men's underwear sales are down by 55%! Interestingly, this is often considered an important economic indicator of a recession.

Now, since companies aren’t making profits and are seeing a slowdown in demand, they are slowing down manufacturing. Result? Manufacturing sector has contracted by 1.1%.

Add to that, declining exports.

Wait, why are exports falling?

You see, everything is connected.

The rise in inflation has led other countries to raise interest rates, leading to recession worries (especially in the US).

Now, the US is one of India’s major export markets. So, demand for exports has also slowed down. And if an actual recession hits, it could further die out!

Sounds troubling, no?

Well, it's not just us who's troubled by this. All of this has burnt a hole in the government’s balance sheet too.

Fewer exports mean less money coming in. So, it has slowed down its expenditure. Capital expenditure is still high, but the expenditure on public services has slowed down.

But hey, this may just be a momentary dip. There is still light at the end of the tunnel, we just have to make it till there.

🌨️ Every Cloud Has A Silver Lining

Most FMCG companies are reporting that they expect demand, particularly rural demand, to rise now.

Our net income and net disposable income have also increased by 18% and 17.8% respectively.

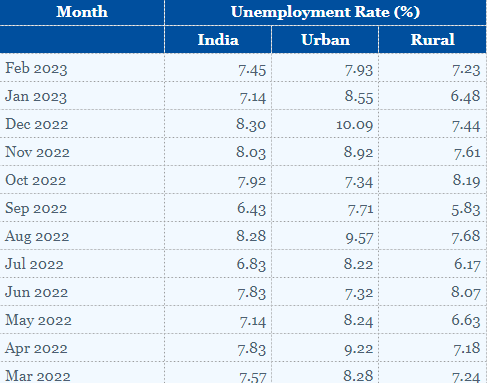

Unemployment has also marginally decreased.

So, public expenditure could rise again.

But this entirely depends on the global economic outlook. If a recession hits our major trade partners, we could be in deep trouble.

What do you think the future looks like for India?

Will we keep growing or will the recession put a brake on our dreams to become the third-largest economy by 2030?

Let us know if you liked today's piece. If you did, please share this with your friends, and get them to subscribe :)

See you tomorrow, smarty! 🤓

If you are coming here for the very first time: Join us on WhatsApp and never miss an update! 👇