How did Jio turn Cash Flow Positive?

5 years of Jio: From burning Rs. 22,000 crores in a year to generating Rs. 5,500 crores

Reliance Industry’s AGM is just around the corner. Streets are abuzz with speculations. The largest company in India is expected to announce something ground-shattering. After all, it has raised Rs. 2,60,074 crores in just one year (FY 2020-21), the most capital raised in a year in India by any company.

It’s action time for Reliance now.

But, today we are not getting into these speculations. Today we will talk about that one venture of Reliance that has changed India’s digital landscape and the life of every Indian.

Today we will talk about Reliance Jio.

The year was 2016 when for the first time ever, we were not rationing our call time or internet usage. Jio’s welcome offer was free for a long time. With this aggressive move, it gained a lion’s share of the market, bleeding many telecom operators to death. But, it came at a cost. It burnt Rs. 22,000 crores a year before its launch and Rs. 1.47 lakh crores in the next 4 years.

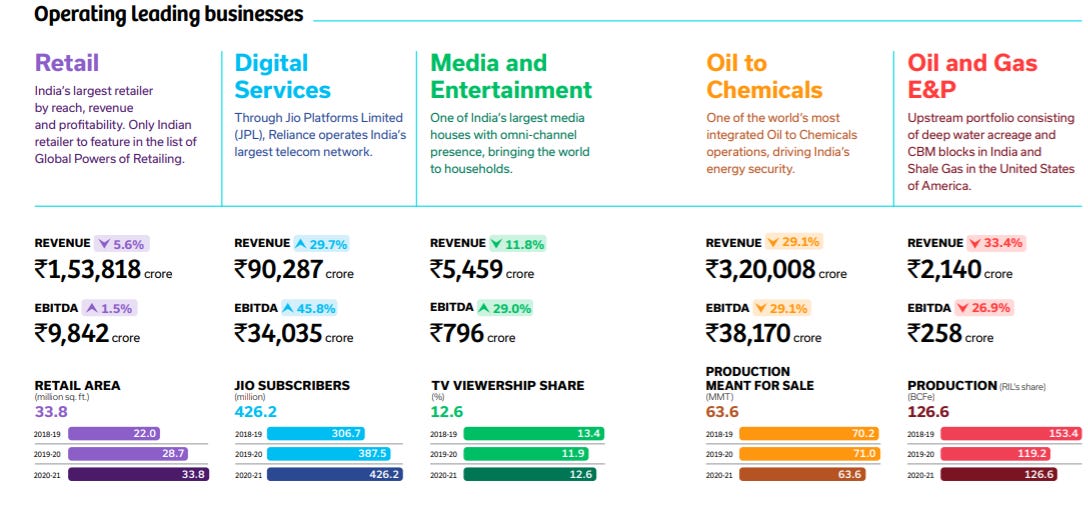

And Jio’s strategy seemed to have worked. While Reliance’s other arms faced the pandemic’s wrath, Jio’s revenue and profits showed impressive growth.

And why just revenue, the company has also become free cash flow (FCF) positive for the very first time! As per Jefferies India’s calculation, Jio has an FCF of Rs. 5500 crores in the financial year 2020-21.

“Free cash what? And how does it matter?”

Think of it like this. Say you have a business. You sell your products and make revenue.

And, once you get the cash, you can now spend that cash to pay off interest on any loans you have, pay off all expenses necessary for operations (salary, etc), and maybe invest some of it for expansion and growth.

If you still have some cash left in your kitty, you can freely do whatever you want to with it. Maybe pay some dividends to those shareholders who trusted you? Maybe buy off competitors (if you have enough cash?) and reduce competition?

Basically, it’s awesome to have free cash in a business, and investors absolutely love it. Your business becomes a money minting machine!

But, how did Jio turn it around?

> Thanks to telecom wars, India had the cheapest mobile data plan for a very long time. But, that wasn’t going to be sustainable and the industry finally had to bring a hike. In December 2019, Jio hiked its plan by as much as 40%. Of course, the slap that came with such a huge spike had to come with a kiss of more free offerings in bundles. But, whatever be the case, its revenues and profits shot up.

> Reduction in capital expenditure: In order to establish itself as the biggest telecom operator, Reliance had to make large investments over a very short period of time. Now that it is the frontrunner of the game, the outflow has come down.

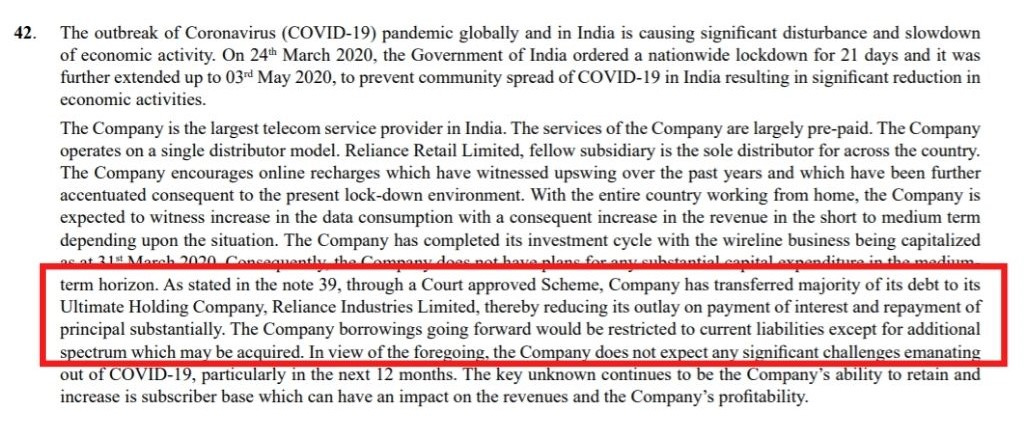

> The loans taken by Jio were simply transferred to its parent entity. This means that Jio does not have to pay interest on the amount that it is using, thus showing a profitable scene. These interests are being expensed by Reliance Industries.

The company is turning into a profitable venture along with commanding the maximum market share of 35.30%. But, it cannot afford to slow down. Close on its heals, follows another company that commands 29.62% of the market share.

We are talking about Bharti Airtel, which is giving Jio a run for its money. In the final two quarters of the financial year 2021, Airtel added more subscribers than Jio did. Airtel’s Average Revenue Per User (ARPU) is Rs. 145 per subscriber per month as compared to Jio’s Rs. 138.

Of course, this did not sit right with Jio. It has already made the next move to claim this crown from Airtel. Any guesses?

Get a chance to interact with the creators of this piece by joining our WhatsApp list! 👇

Jio has already announced unlimited data pack (without restriction to per day use) for pre-paid user along with unlimited calling facility. (The Next Move)

Hi. Another good read. It would help (if it is not too much of an ask) if you can share your thoughts on the below given queries.

Will Reliance Jio be FCF +ve or -ve if it hadn't transferred its debt to Reliance Industry? Also, is this move in compliance with Indian accounting principles?