[Data Story] Amazon vs India's Homegrown Heroes

Is Amazon falling behind its Indian rivals? Here's a detailed breakdown of Amazon's struggles in India.

Amazon needs no introduction.

In the hustling-bustling world of e-commerce, it is an 800-pound gorilla.

Unmatched logistics, the expansive A to Z product range, and a solid customer-centric approach makes the global giant seem almost invincible.

However, the Indian market begs to differ.

Notorious for being a tough nut to crack, the Indian market seems to be favoring indigenous startups like Flipkart and Meesho.

Despite having invested billions of dollars in its India business, Amazon’s performance in India is hardly matching up to its expectations.

Why is Amazon’s globally successful model not producing similar results in India?

How are homegrown startups like Flipkart and Meesho able to give cut-throat competition to the global giant?

Read on.

In this piece we will cover:

India’s place in Amazon's Global Portfolio

Amazon’s India Expedition

Global Giant vs Local Heros

Amazon Bazaar: A Strategic Move or a Desperate Measure?

Is Q-Commerce the New E-Commerce?

Amazon’s Future in India

India’s place in Amazon’s Global Portfolio

In 2023, the tech giant’s global revenue increased 12% YoY to reach $575 billion. Yes, you read that right, 575 billion dollars which is about 4.3 times of India’s infrastructure expenditure budget for 2024!

~61.39% of this revenue, amounting to $353 billion, was generated from North America, which remains the largest fish in Amazon’s bucket. The rest of the world contributed $131 billion (22.78% of Amazon’s revenue) and the balance of $91 billion (15.8% of total revenue) was generated through AWS.

Amazon India earned a total revenue of INR 22,429.5 crores in FY23, which, when converted at a rate of INR 82.75 per dollar, amounts to ~$2.71 billion. Even though this converts to only 0.47% of Amazon’s total revenue, India is the second largest when it comes to Amazon’s annual traffic. Where US users represent ~68.3% of the annual traffic, India contributes ~4.9%.

Amazon’s India Expedition

In 2013, when Amazon launched in India the market size of e-commerce was $16 billion.

Fast forward to 2023, the Indian e-commerce market size was $92.7 billion.

And that is with only 5-6% online retail penetration. In comparison, China has 35%+ online retail penetration. You can imagine the untapped potential!

The market is expected to grow at 29.3% from 2024 to 2032 becoming a $259 billion market by 2032.

Naturally, India is too big a fish to be taken lightly in the world of e-commerce.

What has Amazon India’s growth trajectory been like?

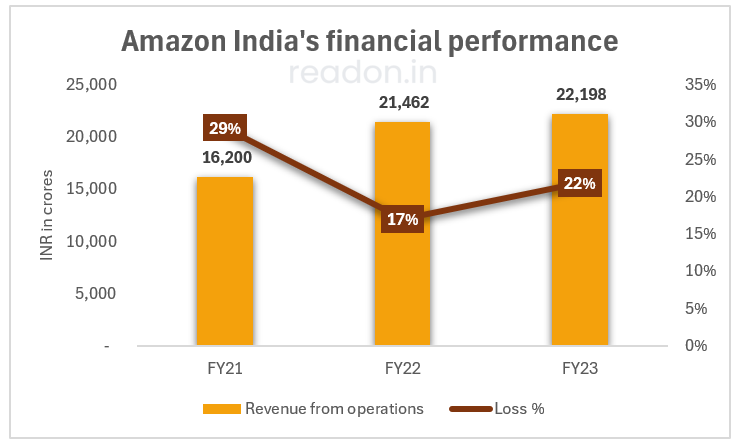

Revenue: Amazon India’s revenue from operations has grown from INR 168.9 crores in FY14 to INR 22,198 crores in FY23. That is a compounded annual growth rate of a whopping 72%!

Loss: In FY14, Amazon incurred a loss of INR 321.3 crores which is about 190% of its then revenue and by FY23 its losses narrowed to 21.87% of revenue amounting to INR 4,584 crores.

Monthly visitors: Amazon’s monthly visitors increased from about 30 million in October 2015 to more than 295 million in May 2023.

Fulfillment centers: Starting with one fulfillment center in Bhiwandi having 0.22 million cubic feet of storage, Amazon today has 60 fulfillment centers with 43 million cubic feet of storage spread across 15 states.

Global Giant vs Local Heroes

Amazon has the largest revenue pool in India in comparison to its competitors. According to a report by Nielsen Media, Amazon is the most preferred online shopping destination in India. Its user experience and customer service is top notch and have been pivotal in winning the trust of Indian consumers.

Amazon is the first e-commerce company in India to have dedicated air cargo capacity. It is also the first to use the Indian Railways Dedicated Freight Corridor to enable faster and more efficient deliveries and service.

Its unmatched logistics sets Amazon apart from competition not just in India, but across the globe. Amazon’s globally expanding business has a reputation of entering new geographies and aggressively eating away the market share of the local dominant players.

However, India is writing a different story.

Even though at a global level Amazon is seeing double-digit growth, its operating revenue in India grew by a meager 3.4% in FY23.

Adding on to the slow revenue growth, is the issue of sluggish year-on-year user growth. While Amazon could grow its user base by only 13%, its competitors, Flipkart and Meesho, were able to grow their user base at 21% and 32% respectively.

Amazon’s slowed pace of growth is not just a representation of its struggles but also highlights the growing prowess of its Indian competitors.

In a snapshot comparison of the financial results declared by the three major e-commerce players of the country, Amazon managed to emerge with the highest revenue and lowest losses.

But is that enough to conclude that it dominates the market?

Well, there is no doubt that Amazon’s global expertise and its deep coffers helped it acquire a lot of customers.

But as the competition continues to strengthen in India, Amazon’s operating revenue growth in comparison to Flipkart and Meesho is astonishingly slow. On the other hand, Flipkart and Meesho also seem to be narrowing their losses, while Amazon’s losses widened in FY23.

Flipkart

In the world of e-commerce, Flipkart was the first to set up an online shop in India in 2009. With about half a decade of a head start, it poses as the biggest competitor for Amazon. With its strong foothold in India, Flipkart became a lucrative investment for Walmart. Looking to enter the hot-selling Indian consumer market, Walmart acquired 77% stake in the Indian unicorn for $16 billion in 2018.

In FY23, Flipkart’s operating revenue from its marketplace arm increased by 42% to INR 14,485 crores and total loss declined by 9% to INR 4,026 crores.

What is Flipkart’s strategy to keep Amazon at bay?

Understanding of Indian Consumers: Flipkart was the first to launch Big Billion Days sales on its platform for the price-sensitive Indian consumer and it was such an astounding success that Amazon soon followed suit with its Great Indian Shopping Festival. In 2023, Flipkart had 1.4 billion customer visits during its festive sales. It is estimated to have the largest market share in the e-commerce market with ~48% market share in the online smartphone market and ~60% share in the online fashion market (including Myntra).

Tapping into the Real India: Flipkart’s ad campaigns are a testament to the company’s focus on Tier 2+ India. In 2022, the company claimed that while Bengaluru and Delhi might be its top cities, 60% of its total customers hail from Tier 3 cities.

Seller focus: Flipkart’s focus is not just on consumers shopping on the platform, but it also spends time and effort on who is selling on the platform. In 2023, Flipkart’s seller base increased by 27%, surpassing 1.4 million sellers. With seller-focused practices such as 10-minute onboarding, AI-powered cataloguing and ad campaigns highlighting the ease of doing business on Flipkart, the company’s vision is to empower and digitize the MSME sellers across the country.

Meesho

Founded in 2015 as a reseller platform, Meesho sets itself apart from its e-commerce peers through its social commerce touch.

It began as a reseller platform with a focus on helping rural India reap the benefits of online retail and its outreach. While sellers list their products on the platform, resellers use their social media outreach to advertise and resell the products. This gives them an avenue to earn commission and build an additional source of income.

Eventually, Meesho entered direct e-commerce sales to pose a challenge against the market leaders like Amazon and Flipkart.

With a GMV of ~$5 billion and a valuation matching its GMV, Meesho is backed by deep-pocketed investors like SoftBank, Meta and Fidelity Investments. Today, Meesho is the fastest growing e-commerce platform in India with 120 million active monthly users, outpacing both Amazon and Flipkart with user growth at 32%.

Meesho’s revenue growth outpaces its user growth with an increase of 77% in operating revenue in FY23 to INR 5,735 crores while its losses declined by 48%. Where the market leaders are using every trick in the book to cut losses, Meesho’s numbers indicate that it might be better than them.

What differentiates Meesho? Well, a lot of things!

The Next Billion Online Shoppers Focus: Over 70% of Meesho’s customers hail from Tier2+ cities. While its competition has a strong footing in the metros of India, Meesho’s focus is in that market which remains underserved and untapped – Tier2+ cities.

Zero Commission: Meesho operates on a zero-commission model, meaning sellers do not need to share a percentage of their revenue with the platform. This not only offers customers highly competitive prices but also helps sellers retain a larger margin on their sales. This zero-commission policy is a win-win for both the seller and the consumer.

Mass Positioning: One thing that helps Meesho outshine its competition is the pure genius of knowing the pain points of its target customers. With over 95% unbranded products, Meesho knows it is targeting that India which gravitates towards what costs less over who is selling it. Almost 80% of the sellers on Meesho are retail business owners. In short, Meesho is changing the way small shop owners reach their customers and is narrowing the digital divide between urban and rural India.

Not Just a Shopping App: Another example of how well Meesho understands its target customers lies in its value proposition for resellers – the ability to earn through the platform. Hitting two birds with one stone, Meesho created a whole new high-impact marketing channel while also providing monetary incentive to resellers. As of 2022, Meesho had over 15 million registered resellers with majority of them being home makers, students and young professionals, leveraging their network through social media to sell products.

Amazon Bazaar: A Strategic Move or a Desperate Measure?

In an attempt to regain lost ground and keep up with the new emerging winds in the e-commerce industry, about 6 months ago in April 2024, Amazon launched ‘Amazon Bazaar’. A platform dedicated to selling unbranded, ultra-affordable items under INR 600, it seems like Amazon’s answer to Meesho.

But Bazaar will not have typically fast 1–2-day deliveries which Amazon is known for. Delivery time in Bazaar is expected to be 4-5 days, similar to Meesho. Why? If you work on lower margins you need to strengthen the cost economics which means compromising on the delivery time.

Not just Amazon, but Flipkart also ventured into resell commerce through launch of its app Shopsy in 2021. And in 2022, ~40% of its new customers came from Shopsy.

Now how could Amazon stay behind?

For them capturing the Tier2+ market is the need of the hour. And with Flipkart’s Shopsy success they could not have waited any longer.

The question is, can Amazon woo the Tier2 market as it did the Tier1? Is it late to join this parade or was it biding its time to make an explosive splash? Only time can tell.

Is Q-Commerce the New E-Commerce?

Adding to Amazon’s woes, is the wild card entry of quick commerce platforms like Blinkit.

Until now quick commerce platforms have been primarily associated with groceries. But their shifted focus on large ticket sizes is turning out to be a real itch on Amazon’s back.

With the promise of ultra-fast deliveries within minutes instead of days, quick commerce is changing not just how India shops but also what Indian consumers will soon start to demand in exchange for their brand loyalty. Sellers too, especially D2C sellers, are increasingly turning to quick commerce to increase product uptake and sales volumes through ultra-quick deliveries.

While Amazon Fresh’s is still not very popular, urban India is increasingly getting used to the convenience offered by the Instamarts, Blinkits of India. Blinkit, emerges as the largest player with an average revenue run rate estimated to be ~INR 12,000 crores, followed by Instamart at ~INR 8,000 to INR 8,500 crores.

Platforms like Blinkit are gearing up for their battle against e-commerce platforms after beating them in groceries.

They have already expanded their product categories to serve some of the most demanded products in online retail such as fashion, beauty, electronics, toys, home and kitchen. In fact they are building their own supply chain to source branded products.

Imagine being able to purchase a PS5 and have it delivered at your doorstep within 10 minutes. Sounds crazy right? Well, not anymore!

Blinkit has started to make splashes by making it possible by listing PS5, I-phones and more high ticket items on its platform. As a result, e-commerce platforms like Flipkart and Amazon first started reducing their delivery times by extending same day delivery in more cities.

But the euphoria doesn’t end here. What Instamart and Blinkit have achieved, has made Quick Commerce a necessity of sorts. And so Nykaa, Licious, Swiggy (food), Zomato (food), Reliance retail have also thrown their hats into the ring. They are all either launching or piloting their 10-15 min delivery services. Even Flipkart launched Minutes, its 10-30 min delivery platform last month. To their credit, they weren’t slow, they just failed twice with Flipkart Quick and Supermart due to infrastructural bottleneck. Let’s see if this time will be different.

But guess who’s again late to the party? Amazon. It is being speculated that they will enter the arena in the first quarter of 2025. But there’s no confirmation yet.

Will this cause irreparable damage to Amazon? Or once it enters it will raze the competition to the ground?

The Biggest Rival you didn’t see coming

The biggest retailer in India is now eyeing the entire online retail market.

With a head-start of over 18,000 stores spread across Tier1 and Tier2+ India, this mega player also has a sweeping mobile network, multiple consumer business, a rich history in India and the home-field advantage.

By now you would have guessed.

Reliance is silently brewing a storm that may change the entire online retail market in India by consolidating and integrating its existing wins like Ajio and Tira into the JioMart bucket. Plus, it’s also piloting the quick commerce services.

Amazon has many battles to fight in India. Be it winning the value-seeking tier 2+ audience or satisfying the time-sensitive tier 1 audience, the competition is heating up on all fronts.

The change that it brought to India’s e-commerce story was just the beginning. But it wasn’t enough. Just when you think the Indian e-commerce space couldn’t be more magical, a new player emerges and pulls out another rabbit from the hat.

We would love to collaborate with you if you love writing about finance and economics and are looking for a platform to showcase your talent 😁