Corporate Bonds Now Available for Retail Investors

The SEBI is finally making it easier for retail investors to invest in corporate bonds. Here's how.

News flash: Retail investors can now invest in India's corporate bonds with just INR 10,000

What does this mean? And why is this a big deal?

Read on.

Understanding Corporate Bonds

First things first. What are corporate bonds?

A corporate bond is a debt security that a company issues to raise funds.

It could be for anything. From expanding operations, funding new projects, to refinancing debt.

Investors can buy these bonds by lending money to the company in exchange for periodic interest payments (known as coupons) and a return of the principal value when the bond matures.

Now, until recently, this opportunity was reserved for institutional investors or those with deep pockets.

The minimum investment amount for corporate bonds used to be a staggering INR 10 lakh until October 2022.

It was later reduced to INR 1 lakh, and now, this number has come down to just INR 10,000.

And this is a big deal.

Why, you ask?

Well, this move is democratising the corporate bond market in India, making it accessible to retail investors like you and me.

You see, India’s corporate bond market is growing. Rapidly.

As per CRISIL Ratings, India’s corporate bond market has been growing at ~9% CAGR over the past five years.

And now, we are set to grow even faster.

The outstanding size of the bond market is expected to grow from ~Rs. 43 lakh crore in FY23 to Rs. 100-120 lakh crore by FY30.

This move gives retail investors an opportunity to be a part of this growth story.

Why Now, Not Earlier?

Historically, India’s corporate bond market has been the playground of institutional investors. Retail investors were often sidelined due to the high entry barriers.

But, things are changing now.

Retail investors are finally ready to not just dip their toes into this market, but take a dive.

Financial literacy among retail investors is on the rise, and there’s an increasing appetite for diversified investment options.

Rising financialisation of household savings is also driving demand.

The number of demat accounts has increased from ~4.1 crores in FY20 to ~11.4 crores in FY23.

All in all, retail investors are now more mature and aware than ever before.

Though India’s corporate bond market to GDP ratio is only 16% as compared to 123% in the US and 36% in China, we’re getting started.

How Can You Get Started With Corporate Bonds?

Enter tech-first investment platforms like GoldenPi, Aspero, IndiaBonds and Wint Wealth.

These platforms have simplified the process of investing in corporate bonds for retail investors.

First, let us understand why you could consider corporate bonds as an investment option:

Corporate bonds offer a balanced risk-return profile, allowing you to diversify your portfolio. You can choose bonds based on your desired level of risk and return. Higher-rated bonds (e.g. AAA) offer lower risk but also lower returns, while lower-rated bonds can offer higher returns at higher risk.

Corporate bonds have the potential to deliver inflation-beating returns. Compared to traditional fixed deposits (FDs), which currently offer around 5-6%, corporate bonds can offer higher returns, ranging from 7-11% or more.

Corporate bonds in India are regulated by the Securities and Exchange Board of India (SEBI). So there are strict rules and checks in place to ensure the safety of your investment. SEBI also provides a grievance redressal mechanism, ensuring that investors have a channel to address any issues or concerns.

Wondering how corporate bonds and government bonds (where, instead of lending to a company, you lend to the government) are different?

Now, before investing in corporate bonds, it’s crucial to evaluate the safety of these bonds. Here are key things to check:

Credit Rating - Credit rating is an assessment of the creditworthiness of the bond issuer. Higher credit ratings (AAA, AA) indicate lower risk of default.

Issuer’s Financial Health - Denoted by the financial stability and profitability of the company issuing the bond. A financially stable company is less likely to default. Investors should review the financial statements, liquidity and business outlook of the bond issuer. It could also be helpful to look at the issuer’s previous history of bond issuance and repayment and be mindful of any prior track record of default.

Yield and Maturity - Yield is the interest rate paid by the bond and maturity is the time until the bond matures. Investors should consider the interest rate (coupon) and the bond's maturity date. Higher yields often come with higher risks.

Liquidity - How easily you can buy or sell the bond in the market. Higher liquidity means you can quickly convert the bond to cash without significant price changes.

Remember, at the end of the day, investment decisions should be aligned with your long-term financial goals.

Personal finance should be personal, after all.

Now, let’s walk through one of the bonds listed on Aspero to understand this better.

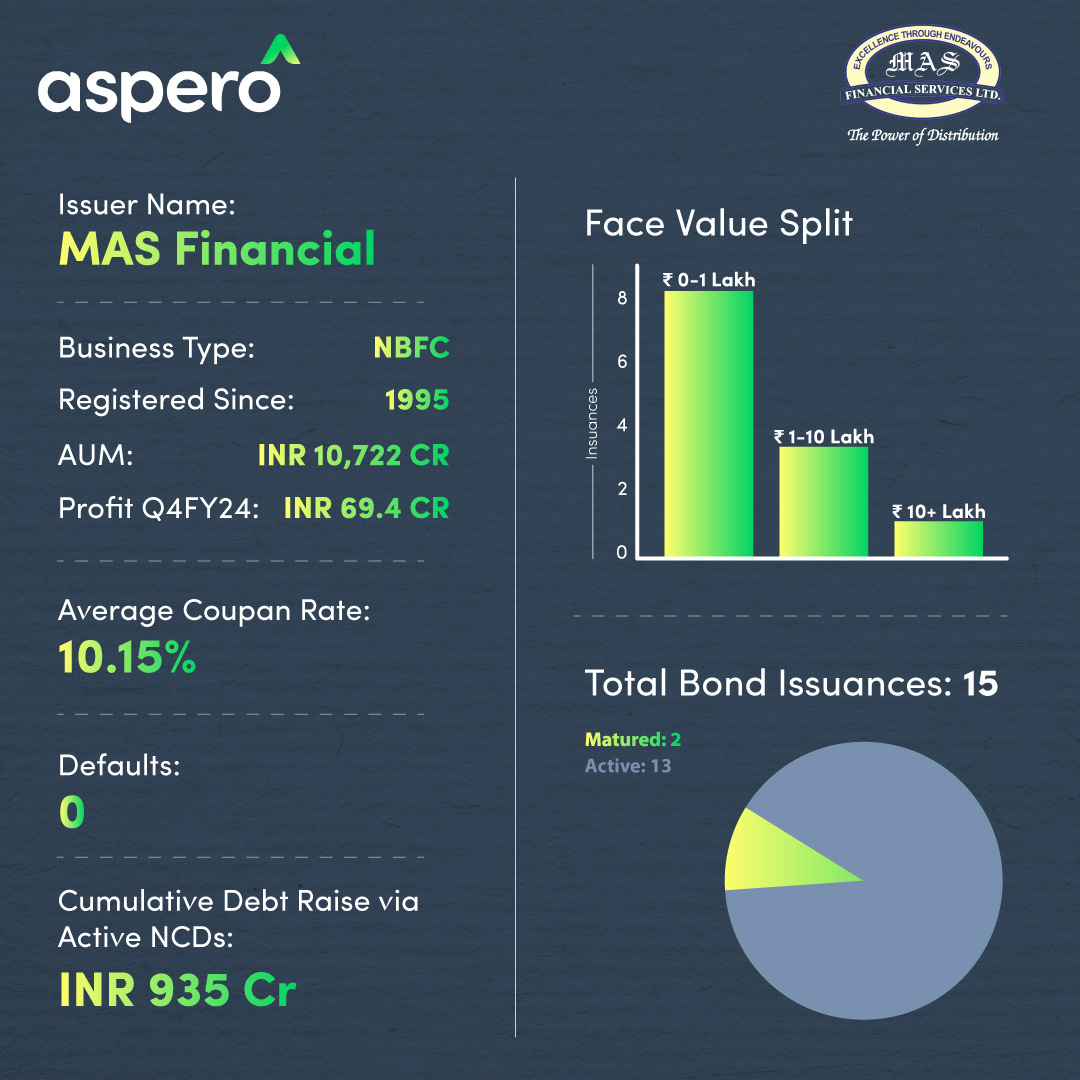

One of the bonds listed on the platform is MAS Financial Bond.

Let’s see how to evaluate this bond:

Minimum Investment Amount - INR 99,214.47

Different bonds may have different minimum investment amounts. If you are new to bonds, you may want to start small.

Interest Payment Frequency - monthly

Bonds can pay interest monthly, quarterly, or annually. If you’re looking for passive income stream, more frequent interest payments (monthly/quarterly) is a plus

Yield To Maturity (YTM) - 9.8%

YTM represents the total return expected if the bond is held until maturity. Comparing the YTM of different bonds with other investment options, like FDs, can help you decide which offers the best returns. In this case, MAS Financial bonds offer a YTM of 9.8%, much higher than the current FD rates.

Maturity Date - 06/12/2025

Depending on your financial goals, you may prefer short-term bonds for quicker returns or long-term bonds for potentially higher yields.

When the SEBI reduced the minimum ticket size from INR 10 lakh to INR 1 lakh, non-institutional investors subscribed to 4% of the total funds raised. This was much higher than the usual average of less than 1%.

Now imagine what could happen with an even lower ticket size of INR 10,000.

As the demand for these bonds go up, corporates might be tempted to use this channel to raise more funds.

This can take the bond market to newer heights.

This can take India’s growth story to newer heights.

And the best part?

SEBI is rooting for retail investors to be a part of this growth story.

It is rooting for people like you and I to be a part of this growth story.

Disclaimer: This blog is not an investment advice.