📜 Building India, One Bond At a Time

With the power to unlock capital for states, municipal bonds are the secret weapon for driving economic growth in India. Indore has tapped the power of these bonds. But will more state adopt them?

Indore has made history in India. Again.

It’s no longer just the cleanest city in India or the hometown of Zakir Khan.

It is now India’s first city to launch green municipal bonds for retail investors!

Now, that’s a loaded sentence, with a lot of jargon to unpack.

So, let’s dive deep into the world of green municipal bonds and understand:

What are green municipal bonds?

Why did Indore issue them?

Can they help other cities and states?

ReadOn!

♻️ Indore’s Green Municipal Bonds

Municipal bonds are bonds launched by municipalities and municipal boards to raise funds for city operations.

These bonds are kind of like government bonds and securities. The only difference?

They’re a bit risky, since the government (or in fancy terms the sovereign) does not guarantee that you’ll get the money you invested in these loans back.

Now, many municipalities have issued green bonds in the past to raise funds.

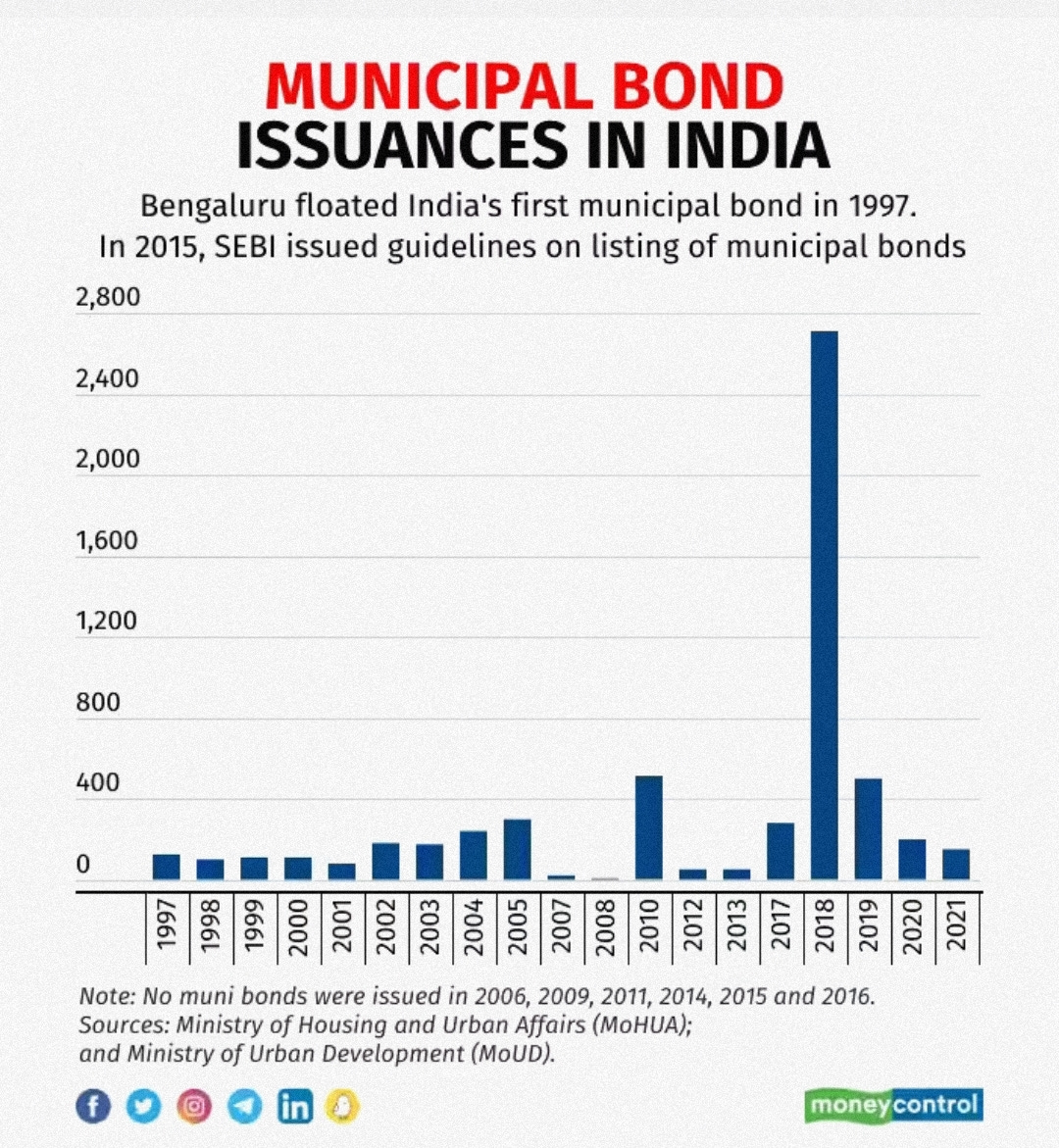

Bangalore was the first to issue green bonds in 1997.

But two things set apart Indore’s bond offering:

Indore’s bonds are green: The bonds that Indore recently launched will finance a solar power plant of 60 megawatts capacity. This power plant will allow Indore to ditch traditional electric run water pumps, and use solar energy, which is greener.

Indore’s bonds can finally be afforded by retail investors: So far, the bond market was only accessible to institutional investors and high net-worth individuals (the real-life richie-riches). But the government made a conscious effort in 2021 to make bonds accessible to retail investors as well (you can read more about it here). And now Indore has replicated this effort by lowering the ticket size of municipal bonds.

In 2018, the face value (basically, selling price) of the bonds was Rs. 10 lakhs.

And now, it is Rs. 1,000! However, the minimum investment of the bond is Rs. 10,000 (meaning you’ll have to buy 10 bonds).

This means people like you and I can also buy these bonds and get a fixed income of 8.25%!

A look into how these bonds will mature:

Each bond of Rs. 1,000 has been divided into four parts worth Rs. 250. Each of these parts is a separately transferable and redeemable principal part (STRPP). What does that mean?

It means that you can choose to sell your bond in parts. You can choose to sell three parts of the bond and just keep one.

Or you can wait for the parts to mature and redeem them. Each of these parts has a different maturity date.

The initial issue for the sale of these bonds is now over (it happened between 10 and 14th February). It was oversubscribed by 5.91 times.

The bonds will now be listed on the NSE.

The move is great for retail investors who are interested in getting a higher fixed income than they get from FDs and savings accounts.

But what's in it for Indore? Why did it have to launch bonds to fund a critical infrastructure project?

Shouldn't it rely on its revenue to fund such projects?

🤔 Why States Need Municipal Bonds

States have been seeing a major decline in revenue due to two factors:

Covid, which stalled the economy.

So, states don’t have a lot of money left for infrastructure development.

But the need for infrastructure development is rising, thanks to rising urbanisation.

Between 2010-21, India’s urbanisation rate increased by 19.6%!

So, states need to develop urban infrastructure ASAP, to keep our roads clean and free of potholes.

How to do this?

They can either keep waiting around for state grants and funds. Or they can do something about it themselves.

Cities like Indore have chosen the latter option.

And the move benefits us all, no?

Cities and states get funds faster for projects. And us? We can fund pothole-free roads and earn fixed income at the same time! Win-win, right?

So, more and more states and cities are now opting for such bonds.

But even though municipal bonds have seen a rise, Indore’s was the first one catering to retail investors.

Outside India, 55%-60% of municipal bonds are held by retail investors. This needs to change.

According to a survey (which covered 47,000 households), 22% of Indians prefer investing their money in fixed deposits. The only other investment option that ranked higher was mutual funds (31%).

So, launching more such municipal funds could spur more investment in India.

🔍 Will More States Launch Municipal Bonds?

The municipal bonds route makes more sense for states than waiting for grants or interest free loans from the government.

Let’s take Indore’s example:

It could have waited around for funds and continued paying Rs. 25 crores for pumping water.

But by launching the project fast, this cost will be cut down by Rs. 4.3 crores per month!

So, Indore will save more than it spends on interest. Plus, with the launch of solar projects, it will get carbon credits. It can sell these credits and earn more money!

But will retail investors actually invest in such projects?

Well, these investments can be risky, since repayment is not guaranteed by the government.

But so far, no municipality has defaulted on its payment.

And the Indore municipal bonds have attracted a lot of retail investors, the category was oversubscribed by 5.78 times.

So, the future seems bright.

Let us know if you have invested or would be willing to invest in such bonds!?

Let us know if you liked today's piece. If you did, please share this with your friends, and get them to subscribe :)

See you tomorrow, smarty! 🤓

If you are coming here for the very first time: Join us on WhatsApp and never miss an update! 👇