🧾Budget 2023: Explained

Here's a summary of all the important policies that were announced in the Budget this year! P. S. This is the first bill in a long time that has reduced personal income tax so do ReadOn!

The Budget is the most-awaited financial document in the country (except for maybe the Adani Group’s actual financials).

And why not? It is on this day that the nation gets ready for its next course of action. It is on this day that the nation writes its fate.

From the rural farmer to the urban businessperson, the words written in this document affect all!

Behind the dancing numbers, lies a story, a plan. This document is more than a mere plan, it is a roadmap to progress, a hope to prosper.

Today, let’s dive deep into the Union Budget 2023 to see what lies ahead of us.

🎯The Goals Guiding the Budget

Budget 2023 laid out Four Opportunities and Seven Priorities.

The Four Opportunities:

Economic Empowerment of Women

PM VIshwakarma KAushal Samman (which focuses on upskilling and supporting Indian artisans and craftsmen)

Tourism

Green Growth

The Seven Priorities:

1) Inclusive Development

2) Reaching the Last Mile

3) Infrastructure and Investment

4) Unleashing the Potential

5) Green Growth

6) Youth Power

7) Financial Sector

Before we get into the long list of policies, let's highlight a few key numbers.

🧮 Let’s Talk Numbers, Baby

The government has met its target fiscal deficit of 6.4%. Next year’s target is 5.9%, and we aim to bring this to 4.5% by 2025-26.

The government increased capex by 33% to Rs. 10 lakh crores.

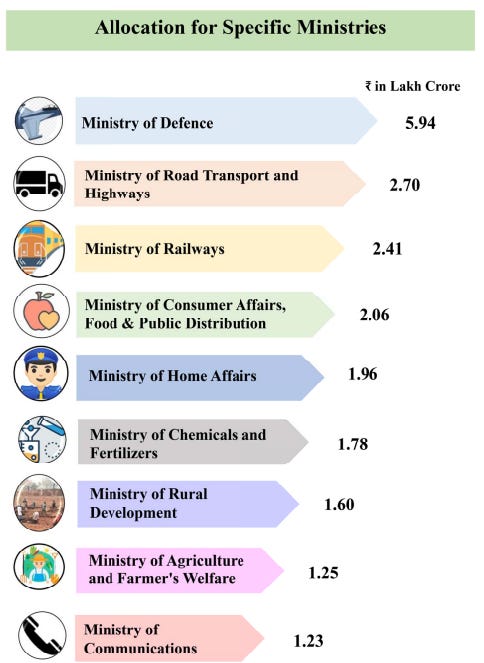

Here is the ministry-wise budget allocation:

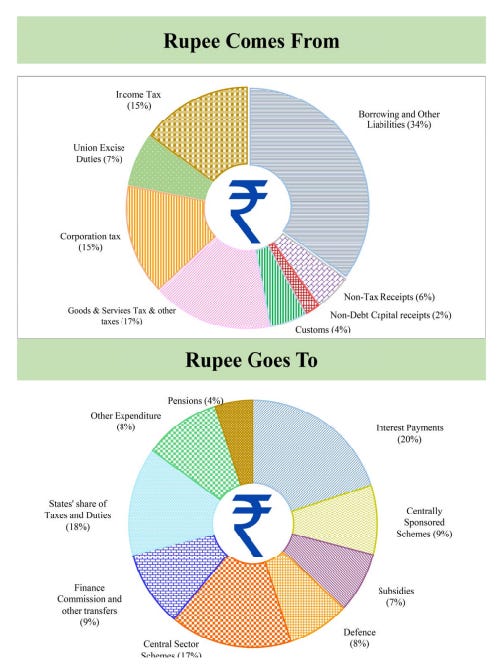

Here’s how the government expects to earn and how it expects to spend!

The most awaited announcement was around income tax rates. And, guess what. The government listened to us and reduced income tax rates! What does this mean for the government? A revenue loss of Rs. 35,000 crores!

Now, let’s look at the seven priorities individually.

🤝1. Inclusive Development

This section focused on agriculture, health and education.

Policies on Agriculture:

Digital public infrastructure will be built to boost productivity and reduce farming risks.

Credit (loans) available to the agricultural, dairy farming and fisheries increased from Rs. 18 lakh crores to Rs. 20 lakh crores.

An agricultural accelerator fund will be set up to create young agri entrepreneurs who can apply their “jugaad skills” to boost the sector.

Policies on Health:

The government has set a target to completely eliminate sickle cell anaemia by 2047. India has the second-highest number of sickle-cell anaemia cases which kill 20% of affected children each year!

157 new nursing colleges will be established.

The government is increasing R&D in this space. For this, it will set up research facilities in ICMR (Indian Council of Medical Research) Labs.

Policies on Education:

This Budget is super focused on upskilling. The government has realised that R&D and upskilling is the key to becoming self-reliant.

It will set up a National Digital Library to “build a culture of reading”. Looks like the government is taking a page from ReadOn’s playbook?

🛣️ 2. Reaching the Last Mile

Policies announced:

Rs. 15,000 crores for providing health benefits, sanitation and clean water to particularly vulnerable tribal groups.

Rs. 5,300 crores to Karnataka’s drought prone areas to facilitate irrigation.

Outlay for PM Awas Yojana (which provides permanent housing to the disadvantaged) was enhanced by 66% to Rs. 79,000 crores.

🏭 3. Infrastructure & Investment

Policies announced:

Rs. 2.40 lakh crores set aside for Railways. This is the highest ever allocated amount!

Rs. 75,000 crores investment for 100 critical transport infrastructure projects. This will increase last and first mile connectivity for ports, coal, steel, fertiliser, and food grains.

An Urban Infrastructure Development Fund (UIDF) will be set up. This fund will be used by public agencies to develop urban infrastructure in Tier 2 and Tier 3 cities. Rs. 10,000 crores per year will be provided for this

✨ 4. Unleashing the Potential

Policies announced:

The government, like us, seems super impressed by ChatGPT so it is focusing on the ‘Make AI in India’ project.

It is also investing in research and development of lab-grown diamonds to make our proposals cheaper!

Compliances reduced for ease of doing business.

The E-courts project will get Rs. 7,000 crores so we don’t get taareekh pe taareekh.

🟢5. Green Growth

Policies announced:

The recently launched National Green Hydrogen Mission received an outlay of Rs. 19,700 crores. This mission will focus on reducing carbon intensity and dependence on fossil fuel imports.

Turning waste to biogas (investment Rs. 10,000 crores).

Replacing old-polluting vehicles.

Using ships for transporting goods instead of trucks (saving money and fuel).

Rs. 35,000 crores also allocated towards energy transition!

✊ 6. Youth Power

Policies announced:

Pradhan Mantri Kaushal Vikas Yojana 4.0: This will be launched in 3 years to provide on-job training, new courses like coding, AI and opening skilling centres.

Launch of Skill India Digital Platform: This will enable demand-based formal skilling and provide entrepreneurship courses.

Under the National Apprenticeship Program Scheme, stipends will be given to 47 lakh youngsters in three years!

Tourism boost: We are finally capitalising on our culture and heritage. 50 destinations will be selected and developed to boost tourism. This will increase revenue and create new jobs. Two birds, one stone!

💵 7. Financial Sector

Policies announced:

Collateral-free credit guarantee worth Rs. 2 lakh crores to MSMEs.

Changes to the Banking Regulation Act, the Banking Companies Act, and the Reserve Bank of India Act to reduce fraud.

A National Financial Information Registry will be set up: This will act as a central repository for financial information. This will ensure access to information and promote financial inclusion.

Introduction of a new savings scheme for women: Mahila Samman Savings Certificate. This will offer deposits of up to Rs. 2 lakhs in the name of women (or a girl) for two years. Interest rate? 7.5%!

The maximum deposit limit for Senior Citizen Savings Scheme will be increased from Rs. 15 lakhs to Rs. 30 lakhs.

States' fiscal deficit limit is set at 3.5% of GSDP. This could lead to some interesting Centre-State drama.

And now the juicy part…

🤑 Tax Benefits

The FM sure knows how to keep us hooked. She saved the best for the last.

And she finally heard us! Here’s what she announced:

Tax rebate increased to Rs. 7 lakhs from Rs.5 lakhs. (amount on which you don't have to pay taxes).

Lower tax rates. In the FM’s own words, this is how much tax has been lowered by: ‘An individual with an annual income of Rs. 9 lakh will be required to pay only Rs. 45,000/-. This is only 5% of his or her income: a reduction of 25% on what he or she is required to pay now, ie, Rs. 60,000.’

Wait, don’t celebrate just yet.

All of this is under the new tax regime. You could consider shifting to the new regime but you would have to give up all your deductions.

If you don’t have any, great. You should shift to the new regime as it would be much more beneficial. But if you do have deductions, sticking to the old regime is better. (Let us know if you want us to cover this in detail).

The extra surcharge applied on the highest tax slab will also be reduced from 37% to 25% in the new tax regime. This would result in reduction of the maximum tax rate to 39%.

Bad news, income on insurance policy premiums above Rs. 5 lakhs will be taxed now.

Standard deduction of Rs. 50,000 has also been extended to the new regime.

Tax benefits have also been provided to MSMEs and startups. Startups can now carry forward their losses for 10 years (earlier it was 7 years). This basically means no taxes on 3-years worth of profits in a 10-year period since incorporation.

But this only applies to startups with less than Rs. 25 crore turnover. This means only 1% of startups will benefit from this!

And that's a wrap. This was our initial take on the Budget. We’ll dive deep into more aspects very soon, with more time in hand. Also looking forward to answering any and all questions!

Let us know your take on the Budget. What was the highlight for you?

Until then, ReadOn!

Let us know if you liked today's piece. If you did, please share this with your friends, and get them to subscribe :)

See you tomorrow, smarty! 🤓

If you are coming here for the very first time: Join us on WhatsApp and never miss an update! 👇

Just brilliant. I had already read many so I was not interested to read from readon as it newly established compared to other sources but you guys know to keep young generation's attention hooked up. Keep up the good work guys!!

Very good summary of entire budget. Kudos to team ReadOn. It helps understand complex terms of budget in easy way. Thank you.