Biased

Mutual Fund investment decisions are subject to cognitive biases, please watch the market movements carefully before investing.

The last couple of months have been characterized by uncertainty and fear.

Fear and panic have spread faster than the virus, and its impact can be seen on the stock markets the world over.

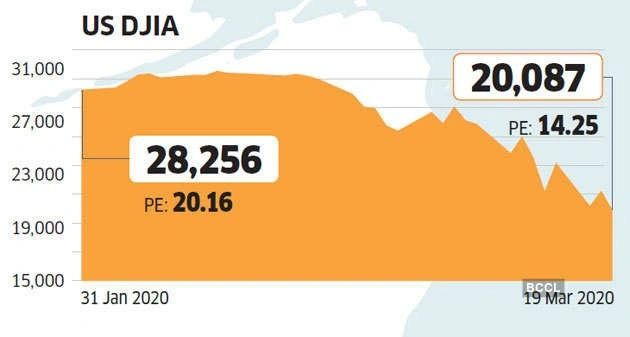

Our very own Sensex’s plunge (along with a fall in global financial markets) is proof of our panic-stricken reactions to negative news. Take a look.

What's interesting to note is that the current fall in Sensex has been the fastest compared to other historical dips (eg: the dotcom bust, the financial crisis of 2008). This time, it’s worse.

So why the knee-jerk reaction? What makes us buy more when everyone else is buying, and sell at the first sign of trouble? What influences an investor's decision-making ability?

We, at ReadOn, were perplexed by these questions, and decided to dive deeper into the human psyche, and understand what affects our investing decisions. The answer was ...

Cognitive Bias

Cognitive bias is a systematic error in our thinking process - the way a person interprets information is prejudiced by notions that they hold dear. The brain is accustomed to thinking and feeling in a certain pattern (it is biased).

More often than not, these patterns lead to poor decisions.

Two of the most note-worthy biases that affect our financial decision making are availability bias and confirmation bias.

Availability bias is a mental shortcut that relies on immediate examples that come to a person's mind (ones that are readily available). It’s a mechanism that we use based on easily available information to form a decision. 'What you believe is true.'

News channels and media, by repeatedly showing the same news, make it readily available to our brain, causing this bias.

In the stock markets too, investors get influenced by information that was recently in the news and they tend to ignore other relevant factors. (Eg: Regular positive news around Reliance’s stock has created euphoria in the masses, and people are buying up the stock in truck-loads, without understanding the fundamentals of its business).

Another demon in the brain is confirmation bias. We tend to perceive a new piece of information in the light of our own preconceived notions. Our brain automatically rejects views, ideas, and opinions that do not fit with our existing beliefs and theories.

The best display of how these biases work was made in the movie “P.K” by Aamir Khan:

More often than not, religious affinity is judged by the type of clothes a person wears. Our pre-existing notions make us believe that the guy in a turban is a Punjabi, and the lady in a burqa is Muslim. Mental error alert!

The Financial Market Connect

When the markets are on a rise, more people get attracted to buying stocks. Everybody is earning easy money, and you don’t want to miss the bus. You want in.

“But, I don’t have knowledge about the stock markets,” you wonder.

Just then, you come across an ad on television that you have been seeing for quite some time now - “Mutual Funds Sahi Hai.” (Here's an explainer on Mutual Funds for the uninitiated).

You do a little Google search and select the “most popular Mutual Fund” scheme that appears at the top. You also come across some articles that tell you why mutual funds are so great. They confirm the pre-existing notion in your brain. You don’t dig deeper and are just happy to get on the joy-ride and make quick money.

Now, why exactly did you zero in on Mutual Funds as a mode of investment?

Because you saw an ad on television. An ad repeated 15 times a day.

The repetition of the mantra, “Mutual Fund Sahi Hai” made you familiar with the idea that Mutual Funds are a good way to invest in the markets, and you ultimately accepted it to be true. Without an ounce of research on your part, you now believed that “Mutual Funds Sahi Hai.”

Repetition - Familiarity - Acceptance.

Marketing 101.

Because this information was made easily and repeatedly available to you, you did not second-guess it. You got played by availability bias. The article that you found online confirmed what was shown in the advertisement. Confirmation bias.

But, the story doesn’t end here.

All this while, you have been investing all your money in the markets through Mutual Funds, and are making good returns. No problem. You pat yourself on the back for this great decision.

And then, all hell breaks loose.

Suddenly, a Virus breaks out, and the whole world is on its knees.

People lose their jobs. With no money in hand and no hope for tomorrow, you start selling your investments. Nobody is telling you now that “Mutual Funds Ab Bhi Sahi Hai.”

The news channels are only reporting the huge economic loss and how markets around the world are crashing. It’s doomsday.

But, shouldn’t the Mutual Fund companies still advertise that “Mutual Funds Sahi Hai?” Now that the markets are at record lows, we should be buying more stocks, instead of selling them, right? Why have all those advertisements dried up, when in fact, people are locked in their homes and spending more time on TV and phones?

Because ads cost money. And run on emotions.

When markets are rising, and Mutual Funds get more money from the public, they can afford to spend more on advertising. More ads giving the same message creates an availability bias, and more and more people start investing their money through MFs. This creates a chain reaction.

[Note that these people are entering when the markets are high (rookie mistake #1)]

When the markets start going down, the funds with MFs dry up. They start cutting their expenses to stay profitable. And advertising expenses are the first to take a hit. Now there are no ads telling you “Mutual Fund Sahi Hai.” All the news channels are howling about the bleak future of the economy. This is also repeated so many times, that you finally accept it to be true. Fear kicks in, and you start withdrawing money from your Mutual Fund or stop your SIP.

[You sell (or stop buying) when the markets are at a low (rookie mistake #2).]

(Think we are making tall claims? Check out our first-hand analysis on two super popular MF schemes at the end of this write-up, where we correlate the change in advertising expenses to change in inflow and outflow of money for these mutual funds).

Mandatory Buffett quote:

"Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can't buy what's popular and do well."

Buy low, sell high. As simple as that.

We often forget this mantra, and our emotions override our logic.

Investor sentiment has always been a key driver in influencing the highs and lows of the market. And events such as this pandemic bring out our worst fears.

So, is cognitive bias playing against us only because of the pandemic?

No. Humans are emotional beings. We get excited when others get excited, we get greedy when others are greedy, and we become fearful when others are fearful.

The market tests investors’ resilience during challenging times. Demonetisation was one such situation when people panicked and sold their investments too soon. COVID-19 is a similar story.

“Be greedy when others are fearful, and fearful when others are greedy.”

Buck the trend. Do some research. Think.

Now that we have hopefully explained the how and the why, let us look at what one can do to avoid biases from affecting investment decisions:

1. Challenge your own assumptions, seek different perspectives

2. Ask why. Always. “Mutual Fund Sahi Hai.” Why? “Buy this amazing stock. It will definitely go up” Why only this stock, why not some other? “Availability Bias affects your investing decisions” Why? Could something else be at play? Could this just be a coincidence?

3. Research thoroughly (which means going beyond the first page of Google search). The “personalised” algorithms of search engines and social media websites reinforce our biases. Eg: If you watch a pro-Modi video on YouTube, you will be recommended only pro-Modi videos on your feed. And vice-versa. The age of “personalisation” of content makes it all the more difficult, and all the more important, to seek alternative views deliberately.

“If you cannot control your emotions, you cannot control your money.”

- Seriously, we need to stop quoting Buffett.

Keeping your emotions in check will make you more money than complex statistical models to predict stock price behaviour.

Next time you are about to make a financial decision in a hurry, just take a moment. Slow down. Think about the biases that you may have. Think about what you read here, today. Think about Buffett. Think about us.

The Analysis

For those who think we are making tall claims - let us show you some proof.

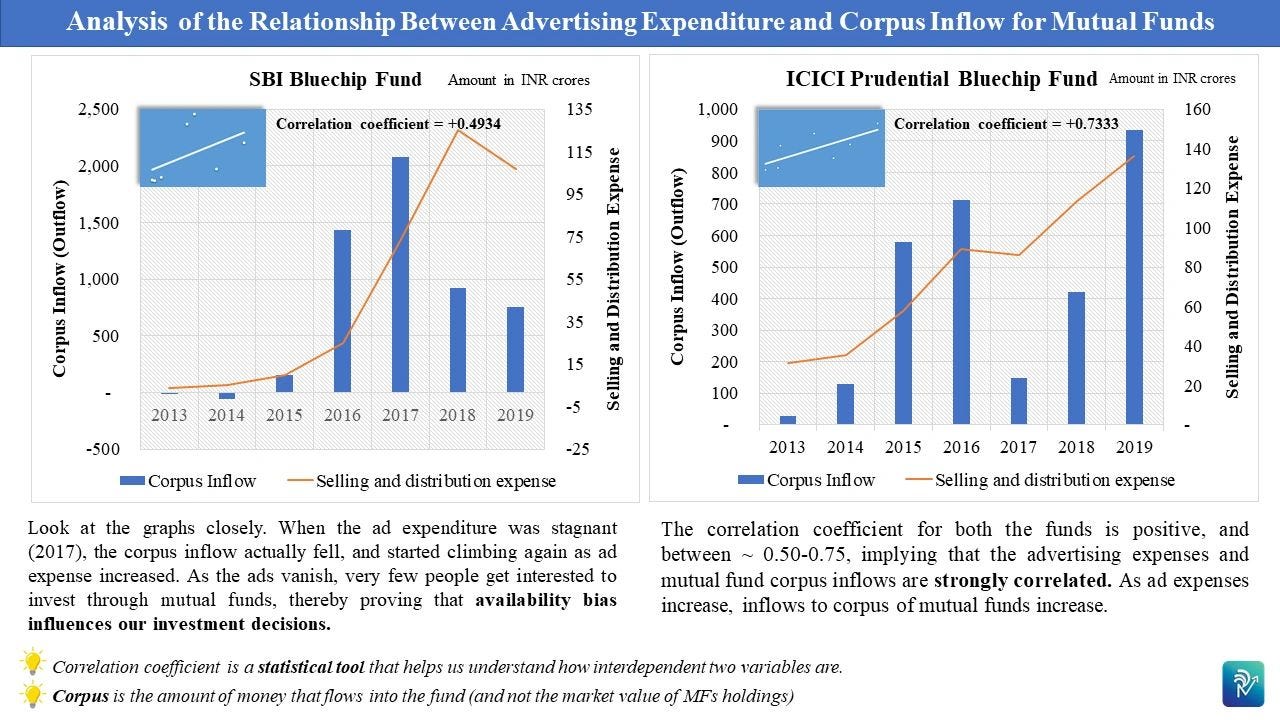

To put availability and confirmation bias to test, we analyzed some top-performing mutual funds (SBI and ICICI Prudential Blue Chip Fund) to understand the correlation between advertising expenditures (that causes availability bias) and investment by retail investors like us in these MFs.

Markets were rapidly increasing from 2014 onwards. Mutual Fund companies started pumping more money in advertisements during this period, which in turn lured small investors to start investing through MFs.

Before 2014, the number of ads on TV relating to mutual funds was paltry. Between 2017-18, ICICI did not increase its ad expenses. The corpus inflows should have remained more or less the same in the absence of ad expenditure. However, we can clearly see that the corpus inflows declined over the years, indicating that advertising creates an availability bias, and makes small investors invest through MFs.

Thousands of readers get our daily updates directly on WhatsApp! 👇 Join now!

Noob's Corner

Q. What is Sensex?

A. Sensex stands for Sensitivity Index. It is the average price of a bunch of 30 top companies from different sectors of the Indian economy.

Let us assume that 3 stocks affect the economy - A, B, and C.

Finance enthusiasts want to track the cumulative effect of these companies or sectors on the economy, and hence, create an index.

Assume that each company has equal weight in the index (33%).

Now, say all the companies were trading at Rs. 100 when the index was created.

So, the value of index will be Rs.100 x 33% (A) + Rs. 100 x 33% (B) + Rs. 100 x 33% (C) = Rs. 100.

Say, after a year, the revised prices are:

A - Rs. 150 (50% up)

B - Rs. 50 (50% down)

C - Rs. 120 (20% up)

Isn’t it difficult to assess the cumulative impact on the economy by looking at individual companies? Let’s see if the index helps.

Value of index = Rs. 150 x 33% + Rs. 50 x 33% + Rs. 120 x 33% = 106.67

Comparing Rs. 106.67 to Rs. 100 index value is easier. It tells us that the stock prices of major companies in the economy grew by 6.67%.

This is essentially what Sensex is - a weighted average stock price of 30 top companies in India that helps assess how the overall economy (using top companies as proxy) is doing.

Q. What is SIP?

A. Systematic Investment Plan (SIP) is a way of investing your money in stocks or mutual funds methodically, over a period of time, based on the principles of rupee-cost averaging. It has recently been marketed as the best way of investing your money (for passive investors, who don't know about stocks) in stock markets to create wealth over a period of time.

You invest a fixed amount of money periodically (usually a month) in a particular stock or mutual fund.

Let's see how rupee cost averaging works.

Say you decide to invest Rs. 10,000 every month in units of a mutual fund that's selling at Rs. 50 per unit today.

Month 1, @Rs. 50 per unit, you get 200 units.

Month 2, the price increased to Rs. 70 per unit. Now, you get 142.86 units for Rs. 10,000.

The average cost per unit at end of Month 2 = Rs. 58.33 per unit

Month 3, the price now falls to Rs. 40 per unit. Now, you get 250 units for Rs. 10,000.

The average cost per unit at end of Month 3 = Rs. 50.60 per unit. And so on.

Basically, you buy lesser units as the price increases, but more units when the price falls. This helps you maintain a healthy average cost per unit.

Disclosure: All content provided in this website is for informational and educational purposes only and is not meant to represent trade or investment recommendations.

References: