🤔 Will A Bad Bank Be Good For India?

India is finally setting up a bad bank and here's why that may be good news.

What if we told you that India was getting a "bad bank”?

Your first reaction would probably be that India already has too many bad banks, why do we need another?

But no, this bad bank is not like Yes Bank or the PMC Bank.

This bad bank will actually help all other banks.

And India's own bad bank, called the National Asset Reconstruction Company Limited, has finally received regulatory approval from the RBI.

It's ready for business. But what is the business of this bad bank?

What's In A Name?

One of the major roles of a bank is to give out loans. But there is no guarantee that they will ever get this loan amount back.

So, these loans, when not timely paid, turn into NPAs (Non-Performing Assets).

This ultimately results in a loss for the bank.

Now, banks know that they will have some losses. But sometimes the number of NPAs can get out of hand.

This puts banks at a risk of collapsing, which can have a major impact on the entire economy.

So, wouldn’t it be great if there was a Super Bank that would solve all the problems for our banks? After all, who doesn’t want to live tension free?

Now, as the non-performing “assets” of a bank are still assets - why not sell them at a low price to someone and save time, effort and money wasted on catching hold of the Mallya’s of the world?

Plus, vasooli is not the core job of a bank, is it?

This is where the idea of a "bad bank" enters the picture.

A bad bank is an institution that buys the bad loans of banks at a discounted price so they can stop worrying about what's lost and focus on fresh lending. This could increase spending and give a major boost to the economy.

Plus, the banks no longer have to worry about the recovery process. This frees up the banks' time and resources as well.

But wait a second! Isn’t this what Asset Reconstruction Companies (ARCs) do?

Bang on. The only difference is that ARCs are not backed by the Central Government. ARCs use private money to buy these loans.

Bad Banks use public money.

Taxpayers money.

Our money.

India's Bad Bank

The idea of a bad bank has existed for a long time. Many countries like the US, Sweden, Ireland and Malaysia have adopted bad banks.

India also had been toying with the idea for a long time. But the pandemic has finally pushed the country to take this step.

You see, many people lost their jobs or had to shut down their businesses during the pandemic. So, they were unable to pay back the loans.

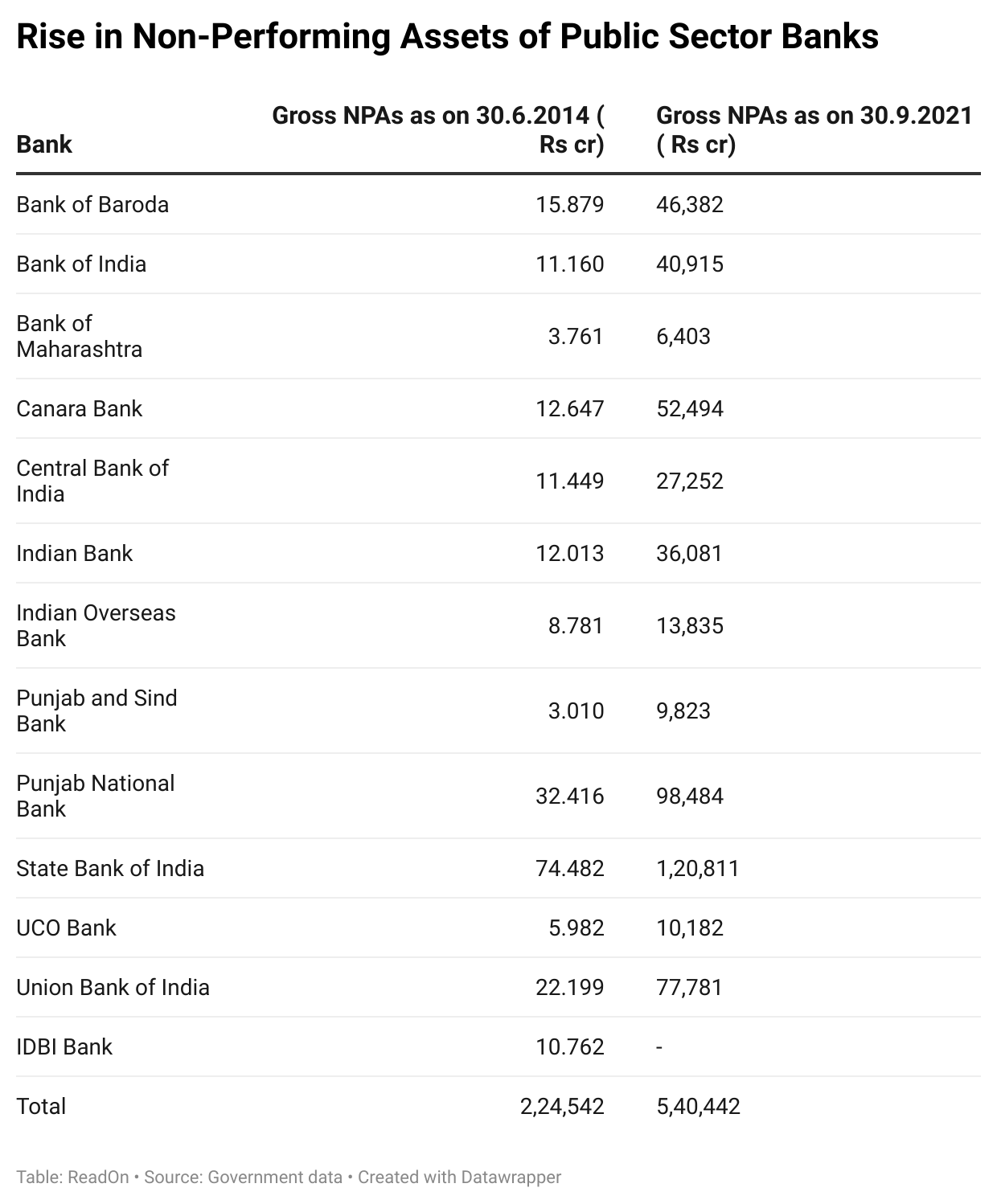

This caused the gross NPAs of public sector banks to almost double in a 7-year time period.

So, they came up with the idea of National Asset Reconstruction Company Limited (NARCL) and the India Debt Resolution Company Limited (IDRCL).

The NARCL will acquire and aggregate loans from the banks, meanwhile, IDRCL will focus on the debt collection process.

Public sector banks will hold a majority stake in the NARCL, while private sector banks will hold a majority stake in IDRCL. This way there will be no preferential treatment towards a specific bank category.

Currently, SBI, Indian Bank, Union Bank, and Punjab National Bank hold the majority stake in NARCL. They also hold some stake in IDRCL.

These banks will be forwarding 38 cases worth Rs. 82,845 crores for debt resolution to the NARCL and the IDRCL but this will be done in phases. The government hopes the bad banks will recover NPAs worth Rs. 2 lakh crores.

For the time being, the two organisations only have to handle 15 cases worth Rs. 50,000 crores.

But what if the bad banks fail to recover the loans they had bought?

The government will reimburse a portion of their costs.

Now, this could be a major problem as the government’s fiscal deficit will also go up.

But won't this make the bad banks complacent? They know the government is going to bail them out when they fail. So, why would they put in any hard work?

That's because these bad banks will have to pay a guarantee fee to the government, which will keep increasing the more they delay the loan recovery process. This will keep them motivated to recover loans.

But still, the system could be dangerous.

You see, these loans have been labelled bad debts for a reason. Banks have tried to recover them but failed. So, it is not necessary that the bad banks will succeed in recovering them. And if their recovery rate is low, it will cost the government which in turn will cost people like you and me.

And God forbid, these bad banks collapse, it could send shockwaves through the entire economy.

This is one of the major reasons India has so far shied away from bad banks. In fact, former RBI governor Raghuram Rajan was strictly against the idea of bad banks. He thought they were just a way of transferring the banks' debt to the government.

Was he right to resist the bad banks? Or will they help our banks and our economy flourish?

Only time will tell…

Share this with your friends via WhatsApp or Twitter and help them become financially smarter! See you tomorrow :)

You can also listen to our stories because the Revolution ReadOn podcast is live!! Here: you can catch it on Spotify, Apple Podcast or Amazon Music, Google Podcasts, Gaana and Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

Every thing has a two faces,BAD bank is also them.i think this is a good initiative to support bank as back up their lending, minimize their risk.this is healthy for our economy.bad bank helps to boost inflow in economy.

Good idea & but implimantation will be challenging... Best wishes...