⚡What's Powering India's Power Sector?

India's power sector is booming. And here's how you can benefit from it.

Look around you. What do you see? Your laptop, your earphones and probably your phone you're reading this on.

We're all becoming slaves of technology, right?

Uh-uh. Slaves of power.

Our biggest fear today is power going out when we are running low on charge.

The power industry is the true black horse that all other major industries are safely riding on.

So, buckle up and let's dive deeper into this space.

😰 The Problems of the Power Sector

Did you know that the power sector is one of the most invested sectors in India?

According to the National Infrastructure Pipeline 2019-25, energy sector projects accounted for the highest share (24%) out of the total expected capital expenditure of Rs. 111 trillion!

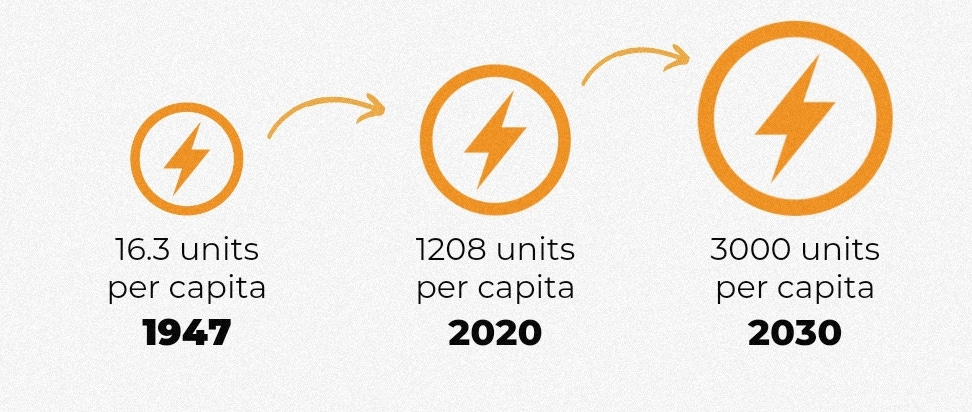

This huge investment was because everyone knew India's power demand would keep rising, so their investment could give them insane gains.

But this didn't happen.

The BSE Power Index fell 60% from 2008-2020. In the same time, Sensex rose over 100%. Why?

You see, power companies were facing a lot of problems:

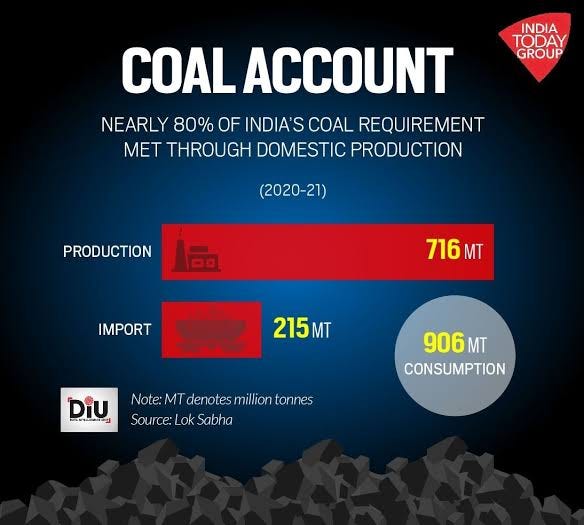

India mainly relies on coal for power but around 20% of this coal has to be imported, raising costs.

Transporting domestic coal comes with a lot of logistics hassles.

A lot of state distribution companies (discoms) owed large sums of money to power generation companies, causing a cash deficit for gencos.

So, most Indians weren't betting on power stocks.

But now they are. In fact, the BSE Power Index is up 247% from March 2020 as compared to Sensex's gain of 120%.

So, what is driving this rally?

🧐 Why are Power Stocks Back in Favour?

With climate change raising temperatures super fast, the demand for electricity is going to reach a new high.

Plus, we have solved some of the problems facing the sector.

For instance, many new coal mines have been developed, increasing our domestic coal supply.

We're also signing a free trade agreement with Australia that will make coal cheaper.

And India has also come up with a lot of policies and reforms to reduce discom dues.

For instance, power generation companies can now reduce the amount of power they provide to discoms by 25% if dues aren't paid in 2.5 months. And if after 30 days the dues still aren't paid, they can completely stop supplying power to the discoms and sell it on the exchange instead.

The government has also launched the Revamped Distribution Sector Scheme, which will help increase the efficiency of discoms by upgrading infrastructure. This will help reduce loss of energy via leakages, theft and other inefficiencies, allowing discoms to be on time as well!

So, this sector is all set to boom! Thinking of investing in this space? ReadOn.

📄 Things to Look Out for Before Investing in the Energy Sector

First, here are the companies that are on the BSE Power Index.

Now, how to evaluate which of the BSE Power Index companies you should invest in?

Here are the factors you should be looking into before investing:

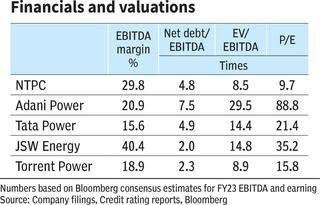

Financials: Now, this was an obvious answer. Before investing in any company, you need to look at its financials, how much debt it has, does it make profit or not, etc.

Here's a little snapshot of some financial metrics of key energy companies:

But this isn't enough. To understand whether or not the company will be profitable in the long run, you need to analyse a few operational metrics as well.

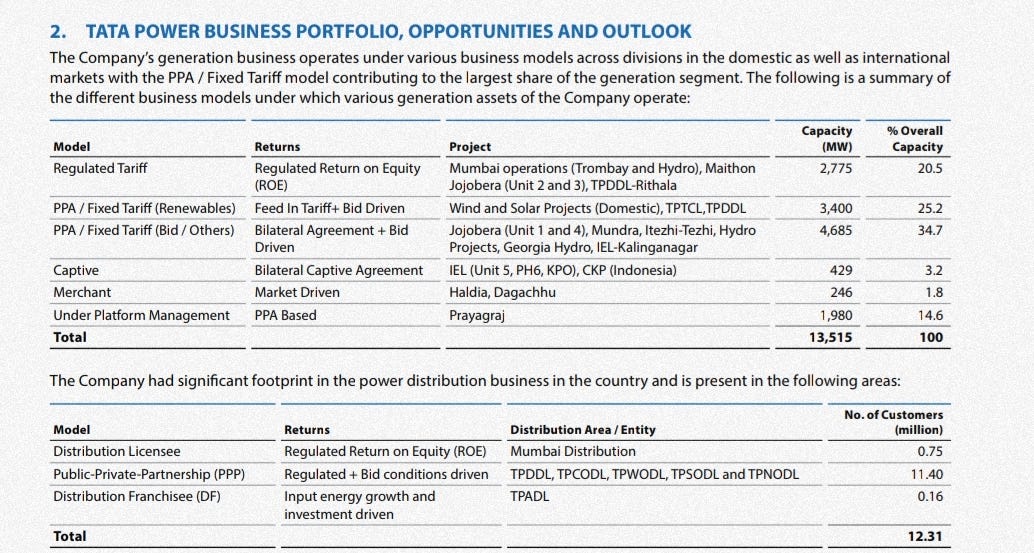

For instance, how many power purchase agreements does the company have? Huh?

Well, the main sources of revenue for a power generating company are:

Power purchase agreements with power distribution companies.

Selling electricity to merchants on trading exchanges like the India Energy Exchange (this is a volatile source of income because the price of electricity fluctuates on these exchanges depending on demand and supply).

Now these power purchase agreements are also of two kinds:

First, where the tariffs are cost-plus based. This means if the company's cost to generate power increases, so does the tariff. (This is a safe, stable kind of income)

Second, where companies bid a specific per unit tariff to win a contract. (These agreements could turn loss-generating if costs for the company suddenly increase).

A look into which kind of agreements the company has, and how much it relies on merchant tariffs from exchanges can give you an idea about its profitability.

You can usually find this information in a company's annual report. Here's a look into Tata Power's PPAs:

Operational Metrics: A lot also depends on the fuel supply agreements of these companies, whether or not they are able to secure coal on time to produce enough power.

Their Plant Load Factor (PLF), the ratio of the average power the plant produced to the actual capacity of the plant, is also important as it tells you how efficient a company's plants are. This could be crucial for profitability especially as plants that have a PLF of over 85% to get incentives.

Discom Dues: Huge dues impact the gencos' current operations, so this is another metric you should check. For instance, discoms owe Rs. 27,000 crores to NTPC (as of FY22), blocking a huge chunk of the power generating company's money.

How Green Are These Companies: The future of energy is green. So, a look into how much these companies are expanding their renewable energy capacity is also important for a long term investment.

Hope this helps you get a clear picture of India's power sector and the companies behind it. Let us know if you will be investing in any of them!

⚡In a line: India's power sector is back in favour after a brief dry spell thanks to climate change.

💡Quick question: Have you invested in any power stocks yet?

Share this with your friends via WhatsApp or Twitter and help them grow!

See you tomorrow :)

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇