📈 Vodafone Idea Shares Sky High: How?

Vodafone Idea shares have just hit their 52-week high despite its poor performance. Here's why.

This has probably been Vodafone Idea's motto over the last few years.

The company has suffered a lot since Jio entered the telecom market in 2016. Jio disrupted the entire sector by offering services dirt cheap.

But now the company's shares have hit a 52-week high of Rs. 16.40. The shareholders who kept faith and held on are rejoicing! So, what's behind the company's change in fortune?

Vodafone Idea's Bad Luck Spree

After Jio's entry, other telecom companies needed to act quick. They had to do something to prevent the draining of their customer base.

So, Vodafone and Idea, both of which were struggling, decided to merge and form the biggest telecom company in India at the time. But the bigger they are, the harder they fall.

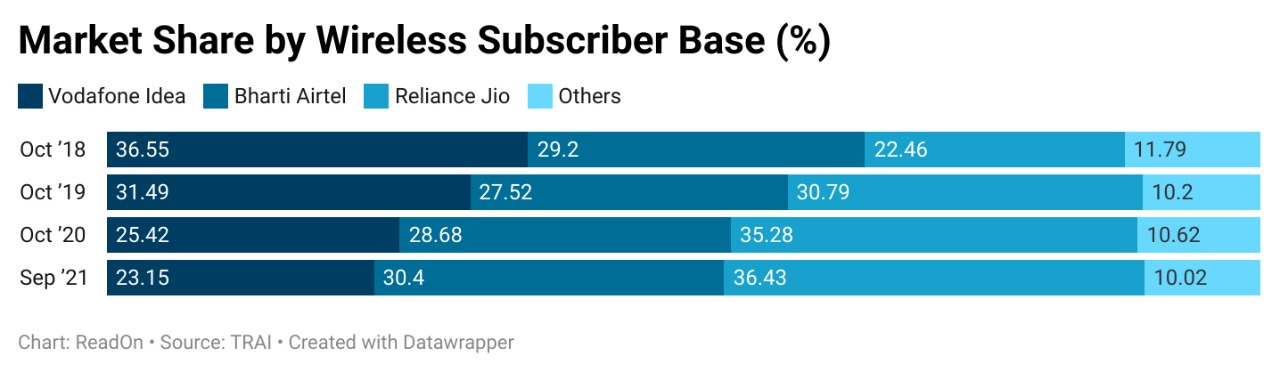

Despite the company's increased size and market share it began charting losses after losses. It eventually lost its position as market leader to Jio in 2020.

And to add to these woes, the company had not one but two major tussles with the government.

The first one impacted not just Vodafone alone but other telecom companies as well. You see, the government claimed that these companies' adjusted gross revenue (AGR), on which dues need to be paid, should include revenue from both telecom and non-telecom services.

The companies made several protests against this because honestly who likes to pay more money? But the government was adamant and the Supreme Court ruled that they had to pay dues on their entire revenue.

This put Vodafone Idea and other telecom companies in massive debt, especially because their cash flow was already reduced, thanks to Jio's disruption. VI currently owes Rs. 58,000 crores in AGR dues (You can read more about AGR dues here and here ).

And there's more. If you're a true millennial, you'll remember that before Vodafone became Vodafone Idea, it was called Hutch.

In 2007, the Vodafone Group, a British company, bought a 67% stake in Hutchison Telecommunications for $11 billion.

Now, the government saw this huge deal and wanted a cut. So, it demanded Rs. 11,218 crores in capital gains and withholding tax from Vodafone plus a penalty of Rs. 7,900 crores.

The company, however, said that according to the Income Tax Act, it need not pay any such tax for the stake purchase. And, the Supreme Court agreed.

But once the government decides it wants taxes, it will get them by hook or by crook.

So, it created a new provision that would tax such deals and made it retrospectively applicable. This means any such deals that had taken place even before the law was formulated would now have to pay taxes according to the new law. Pretty cunning move, right?

Well, Vodafone definitely didn't think so. Neither did other companies like Cairn Energy which would also have to pay taxes under the new law.

All of this has added to Vodafone Idea's massive debts, so much so, that many believed the company would go bankrupt.

Source: EquityMaster.com

But guys, how are Vodafone Idea's shares rising then?

The company may have had its fair share of bad luck, but things are looking up for it now. How?

Vodafone Idea's Day in the Sun

Just like how a series of unfortunate events brought down the company, a series of very fortunate events is now helping its shares.

New reports have suggested that bondholders of the company will receive their interest on time (December 13) as VI has managed to raise funds.

Plus, it is announced that holders of its unsecured redeemable non-convertible debentures (a financial instrument that a company issues to raise funds; it pays a fixed interest rate) will get interest on December 20.

But wait, wasn't VI in debt? Then how has it raised money to pay these bondholders? Don't worry, there is no golmaal (scam) here.

Remember the retrospective taxation law we told you about? Seemed shady, right? Well, the Permanent Court of Arbitration in Hague thought the same and asked India not to enforce that law.

So, the country is now returning all the taxes collected from Cairn Energy, Vodafone, and other companies. Vodafone is set to receive a refund of Rs. 44.7 crores from the government.

Also, the years-long standoff between the telecom companies has finally ended. So far, none of the three major telecom companies was willing to increase tariffs in fear of losing customers in the highly competitive market.

But Bharti Airtel finally blinked and raised its prices. And that was signal enough, Vodafone and Jio also raised tariffs soon after. And this increased tariffs will further bring more cash flow for the company.

In addition to this, the Indian government has realised how tough the conditions in India's telecom sector are. The cost of airwaves in the country (which is what telecom companies buy to make sure you get network coverage) is sky-high and much costlier than in other countries around the world.

But the government is now considering lowering the cost so that the telecom sector can have some breathing space.

And probably to make up for its strict rules and regulations in the past, it is also releasing the bank guarantees of VI and other telecom companies. Huh?

Bank guarantees are well… guarantees that the bank will pay on behalf of the company if it fails to make a payment.

In India, telecom companies had to give the government a bank guarantee of around Rs. 220 crores to get a telecom licence. But now the department of telecom has revised the requirement, reducing the number of bank guarantees required to Rs. 44 crores. Wondering how this will help?

If these companies now get the bank guarantees back, they can negotiate better deals, have better working capital management and so on.

With this series of good news, investors are highly optimistic that Vodafone Idea's time has now come. They're once again investing in the company and its shares are rising.

But the fact remains that Vodafone Idea's market share has considerably reduced. It is one of the weakest telecom companies right now.

Will this series of cash inflows help it rise? Or is this just a temporary high point in VI's story of woe?

Only time will tell...

Share this with your friends via WhatsApp or Twitter and help them declutter news from noise! See you tomorrow :)

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

I faced worst problem. When crossed over to other state,roaming changed to international and also balance went to zero. Calls not allowed. Many times without notice the postpaid rates were increased.

Do not believe in rumours of media vi is most ethical and strong company . great service provider