🤔 Why is the World's Most Expensive Stock Not Splitting?

Stock Splits are as delicious as Banana Splits. But Buffett won't have it!

If you won a lottery of Rs. 3.8 crores or $500,000, you could buy a lavish 3 BHK house in Bangalore or around 10 Tesla Model 3 cars, or over 8,000 grams of gold.

Or you could get one, just one share of Berkshire Hathaway.

Yes, the company's stock recently hit the $500,000 mark, as shares soared 12% this year, outperforming even the S&P 500 (which is down 8.5%).

Wondering why its share price is so high?

ReadOn!

Buffett's Investing Style

It may be surprising for you to know that the world's most expensive stock (Berkshire Hathaway) doesn't belong to the world's highest-valued company.

That's because Apple, Microsoft, Alphabet, Amazon and the others all opted for stock splits.

Stock splits are exactly what they sound like: splitting a stock into multiple parts to reduce its price.

So, if a company goes for a 5:1 stock split, you would have 5 stocks for each stock you held and their price would be divided by 5.

But why do these companies go for this?

Simple, to make them cheaper. If stocks are cheaper, more people will be able to buy them, which will increase participation.

Makes sense, no?

Then why isn't Berkshire Hathaway going for stock splits?

Two words: Warren Buffett (naam to suna hi hoga).

While most companies want to make their stock available to as many investors as possible, Buffett (the CEO of Berkshire Hathaway and everyone's favourite investing guru) is of the opposite school of thought.

He only wants those investors who believe in the company's worth and are in it for the long run: not those looking to make a quick buck.

Take a look at this quote from the man himself to understand how he thinks:

“I don’t want anybody buying Berkshire thinking that they can make a lot of money fast. They’re not going to do it, in the first place. And some of them will blame themselves, and some of them will blame me. They’ll all be disappointed. I don’t want disappointed people.

The idea of giving people crazy expectations has terrified me from the moment I first started selling stocks.”

Basically, Buffett wants investors who think just like him.

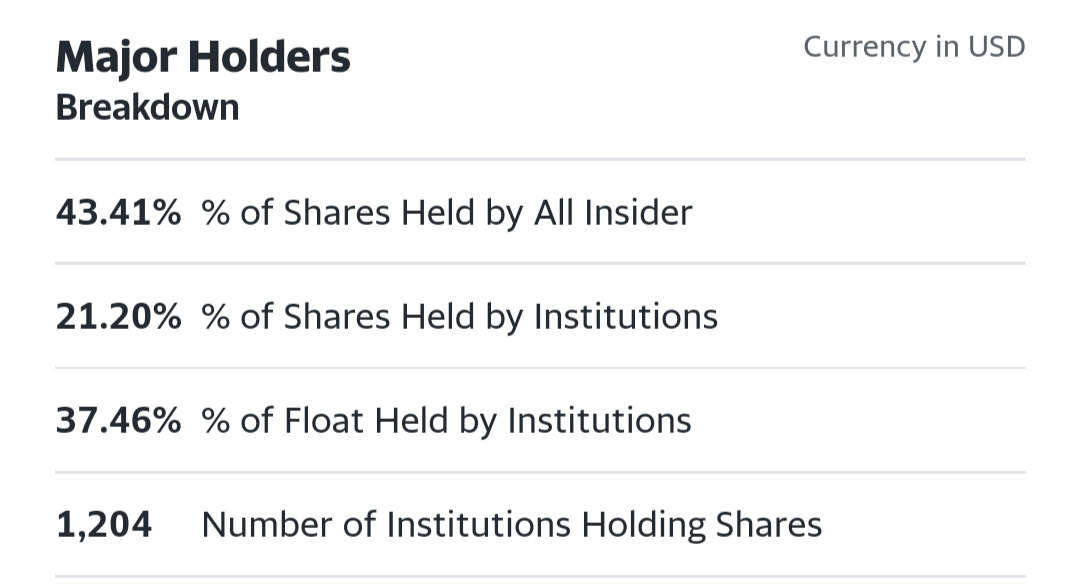

Which is probably why 43.41% of the company's shares are held by insiders.

However, Buffet did create a more affordable investment option for retail investors who wanted to invest in Berkshire Hathaway: Class B shares.

You see, before these shares were introduced, retail investors had to invest in Berkshire Hathaway through unit funds or mutual funds.

But Buffett didn't like the fact that people had to pay an extra fee to invest in his company.

So, he introduced Class B shares, which are cheaper (worth $344 as of March 18, 2022) and have lesser voting rights.

Some of you may be wondering that fractional investing is allowed in US, so what's the big deal? Anyone can buy just a fractional share? Well, it comes with its own hassles. Here, read this if you want to dive deeper: https://www.sec.gov/oiea/investor-alerts-and-bulletins/fractional-share-investing-buying-slice-instead-whole-share

Stock Splits: Good or Bad?

Buffett's firm determination not to split Berkshire Hathaway stocks and his tendency to usually be right about the stock market has made many question if stock splits are actually good or bad.

Well, looking at it purely from a financial inclusion standpoint, stock splits are obviously good.

If companies like Apple, Tesla and Amazon didn't split their stocks, common retail investors would never be able to afford them (or would only be able to buy a fraction of their shares).

Plus, stock splits are also good for the company.

Yes, even though the split changes nothing fundamentally about the company, stock prices usually go up.

For instance, both Amazon and Alphabet announced stock splits recently and their stocks went up 2.7% and 0.4% respectively.

First, because of a lower price its liquidity will increase, which in turn will increase its overall price.

Second, for US companies, a lower price also means that there are higher chances of getting included in the Dow Jones index. The index values stocks on the basis of their price and doesn't allow very expensive stocks to be listed. But if the stock split reduces the price, it can be included in the index, which will further increase trading volume.

This is why even Buffett has split the Class B shares of Berkshire Hathaway.

So, it seems Class A shares are just Buffett's way of testing out investors. He has inadvertently turned investors into part of a super-exclusive millionaire club.

Share this with your friends via WhatsApp or Twitter and help them become financially smarter! See you tomorrow :)

You can also listen to our stories because the Revolution ReadOn podcast is live!! Here: you can catch it on Spotify, Apple Podcast or Amazon Music, Google Podcasts, Gaana and Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇