🧐 The Curious Case of Yes Bank Bonds

Yes Bank, A special bond, and a legal drama. What's going on?

The Yes Bank fraud saga has been going on for quite some time now. Innocent people lost thousands of crores due to the fault of some greedy people, including Yes Bank's MD and CEO Rana Kapoor who was arrested for money laundering in 2020.

But the saga has been dragging on not just because of this injustice. It is also dragging on thanks to another so-called injustice against the bank's investors, done by the SEBI and the RBI.

An injustice worth Rs. 8,415 crores.

You see, when the RBI and SEBI were restructuring the indebted Yes Bank after its failure, they decided to write off investments made in Additional Tier-1 (AT-1) Bonds. Meaning those who had invested in these bonds would not get their money back.

Cue: A legal battle that is still raging.

But now new evidence has come to light that shows this whole drama regarding AT-1 bonds could have been avoided. Wondering what's going on? ReadOn!

What are AT-1 Bonds?

AT-1 bonds are very special bonds – ones that can live forever, that do not require its issuer to pay back.

You may be wondering “But, isn’t this like equity? Where the company has no obligation to pay back the amount taken from you, ever? And only gives you the profits it earns on your money?”

Yes, perpetual bonds (“perps”) are bonds issued for eternity – they have no redemption period. They are the “Forever Loans.” And they feel exactly like equity.

Now, imagine someone asking you for a loan and saying they will return the money… never! Isn’t that so damned risky? What if they run away? What if they die?

Well, yes. Perpetual bonds are as risky as bonds can be. Sometimes they are even riskier than equity.

But then why would people agree to invest in them?

Simple, they give very high returns (around 9.5% in the case of Yes Bank). Plus, to make them seem safe, banks include a call option.

A “call” option implies that the bank (issuer) has a right to buy the bonds from you (investor) after a fixed tenure. This tenure is usually 5-10 years.

Now investors think this means that their money is safe. But sadly they are mistaken. Banks have a right to buy back these bonds, not an obligation. History has shown that several banks like Andhra Bank and Lakshmi Vilas Bank have failed to pay investors.

And history repeated itself in the case of Yes Bank.

The Problem With AT-1 Bonds

But if RBI and SEBI were helping restructure the bank doesn't that mean that investors should get at least some money back?

Well, yes. And the equity investors did. But not the AT-1 bond investors.

Umm, why this discrimination?

Because of the fine print, that's why.

You see, according to bank regulatory norms (BASEL-III rules) and AT-1 bond contracts, these instruments can be completely written off in case banks' capital ratios fall below a specified threshold.

This is your reminder to always read the offer documents carefully.

But Rs. 8,415 crores is a lot of money. So, the mutual fund houses, including Nippon Mutual Fund, Franklin Templeton India, Barclays and Kotak Mutual Fund, told the regulators "We'll see you in court."

They filed a case in Bombay High Court to stay the bank's restructuring. But alas the court hasn't heard their pleas.

And both the RBI and SEBI have said that the investors knew how risky these investments were, they had earned a hefty interest from them for quite some time, so they shouldn't complain now.

But as we said, new evidence has come out that changes everything.

The Twist in the Tale

According to the response provided to a Right to Information (RTI) filing by L.V. Srinivasan, an RTI activist from Chennai, back when the RBI was restructuring Yes Bank after its failure, it wanted to reduce the amount of these bonds and convert them to equity to avoid future litigation. Farsighted, eh?

But the Department of Financial Services intervened and said that this was not a good idea. Because this move would reduce the stake of banks like SBI and the others who bailed out Yes Bank.

And that's not all. There is another twist to this tale. Remember how the SEBI said that investors shouldn't cry over spilt milk because they knew the risks that their investments came with?

Turns out the investors did not know the risks! You see, these bonds had been sold to them as "Super FDs"! And we all know that FDs are safe. So, investors assumed these super FDs were also super safe.

In light of this development, in April 2021 the SEBI penalized the bank and three other officials. But this penalty was stayed by the Securities and Appellate Tribunal (SAT).

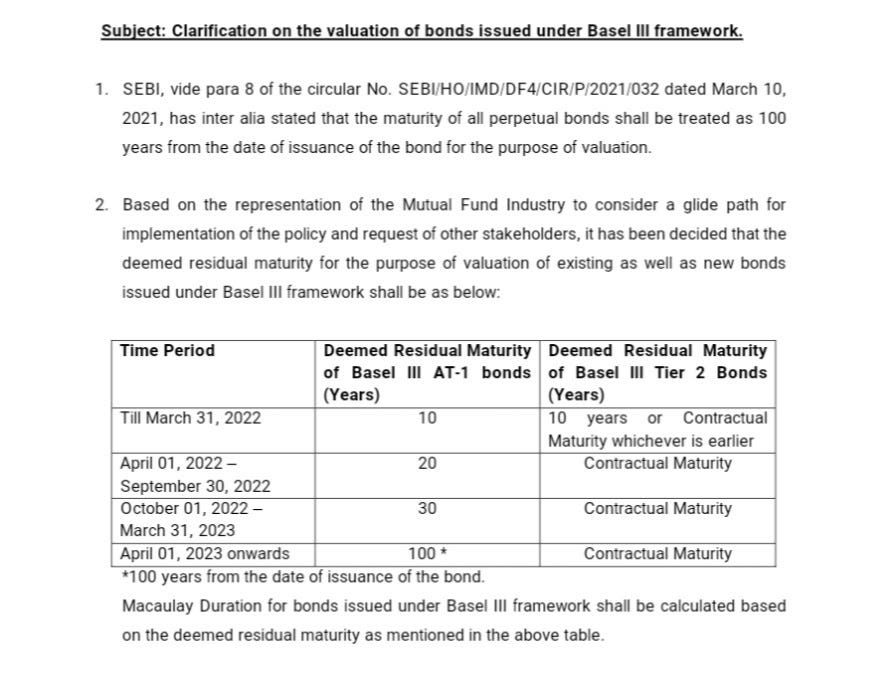

But SEBI didn't stop here. It had realised how dangerous these bonds were. Thus, soon after this penalty, it issued new rules for the issuance of these bonds. These rules stated that only experienced institutional investors can now buy these bonds. (You can read more about them here).

Not just that. It is now investigating the mutual fund houses that invested retail investors money into these risky securities.

Now, the question is will these new developments help investors get their money back? Will the RBI's initial stance convince the court that these investors had been met with injustice? And will SEBI's new rules finally put an end to such scams?

Only time will tell…

Share this with your friends via WhatsApp or Twitter and help them become financially smarter! See you tomorrow :)

You can also listen to our stories because the Revolution ReadOn podcast is live!! Here: you can catch it on Spotify, Apple Podcast or Amazon Music, Google Podcasts, Gaana and Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

Actually if someone notice, Indirectly all the time SBI is telling the investors that thes AT -1 bonds are risky and are too dangerous but now after all this, all blame to investors

Entertainment