📈 Rising Interest Rates: Spell of Doom?

Interest rates are on a rise in the US and UK. How does it impact the Indian markets?

Since Covid hit the world in 2019, a lot of things have changed. Our lifestyle, our habits, the way businesses function.

Pretty much everything.

Except one.

Central bank interest rates.

But now the winds are changing. The rates have remained low for too long and the Bank of England (BoE) and Fed have had enough.

The BoE has already raised the interest rate by 0.15% and the US Federal Reserve has announced that it will decrease its bond purchases and increase rates by next year.

But, what does all of this mean for us?

Why Increase Interest Rates?

Before we talk about the impact of these interest rates, let's ask why these banks had to increase the rates.

Low-interest rates meant easy access to money. And easy access to money increases the amount of money in the market. But this extra money is chasing the same number of goods and services. So, things get more expensive. Classic case of inflation. (You can read more about inflation here.)

The central banks endured this inflation for quite some time. What else could they do? Raising interest rates when Covid was still raging would have dire consequences on the economy. How would have people survived without money in such tough times? So, they chose the lesser of two evils.

However, now they've decided that enough is enough. Inflation is too high now and it will probably have a larger and more far-reaching negative impact than higher interest rates.

But how do the US' and the UK's decisions impact us all the way across the ocean?

Well, thanks to globalisation, the major economies in the world are interconnected. And since the dollar backs most currencies in the world, anything the US does impacts all of us.

Impact on India

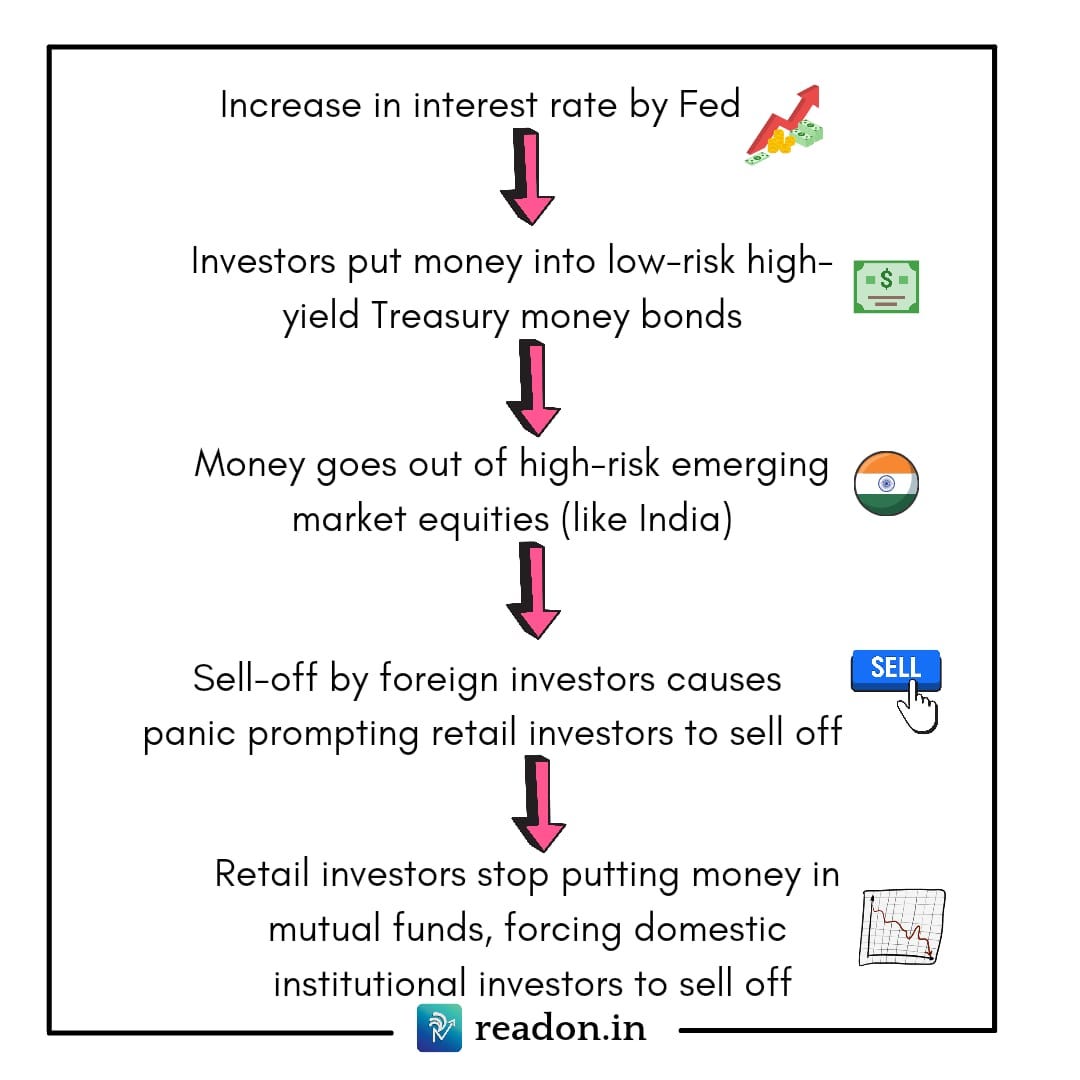

So, here's how the Fed's increased interest rates will impact us:

As the Fed increases interest rates, investors will begin investing more money into Treasury bonds. Because they will get a higher rate of return. To invest money in these bonds, they will pull out money from equity investments in high-risk emerging markets like India.

When they pull out their money, the market will drop, causing panic among retail investors. They will then begin selling off stocks left, right and centre, further causing the market to fall!

Not just that, these investors will probably pull money from mutual funds as well. So, these mutual fund institutions also start facing a liquidity crunch. They also sell off their shares to get funds. And the market comes crashing down!

That drastic eh? How much influence do these foreign investors even hold over the Indian markets?

You will be surprised to know that they hold assets worth around Rs. 49.37 lakh crores, which is approximately 18%-19% of the total Indian stock market cap.

So, if these investors pull out their money at once, it can cause panic in the market and lead to a massive sell-off.

Also, as the US interest rate goes up, investing in the US market becomes more lucrative for us. So, more people invest in US markets making the dollar stronger in comparison to the rupee.

Now, the weakening rupee has a major impact on our economy. Imports become more expensive. And India is the world's eighth-largest importer.

Do you see the problem now?

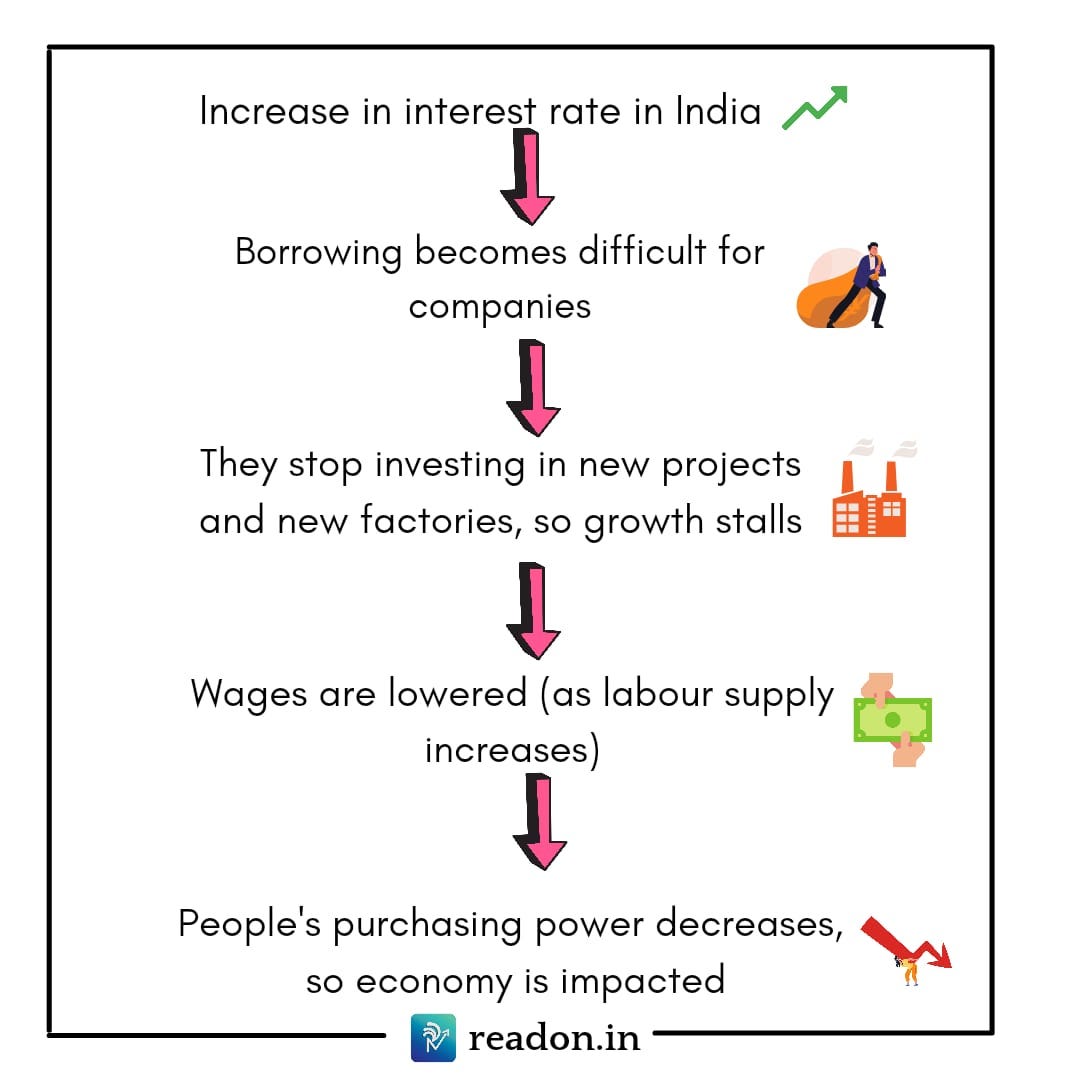

To counteract all these issues, India will also eventually be forced to raise its interest rate.

So, is the problem solved then?

Well, hardly. This will create a whole new set of problems:

As interest rates increase, borrowing money gets costlier. Companies invest less in opening new factories, scaling operations. This results in lesser job creation, more unemployment. This in turn leads to lesser wages (as the supply of labour increases), which in turn results in lesser purchasing power and thus, lesser growth in economic activity.

For a young country like ours that needs to employ its youth and create more jobs, this whole saga will prove to be super detrimental.

What can you do at an individual level? Well, maybe earn in $ than INR. Start an export venture, and hire more Indians?

The truth is, we are at the mercy of bankers in the West. All we can do is react to these changes, and hedge ourselves until we become a dominant economic force.

Share this with your friends via WhatsApp or Twitter and help them declutter news from noise! See you tomorrow :)

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

Bravo! Very well written and succintly explained!

Or we can clear bonds given by India to US thus increasing rupee value but it for that we need treasuries from RBI which were used up to save banks during covid.