🧐 Pakistan's Economic Crisis Explained

Here's why Pakistan is having a difficult time making ends meet.

The pandemic and the era of low interest rates have impacted several economies, taking them near bankruptcy.

Our neighbour in the South, Sri Lanka, is a prime example of this (You can read about Sri Lanka's economic challenges here).

Sadly Sri Lanka is not the only one. Now economic troubles have begun to brew in one more neighbouring country: Pakistan.

And while the geopolitical situation has a role to play in its current financial state, the seeds of its potential bankruptcy were sown much ahead.

Wondering how? ReadOn!

🗞 Pakistan's Current Situation

Pakistan is currently in dire straits.

It has a foreign debt of $130 billion, while its foreign reserves are only around $11.3 billion.

Because of this situation, the country's currency hit an all-time low of PKR 200 against the dollar and the price of its international dollar-denominated bonds have fallen by 30% to $0.65 (when a country's economic situation is not good the price of its bonds falls as demand dries down).

The country cannot really go to the international markets to borrow money. A bailout by the International Monetary Fund (IMF) remains its only hope.

And all of this is a result of Pakistan's unhealthy borrowing habit.

Yes, since 1951 the government has been reliant on foreign funds to run the country.

The major contributors of this debt have been countries like Saudi Arabia, China, the US and even the IMF.

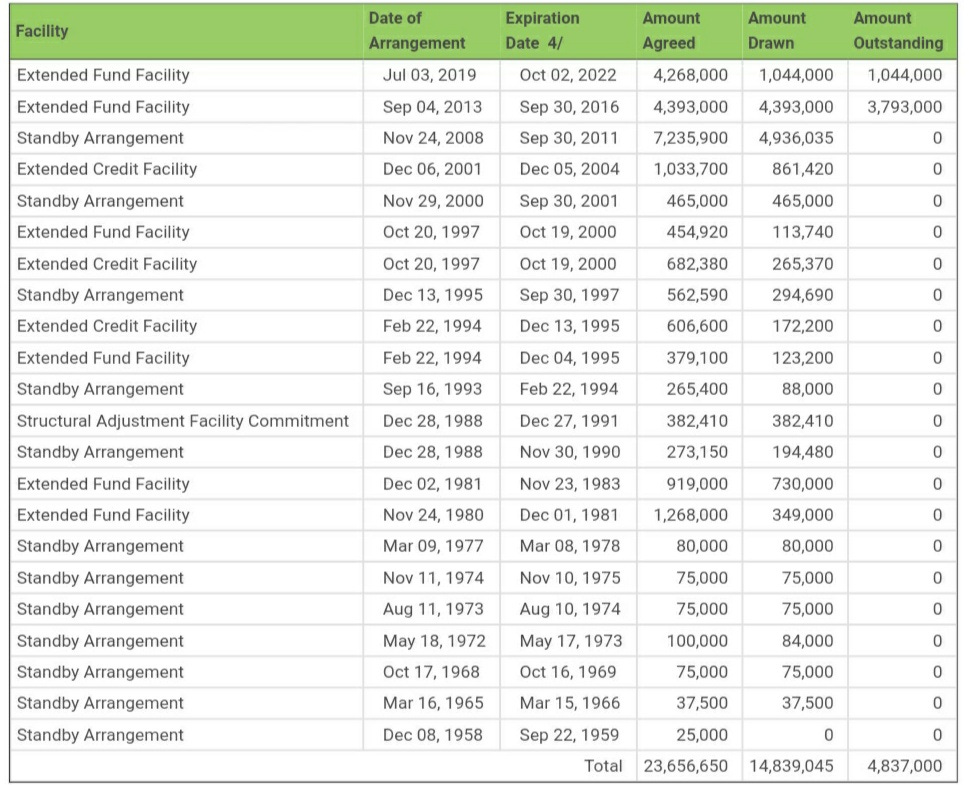

Here's how much the country has borrowed from IMF alone:

And while this is much less than some other countries' external debts, the problem is Pakistan doesn't really have enough resources to pay back its debts.

Yes, for the last couple of years the country has just been borrowing money from one lender to pay back another.

Wait, why does it not have money though?

🔍 The Root Cause

Because the country is heavily dependent on imports.

While the country's imports are worth $56.380 billion, its exports only account for $25.304 billion.

And these exports have been declining over the years, due to the country's lack of investment in private firms. And these firms also usually do not get adequate financing from other sources to expand.

Result? A constant trade deficit due to which Pakistan has to keep on borrowing to pay debts.

And as Pakistan constantly has to dig into its foreign reserves to pay for imports, the foreign reserves dwindle (making them more expensive because demand is high and supply is low), leading to a decline in the value of the local currency.

Because the value of the currency declines, the country now needs more money to get imported goods and pay off its debts.

And as it doesn't have enough foreign reserves, it again has to borrow money to meet its requirements.

This vicious cycle goes on and on.

And this cycle is exactly why Pakistan is in this dire situation right now.

It needs $36 billion to survive in the next fiscal year (starting in June) but this time looking at the country's condition and given the Russia-Ukraine war which has caused food shortages and fuelled inflation, no lender is willing to come rescue Pakistan.

At least not until the IMF steps in.

Why wait for the IMF?

Because the IMF will set strict conditions that the country will have to follow to get its economy right on track. This will increase chances that the lenders will get their loan payments back.

For instance, one of the strict conditions that the IMF wants Pakistan to follow is to remove the subsidies on fuel prices. Why?

Because these subsidies cost the country $600 million per month!

The government had been incurring a huge cost to ensure that high prices do not impact consumers who were already dealing with an 13.4% inflation.

But the IMF didn't support this as it was bad for the economy as a whole.

So, it had stopped its bailout program, cutting aid to the country. However, a new government has since been formed and it has agreed to raise fuel prices to get a $6 billion loan from the IMF.

But why isn't Pakistan doing anything to improve its condition?

Well, it is. The country is aiming to develop its infrastructure.

For this it had taken a loan from China (under its Belt and Road Infrastructure initiative which gives developing countries loans to boost their economy). However, most of these projects have stalled due to poor management and new loans have stopped coming as the country still owes China around $14 billion.

The new government has planned to scrap off this project (started in 2015) to cut their losses. But this won't be of much help.

So, what can Pakistan do?

It can use the new money that is coming in to boost production capacity, build good infrastructure and boost its economy.

Easier said than done. It's going to be an uphill task since a high chunk of the loan will go towards procuring wheat and other necessary materials like fuel for the country.

Most importantly, the country will have to find money or find ways of making money for its economic development.Its current strategy of continued loans is not sustainable.

In fact, it could be looking at a massive default by the end of this year itself, which will make it even more difficult for it to get future funds.

Only time will tell, if Pakistan will manage to turn its situation around or will it go the Sri Lanka way.

⚡In a line: Pakistan's habit of borrowing money has led to a massive economic crisis.

💡 Quick question: Do you think Pakistan will be able to salvage the situation?

Share this with your friends via WhatsApp or Twitter and help them declutter news from noise! See you tomorrow :)

You can also listen to our stories. Catch it on Spotify, Apple Podcast, Amazon Music, Google Podcasts, Gaana or Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇