😮 New IPO Rules Coming Soon?

SEBI is proposing new rules for loss-making IPO-bound companies. Here's why.

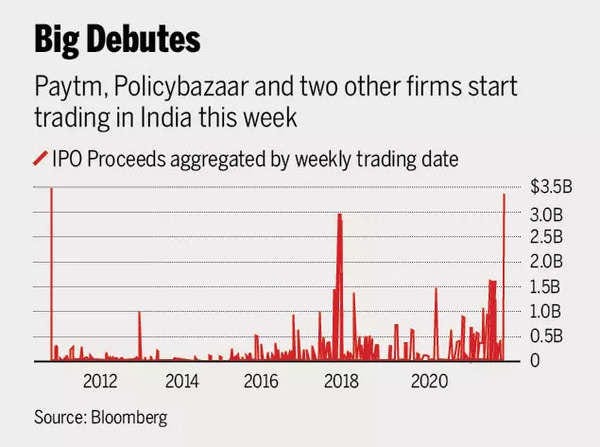

2021 was a bumper year for IPOs.

We saw 63 new companies debut on the stock market and raise Rs. 1.2 lakh crores collectively, the highest amount in the last 20 years!

But this high was short-lived.

A lot of these companies like Nykaa, Zomato, Paytm soon came crashing down.

And maybe this has forced SEBI to take a look at the IPO process.

What does it plan to do? ReadOn!

From IPO Highs to Seeing Red

Investors in Nykaa, Zomato, Policybazaar, and Paytm have collectively lost Rs. 1.3 lakh crores of their wealth.

But the blame for this doesn't fall completely on these companies' shoulders.

The entire market is currently witnessing massive sell-offs for multiple reasons like the US Fed raising interest rates (here's how that is impacting markets) and the Russia-Ukraine crisis.

But new-age tech companies have been the ones worst impacted.

You see, these companies' stocks are growth stocks. Even though the companies were seeing losses, investors believed that they would multiply their money.

But as soon as the market sell-off began, investors began thinking that the IPO prices of these companies were too high and that they wouldn't be able to give them returns as great as they had expected.

And they weren't wrong. Some of these companies' shares had been grossly overvalued. In fact, the price of Paytm's IPO shares was so high that many questioned whether they were deliberately overvalued to get the title of India's biggest IPO. The sky-high prices caused shares to tank 27% on listing day itself, which even caught SEBI's attention.

Plus, with central banks raising rates, government bonds seemed like a safer investment choice.

So, many investors, especially foreign institutional investors began dumping stocks. And the retail investors who held on, saw huge losses.

Now, SEBI realised how unfair this was for investors. So, it has decided to step in.

SEBI Changing the IPO Game

SEBI knows that more and more new age tech companies are now going to list on the market.

And since these companies are mainly focused on scaling up and growing fast, initially, they are making huge losses.

But the disclosure norms as per current IPO rules take into account only four parameters:

Earnings per share (profit/loss the company makes per share)

P/E ratio (the ratio of the company's current share price to its earnings per share)

Return on net worth (% return the company gives on your investments)

Net asset value.

Now, both profit-making and loss-making companies have to submit these metrics. But these metrics cannot adequately analyse the worth of a loss-making company. Investors who are betting on the company don't have enough information and usually bet on the company due to its public image.

So, SEBI has decided it is now time to change the IPO rules and go full Shark Tank on these companies.

But before SEBI does this, it is asking us what we think about the new rules it has proposed.

So, take a look at the proposed rules to determine issue price and see if you approve:

Apart from the four metrics mentioned above, the companies now also need to provide a list of key performance indicators (KPIs: Factors like Gross Margin, Cash Flow, Customer Acquisition Cost that give an idea of how the company is performing) for the past three years.

They also have to explain why these KPIs are relevant to the issue price.

Plus, they need to present all the data that they shared with pre-IPO investors. All investors need to know the same information.

Also, they need to compare their KPIs with similar companies listed in India and abroad to show how they are performing in comparison to their peers.

If they have not included a particular KPI, they need to explain why it isn't relevant.

All these KPIs need to be audited.

The company also needs to reveal its pre-IPO valuation based on the issue or sale of new shares in the past 18 months.

These rules will only apply to companies that have been seeing losses for the past three years.

Now, the questions that SEBI wants us to answer are:

Are KPIs important?

Should they be audited?

Is a three-year lookback period enough? The same goes for the 18-month lookback period for the valuation.

Should companies have to compare KPIs with global peers?

The ball is now in our court. We need to analyse whether these factors can actually help determine a fairer IPO value for loss-making companies or not.

Let us and the SEBI know your thoughts about the matter and stay tuned to know if SEBI actually implements these rules.

P.S. Here's the entire SEBI report on the matter, if you want to read it.

It’s time to begin the journey of creating long-term wealth! Become a ReadOn Club Member to discuss high growth potential startups, crypto projects and stocks with other finance enthusiasts. And so much more! Check it out 👇

Share this with your friends via WhatsApp or Twitter and help them become financially smarter! See you tomorrow :)

You can also listen to our stories because the Revolution ReadOn podcast is live!! Here: you can catch it on Spotify, Apple Podcast or Amazon Music, Google Podcasts, Gaana and Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇