📊 Meta's Mega Loss=Alphabet's Gain?

Meta recently made history, by losing the most amount of money in market history. What's behind this loss and how is Google benefitting from it?

What a crazy week! From India’s budget announcement to the results announcement of three of the five major FAAMG stocks: Facebook (now known as Meta), Google, and Amazon we saw it all.

While Google and Amazon performed quite well, Meta's results have caused the company to lose $251.3 billion in market value and caused Mark Zuckerberg's net worth to plunge by $29 billion. That's more than the GDP of Nepal ($24.88 billion)!

But what caused such a massive loss?

From Metaverse to Meta-worse?

Meta's Q4 earnings report has been historic for several reasons.

It was the first earnings report since the company rebranded itself. It also marked the first time that Facebook saw a decline in daily active users since it was formed!

What's more? It led to the biggest wipeout in market history!

This comes even though Meta's revenue was $33.7 billion up 19.9% from last year.

Facebook's Monthly Average Users (MAU) were also up 4% from last year.

But its Daily Active Users (DAU) fell by half a million from 1.930 billion to 1.929 billion.

Now, for many, this wasn't surprising. Facebook is a thing of the past, a relic of history for many, who now prefer apps like TikTok and Snapchat.

But this decline, though seemingly minor, may be the death knell for the social media platform.

Worse still, this was not the only reason the company's shares fell.

Meta revealed that it expected its Q1 2022 revenue to be around $27 billion-$29 billion. This is much below its current revenue and analysts' expectations.

And the credit for this goes to none other than Apple.

Last year, Apple introduced a new feature that would allow people to turn off an app's ability to track their online activity.

Now, this may seem like good news to you and me but for companies like Meta, this means a huge loss.

Because Meta's apps like Facebook, Instagram and WhatsApp collect our data, which it then uses to show us targeted ads. If it cannot show us targeted ads, businesses will stop advertising on its apps. And it will lose ad revenue (its biggest income source).

This whole ordeal is set to cost Meta around $10 billion. But the company's heads said they are working hard to try and overcome this problem.

Not just that, it is trying to focus on monetising the addictive Reels that hold the magical power of keeping us glued to our phones.

But its biggest play is still the metaverse. Facebook knows that ultimately Instagram and WhatsApp may also lose their charm if another addictive new platform comes up.

So, it is trying to beat itself to the punch.

By creating this next addictive platform itself.

Genius, right?

But on this front also it is currently just bleeding money, with nothing much to show for it.

Its metaverse division lost $3.3 billion in Q4 and a total of $10 billion last year.

This further reduced its profits. And there is no guarantee that this massive expenditure will bear results any time soon or ever...

While Facebook was losing money and people, Google was having a field day!

Facebook's Loss is Google's Gain

Google's parent company Alphabet saw phenomenal Q4 results that pushed its shares up 9%.

It reported a revenue of $75.3 billion, up 32% from last year. The company also recorded a full-year revenue of $257 billion for 2021, reaching the $200 billion revenue milestone for the first time ever!

Of this, Google's ad revenue accounted for $61.24 billion, up 33% from last year.

Retail ad sales accounted for the majority of this revenue, as more businesses pivoted to Google ads, thanks to the pandemic.

Google also launched several AI-related features to help businesses better manage their sales, predict trends, and stock products accordingly.

This growth comes at the cost of Meta which saw its e-commerce growth slow down considerably this quarter.

And this again is thanks to Apple.

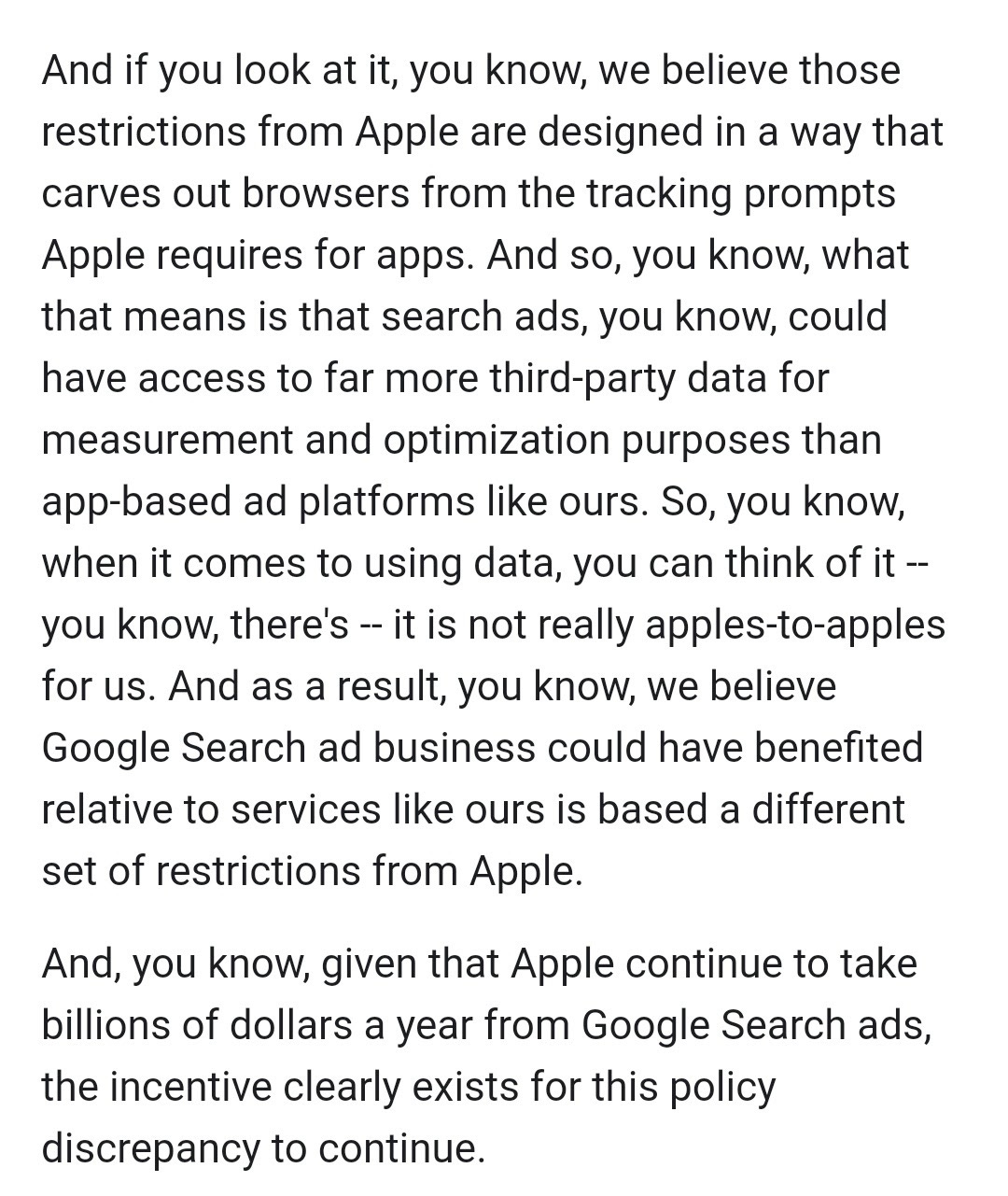

Meta's Chief Financial Officer claimed that the tracking restrictions that are applied on its apps are not applied on Google, as it is not really an app but a browser.

And Google and Apple already have a separate deal, under which Google pays Apple billions of dollars to remain the default search engine on Apple's devices.

This deal could have further incentivised Apple to tweak restrictions in such a way that they don't impact Google.

So, advertisers have jumped Meta's ship and have gone over to Google where they will get better exposure.

So, all is well for Alphabet? Nuh-uh.

The company's traffic acquisition costs have increased from $11.5 billion in Q3 to $13.4 billion in Q4, much above analysts' expectations. This means it now has to pay more to get users on board.

Plus, YouTube's ad revenue ($8.63 billion) fell below analysts' expectations ($8.87 billion).

Not just that, YouTube recorded 15 billion daily active users, a metric that has remained the same since July 2021.

This comes as apps like TikTok are taking away YouTube's viewership. So, will YouTube also go the Facebook way soon? Will it also become an uncool app only meant for parents to watch news and cooking videos?

Well, even if that happens, it won't be a major blow to Alphabet, thanks to Google.

Apart from its good performance, Alphabet's 20:1 stock split (shareholders get 20 shares for each share they hold) was also instrumental in pushing the company's stock up. It could have soon hit a $2 trillion market cap. But Meta's plunge has brought down the stock price of several tech companies, Alphabet included.

In other news, Spotify CEO also lost $1 billion as the company's stock has fallen by a third this year! This is because several musicians have dropped the platform protesting the fact that the platform hosts Joe Rogan's podcast despite the fact that he is spreading Covid misinformation.

So, is this going to be a bad year for the tech sector? And will Meta recover from this setback?

Let us know what you think about this situation on Twitter.

ReadOn Startup Challenge is here! 🚀

Get insider insights on how a startup really works, apply the learnings, compete with your peers and win cash prizes worth INR 20,000 😃

Fill out this small form to participate (2 mins)!

And don't forget to share with your crazy startup friends! 🤩🤩🤩

Share this with your friends via WhatsApp or Twitter and help them become financially smarter! See you tomorrow :)

You can also listen to our stories because the Revolution ReadOn podcast is live!! Here: you can catch it on Spotify, Apple Podcast or Amazon Music, Google Podcasts, Gaana and Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇