🧐 Loans that Last Forever?

What if your loan deadline got extended indefinitely? The whole economy would suffer. But that's what some NBFCs are currently doing. Here's how their scheme works.

Remember when we were back in school, we probably had one big troublemaker in our class (we're hoping it wasn't you)?

No matter how many times they got punished, they would always find a way to create new trouble.

It seems like NBFCs are that troublemaker for our economy.

And the latest trouble they have created: evergreen loans.

🤔 What Even is an Evergreen Loan?

Yes, you guessed it:an evergreen loan is one that keeps continuing. But how?

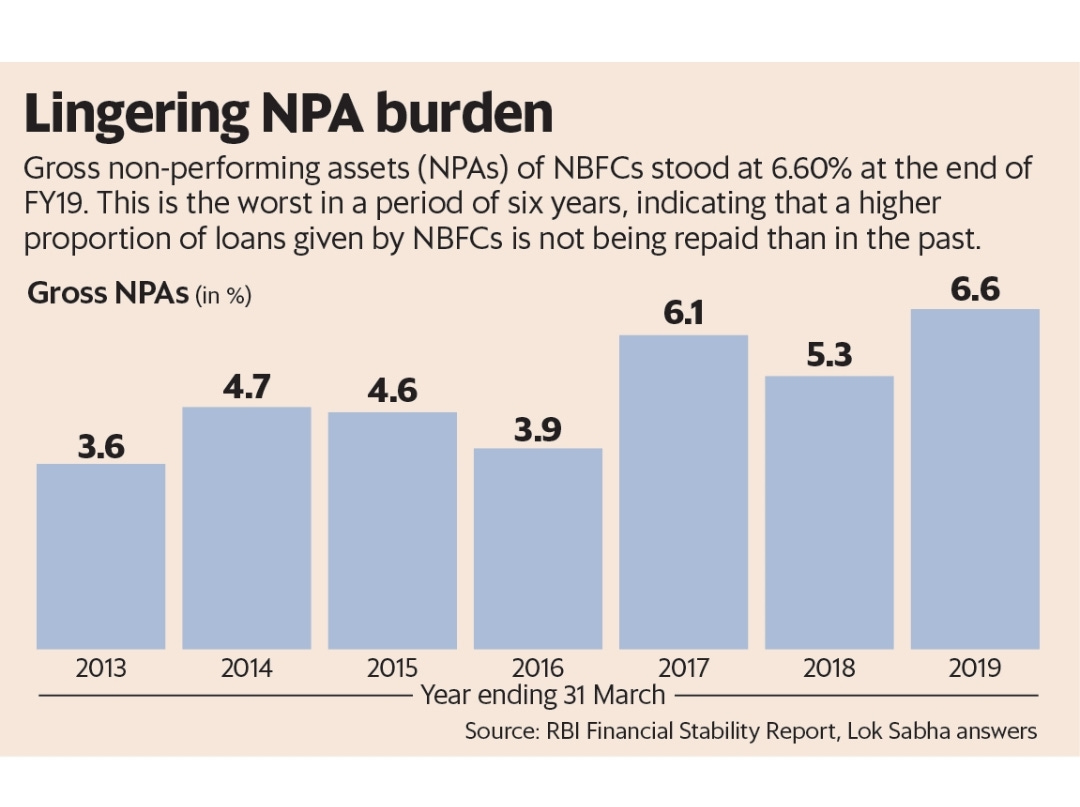

When a bank loans out money to a borrower, there is a risk that the borrower won't pay back the money or the interest, turning this loan into a non-performing asset (NPA) for the bank.

In simple terms, the bank just lost that money it had given to the borrower.

Now, sometimes banks give into sunk cost fallacy.

They don't want to show a high number of NPAs because this will alert authorities that they are not doing their job well. Plus, it will spook investors, which could cause banks' stock prices to fall.

So, what do they end up doing?

Simple. Give another loan to the same borrower, so they can pay the first loan with the second loan.

Frankly speaking, this is just throwing good money after bad. Think about it: taking a loan to repay your last loan. And again. And again… it'll only create a debt trap for the borrower.

If the RBI and SEBI get wind of this practice, the banks are going to be in trouble.

But some clever NBFCs have found a loophole around evergreening of loans to avoid being caught.

These NBFCs aren't directly giving loans to borrowers who have failed to repay. They are doing so through an Alternative Investment Fund (AIF).

These funds are like mutual funds but for the rich. They are private vehicles that pool in money from investors to invest in alternative investments (hence, the name).

Why only for the rich? Because the minimum investment amount is around Rs. 25 lakhs to Rs. 1 crore.

Now, you must be thinking how these AIFs are helping NBFCs evergreen loans, right?

Let's understand with the help of an example.

⚡ The Role of AIFs

Suppose NBFC A loaned Rs. 50 lakhs to a Borrower Company B.

Now, Borrower B is refusing to pay back the money.

NBFC A does not want this NPA. So, it asks AIF C to invest money in borrower B. But why would the AIF do so?

Well, many AIFs feel that these companies could bounce back after a little help. Some AIFs even buy NPAs directly from banks because they believe they can redeem the money.

To get AIFs to invest in the borrowers they want, NBFCs also invest some money back in the borrower through the AIF.

The NBFC becomes one of the investors in the pool of investors of the AIF.

So, out of the AIF's total Rs. 50 lakhs pool, NBFC A will put in Rs. 10 lakhs.

Now, Borrower B has received another Rs. 50 lakhs, through which it can pay back NBFC A. But in essence, the NBFC just lost Rs. 10 lakhs.

But ReadOn, it could get back the Rs. 10 lakhs it invested, no?

Well, that usually does not happen. You see, most NBFCs tie up with AIFs that have a priority distribution model. Huh?

The priority distribution model works such that one group of investors is allowed to either get an earlier exit than the others or have to bear a lower loss than others in case the investment tanks.

This is usually done to lure in high-ticket investors by promising them that even in the case of losses, they bear lower losses and in the case of profits, they make more money.

Sounds unfair? Well, that's life.

NBFCs are usually the non-prioritised investors base in the priority distribution AIF. Which means they don't get the early exits or the high profits. They have to bear the high losses in case there are any.

Now, NBFCs are ready to take this risk just to get another chance at making their money back.

But this Yudhishthir style of taking risks is not a good idea for anyone.

Enter: SEBI ringing the alarm bells about this practice.

It has warned the RBI that NBFCs are misbehaving again and need further regulation.

But that's not all. It has also put a stop to priority distribution AIFs for the time being.

Yes, life isn't fair but SEBI is.

But how does all of this matter to you, dear reader?

Well, everything in this universe and in this economy is connected.

You see, the banks that you have your savings accounts in are the ones that lend money to NBFCs.

In March 2019, bank lending accounted for 29.2% of NBFC borrowings as compared to 21.2% in March 2017.

If NBFCs bet this money away and end up losing it, bank NPAs rise. This causes liquidity problems for banks, triggering ripples throughout the economy.

So, NBFCs need to be kept in check.

It's a good thing we have the RBI and the SEBI around to do so. Let's hope they are always the first ones to smell trouble and put an end to them.

⚡In a line: NBFCs are getting creative to reduce their non-performing assets but SEBI and RBI are having none of it.

💡Quick question: Will the RBI be able to stop such scams in the future?

Share this with your friends via WhatsApp or Twitter and help them grow! See you tomorrow :)

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

Clever way of reducing losses by NBFC. But AIF's are to be blamed more than the NBFC's as they are assuming risk by taking positions in these bad loans irrespective of the background of the borrower. But, if they are willing to bet on it and the investors in AIF's have been provided with the information on risk they are taking then what's wrong in this setup.

A detailed article on what and where AIFs invest would be an enlightening read.