😯 India is Not Retirement Ready

Being ready for retirement is personal finance 101 but sadly most of the Indian population does not have a retirement plan or pension scheme. Here's why.

LinkedIn and Twitter are currently full of posts analysing India's position on the World Hunger Index and Happiness Index.

While some people are criticising the government for our low ranks on these indices, others are claiming their methodology is flawed.

But in the middle of all this, we found yet another index that we should be carefully looking at: Global Pension Index.

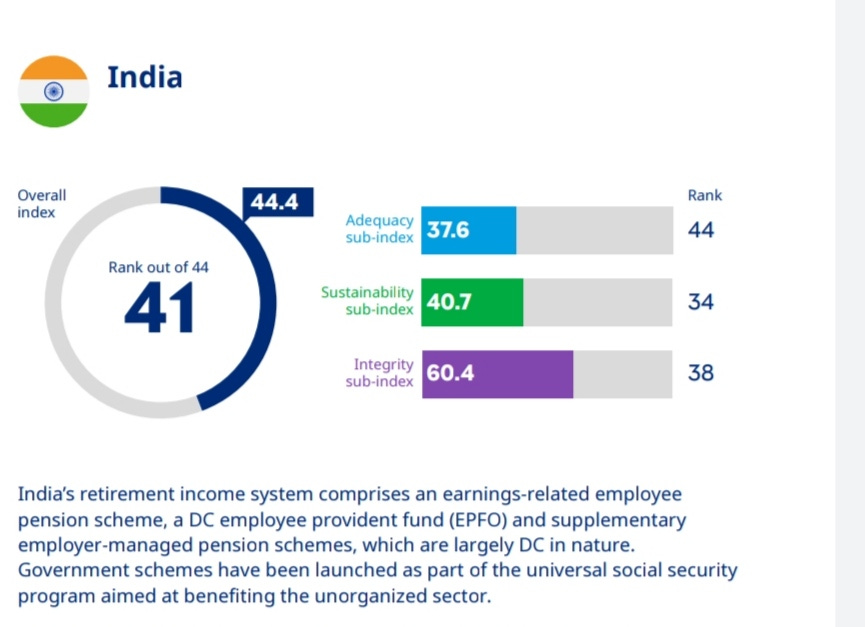

On this index, India has ranked 41 out of 44.

And like all Indian parents we want to know why our country has scored less and which countries have performed better and why?

Curious? ReadOn!

😥 India's Pension Problems

Before we delve into the bad news, let's start on a positive note. India's score has improved a little bit since last year.

However, compared to most countries, things don't look that good for us.

And to understand our bad score we need to understand our pension system.

India mainly has three major pension schemes: The National Pension Scheme, The Employee Provident Fund and the Atal Pension Yojna.

How do these schemes work?

The idea behind NPS and EPF is similar, just NPS is meant for government employees and EPF is meant for private sector employees.

These schemes literally force employees to save up for their retirement, which is a good thing because most people in India are struggling to save any money.

Under these schemes, employees have to set aside and invest a portion of their salaries to a provident fund and their employer will set aside the same amount (if the government is your employer it may set aside a higher amount than you) in the fund.

So, you have a nice nest egg waiting for you when you retire.

Sounds simple enough, what's the flaw then?

While anyone can invest in NPS, it is only mandatory if you are a government employee and that's when the government's contributions come in.

And EPF is only mandatory if you have a salary of less than Rs. 15,000.

What about Atal Pension Yojana?

It is also not mandatory and is simply a pension scheme meant for those who are not technically employees of an organisation: businessmen, gig workers, housewives, etc.

So, to sum it up there is no one pension scheme that is mandatory for the majority of the population.

And that's a red flag.

Given that only 27% of Indian folks are financially literate, a lot of people have no idea how much they should be saving for retirement or how.

Which is why only 6% of our population is covered under pension plans. The others are either relying on their kids or on whatever meagre amount they manage to save to get through retirement.

And that leaves them prone to major financial risks.

Now, if you do have a pension plan or a separate retirement fund, you are probably beginning to question why you should care about this situation?

🤨 Why Should You Care?

The answer is simple: you are an Indian. What happens in India, no matter how far removed, impacts you as well.

You see, if people beyond the retirement age do not have enough money to sustain themselves, they stop contributing to the growth of our country.

And the elderly retired population is soon set to rise and grow more than the working population.

This could mean a massive economic slowdown for our entire country.

We can say goodbye to our dreams of becoming a developed nation and a $10 trillion economy.

What's more, even if you are covered under a pension plan, chances are you will only get around 5% of your income as pension payments.

So, how can we solve this problem?

🤓 Does India Need Pension Tuitions?

Well, we can take a few lessons from the index's toppers.

For starters, India could provide a minimum level of support to the poorest of our oldest population without them having to enroll in any pension schemes.

Most countries that ranked well on the index like Iceland, Netherlands and Denmark, provide some amount of pension, with no strings attached, to most of their population.

Second, we should make pension plans mandatory for all employees, again something that the top-ranking countries have done.

Third, 47.6 crores of our population is working in the informal sector. We should also devise better pension plans for them.

Fourth, till we can make pension plans mandatory we should be educating people about how important such plans are and how saving for retirement is an absolute necessity.

But this is easier said than done. The countries which have implemented these steps have a tiny population, which makes such implementation faster and easier.

With our super large population, it may take us considerable time before we are ready to implement such steps.

What more steps can we take to make sure India ranks better on the index next time?

⚡In a line: India really needs to up its pension game if it wants to become a developed nation.

💡Quick question: Do you have a retirement plan? If no, why not?

Share this with your friends via WhatsApp or Twitter and help us grow! See you tomorrow :)

You can also listen to our stories. Catch it on Spotify, Apple Podcast, Amazon Music, Google Podcasts, Gaana or Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

BHARAT Has family culture and joint family system too....only corporate young culture has now started but they go for earning and new exposer....it is human support needed most and like minded company to live ....