🤔 Does The Adani Group Pose A Danger To The Indian Economy?

Adani is making yet another million dollar acquisition. But a recent report is concerned about the levels of debt the company has taken on and its impact on the economy.

Disclaimer: Nothing in this blog should be considered as investment advice.

NDTV has gone straight from reporting news to being the news.

All because of a hostile takeover attempt from none other than India's richest man.

Yes, after owning everything from ports to airports, Adani might soon become a majority stakeholder in NDTV.

But wondering why this is a hostile takeover?

ReadOn!

🤝 The Adani-NDTV Deal

The deal: Adani’s media arm AMG Media Works Ltd. is set to acquire 29.18% of NDTV through warrants and an additional 26% through an open offer. Confused?

Let’s get into the nitty gritties.

NDTV has a promoter company called RRPR Holding Private Ltd.

This company owns 29.18% of NDTV.

Now, back in 2009, RRPR had taken a loan worth Rs. 403 crores from Vishwapradhan Commercial Pvt. Ltd.

RRPR didn’t have to pay any interest on this loan as long as it paid back the money in 2019.

But since this was a huge risk, VCPL took convertible warrants (which can basically be turned into the company’s shares) for 99.9% stake in RRPR.

RRPR failed to pay back the loan.

Meanwhile, VCPL was acquired by AMG, Adani’s Media arm, a few days back.

So, the convertible warrants that VCPL is now exercising (because its loan wasn’t repaid), will now go to Adani.

Now, Adani is betting big on media (because a media company allows you to float your own narrative ). So, he wasn’t happy with a minority stake in NDTV.

Which is why Adani Group is also launching an open offer.

Basically, it is asking NDTV’s existing shareholders to sell their stake at Rs. 294/share, well below the current market price of Rs. 388.20/share, because it wants to buy an additional 26% stake in the company.

Why is this being called a hostile takeover?

Because the owners of RRPR were not even consulted before this whole thing began.

Now, Adani’s move to expand his media business further, which is going to cost it a whopping Rs. 492.81 crores, has raised a lot of eyebrows.

Especially because the news came on the same day that financial research company CreditSights launched a report stating that the Adani Group was “deeply overleveraged” and could “spiral into a debt trap.”

💰 Adani Acquisition (Read: Borrowing) Spree

Even without expanding into the media space, Adani, the richest man in Asia, has managed to make it to the headlines every other day, thanks to his massive acquisition sprees.

Just in the past year the Adani Group has spent over Rs. 1.3 lakh crores (the number is from May 2022 and has probably grown a lot by now) on 32 acquisitions.

And the company has a total debt of Rs. 2.3 lakh crores, almost double that of Ambani’s.

Wondering why the richest man in Asia is borrowing so much money?

Because that’s how business works.

The major part of a billionaire’s wealth is paper wealth: meaning they don’t actually have this money. Their wealth and worth is determined by the stock value of their company.

Which is why Ambani and Adani keep switching places as Asia’s richest man.

Now, suppose Adani wants money to acquire NDTV.

He could either sell some of his stake to get cash to buy the company.

Or he could borrow money from banks.

If he goes for option 1, he will have to pay taxes on the profits he makes from the sale of shares. And this tax will be much higher than the interest he will have to pay on the loan he takes from the banks.

So, he obviously chooses option 2, like most smart businessmen.

But the problem now lies in the fact that he has borrowed too much money.

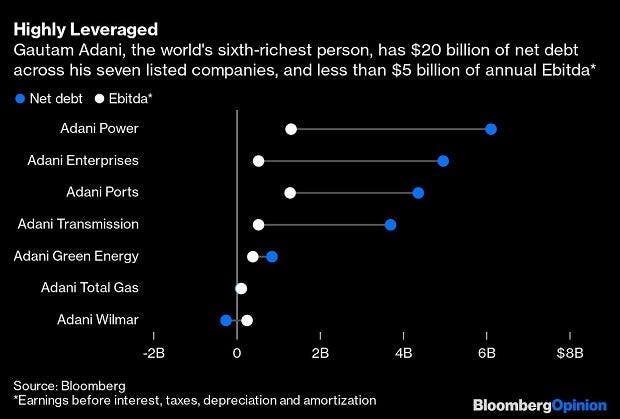

And his conglomerate’s total EBITDA is 4x lower than his net debt. On the other hand RIL’s debt to EBITDA ratio is 0.7 (giving it a better credit rating than our country).

And the worst part?

Adani and his family have invested little of their own money in these ventures, relying mainly on debt.

Which means the major burden is on SBI, PNB, Canara bank, Standard Chartered, Barclays and the countless other banks (and their customers) who have invested money in these companies.

And that’s not all. Here are the other problems that CreditSights has found with the Adani Group:

It is entering too many unrelated and capital intensive businesses. This increases the load on the company, raising chances of failure.

Adani is clearly in a competition with Ambani and is entering more and more sectors where Ambani has a presence. This competitive spirit is increasing Adani’s debt and may cost the company in the long run.

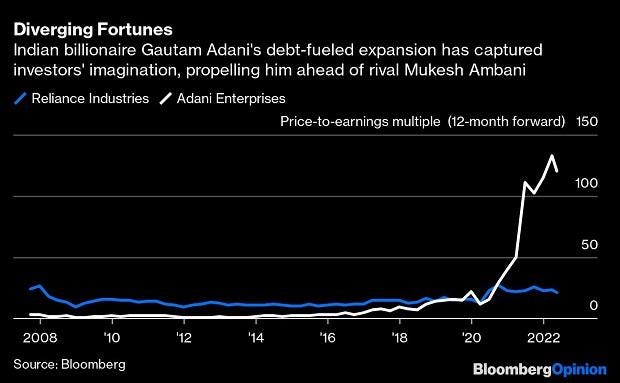

While this report has led the company to lose Rs. 94,000 crores due to a stock market sell-off, investors have been mainly bullish on Adani.

Adani Enterprises and Adani Green Energy have grown 1300% since 2020, while Adani Total Gas has grown 900%.

In the same time the Sensex grew only 42%.

Adani Group’s Price to Earnings Ratio is 124, which means people are ready to pay Rs.124 to the company for every Re. 1 it earns. That’s the kind of faith people have in the company.

But this faith also poses a major problem, because if the conglomerate falls from this height, a lot of people could get hurt.

And this could be harmful for the entire economy.

And since Adani is currently betting big on infrastructure and growth, an upcoming recession could pose problems for the company.

This could be India’s Evergrande moment.

However, some believe the company is too big to fail and even CreditSights has taken “comfort” in the fact that it has strong support from banks and the government.

Only time will tell if Adani Group will be able to make it big or will it come crashing down.

⚡ In a line: Adani is buying NDTV, a move for which he may have to borrow again, but a new report warns that he might have already taken on too much debt.

💡 Quick question: Is Adani too big to fail?

Share this with your friends via WhatsApp or Twitter and help them declutter news from noise! See you tomorrow :)

You can also listen to our stories. Catch it on Spotify, Apple Podcast, Amazon Music, Google Podcasts, Gaana or Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

No one can stop BHARAT ,INDIA Now and ADANI can not be threat as very big global financers are keen and ready to support....BHARAT IS UPCOMING GLOBAL SUPER POWER FROM 3 TO 30 TRILLION IN COMING 3 DECADES....max times....ALLTIMES